-

Stocks rise as US inflation cools, tech stocks bounce

Stocks rise as US inflation cools, tech stocks bounce

-

Zelensky presses EU to tap Russian assets at crunch summit

-

Pope replaces New York's Cardinal Dolan with pro-migrant bishop

Pope replaces New York's Cardinal Dolan with pro-migrant bishop

-

Odermatt takes foggy downhill for 50th World Cup win

-

France exonerates women convicted over abortions before legalisation

France exonerates women convicted over abortions before legalisation

-

UK teachers to tackle misogyny in classroom

-

Historic Afghan cinema torn down for a mall

Historic Afghan cinema torn down for a mall

-

US consumer inflation cools unexpectedly in November

-

Danish 'ghetto' residents upbeat after EU court ruling

Danish 'ghetto' residents upbeat after EU court ruling

-

ECB holds rates but debate swirls over future

-

Pope replaces New York's Cardinal Timothy Dolan with little-known bishop

Pope replaces New York's Cardinal Timothy Dolan with little-known bishop

-

Bank of England cuts interest rate after UK inflation slides

-

Have Iran's authorities given up on the mandatory hijab?

Have Iran's authorities given up on the mandatory hijab?

-

Spain to buy 100 military helicopters from Airbus

-

US strike on alleged drug boat in Pacific kills four

US strike on alleged drug boat in Pacific kills four

-

Thailand strikes building in Cambodia's border casino hub

-

Protests in Bangladesh as India cites security concerns

Protests in Bangladesh as India cites security concerns

-

European stocks rise before central bank decisions on rates

-

Tractors clog Brussels in anger at EU-Mercosur trade deal

Tractors clog Brussels in anger at EU-Mercosur trade deal

-

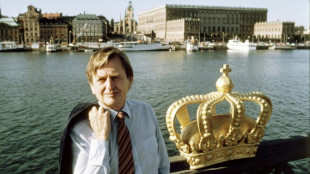

Not enough evidence against Swedish PM murder suspect: prosecutor

-

Nepal's ousted PM Oli re-elected as party leader

Nepal's ousted PM Oli re-elected as party leader

-

British energy giant BP extends shakeup with new CEO pick

-

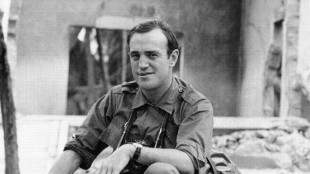

Pulitzer-winning combat reporter Peter Arnett dies at 91

Pulitzer-winning combat reporter Peter Arnett dies at 91

-

EU kicks off crunch summit on Russian asset plan for Ukraine

-

Lyon humbled to surpass childhood hero McGrath's wicket tally

Lyon humbled to surpass childhood hero McGrath's wicket tally

-

Sri Lanka plans $1.6 bn in cyclone recovery spending in 2026

-

England vow to keep 'fighting and scrapping' as Ashes slip away

England vow to keep 'fighting and scrapping' as Ashes slip away

-

'Never enough': Conway leans on McKenzie wisdom in epic 300 stand

-

Most Asian markets track Wall St lower as AI fears mount

Most Asian markets track Wall St lower as AI fears mount

-

Cambodia says Thailand bombs casino hub on border

-

Thai queen wins SEA Games gold in sailing

Thai queen wins SEA Games gold in sailing

-

England Ashes dreams on life-support as Australia rip through batting

-

Masterful Conway, Latham in 323 opening stand as West Indies wilt

Masterful Conway, Latham in 323 opening stand as West Indies wilt

-

Danish 'ghetto' tenants hope for EU discrimination win

-

Cricket Australia boss slams technology as Snicko confusion continues

Cricket Australia boss slams technology as Snicko confusion continues

-

Conway and Latham's 323-run opening stand batters hapless West Indies

-

Alleged Bondi shooters holed up in hotel for most of Philippines visit

Alleged Bondi shooters holed up in hotel for most of Philippines visit

-

Japan govt sued over 'unconstitutional' climate inaction

-

US approves $11 billion in arms sales to Taiwan: Taipei

US approves $11 billion in arms sales to Taiwan: Taipei

-

England battle to save Ashes as Australia rip through top-order

-

Guarded and formal: Pope Leo XIV sets different tone

Guarded and formal: Pope Leo XIV sets different tone

-

What to know about the EU-Mercosur deal

-

Trump vows economic boom, blames Biden in address to nation

Trump vows economic boom, blames Biden in address to nation

-

Conway 120 as New Zealand in command at 216-0 against West Indies

