-

Protests in Bangladesh as India cites security concerns

Protests in Bangladesh as India cites security concerns

-

European stocks rise before central bank decisions on rates

-

Tractors clog Brussels in anger at EU-Mercosur trade deal

Tractors clog Brussels in anger at EU-Mercosur trade deal

-

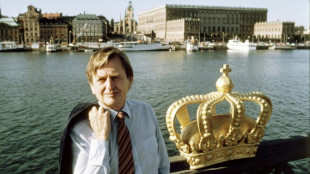

Not enough evidence against Swedish PM murder suspect: prosecutor

-

Nepal's ousted PM Oli re-elected as party leader

Nepal's ousted PM Oli re-elected as party leader

-

British energy giant BP extends shakeup with new CEO pick

-

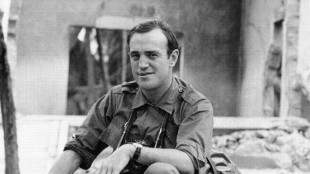

Pulitzer-winning combat reporter Peter Arnett dies at 91

Pulitzer-winning combat reporter Peter Arnett dies at 91

-

EU kicks off crunch summit on Russian asset plan for Ukraine

-

Lyon humbled to surpass childhood hero McGrath's wicket tally

Lyon humbled to surpass childhood hero McGrath's wicket tally

-

Sri Lanka plans $1.6 bn in cyclone recovery spending in 2026

-

England vow to keep 'fighting and scrapping' as Ashes slip away

England vow to keep 'fighting and scrapping' as Ashes slip away

-

'Never enough': Conway leans on McKenzie wisdom in epic 300 stand

-

Most Asian markets track Wall St lower as AI fears mount

Most Asian markets track Wall St lower as AI fears mount

-

Cambodia says Thailand bombs casino hub on border

-

Thai queen wins SEA Games gold in sailing

Thai queen wins SEA Games gold in sailing

-

England Ashes dreams on life-support as Australia rip through batting

-

Masterful Conway, Latham in 323 opening stand as West Indies wilt

Masterful Conway, Latham in 323 opening stand as West Indies wilt

-

Danish 'ghetto' tenants hope for EU discrimination win

-

Cricket Australia boss slams technology as Snicko confusion continues

Cricket Australia boss slams technology as Snicko confusion continues

-

Conway and Latham's 323-run opening stand batters hapless West Indies

-

Alleged Bondi shooters holed up in hotel for most of Philippines visit

Alleged Bondi shooters holed up in hotel for most of Philippines visit

-

Japan govt sued over 'unconstitutional' climate inaction

-

US approves $11 billion in arms sales to Taiwan: Taipei

US approves $11 billion in arms sales to Taiwan: Taipei

-

England battle to save Ashes as Australia rip through top-order

-

Guarded and formal: Pope Leo XIV sets different tone

Guarded and formal: Pope Leo XIV sets different tone

-

What to know about the EU-Mercosur deal

-

Trump vows economic boom, blames Biden in address to nation

Trump vows economic boom, blames Biden in address to nation

-

Conway 120 as New Zealand in command at 216-0 against West Indies

-

Taiwan eyes fresh diplomatic ties with Honduras

Taiwan eyes fresh diplomatic ties with Honduras

-

ECB set to hold rates but debate swirls over future

-

Asian markets track Wall St lower as AI fears mount

Asian markets track Wall St lower as AI fears mount

-

EU holds crunch summit on Russian asset plan for Ukraine

-

Australia PM vows to stamp out hatred as nation mourns youngest Bondi Beach victim

Australia PM vows to stamp out hatred as nation mourns youngest Bondi Beach victim

-

Australian PM vows hate speech crackdown after Bondi Beach attack

-

Turkmenistan's battle against desert sand

Turkmenistan's battle against desert sand

-

Ukraine's Zelensky in Poland for first meeting with nationalist president

-

England in disarray at 59-3 in crunch Test as Lyon, Cummins pounce

England in disarray at 59-3 in crunch Test as Lyon, Cummins pounce

-

Japan faces lawsuit over 'unconstitutional' climate inaction

-

Migrants forced to leave Canada after policy change feel 'betrayed'

Migrants forced to leave Canada after policy change feel 'betrayed'

-

What's next for Venezuela under the US oil blockade?

