-

Stocks rise as US inflation cools, tech stocks bounce

Stocks rise as US inflation cools, tech stocks bounce

-

Zelensky presses EU to tap Russian assets at crunch summit

-

Pope replaces New York's Cardinal Dolan with pro-migrant bishop

Pope replaces New York's Cardinal Dolan with pro-migrant bishop

-

Odermatt takes foggy downhill for 50th World Cup win

-

France exonerates women convicted over abortions before legalisation

France exonerates women convicted over abortions before legalisation

-

UK teachers to tackle misogyny in classroom

-

Historic Afghan cinema torn down for a mall

Historic Afghan cinema torn down for a mall

-

US consumer inflation cools unexpectedly in November

-

Danish 'ghetto' residents upbeat after EU court ruling

Danish 'ghetto' residents upbeat after EU court ruling

-

ECB holds rates but debate swirls over future

-

Pope replaces New York's Cardinal Timothy Dolan with little-known bishop

Pope replaces New York's Cardinal Timothy Dolan with little-known bishop

-

Bank of England cuts interest rate after UK inflation slides

-

Have Iran's authorities given up on the mandatory hijab?

Have Iran's authorities given up on the mandatory hijab?

-

Spain to buy 100 military helicopters from Airbus

-

US strike on alleged drug boat in Pacific kills four

US strike on alleged drug boat in Pacific kills four

-

Thailand strikes building in Cambodia's border casino hub

-

Protests in Bangladesh as India cites security concerns

Protests in Bangladesh as India cites security concerns

-

European stocks rise before central bank decisions on rates

-

Tractors clog Brussels in anger at EU-Mercosur trade deal

Tractors clog Brussels in anger at EU-Mercosur trade deal

-

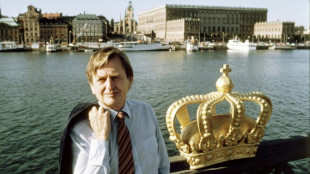

Not enough evidence against Swedish PM murder suspect: prosecutor

-

Nepal's ousted PM Oli re-elected as party leader

Nepal's ousted PM Oli re-elected as party leader

-

British energy giant BP extends shakeup with new CEO pick

-

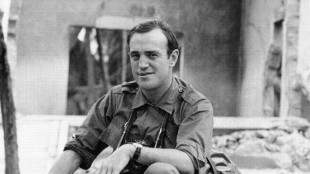

Pulitzer-winning combat reporter Peter Arnett dies at 91

Pulitzer-winning combat reporter Peter Arnett dies at 91

-

EU kicks off crunch summit on Russian asset plan for Ukraine

-

Lyon humbled to surpass childhood hero McGrath's wicket tally

Lyon humbled to surpass childhood hero McGrath's wicket tally

-

Sri Lanka plans $1.6 bn in cyclone recovery spending in 2026

-

England vow to keep 'fighting and scrapping' as Ashes slip away

England vow to keep 'fighting and scrapping' as Ashes slip away

-

'Never enough': Conway leans on McKenzie wisdom in epic 300 stand

-

Most Asian markets track Wall St lower as AI fears mount

Most Asian markets track Wall St lower as AI fears mount

-

Cambodia says Thailand bombs casino hub on border

-

Thai queen wins SEA Games gold in sailing

Thai queen wins SEA Games gold in sailing

-

England Ashes dreams on life-support as Australia rip through batting

-

Masterful Conway, Latham in 323 opening stand as West Indies wilt

Masterful Conway, Latham in 323 opening stand as West Indies wilt

-

Danish 'ghetto' tenants hope for EU discrimination win

-

Cricket Australia boss slams technology as Snicko confusion continues

Cricket Australia boss slams technology as Snicko confusion continues

-

Conway and Latham's 323-run opening stand batters hapless West Indies

-

Alleged Bondi shooters holed up in hotel for most of Philippines visit

Alleged Bondi shooters holed up in hotel for most of Philippines visit

-

Japan govt sued over 'unconstitutional' climate inaction

-

US approves $11 billion in arms sales to Taiwan: Taipei

US approves $11 billion in arms sales to Taiwan: Taipei

-

England battle to save Ashes as Australia rip through top-order

-

Guarded and formal: Pope Leo XIV sets different tone

Guarded and formal: Pope Leo XIV sets different tone

-

What to know about the EU-Mercosur deal

-

Trump vows economic boom, blames Biden in address to nation

Trump vows economic boom, blames Biden in address to nation

-

Conway 120 as New Zealand in command at 216-0 against West Indies

-

Taiwan eyes fresh diplomatic ties with Honduras

Taiwan eyes fresh diplomatic ties with Honduras

-

ECB set to hold rates but debate swirls over future

-

Asian markets track Wall St lower as AI fears mount

