-

Stocks rise as US inflation cools, tech stocks bounce

Stocks rise as US inflation cools, tech stocks bounce

-

Zelensky presses EU to tap Russian assets at crunch summit

-

Pope replaces New York's Cardinal Dolan with pro-migrant bishop

Pope replaces New York's Cardinal Dolan with pro-migrant bishop

-

Odermatt takes foggy downhill for 50th World Cup win

-

France exonerates women convicted over abortions before legalisation

France exonerates women convicted over abortions before legalisation

-

UK teachers to tackle misogyny in classroom

-

Historic Afghan cinema torn down for a mall

Historic Afghan cinema torn down for a mall

-

US consumer inflation cools unexpectedly in November

-

Danish 'ghetto' residents upbeat after EU court ruling

Danish 'ghetto' residents upbeat after EU court ruling

-

ECB holds rates but debate swirls over future

-

Pope replaces New York's Cardinal Timothy Dolan with little-known bishop

Pope replaces New York's Cardinal Timothy Dolan with little-known bishop

-

Bank of England cuts interest rate after UK inflation slides

-

Have Iran's authorities given up on the mandatory hijab?

Have Iran's authorities given up on the mandatory hijab?

-

Spain to buy 100 military helicopters from Airbus

-

US strike on alleged drug boat in Pacific kills four

US strike on alleged drug boat in Pacific kills four

-

Thailand strikes building in Cambodia's border casino hub

-

Protests in Bangladesh as India cites security concerns

Protests in Bangladesh as India cites security concerns

-

European stocks rise before central bank decisions on rates

-

Tractors clog Brussels in anger at EU-Mercosur trade deal

Tractors clog Brussels in anger at EU-Mercosur trade deal

-

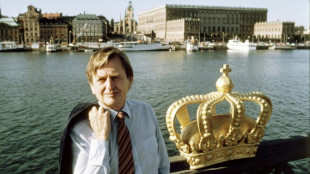

Not enough evidence against Swedish PM murder suspect: prosecutor

-

Nepal's ousted PM Oli re-elected as party leader

Nepal's ousted PM Oli re-elected as party leader

-

British energy giant BP extends shakeup with new CEO pick

-

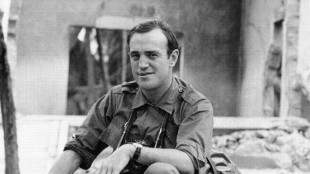

Pulitzer-winning combat reporter Peter Arnett dies at 91

Pulitzer-winning combat reporter Peter Arnett dies at 91

-

EU kicks off crunch summit on Russian asset plan for Ukraine

-

Lyon humbled to surpass childhood hero McGrath's wicket tally

Lyon humbled to surpass childhood hero McGrath's wicket tally

-

Sri Lanka plans $1.6 bn in cyclone recovery spending in 2026

-

England vow to keep 'fighting and scrapping' as Ashes slip away

England vow to keep 'fighting and scrapping' as Ashes slip away

-

'Never enough': Conway leans on McKenzie wisdom in epic 300 stand

-

Most Asian markets track Wall St lower as AI fears mount

Most Asian markets track Wall St lower as AI fears mount

-

Cambodia says Thailand bombs casino hub on border

-

Thai queen wins SEA Games gold in sailing

Thai queen wins SEA Games gold in sailing

-

England Ashes dreams on life-support as Australia rip through batting

-

Masterful Conway, Latham in 323 opening stand as West Indies wilt

Masterful Conway, Latham in 323 opening stand as West Indies wilt

-

Danish 'ghetto' tenants hope for EU discrimination win

-

Cricket Australia boss slams technology as Snicko confusion continues

Cricket Australia boss slams technology as Snicko confusion continues

-

Conway and Latham's 323-run opening stand batters hapless West Indies

-

Alleged Bondi shooters holed up in hotel for most of Philippines visit

Alleged Bondi shooters holed up in hotel for most of Philippines visit

-

Japan govt sued over 'unconstitutional' climate inaction

-

US approves $11 billion in arms sales to Taiwan: Taipei

US approves $11 billion in arms sales to Taiwan: Taipei

-

England battle to save Ashes as Australia rip through top-order

-

Guarded and formal: Pope Leo XIV sets different tone

Guarded and formal: Pope Leo XIV sets different tone

-

What to know about the EU-Mercosur deal

-

Trump vows economic boom, blames Biden in address to nation

Trump vows economic boom, blames Biden in address to nation

-

Conway 120 as New Zealand in command at 216-0 against West Indies

-

Taiwan eyes fresh diplomatic ties with Honduras

Taiwan eyes fresh diplomatic ties with Honduras

-

ECB set to hold rates but debate swirls over future

-

Asian markets track Wall St lower as AI fears mount

Asian markets track Wall St lower as AI fears mount