-

Taiwan eyes fresh diplomatic ties with Honduras

Taiwan eyes fresh diplomatic ties with Honduras

-

ECB set to hold rates but debate swirls over future

-

Asian markets track Wall St lower as AI fears mount

Asian markets track Wall St lower as AI fears mount

-

EU holds crunch summit on Russian asset plan for Ukraine

-

Australia PM vows to stamp out hatred as nation mourns youngest Bondi Beach victim

Australia PM vows to stamp out hatred as nation mourns youngest Bondi Beach victim

-

Australian PM vows hate speech crackdown after Bondi Beach attack

Stocks retreat as US hits Nvidia chip export to China

European and Asian stock markets mostly retreated Wednesday after the US government imposed restrictions on exports of a key Nvidia chip to China, the latest trade war salvo between the world's biggest economies.

Nvidia late Tuesday notified regulators that it expects a $5.5 billion hit this quarter owing to a new US licensing requirement on the chip it can legally sell in the Asian country.

The company at the heart of helping to power artificial intelligence said it must obtain licenses to export its H20 chips to China because of concerns they may be used in supercomputers there.

President Donald Trump's decision over Nvidia is "signalling a tech-led decline for US equities" when Wall Street opens, noted Joshua Mahony, analyst at trading group Scope Markets.

After a relatively peaceful couple of days on markets following last week's tariff-fuelled ructions, investors were once again on the defensive, sending safe haven gold above $3,300 an ounce for the first time.

Nvidia shares tumbled around six percent in after-market trade, and its Asian suppliers were also hit.

Trump has also kicked off an investigation that could see tariffs imposed on critical minerals such as rare earths, which are used in a wide range of products including smartphones, wind turbines and electric vehicle motors.

"Nvidia dropped the mic, revealing fresh export curbs on AI gear headed to China," said Stephen Innes at SPI Asset Management.

"Then came the other shoe: Trump ordering a new probe into tariffs on critical minerals. Boom -- just like that, we're back in whiplash mode.

"Welcome to the new normal: one step forward, two tariff probes back," added Innes.

In Europe, London's benchmark FTSE 100 stocks index was down about 0.5 percent around midday, even as official data showed UK inflation slowed more than expected in March.

Paris and Frankfurt shed a similar amount.

The dollar slid once more against main rivals, helping gold to reach yet another fresh record high, this time at $3,317.75.

Oil prices rose nearly one percent after recent sharp falls on fears that the tariffs will dampen global economic growth.

However, cheaper oil could help put on lid on inflation, analysts said.

Trump's most recent moves mark the latest salvo in an increasingly nasty row that has seen Washington and Beijing hit each other with eye-watering tariffs.

China did little to soothe worries Wednesday by saying US levies were putting pressure on its economy, even if official data showed it expanded more than expected in the first quarter.

Beijing told Washington to "stop threatening and blackmailing".

A decision by Hong Kong's postal service to stop shipping US-bound goods in response to "bullying" levies added to the unease.

- Key figures around 1035 GMT -

London - FTSE 100: DOWN 0.4 percent at 8,220.27 points

Paris - CAC 40: DOWN 0.5 percent at 7,295.34

Frankfurt - DAX: DOWN 0.5 percent at 21,150.31

Tokyo - Nikkei 225: DOWN 1.0 percent at 33,920.40 (close)

Hong Kong - Hang Seng Index: DOWN 1.9 percent at 21,056.98 (close)

Shanghai - Composite: UP 0.3 percent at 3,276.00 (close)

New York - Dow: UP 0.4 percent at 40,368.96 (close)

Euro/dollar: UP at $1.1369 from $1.1291 on Tuesday

Pound/dollar: UP at $1.3272 from $1.3232

Dollar/yen: DOWN at 142.66 yen from 143.18 yen

Euro/pound: UP at 85.69 pence from 85.30 pence

Brent North Sea Crude: UP 0.9 percent at $65.23 per barrel

West Texas Intermediate: UP 0.9 percent at $61.87 per barrel

burs-bcp/lth

Ch.Campbell--AT