-

Surprise appointment Riera named Frankfurt coach

Surprise appointment Riera named Frankfurt coach

-

Maersk to take over Panama Canal port operations from HK firm

-

US arrests prominent journalist after Minneapolis protest coverage

US arrests prominent journalist after Minneapolis protest coverage

-

Analysts say Kevin Warsh a safe choice for US Fed chair

-

Trump predicts Iran will seek deal to avoid US strikes

Trump predicts Iran will seek deal to avoid US strikes

-

US oil giants say it's early days on potential Venezuela boom

-

Fela Kuti to be first African to get Grammys Lifetime Achievement Award

Fela Kuti to be first African to get Grammys Lifetime Achievement Award

-

Trump says Iran wants deal, US 'armada' larger than in Venezuela raid

-

US Justice Dept releases new batch of documents, images, videos from Epstein files

US Justice Dept releases new batch of documents, images, videos from Epstein files

-

Four memorable showdowns between Alcaraz and Djokovic

-

Russian figure skating prodigy Valieva set for comeback -- but not at Olympics

Russian figure skating prodigy Valieva set for comeback -- but not at Olympics

-

Barcelona midfielder Lopez agrees contract extension

-

Djokovic says 'keep writing me off' after beating Sinner in late-nighter

Djokovic says 'keep writing me off' after beating Sinner in late-nighter

-

US Justice Dept releasing new batch of Epstein files

-

South Africa and Israel expel envoys in deepening feud

South Africa and Israel expel envoys in deepening feud

-

French eyewear maker in spotlight after presidential showing

-

Olympic dream 'not over', Vonn says after crash

Olympic dream 'not over', Vonn says after crash

-

Brazil's Lula discharged after cataract surgery

-

US Senate races to limit shutdown fallout as Trump-backed deal stalls

US Senate races to limit shutdown fallout as Trump-backed deal stalls

-

'He probably would've survived': Iran targeting hospitals in crackdown

-

Djokovic stuns Sinner to set up Australian Open final with Alcaraz

Djokovic stuns Sinner to set up Australian Open final with Alcaraz

-

Mateta omitted from Palace squad to face Forest

-

Gold, silver prices tumble as investors soothed by Trump's Fed pick

Gold, silver prices tumble as investors soothed by Trump's Fed pick

-

Trump attorney general orders arrest of ex-CNN anchor covering protests

-

Djokovic 'pushed to the limit' in stunning late-night Sinner upset

Djokovic 'pushed to the limit' in stunning late-night Sinner upset

-

Tunisia's famed blue-and-white village threatened after record rains

-

Top EU official voices 'shock' at Minneapolis violence

Top EU official voices 'shock' at Minneapolis violence

-

Kremlin says agreed to halt strikes on Kyiv until Sunday

-

Carrick calls for calm after flying start to Man Utd reign

Carrick calls for calm after flying start to Man Utd reign

-

Djokovic to meet Alcaraz in Melbourne final after five-set marathon

-

Italian officials to testify in trial over deadly migrant shipwreck

Italian officials to testify in trial over deadly migrant shipwreck

-

Iran says defence capabilities 'never' up for negotiation

-

UN appeals for more support for flood-hit Mozambicans

UN appeals for more support for flood-hit Mozambicans

-

Lijnders urges Man City to pile pressure on Arsenal in title race

-

Fulham sign Man City winger Oscar Bobb

Fulham sign Man City winger Oscar Bobb

-

Strasbourg's Argentine striker Panichelli sets sights on PSG, World Cup

-

Jesus 'made love': Colombian president irks Christians with steamy claim

Jesus 'made love': Colombian president irks Christians with steamy claim

-

IAEA board meets over Ukraine nuclear safety concerns

-

Eurozone growth beats 2025 forecasts despite Trump woes

Eurozone growth beats 2025 forecasts despite Trump woes

