-

North Korean POWs in Ukraine seeking 'new life' in South

North Korean POWs in Ukraine seeking 'new life' in South

-

Japanese golf star 'Jumbo' Ozaki dies aged 78

-

Johnson, Castle shine as Spurs rout Thunder

Johnson, Castle shine as Spurs rout Thunder

-

Thai border clashes hit tourism at Cambodia's Angkor temples

-

From predator to plate: Japan bear crisis sparks culinary craze

From predator to plate: Japan bear crisis sparks culinary craze

-

Asian markets mostly up after US growth fuels Wall St record

-

'Happy milestone': Pakistan's historic brewery cheers export licence

'Happy milestone': Pakistan's historic brewery cheers export licence

-

Chevron: the only foreign oil company left in Venezuela

-

US denies visas to EU ex-commissioner, four others over tech rules

US denies visas to EU ex-commissioner, four others over tech rules

-

Koepka leaves LIV Golf: official

-

US slams China policies on chips but will delay tariffs to 2027

US slams China policies on chips but will delay tariffs to 2027

-

Arsenal reach League Cup semis with shoot-out win over Palace

-

Contenders Senegal, Nigeria start Cup of Nations campaigns with wins

Contenders Senegal, Nigeria start Cup of Nations campaigns with wins

-

Tunisia ease past Uganda to win Cup of Nations opener

-

S&P 500 surges to record after strong US economic report

S&P 500 surges to record after strong US economic report

-

UK police say no action against Bob Vylan duo over Israel army chant

-

Libya's top military chief killed in plane crash in Turkey

Libya's top military chief killed in plane crash in Turkey

-

Venezuela passes law to jail backers of US oil blockade

-

French parliament passes emergency budget extension

French parliament passes emergency budget extension

-

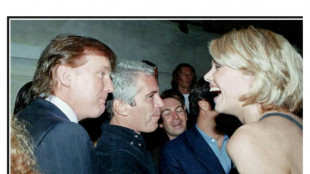

Trump in Epstein files: five takeaways from latest release

-

Wasteful Nigeria open AFCON campaign with narrow win over Tanzania

Wasteful Nigeria open AFCON campaign with narrow win over Tanzania

-

Ukraine retreats in east as Russian strikes kill three, hit energy

-

Macron meets French farmers in bid to defuse anger over trade deal

Macron meets French farmers in bid to defuse anger over trade deal

-

Ineos snap up Scotsman Onley

-

UK comedian Russell Brand faces new rape, assault charges: police

UK comedian Russell Brand faces new rape, assault charges: police

-

World is 'ready' for a woman at helm of UN: Chile's Bachelet tells AFP

-

Real Madrid's Endrick joins Lyon on loan

Real Madrid's Endrick joins Lyon on loan

-

Latest Epstein files renew scrutiny of Britain's ex-prince Andrew

-

US consumer confidence tumbles in December

US consumer confidence tumbles in December

-

Norwegian biathlete Sivert Guttorm Bakken found dead in hotel

-

UK comedian Russell Brand faces two new rape, assault charges: police

UK comedian Russell Brand faces two new rape, assault charges: police

-

Venezuela seeks to jail backers of US oil blockade

-

Norwegian biathlete Sivert Guttorm Bakken found dead

Norwegian biathlete Sivert Guttorm Bakken found dead

-

Wall Street stocks edge higher

-

Vietnam Communist Party endorses To Lam to stay in top job

Vietnam Communist Party endorses To Lam to stay in top job

-

US economic growth surges in 3rd quarter, highest rate in two years

-

Frank defends Van de Ven after Slot slams 'reckless' foul on Isak

Frank defends Van de Ven after Slot slams 'reckless' foul on Isak

-

Russian paramilitaries in CAR say take election threat 'extremely seriously'

