-

Gold, silver prices tumble as investors soothed by Trump Fed pick

Gold, silver prices tumble as investors soothed by Trump Fed pick

-

Ko, Woad share lead at LPGA season opener

-

US Senate votes on funding deal - but shutdown still imminent

US Senate votes on funding deal - but shutdown still imminent

-

US charges prominent journalist after Minneapolis protest coverage

-

Trump expects Iran to seek deal to avoid US strikes

Trump expects Iran to seek deal to avoid US strikes

-

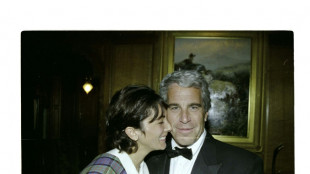

US Justice Dept releases documents, images, videos from Epstein files

-

Guterres warns UN risks 'imminent financial collapse'

Guterres warns UN risks 'imminent financial collapse'

-

NASA delays Moon mission over frigid weather

-

First competitors settle into Milan's Olympic village

First competitors settle into Milan's Olympic village

-

Fela Kuti: first African to get Grammys Lifetime Achievement Award

-

Cubans queue for fuel as Trump issues oil ultimatum

Cubans queue for fuel as Trump issues oil ultimatum

-

'Schitt's Creek' star Catherine O'Hara dead at 71

-

Curran hat-trick seals 11 run DLS win for England over Sri Lanka

Curran hat-trick seals 11 run DLS win for England over Sri Lanka

-

Cubans queue for fuel as Trump issues energy ultimatum

-

France rescues over 6,000 UK-bound Channel migrants in 2025

France rescues over 6,000 UK-bound Channel migrants in 2025

-

Surprise appointment Riera named Frankfurt coach

-

Maersk to take over Panama Canal port operations from HK firm

Maersk to take over Panama Canal port operations from HK firm

-

US arrests prominent journalist after Minneapolis protest coverage

-

Analysts say Kevin Warsh a safe choice for US Fed chair

Analysts say Kevin Warsh a safe choice for US Fed chair

-

Trump predicts Iran will seek deal to avoid US strikes

-

US oil giants say it's early days on potential Venezuela boom

US oil giants say it's early days on potential Venezuela boom

-

Fela Kuti to be first African to get Grammys Lifetime Achievement Award

-

Trump says Iran wants deal, US 'armada' larger than in Venezuela raid

Trump says Iran wants deal, US 'armada' larger than in Venezuela raid

-

US Justice Dept releases new batch of documents, images, videos from Epstein files

-

Four memorable showdowns between Alcaraz and Djokovic

Four memorable showdowns between Alcaraz and Djokovic

-

Russian figure skating prodigy Valieva set for comeback -- but not at Olympics

-

Barcelona midfielder Lopez agrees contract extension

Barcelona midfielder Lopez agrees contract extension

-

Djokovic says 'keep writing me off' after beating Sinner in late-nighter

-

US Justice Dept releasing new batch of Epstein files

US Justice Dept releasing new batch of Epstein files

-

South Africa and Israel expel envoys in deepening feud

-

French eyewear maker in spotlight after presidential showing

French eyewear maker in spotlight after presidential showing

-

Olympic dream 'not over', Vonn says after crash

-

Brazil's Lula discharged after cataract surgery

Brazil's Lula discharged after cataract surgery

-

US Senate races to limit shutdown fallout as Trump-backed deal stalls

-

'He probably would've survived': Iran targeting hospitals in crackdown

'He probably would've survived': Iran targeting hospitals in crackdown

-

Djokovic stuns Sinner to set up Australian Open final with Alcaraz

-

Mateta omitted from Palace squad to face Forest

Mateta omitted from Palace squad to face Forest

-

Gold, silver prices tumble as investors soothed by Trump's Fed pick

-

Trump attorney general orders arrest of ex-CNN anchor covering protests

Trump attorney general orders arrest of ex-CNN anchor covering protests

-

Djokovic 'pushed to the limit' in stunning late-night Sinner upset

-

Tunisia's famed blue-and-white village threatened after record rains

Tunisia's famed blue-and-white village threatened after record rains

-

Top EU official voices 'shock' at Minneapolis violence

-

Kremlin says agreed to halt strikes on Kyiv until Sunday

Kremlin says agreed to halt strikes on Kyiv until Sunday

-

Carrick calls for calm after flying start to Man Utd reign

-

Djokovic to meet Alcaraz in Melbourne final after five-set marathon

Djokovic to meet Alcaraz in Melbourne final after five-set marathon

-

Italian officials to testify in trial over deadly migrant shipwreck

-

Iran says defence capabilities 'never' up for negotiation

Iran says defence capabilities 'never' up for negotiation

-

UN appeals for more support for flood-hit Mozambicans

-

Lijnders urges Man City to pile pressure on Arsenal in title race

Lijnders urges Man City to pile pressure on Arsenal in title race

-

Fulham sign Man City winger Oscar Bobb

China cuts lending rates, boosting property firms

China further reduced bank lending costs Thursday in the latest move to boost its stuttering economy, providing some much-needed support to the country's beleaguered developers.

Property firm shares and bonds surged on the fresh rate cut from People's Bank of China -- the second in two months -- days after Beijing reported slower growth in the final months of 2021.

The slowing real estate industry has put downward pressure on growth, with several large companies including debt-laden development giant Evergrande defaulting in recent months.

The central bank said it had lowered the one-year loan prime rate (LPR) to 3.7 percent, from 3.8 percent in December.

It had reduced the LPR -- which guides how much interest commercial banks charge to corporate borrowers -- in December, for the first time in 20 months, as the economy was threatened by the real estate crisis and coronavirus flare-ups.

The launch of a regulatory drive last year to curb speculation and leverage had cut off avenues to crucially needed cash, sparking a crisis in the property sector.

But investors regained confidence amid expectations of regulatory easing with shares in Hong Kong-listed Agile Group up more than six percent and Country Garden climbing 7.4 percent.

Property developer bonds also surged Thursday on news of the rate cut, in what Bloomberg said was a record-breaking rally, highlighting the huge sums of money primed to flow into distressed securities if the property sector crackdown was eased.

Thursday's move comes after the world's second-biggest economy reported strong 8.1 percent growth in 2021, but with the first half of the year accounting for much of that growth.

The central bank also cut the interest rate on its one-year policy loans on Monday -- the first drop in the key rate for loans to financial institutions since early 2020.

- 'Targeted support' -

China was the only major economy to expand in 2020, after quickly bringing the outbreak under control.

But the country is now battling several localised virus clusters as it deals with the ongoing property market slump and fallout from a wide-ranging regulatory crackdown last year.

"Today's reductions to both the one-year and five-year Loan Prime Rates (LPR) continue the PBOC's efforts to push down borrowing costs," said Sheana Yue, China economist at Capital Economics.

She said the cuts mean "mortgages will now be slightly cheaper, which should help shore up housing demand."

"Targeted support for property buyers does appear to be limiting one of the more severe downside risks facing the economy."

Hong Kong-listed China Aoyuan Group became the latest major developer to miss bond payments, saying in a filing it would be unable to pay two notes due Thursday and Saturday, amounting to $688 million in total.

Fitch Ratings also downgraded its rating for real estate giant Sunac China Holdings, warning the developer would have to use its cash reserves to pay off debts maturing soon.

W.Nelson--AT