-

EU holds crunch summit on Russian asset plan for Ukraine

-

Australia PM vows to stamp out hatred as nation mourns youngest Bondi Beach victim

Australia PM vows to stamp out hatred as nation mourns youngest Bondi Beach victim

-

Australian PM vows hate speech crackdown after Bondi Beach attack

Trump signals relief on auto tariffs as industry awaits details

The White House said Tuesday it will soften tariffs on automakers, sparking optimism in Detroit whose car manufacturing industry has been on tenterhooks awaiting details on President Donald Trump's fast-evolving policy.

The measures, which include a guarantee that a carmaker wouldn't face multiple tariffs on the same vehicle, are designed to prod US and foreign companies to expand or build new factories to support domestic manufacturing.

Automakers have been among the hardest-hit sectors by Trump's multi-pronged assault on free trade. The announcement of relief is being timed in parallel with a visit by the president later Tuesday to the Detroit area to celebrate his 100th day in office.

"The president will sign the executive order on auto tariffs later today," White House Press Secretary Karoline Leavitt told reporters.

Analysts have warned that the myriad levies could result in higher prices, denting US car sales and threatening jobs.

But Trump, who has slammed free trade deals from his first presidential campaign in 2016, has embraced tariffs as necessary to spur more auto manufacturing in the United States.

But the administration determined that some relief was needed to give companies enough time to move supply chains to the country, a senior Commerce Department official said in a briefing.

"You're going to see a massive resurgence of domestic auto manufacturing," the official said.

- Grace period -

Besides a 25 percent tariff on finished imported cars, the industry has also been affected by Trump's 25 percent tariff on steel and aluminum. Automakers are also set to face new tariffs on foreign auto parts expected to take effect on May 3.

Trump's new policy includes a guarantee that a company wouldn't face both a 25 percent levy for an imported vehicle and 25 percent on steel or aluminum; the importer would pay the higher of the two levies, but not both, a Commerce official said.

The other change is that companies that import parts for vehicles assembled in the United States would be able to offset 15 percent of the vehicles list price in the first year and 10 percent in the second year.

That modification is designed to give companies two years to move supply chains to the United States.

Automakers told the Trump administration there would be "dramatic increases in production... as the payoff to America" from a two-year grace period, a Commerce official said.

Roughly half the cars sold in the United States are assembled within the country, with another 25 percent coming from Mexico and Canada and the remainder from a broader swath of nations including Germany, Japan and South Korea.

Automakers have already announced some investment decisions in light of the tariffs.

But analysts have cautioned that Trump's approach will not incentivize multi-billion-dollar investments if the industry does not believe the tariffs will last throughout Trump's administration and beyond.

General Motors said earlier this month that it plans to boost truck production at its plant in Fort Wayne, Indiana.

GM is looking at other actions "we could implement quickly, efficiently and with low near-term costs," Chief Financial Officer Paul Jacobson said Monday.

Jacobson declined to comment on GM's plans for South Korea, where it builds a number of low-cost vehicles that have become popular with US consumers focused on price.

Ford CEO Jim Farley said the company "welcomes and appreciates these decisions by President Trump, which will help mitigate the impact of tariffs on automakers, suppliers and consumers," according to a statement.

"Ford sees policies that encourage exports and ensure affordable supply chains to promote more domestic growth as essential," said Farley, who estimated that US factories could build four million more cars annually, supporting hundreds of thousands of new jobs.

Nissan, Honda and Volvo have been among the foreign automakers that have announced steps to boost investment in the United States.

N.Walker--AT