-

North Korean POWs in Ukraine seeking 'new life' in South

North Korean POWs in Ukraine seeking 'new life' in South

-

Japanese golf star 'Jumbo' Ozaki dies aged 78

-

Johnson, Castle shine as Spurs rout Thunder

Johnson, Castle shine as Spurs rout Thunder

-

Thai border clashes hit tourism at Cambodia's Angkor temples

-

From predator to plate: Japan bear crisis sparks culinary craze

From predator to plate: Japan bear crisis sparks culinary craze

-

Asian markets mostly up after US growth fuels Wall St record

-

'Happy milestone': Pakistan's historic brewery cheers export licence

'Happy milestone': Pakistan's historic brewery cheers export licence

-

Chevron: the only foreign oil company left in Venezuela

-

US denies visas to EU ex-commissioner, four others over tech rules

US denies visas to EU ex-commissioner, four others over tech rules

-

Koepka leaves LIV Golf: official

-

US slams China policies on chips but will delay tariffs to 2027

US slams China policies on chips but will delay tariffs to 2027

-

Arsenal reach League Cup semis with shoot-out win over Palace

-

Contenders Senegal, Nigeria start Cup of Nations campaigns with wins

Contenders Senegal, Nigeria start Cup of Nations campaigns with wins

-

Tunisia ease past Uganda to win Cup of Nations opener

-

S&P 500 surges to record after strong US economic report

S&P 500 surges to record after strong US economic report

-

UK police say no action against Bob Vylan duo over Israel army chant

-

Libya's top military chief killed in plane crash in Turkey

Libya's top military chief killed in plane crash in Turkey

-

Venezuela passes law to jail backers of US oil blockade

-

French parliament passes emergency budget extension

French parliament passes emergency budget extension

-

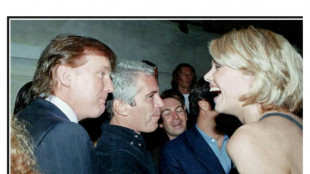

Trump in Epstein files: five takeaways from latest release

-

Wasteful Nigeria open AFCON campaign with narrow win over Tanzania

Wasteful Nigeria open AFCON campaign with narrow win over Tanzania

-

Ukraine retreats in east as Russian strikes kill three, hit energy

-

Macron meets French farmers in bid to defuse anger over trade deal

Macron meets French farmers in bid to defuse anger over trade deal

-

Ineos snap up Scotsman Onley

-

UK comedian Russell Brand faces new rape, assault charges: police

UK comedian Russell Brand faces new rape, assault charges: police

-

World is 'ready' for a woman at helm of UN: Chile's Bachelet tells AFP

-

Real Madrid's Endrick joins Lyon on loan

Real Madrid's Endrick joins Lyon on loan

-

Latest Epstein files renew scrutiny of Britain's ex-prince Andrew

-

US consumer confidence tumbles in December

US consumer confidence tumbles in December

-

Norwegian biathlete Sivert Guttorm Bakken found dead in hotel

-

UK comedian Russell Brand faces two new rape, assault charges: police

UK comedian Russell Brand faces two new rape, assault charges: police

-

Venezuela seeks to jail backers of US oil blockade

-

Norwegian biathlete Sivert Guttorm Bakken found dead

Norwegian biathlete Sivert Guttorm Bakken found dead

-

Wall Street stocks edge higher

-

Vietnam Communist Party endorses To Lam to stay in top job

Vietnam Communist Party endorses To Lam to stay in top job

-

US economic growth surges in 3rd quarter, highest rate in two years

-

Frank defends Van de Ven after Slot slams 'reckless' foul on Isak

Frank defends Van de Ven after Slot slams 'reckless' foul on Isak

-

Russian paramilitaries in CAR say take election threat 'extremely seriously'

-

Trump in the Epstein files: five takeaways from latest release

Trump in the Epstein files: five takeaways from latest release

-

UK govt to relax farmers inheritance tax after protests

-

Pakistani firm wins auction for state airline PIA

Pakistani firm wins auction for state airline PIA

-

Stocks slip on strong US growth data

-

DR Congo beat Benin to kick off Cup of Nations bid

DR Congo beat Benin to kick off Cup of Nations bid

-

New Epstein files dump contains multiple Trump references

-

Russian strike could collapse Chernobyl shelter: plant director

Russian strike could collapse Chernobyl shelter: plant director

-

Springbok captain Kolisi to rejoin Stormers

-

Italy fines Ryanair $300 mn for abuse of dominant position

Italy fines Ryanair $300 mn for abuse of dominant position

-

Mahrez eyes strong AFCON showing from Algeria

-

Killer in Croatia school attack gets maximum 50-year sentence

Killer in Croatia school attack gets maximum 50-year sentence

-

Thousands of new Epstein-linked documents released by US Justice Dept

BoE unveils fifth rate hike in row as inflation soars

The Bank of England on Thursday hiked its main interest rate for a fifth straight time, as it forecast British inflation to soar further this year to above 11 percent.

BoE policymakers agreed at a regular meeting to increase the cost of borrowing by a quarter-point to 1.25 percent, the highest level since the global financial crisis in 2009.

The pound slumped one percent against the dollar following the announcement, one day after the Federal Reserve hiked US interest rates far more aggressively to fight runaway consumer prices in the world's biggest economy.

The BoE's latest rise was in response to "continuing signs of robust cost and price pressures... and the risk that those pressures become more persistent", said minutes of the UK meeting.

A minority of BoE policymakers had voted for an increase to 1.5 percent.

The Bank of England is avoiding "shock and awe tactics being employed across the Atlantic", said Laith Khalaf, head of investment analysis at AJ Bell.

"Despite the UK starting to tighten monetary policy first, interest rates are now higher in the US."

The US Federal Reserve on Wednesday announced the most aggressive interest rate increase in nearly 30 years -- and said it is prepared to do so again next month in an all-out battle to drive down surging consumer prices.

The Fed's rate hike of 0.75 percentage points comes after US inflation rocketed to 8.6 percent in May, the highest level in more than four decades.

In the UK, inflation stands at nine percent, the highest level in 40 years.

Prices are soaring worldwide as economies reopen from pandemic lockdowns and in the wake of the Ukraine war that is pushing already high energy costs even higher.

- Growth impact -

British economic output declined for a second month in a row in April, weighed down by rocketing prices that are causing a cost-of-living crisis for millions of Britons, while increasing the risk of a UK recession this year.

Data this week also revealed the first rise in the UK unemployment rate since the end of 2020 -- although at 3.8 percent it remains at a near 50-year low point amid record-high job vacancies.

At the same time, the value of average UK wages is falling at the fastest pace in more than a decade.

Fearing fallout from surging inflation, the BoE began to raise its key interest rate in December, from a record-low level of 0.1 percent.

Almost two years earlier, as the Covid-19 pandemic began to take hold, the BoE slashed the rate to just above zero and decided to pump massive sums of new cash into the economy.

In the neighbouring eurozone, the European Central Bank is next month set to raise interest rates for the first time in more than a decade.

Switzerland's central bank hiked its rate Thursday for the first time in 15 years.

burs-bcp/rfj/lth

Th.Gonzalez--AT