-

US denies visas to EU ex-commissioner, four others over tech rules

US denies visas to EU ex-commissioner, four others over tech rules

-

Koepka leaves LIV Golf: official

-

US slams China policies on chips but will delay tariffs to 2027

US slams China policies on chips but will delay tariffs to 2027

-

Arsenal reach League Cup semis with shoot-out win over Palace

-

Contenders Senegal, Nigeria start Cup of Nations campaigns with wins

Contenders Senegal, Nigeria start Cup of Nations campaigns with wins

-

Tunisia ease past Uganda to win Cup of Nations opener

-

S&P 500 surges to record after strong US economic report

S&P 500 surges to record after strong US economic report

-

UK police say no action against Bob Vylan duo over Israel army chant

-

Libya's top military chief killed in plane crash in Turkey

Libya's top military chief killed in plane crash in Turkey

-

Venezuela passes law to jail backers of US oil blockade

-

French parliament passes emergency budget extension

French parliament passes emergency budget extension

-

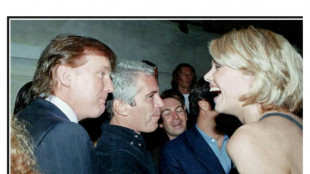

Trump in Epstein files: five takeaways from latest release

-

Wasteful Nigeria open AFCON campaign with narrow win over Tanzania

Wasteful Nigeria open AFCON campaign with narrow win over Tanzania

-

Ukraine retreats in east as Russian strikes kill three, hit energy

-

Macron meets French farmers in bid to defuse anger over trade deal

Macron meets French farmers in bid to defuse anger over trade deal

-

Ineos snap up Scotsman Onley

-

UK comedian Russell Brand faces new rape, assault charges: police

UK comedian Russell Brand faces new rape, assault charges: police

-

World is 'ready' for a woman at helm of UN: Chile's Bachelet tells AFP

-

Real Madrid's Endrick joins Lyon on loan

Real Madrid's Endrick joins Lyon on loan

-

Latest Epstein files renew scrutiny of Britain's ex-prince Andrew

-

US consumer confidence tumbles in December

US consumer confidence tumbles in December

-

Norwegian biathlete Sivert Guttorm Bakken found dead in hotel

-

UK comedian Russell Brand faces two new rape, assault charges: police

UK comedian Russell Brand faces two new rape, assault charges: police

-

Venezuela seeks to jail backers of US oil blockade

-

Norwegian biathlete Sivert Guttorm Bakken found dead

Norwegian biathlete Sivert Guttorm Bakken found dead

-

Wall Street stocks edge higher

-

Vietnam Communist Party endorses To Lam to stay in top job

Vietnam Communist Party endorses To Lam to stay in top job

-

US economic growth surges in 3rd quarter, highest rate in two years

-

Frank defends Van de Ven after Slot slams 'reckless' foul on Isak

Frank defends Van de Ven after Slot slams 'reckless' foul on Isak

-

Russian paramilitaries in CAR say take election threat 'extremely seriously'

-

Trump in the Epstein files: five takeaways from latest release

Trump in the Epstein files: five takeaways from latest release

-

UK govt to relax farmers inheritance tax after protests

-

Pakistani firm wins auction for state airline PIA

Pakistani firm wins auction for state airline PIA

-

Stocks slip on strong US growth data

-

DR Congo beat Benin to kick off Cup of Nations bid

DR Congo beat Benin to kick off Cup of Nations bid

-

New Epstein files dump contains multiple Trump references

-

Russian strike could collapse Chernobyl shelter: plant director

Russian strike could collapse Chernobyl shelter: plant director

-

Springbok captain Kolisi to rejoin Stormers

-

Italy fines Ryanair $300 mn for abuse of dominant position

Italy fines Ryanair $300 mn for abuse of dominant position

-

Mahrez eyes strong AFCON showing from Algeria

-

Killer in Croatia school attack gets maximum 50-year sentence

Killer in Croatia school attack gets maximum 50-year sentence

-

Thousands of new Epstein-linked documents released by US Justice Dept

-

Stocks steady as rate cut hopes bring Christmas cheer

Stocks steady as rate cut hopes bring Christmas cheer

-

Bangladesh summons Indian envoy as protest erupts in New Delhi

-

Liverpool's Isak faces two months out after 'reckless' tackle: Slot

Liverpool's Isak faces two months out after 'reckless' tackle: Slot

-

Thailand-Cambodia border meeting in doubt over venue row

-

For director Josh Safdie, 'Marty Supreme' and Timothee Chalamet are one and the same