-

Salvadorans freed with conditional sentence for Bukele protest

Salvadorans freed with conditional sentence for Bukele protest

-

Brazil Congress passes bill to cut Bolsonaro prison term

-

Cricket Australia boss slams technology 'howler' in Ashes Test

Cricket Australia boss slams technology 'howler' in Ashes Test

-

New Zealand 83-0 at lunch on day one of third West Indies Test

-

Ecuadorean footballer Mario Pineida shot and killed

Ecuadorean footballer Mario Pineida shot and killed

-

US government admits liability in deadly DC air collision

-

Wasatch Property Management Launches Fully Integrated AI Voice Agent, Elevating the Prospect Experience Across Its Portfolio

Wasatch Property Management Launches Fully Integrated AI Voice Agent, Elevating the Prospect Experience Across Its Portfolio

-

Classover Advances Next-Generation AI Tutor: Real-Time Adaptive Instruction for K-12 at Scale

-

Hemogenyx Pharmaceuticals PLC - Issue of Equity

Hemogenyx Pharmaceuticals PLC - Issue of Equity

-

SolePursuit Capital Syndicate Establishes Strategic Coordination Office and Appoints Laurence Kingsley as Head

| SCS | 0.12% | 16.14 | $ | |

| RBGPF | -2.23% | 80.22 | $ | |

| CMSC | -0.34% | 23.26 | $ | |

| BCC | 0.59% | 76.29 | $ | |

| RELX | -0.64% | 40.56 | $ | |

| BCE | -0.78% | 23.15 | $ | |

| JRI | -0.6% | 13.43 | $ | |

| NGG | 1.8% | 77.16 | $ | |

| CMSD | -0.43% | 23.28 | $ | |

| RYCEF | 1.48% | 14.86 | $ | |

| RIO | 1.55% | 77.19 | $ | |

| VOD | 0.86% | 12.81 | $ | |

| BTI | -0.21% | 57.17 | $ | |

| GSK | -0.14% | 48.71 | $ | |

| BP | 2.06% | 34.47 | $ | |

| AZN | -1.66% | 89.86 | $ |

Asset flight challenges US safe haven status

The US has long been considered a financial safe haven. The sell-off of the dollar, stocks and Treasury bonds in a spree sparked by panic at President Donald Trump's trade war is starting to raise questions about if that's still true.

- What happened this week to US assets? -

US equities and the greenback have been under pressure for weeks. This week, the volatility spread to the US Treasury market, long considered by global investors to be a refuge.

On Wednesday morning before Trump announced he was pausing many of his most onerous tariffs for 90 days, yields on both the 10-year and 30-year US Treasury bonds spiked suddenly.

Trump's pivot -- which sparked a mammoth equity market rally Wednesday afternoon -- also provided temporary relief to the US Treasury market. But yields began rising again on Thursday.

"There's clearly a flight from US bonds," said Steve Sosnick of Interactive Brokers. "That money is flowing out of the US bond market and doing so very quickly."

JPMorgan Chase CEO Jamie Dimon rejected the notion that US Treasuries were no longer a haven, but acknowledged an impact from recent market volatility.

"It does change the nature a little bit from the certainty point of view," Dimon said Friday, while adding that the United States still stands out as safe "in this turbulent world."

- Why are investors fleeing US bonds? -

The most obvious reason is that the near-term outlook on the US economy has deteriorated, with more economists betting on a recession due to tariff-related inflation and a slowdown in business investment amid policy uncertainty.

That's a big shift from just 80 days ago at the World Economic Forum where "everyone talked about US supremacy," BlackRock CEO Larry Fink said Friday.

Analysts also see the reaction as stemming from Trump's policies such as his "America First" agenda that frays ties with other countries and his proposed tax cuts that could mean bigger US deficits.

"Unconventional policies that gamble with a country's public finances and/or its growth outlook can cause bond investors to question the assumption that government debt is risk free," said a note from Berenberg Economics.

"The breakdown in the relationship between US Treasury yields and the dollar highlights the concerns of investors about Donald Trump's policy agenda," Berenberg said.

Analysts have said some of the selling in US Treasuries is likely from equity investors who need to raise cash quickly. There has also been speculation that the Chinese government could liquidate US Treasury holdings in the US-China trade war, although such a move would also badly hit Beijing.

- What will happen next? -

The safe nature of US Treasury bonds is connected to the reserve currency status of the dollar, a feature that allows the United States to operate with much larger fiscal deficits than other countries.

Since Trump's inauguration, the euro has risen 10 percent against the greenback.

Still there is very little talk of a shift in the dollar's status anytime soon. The greenback is the currency in which oil and other global commodities trade. Central banks around the world will continue to hold assets in dollars and US Treasuries.

"There will be scarring impacts from this, but I don't think it's going to dislocate the dollar as the de facto global currency," said Will Compernolle of FHN Financial. "I just don't see any other alternative for now."

BlackRock's Fink remains bullish on the United States long-term, noting planned investments in artificial intelligence and infrastructure that will fuel growth.

Trump policies such as tax cuts and deregulation will "unlock an amazing amount of private capital," predicted Fink, who believes this upbeat future has been "obscured" by tariffs.

Morgan Stanley CEO Ted Pick said corporate deals could soon pick up, viewing Trump's proposed tax cuts and deregulation as catalysts that may allow clients to say "we will go forward."

M.O.Allen--AT