-

Israel to partially reopen Gaza's Rafah crossing on Sunday

-

Dutch PM-elect Jetten says not yet time to talk to Putin

Dutch PM-elect Jetten says not yet time to talk to Putin

-

Social media fuels surge in UK men seeking testosterone jabs

-

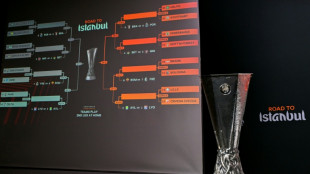

Forest face Fenerbahce, Celtic draw Stuttgart in Europa League play-offs

Forest face Fenerbahce, Celtic draw Stuttgart in Europa League play-offs

-

US speed queen Vonn crashes at Crans-Montana, one week before Olympics

-

Trump nominates former US Fed official as next central bank chief

Trump nominates former US Fed official as next central bank chief

-

Alcaraz defends controversial timeout after beaten Zverev fumes

-

New Dutch government pledges ongoing Ukraine support

New Dutch government pledges ongoing Ukraine support

-

Newcastle still coping with fallout from Isak exit, says Howe

-

Chad, France eye economic cooperation as they reset strained ties

Chad, France eye economic cooperation as they reset strained ties

-

Real Madrid to play Benfica, PSG face Monaco in Champions League play-offs

Stocks rally before key Fed update, oil hits $90

European and US stock markets powered higher Wednesday, recovering further from recent sharp losses, as traders await the outcome of a key Federal Reserve policy meeting.

Meanwhile, the main international oil contract hit $90 per barrel amid continued geopolitical tensions.

Wall Street's main indices snapped higher Wednesday, rebounding from Tuesday's losses, with the Dow up 1.1 percent in late morning trading.

Europe's major indices also ended the day with strong gains.

After weeks of uncertainty, the US central bank delivers Wednesday its views on the state of the world's top economy and how officials plan to tackle decades-high inflation without knocking its recovery off course.

While Fed boss Jerome Powell has pledged that interest rate rises would be carefully calibrated, the prospect of higher borrowing costs has rattled markets across the world.

Most key indices have been deep in the red from the start of the year -- with Wall Street particularly hard hit.

Powell's comments Wednesday will be pored over for signs of the Fed's plans, which most commentators believe include a first hike in March.

"The big question going into this meeting for traders and investors is whether the Fed will increase... four times this year and when the first interest rate hike will take place," said Naeem Aslam, chief market analyst at Avatrade.

- Market buzz -

Part of the market's exuberance may also be speculation that Powell may tone down his remarks about the need to aggressively raise interest rates.

"There is even some buzz that Fed Chair Powell won't sound as hawkish as feared when he holds his press conference," said analyst Patrick J. O'Hare at Briefing.com.

"That view may come back to bite the market," he added.

Despite recent stock market volatility, analysts believe investors remain relatively upbeat about the prospects for the global economy once the current wave of the Covid-19 pandemic wanes.

"Providing (a) boost to the stock markets is optimism that the economic recovery is going to speed up in the months ahead," said Fawad Razaqzada at ThinkMarkets.

Pent up demand for holiday travel will be unleashed as "travel restrictions continue to ease across Europe as Omicron cases decline and more people get double or triple vaccinated," he added.

Nevertheless, authorities are currently downgrading growth forecasts as the impact of the Omicron variant becomes clear.

Germany on Wednesday trimmed its 2022 growth forecast to 3.6 percent, down from 4.1 percent.

The International Monetary Fund on Tuesday lowered its forecast for global growth by half a point to 4.4 percent due to the Omicron variant and geopolitical tensions.