For director Josh Safdie, 'Marty Supreme' and Timothee Chalamet are one and the same

-

Kyiv's wartime Christmas showcases city's 'split' reality

-

Gazans fear renewed displacement after Israeli strikes

Gazans fear renewed displacement after Israeli strikes

-

Locals sound alarm as Bijagos Islands slowly swallowed by sea

Warehouse business catches fire, boosted by pandemic, e-commerce

The rise of e-commerce and the logistical nightmare created by the Covid-19 pandemic have caused a surge in demand for warehouse space in the United States, and big investment funds have taken note.

"It's been a tremendous struggle to find the appropriate location for clients," said Michael Schipper of Blau & Berg, a commercial real estate specialist in New Jersey and New York.

Available space has been dwindling steadily for a year and a half, and the vacancy rate is now 3.4 percent, although developers delivered 90 million square feet of new warehouse space in the first three months of the year, according to commercial real estate firm Jones Lang LaSalle.

Demand is so strong that purchase prices have tripled or quadrupled in just six years in northern New Jersey.

Nationally, average rental costs have jumped 22 percent in two years, according to analytics firm Beroe.

"Demand for space from logistics and distribution activities driven by e-commerce industry" is the major factor in the US market, according to Beroe, which notes that demand has exceeded supply for 18 months.

In addition, unlike traditional storage sites, fulfilling online orders requires technologically advanced warehouses, said Mark Manduca, chief investment officer at GXO, a supply chain management company.

Beroe said this equipment, which requires massive investments, allows firms "to improve warehouse efficiency and to speed up warehouse activities to meet the same-day delivery demands."

Pioneered by Amazon, other retailers were obliged to scramble to catch up to the new standard of immediate delivery set by the Seattle-based online sales giant.

In recent years, a lot of those companies have been rapidly ramping up their own e-commerce efforts, Manduca said.

"Those are the people that are really driving that demand for last mile warehousing," he said.

The demands of instant delivery have forced many sellers to acquire multiple storage locations to get closer to customers, especially in urban areas where real estate was already expensive.

The coronavirus pandemic accelerated that trend, as e-commerce sales surged by 56 percent between early 2020 and early 2022.

- A correction coming?-

Another pandemic effect was the logistical mess caused by Covid-lockdowns and health restrictions.

That revealed storage capacity "in the wrong place, supply chain issues, and more recently, inventory rebuilds that have kind of almost overshot to a certain degree," Manduca said.

To address those issues, he says, many companies are "now looking at facilities closer to home, which is naturally increasing the demand for warehousing," he said.

Amid the rise in demand, private equity firm Blackstone has invested heavily in the sector, and currently owns $170 billion worth of warehouses. It now rivals Prologis, the world's number one.

"We're also now seeing a surge in corporations increasing inventory holdings to mitigate supply chain issues" and are therefore looking for additional storage space, Blackstone President Jon Gray said in April.

Other private equity giants, such as KKR, Carlyle, Apollo or Sweden's EQT have all bought sites to ride the wave.

But Schipper cautions that while the warehousing industry "has a long term positive trajectory, ... I think that there needs to be a pause."

"You cannot run up in parabolic fashion forever," he said, noting that the current tightening of credit conditions also could play a role.

One sign of a possible correction coming: Amazon's decision to sublet or renegotiate the rent for 30 million square feet of warehouse space.

"You're going to see demand for space go down and rental rates will stop going up at the pace that they're going up. There's just not any way around it," Ward Fitzgerald, chief executive of EQT Exeter Property Group, warned in the Wall Street Journal.

"They'll continue their trajectory maybe 12 months from now, but ... there's going to be a correction."

While demand could keep rising for some time, Schipper said, "The question really is how much? And for how long?

"I don't think anybody knows the answer."

T.Wright--AT