Asian markets track Wall St lower as AI fears mount

-

EU holds crunch summit on Russian asset plan for Ukraine

-

Australia PM vows to stamp out hatred as nation mourns youngest Bondi Beach victim

Australia PM vows to stamp out hatred as nation mourns youngest Bondi Beach victim

-

Australian PM vows hate speech crackdown after Bondi Beach attack

Fed official says 'absolutely' ready to intervene in financial markets

The US Federal Reserve is "absolutely" prepared to intervene to help calm nervous financial markets, a senior central bank official said Friday, after President Donald Trump's tariff plans roiled Wall Street.

The US president imposed sweeping import taxes on dozens of countries on April 2, only to abruptly, temporarily roll many of them back to 10 percent in response to turbulence in the stock and bond markets, while leaving China with new tariffs totaling 145 percent.

The Fed would "absolutely be prepared" to deploy its various tools to help stabilize the financial markets if the need arose, Boston Fed President Susan Collins told the Financial Times in an interview published Friday.

Any intervention by the Federal Reserve would depend on "what conditions we were seeing," added Collins, who is one of 12 voting members of the Fed's all-important rate-setting committee this year.

"The higher the tariffs are, the more the potential slowdown in growth as well as elevation and inflation that one would expect," Collins said in a separate interview with Yahoo Finance earlier Friday, adding that she expects inflation to rise "well above" three percent this year, but no "significant" economic downturn.

Her comments indicate she expects price growth to remain stuck firmly above the US central bank's long-term target of two percent, likely preventing the Fed from being able to cut interest rates in the coming months.

- Growth 'below one percent' -

Since Trump's tariffs came into effect earlier this month, Fed officials have been more outspoken than usual about the effects of the government's plans on inflation and growth.

Many have also voiced concerns about long-term inflation expectations, which can cause a vicious cycle of price increases if they are not kept in check.

A widely-referenced consumer sentiment survey published Friday by the University of Michigan noted a sharp drop in consumer confidence, and flagged another worrying rise in both short-term and longer-term inflation expectations.

"Year-ahead inflation expectations surged from 5.0 percent last month to 6.7 percent this month, the highest reading since 1981," the survey noted.

"Long-run inflation expectations climbed from 4.1 percent in March to 4.4 percent in April, reflecting a particularly large jump among independents," it added.

But for now, the University of Michigan's survey on inflation expectations remains an outlier, with financial market measures of inflation expectation still largely pricing in a long-term path closer to the Fed's two percent target.

In a speech in Hot Springs, Arkansas on Friday, St. Louis Fed President Alberto Musalem said "continued vigilance" and "careful monitoring" of the incoming data was needed.

Musalem, a voting member of the Fed's rate-setting committee this year, said that while he still expects a "moderate" pace of economic expansion, the near-term risks were "skewed" toward rising inflation, slower economic growth and a cooler labor market.

"I would be wary of assuming the impact of high tariffs on inflation would be only brief or limited," he said.

On a busy day of speeches from central bank officials, New York Fed President John Williams went further than his colleagues on the bank's rate-setting committee, putting out estimates of how he expects Trump's immigration and tariff policies -- and the uncertainty surrounding them -- to affect the US economy this year.

"I now expect real GDP growth will slow considerably from last year's pace, likely to somewhat below one percent," he told a conference in Puerto Rico.

"With this downshift in the pace of growth... I expect the unemployment rate to rise from its current level of 4.2 percent to between 4.5 and 5 percent over the next year," he said.

Williams added that he expected increased tariffs to "boost inflation this year to somewhere between 3.5 and 4 percent" -- well above the bank's long-term target.

B.Torres--AT