-

Trump in the Epstein files: five takeaways from latest release

Trump in the Epstein files: five takeaways from latest release

-

UK govt to relax farmers inheritance tax after protests

-

Pakistani firm wins auction for state airline PIA

Pakistani firm wins auction for state airline PIA

-

Stocks slip on strong US growth data

-

DR Congo beat Benin to kick off Cup of Nations bid

DR Congo beat Benin to kick off Cup of Nations bid

-

New Epstein files dump contains multiple Trump references

-

Russian strike could collapse Chernobyl shelter: plant director

Russian strike could collapse Chernobyl shelter: plant director

-

Springbok captain Kolisi to rejoin Stormers

-

Italy fines Ryanair $300 mn for abuse of dominant position

Italy fines Ryanair $300 mn for abuse of dominant position

-

Mahrez eyes strong AFCON showing from Algeria

-

Killer in Croatia school attack gets maximum 50-year sentence

Killer in Croatia school attack gets maximum 50-year sentence

-

Thousands of new Epstein-linked documents released by US Justice Dept

US Fed announces biggest interest rate hike since 1994

The Federal Reserve announced the most aggressive interest rate increase in nearly 30 years, raising the benchmark borrowing rate by 0.75 percentage points on Wednesday as it battles against surging inflation.

The Fed's policy-setting Federal Open Market Committee reaffirmed that it remains "strongly committed to returning inflation to its 2 percent objective" and expects to continue to raise the key rate.

Until recently, the central bank seemed set to approve a 0.5-percentage-point increase, but economists say the rapid surge in inflation put the Fed behind the curve, meaning it needed to react strongly to prove its resolve to combat inflation

The super-sized move was the first 75-basis-point increase since November 1994.

Fed Chair Jerome Powell will hold a press conference after the meeting to provide more details on the central bank's plans, which will be closely watched for signals on how aggressive policymakers will be in coming meetings.

Committee members now see the federal funds rate ending the year at 3.4 percent, up from the 1.9 percent projection in March, according to the median quarterly forecast.

They also expect the Fed's preferred inflation index to rise to 5.2 percent by the end of the year, with GDP growth slowing to 1.7 percent in 2022 from the previous 2.8 percent forecast.

The FOMC noted that effects of Russia's invasion of Ukraine are "creating additional upward pressure on inflation and are weighing on global economic activity."

And ongoing Covid-19 lockdowns in China "are likely to exacerbate supply chain disruptions."

Kansas City Federal Reserve Bank President Esther George, a noted inflation-hawk, dissented from the committee vote, preferring a smaller, half-point increase.

- Caught off guard -

US central bankers began raising interest rates off zero in March as buoyant demand from American consumers for homes, cars and other goods clashed with transportation and supply chain snarls in parts of the world where Covid-19 remained -- and remains -- a challenge.

That fueled inflation, which got dramatically worse after Russia invaded Ukraine in late February and Western nations imposed steep sanctions on Moscow, sending food and fuel prices up at a blistering rate.

US gasoline prices have topped $5.00 a gallon for the first time ever and are setting new records daily.

Economists thought March was the peak for consumer price hikes, but the rate spiked again in May, jumping 8.6 percent in the latest 12 months, and wholesale prices surged as well, almost entirely due to soaring costs for energy, especially gasoline.

The Fed was caught off guard with the speed of the price increases, and while policymakers usually prefer to clearly telegraph any policy shift to financial markets, the latest data changed the calculus.

Powell had indicated policymakers were poised to implement another half-point increase in the benchmark borrowing rate this week and a similar move next month, aiming to douse red-hot inflation without tipping the economy into recession and avoid a bout of 1970s-style stagflation.

However, the central bank cannot influence supply issues, and rate hikes only work by cooling demand and slowing the economy -- meaning policymakers are walking a fine line between having an impact and doing too much.

And the impact won't be immediate.

"Monetary policy operates with lags, today's inflation reflects decisions taken a year ago," said Adam Posen, head of the Peterson Institute for International Economics and a former central banker.

"Had Fed hiked in 2021Q2/Q3, then inflation now would be different -- not least (because) the current global shocks wouldn't be piling on already high inflation," he said on Twitter.

Ch.Campbell--AT