- Oil risk premium -

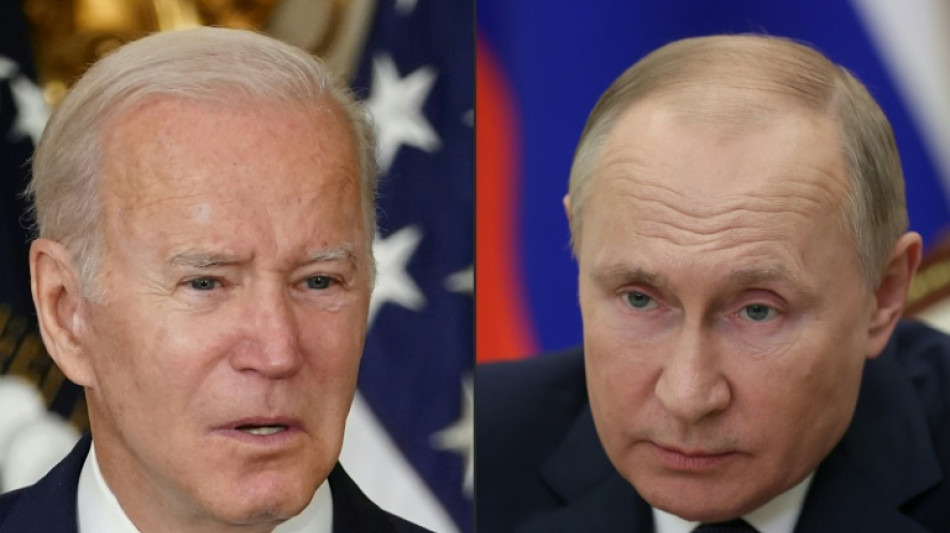

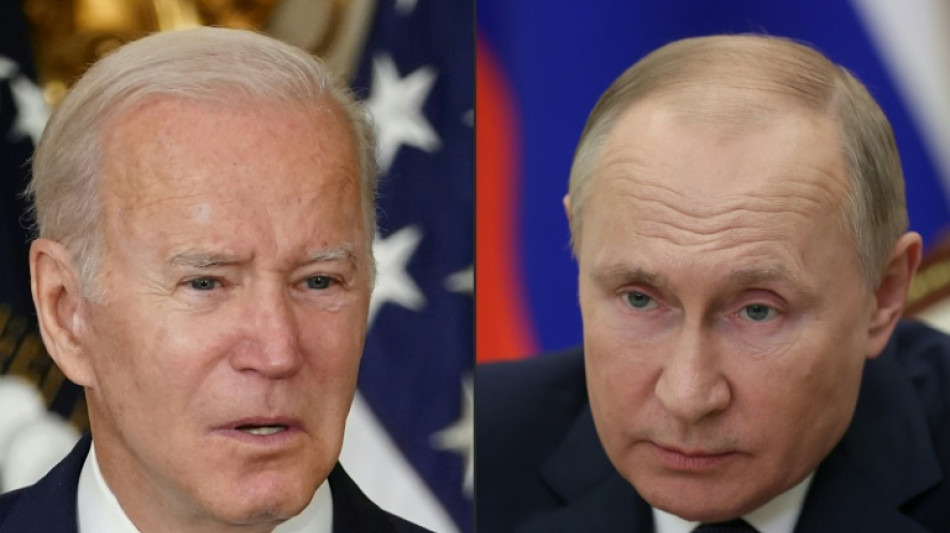

Included in those tensions is the standoff on the Ukraine-Russia border, with Moscow building up troop numbers and the West led by the United States warning the risk of an invasion "remains imminent" and urging its citizens to leave Ukraine.

The West has threatened to impose severe sanctions on Russia in case it goes forward with an invasion.

Those tensions helped push the price of Brent crude above $90 for the first time since October 2014.

"The fundamentals (of supply and demand) remain bullish for oil prices and the prospect of a Russian invasion of Ukraine will only increase the risk premium," OANDA analyst Craig Erlam told AFP.

"With the price now above $90 and gathering momentum once more, it may just be a matter of time until it's flirting with $100."

- Key figures around 1630 GMT -

New York - Dow: UP 1.1 percent at 34,657.07 points

EURO STOXX 50: UP 2.1 percent at 4,165.04

London - FTSE 100: UP 1.3 percent at 7,469.78 (close)

Paris - CAC 40: UP 2.1 percent at 6,981.96 (close)

Frankfurt - DAX: UP 2.2 percent at 15,459.39 (close)

Tokyo - Nikkei 225: DOWN 0.4 percent at 27,011.33 (close)

Hong Kong - Hang Seng Index: UP 0.2 percent at 24,289.90 (close)

Shanghai - Composite: UP 0.7 percent at 3,455.67 (close)

Euro/dollar: DOWN at $1.1283 from $1.1305 late Tuesday

Pound/dollar: UP at $1.3515 from $1.3507

Euro/pound: DOWN at 83.46 pence from 83.66 pence

Dollar/yen: UP at 114.35 yen from 113.87 yen

Brent North Sea crude: UP 2.1 percent at $90.30 per barrel

West Texas Intermediate: UP 2.1 percent at $87.66 per barrel

burs-rl/

R.Lee--AT