-

Stocks rise as US inflation cools, tech stocks bounce

Stocks rise as US inflation cools, tech stocks bounce

-

Zelensky presses EU to tap Russian assets at crunch summit

-

Pope replaces New York's Cardinal Dolan with pro-migrant bishop

Pope replaces New York's Cardinal Dolan with pro-migrant bishop

-

Odermatt takes foggy downhill for 50th World Cup win

-

France exonerates women convicted over abortions before legalisation

France exonerates women convicted over abortions before legalisation

-

UK teachers to tackle misogyny in classroom

-

Historic Afghan cinema torn down for a mall

Historic Afghan cinema torn down for a mall

-

US consumer inflation cools unexpectedly in November

-

Danish 'ghetto' residents upbeat after EU court ruling

Danish 'ghetto' residents upbeat after EU court ruling

-

ECB holds rates but debate swirls over future

-

Pope replaces New York's Cardinal Timothy Dolan with little-known bishop

Pope replaces New York's Cardinal Timothy Dolan with little-known bishop

-

Bank of England cuts interest rate after UK inflation slides

-

Have Iran's authorities given up on the mandatory hijab?

Have Iran's authorities given up on the mandatory hijab?

-

Spain to buy 100 military helicopters from Airbus

-

US strike on alleged drug boat in Pacific kills four

US strike on alleged drug boat in Pacific kills four

-

Thailand strikes building in Cambodia's border casino hub

-

Protests in Bangladesh as India cites security concerns

Protests in Bangladesh as India cites security concerns

-

European stocks rise before central bank decisions on rates

-

Tractors clog Brussels in anger at EU-Mercosur trade deal

Tractors clog Brussels in anger at EU-Mercosur trade deal

-

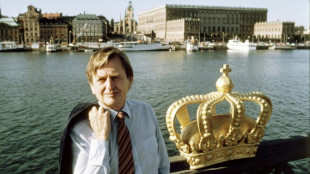

Not enough evidence against Swedish PM murder suspect: prosecutor

-

Nepal's ousted PM Oli re-elected as party leader

Nepal's ousted PM Oli re-elected as party leader

-

British energy giant BP extends shakeup with new CEO pick

-

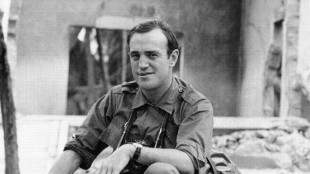

Pulitzer-winning combat reporter Peter Arnett dies at 91

Pulitzer-winning combat reporter Peter Arnett dies at 91

-

EU kicks off crunch summit on Russian asset plan for Ukraine

-

Lyon humbled to surpass childhood hero McGrath's wicket tally

Lyon humbled to surpass childhood hero McGrath's wicket tally

-

Sri Lanka plans $1.6 bn in cyclone recovery spending in 2026

-

England vow to keep 'fighting and scrapping' as Ashes slip away

England vow to keep 'fighting and scrapping' as Ashes slip away

-

'Never enough': Conway leans on McKenzie wisdom in epic 300 stand

-

Most Asian markets track Wall St lower as AI fears mount

Most Asian markets track Wall St lower as AI fears mount

-

Cambodia says Thailand bombs casino hub on border

-

Thai queen wins SEA Games gold in sailing

Thai queen wins SEA Games gold in sailing

-

England Ashes dreams on life-support as Australia rip through batting

-

Masterful Conway, Latham in 323 opening stand as West Indies wilt

Masterful Conway, Latham in 323 opening stand as West Indies wilt

-

Danish 'ghetto' tenants hope for EU discrimination win

-

Cricket Australia boss slams technology as Snicko confusion continues

Cricket Australia boss slams technology as Snicko confusion continues

-

Conway and Latham's 323-run opening stand batters hapless West Indies

-

Alleged Bondi shooters holed up in hotel for most of Philippines visit

Alleged Bondi shooters holed up in hotel for most of Philippines visit

-

Japan govt sued over 'unconstitutional' climate inaction

-

US approves $11 billion in arms sales to Taiwan: Taipei

US approves $11 billion in arms sales to Taiwan: Taipei

-

England battle to save Ashes as Australia rip through top-order

-

Guarded and formal: Pope Leo XIV sets different tone

Guarded and formal: Pope Leo XIV sets different tone

-

What to know about the EU-Mercosur deal

-

Trump vows economic boom, blames Biden in address to nation

Trump vows economic boom, blames Biden in address to nation

-

Conway 120 as New Zealand in command at 216-0 against West Indies

-

Taiwan eyes fresh diplomatic ties with Honduras

Taiwan eyes fresh diplomatic ties with Honduras

-

ECB set to hold rates but debate swirls over future

-

Asian markets track Wall St lower as AI fears mount

Asian markets track Wall St lower as AI fears mount

-

EU holds crunch summit on Russian asset plan for Ukraine

-

Australia PM vows to stamp out hatred as nation mourns youngest Bondi Beach victim

Australia PM vows to stamp out hatred as nation mourns youngest Bondi Beach victim

-

Australian PM vows hate speech crackdown after Bondi Beach attack

BP profit drops 70% amid pivot back to oil and gas

Britain's BP said on Tuesday net profit plunged in the first quarter as the struggling energy giant undergoes a major overhaul back to its fossil fuel business.

Profit after tax declined to $687 million, down from $2.3 billion in the first three months of 2024, driven by weaker gas sales and lower refining margins, BP said in a statement.

Total revenue fell four percent to slightly under $48 billion.

BP and other oil majors have been hit by a recent slump in crude prices on fears that US President Donald Trump's tariffs could cause a recession, impacting demand.

"We continue to monitor market volatility and changes and remain focused on moving at pace," chief executive Murray Auchincloss said in an earnings statement.

Under pressure from investors, BP is in the midst of a major reset that saw it shelve its once industry-leading carbon-reduction targets to focus on fossil fuel output deemed more profitable.

The recent retreat in oil prices has cast doubt over this, however, according to analysts.

BP also announced that the head of sustainability strategy Giulia Chierchia will step down from her role in June and will not be replaced.

Auchincloss said he remains "confident" in the reset, adding that BP has "already made significant progress."

To the dismay of environmentalists, the new strategy includes cutting cleaner energy investment by more than $5 billion annually.

Shares in the company fell over four percent in early deals on London's top-tier FTSE 100 index which was trading flat overall.

The company on Tuesday also reduced its quarterly share buyback to $750 million, at the lower end of expectations.

- Investor pressure -

The strategy overhaul followed a difficult trading year for BP, which is under pressure from investors to boost its share price as countries look to slash emissions.

The company confirmed last week that US activist investment fund Elliott Investment Management has taken a stake of just over five percent in BP.

The fund is known for forcing through corporate changes within groups it invests in, according to analysts.

BP at the start of April said chairman Helge Lund, who assumed the role in 2019, would depart the company next year.

"Geopolitics and trade tensions are more complex today than for a long time. This uncertainty has had an impact on BP," Lund told shareholders at the company's annual general meeting in April.

The Norwegian national worked with three CEOs at BP, which included helping guide the company through the turbulent Covid years when demand for energy collapsed.

"BP's making the best it can of a sticky situation," said Derren Nathan, head of equity research at Hargreaves Lansdown.

The group is ramping up its global exploration programme, with around 40 wells planned over the next three years, including as many as 15 to be drilled this year.

It recently announced it had made a new oil discovery off the US Gulf coast.

"But going into the second quarter weaker oil prices means management will be under more pressure than ever to meet the expectations of its biggest shareholder," Nathan added.

O.Gutierrez--AT