-

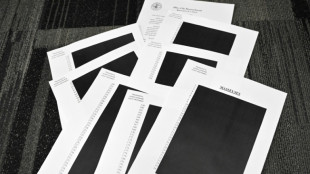

Epstein files opened: famous faces, many blacked-out pages

Epstein files opened: famous faces, many blacked-out pages

-

Ravens face 'special' Patriots clash as playoffs come into focus

-

Newly released Epstein files: what we know

Newly released Epstein files: what we know

-

Musk wins US court appeal of $56 bn Tesla pay package

-

US judge voids murder conviction in Jam Master Jay killing

US judge voids murder conviction in Jam Master Jay killing

-

Trump doesn't rule out war with Venezuela

-

Haller, Aouar out of AFCON, Zambia coach drama

Haller, Aouar out of AFCON, Zambia coach drama

-

Nasdaq rallies again while yen falls despite BOJ rate hike

-

Bologna win shoot-out with Inter to reach Italian Super Cup final

Bologna win shoot-out with Inter to reach Italian Super Cup final

-

Brandt and Beier send Dortmund second in Bundesliga

-

Trump administration begins release of Epstein files

Trump administration begins release of Epstein files

-

UN Security Council votes to extend DR Congo mission by one year

-

Family of Angels pitcher, club settle case over 2019 death

Family of Angels pitcher, club settle case over 2019 death

-

US university killer's mystery motive sought after suicide

-

Rubio says won't force deal on Ukraine as Europeans join Miami talks

Rubio says won't force deal on Ukraine as Europeans join Miami talks

-

Burkinabe teen behind viral French 'coup' video has no regrets

-

Brazil court rejects new Bolsonaro appeal against coup conviction

Brazil court rejects new Bolsonaro appeal against coup conviction

-

Three-time Grand Slam winner Wawrinka to retire in 2026

-

Man Utd can fight for Premier League title in next few years: Amorim

Man Utd can fight for Premier League title in next few years: Amorim

-

Pandya blitz powers India to T20 series win over South Africa

-

Misinformation complicated Brown University shooting probe: police

Misinformation complicated Brown University shooting probe: police

-

IMF approves $206 mn aid to Sri Lanka after Cyclone Ditwah

-

US halts green card lottery after MIT professor, Brown University killings

US halts green card lottery after MIT professor, Brown University killings

-

Stocks advance as markets cheer weak inflation

-

Emery says rising expectations driving red-hot Villa

Emery says rising expectations driving red-hot Villa

-

Three killed in Taipei metro attacks, suspect dead

-

Seven Colombian soldiers killed in guerrilla attack: army

Seven Colombian soldiers killed in guerrilla attack: army

-

Amorim takes aim at Man Utd youth stars over 'entitlement'

-

Mercosur meets in Brazil, EU eyes January 12 trade deal

Mercosur meets in Brazil, EU eyes January 12 trade deal

-

US Fed official says no urgency to cut rates, flags distorted data

-

Rome to charge visitors for access to Trevi Fountain

Rome to charge visitors for access to Trevi Fountain

-

Spurs 'not a quick fix' for under-fire Frank

-

Poland president accuses Ukraine of not appreciating war support

Poland president accuses Ukraine of not appreciating war support

-

Stocks advance with focus on central banks, tech

-

Amorim unfazed by 'Free Mainoo' T-shirt ahead of Villa clash

Amorim unfazed by 'Free Mainoo' T-shirt ahead of Villa clash

-

PSG penalty hero Safonov ended Intercontinental win with broken hand

-

French court rejects Shein suspension

French court rejects Shein suspension

-

'It's so much fun,' says Vonn as she milks her comeback

-

Moscow intent on pressing on in Ukraine: Putin

Moscow intent on pressing on in Ukraine: Putin

-

UN declares famine over in Gaza, says 'situation remains critical'

-

Guardiola 'excited' by Man City future, not pondering exit

Guardiola 'excited' by Man City future, not pondering exit

-

Zabystran upsets Odermatt to claim first World Cup win in Val Gardena super-G

-

Czechs name veteran coach Koubek for World Cup play-offs

Czechs name veteran coach Koubek for World Cup play-offs

-

PSG penalty hero Safonov out until next year with broken hand

-

Putin says ball in court of Russia's opponents in Ukraine talks

Putin says ball in court of Russia's opponents in Ukraine talks

-

Czech Zabystran upsets Odermatt to claim Val Gardena super-G

-

NGOs fear 'catastrophic impact' of new Israel registration rules

NGOs fear 'catastrophic impact' of new Israel registration rules

-

US suspends green card lottery after MIT professor, Brown University killings

-

Stocks mixed with focus on central banks, tech

Stocks mixed with focus on central banks, tech

-

Arsenal in the 'right place' as Arteta marks six years at club

UK housing market hit by budget fallout

Britain's housing market has been rocked by the UK government's costly budget, as retail banks pull mortgage rates in anticipation of more costly products, sparking fears of tumbling home prices.

Homebuyers are gripped by panic after the Bank of England declared it would not hesitate to lift its main interest rate in response to the government's anticipated borrowing splurge that many see as further fuelling sky-high inflation.

- 'Torrid week' -

"It has been a torrid week for the mortgage market," Sarah Coles, personal finance analyst at broker Hargreaves Lansdown, told AFP.

Home-loan providers, which offer mortgages based on the central bank's rate, have scrapped about 40 percent of available products since the budget on September 23, according to data provider Moneyfacts.

That equates to more than 1,600 mortgage rates offered for a fixed period of time.

Coles said "the market struggled to function normally" as the pound struck a record-low against the dollar following the economic plan announced by the government of new Prime Minister Liz Truss.

The central bank reacted by launching emergency purchases of long-dated UK government bonds as soaring yields put pension funds at risk of collapse.

"Lenders withdrew (mortgage) rates for new customers while they waited for the dust to settle," said Coles.

"Once things feel more functional, they will be back but at a higher rate."

Major UK bank Barclays said that "due to high demand" it "withdrew a small number of mortgage products from sale for new customers".

For some time, the average mortgage rate has hovered around two percent for a fix lasting between two and five years, according to Moneyfacts.

However, those same mortgage deals are now approaching five percent, more than doubling monthly repayment costs.

- Added costs -

Tom Bill, head of UK residential research at Knight Frank, told AFP that mortgage holders could find themselves paying an additional "hundreds of pounds per month, that they're going to have to find", adding to the cost-of-living crisis.

The removal of mortgage deals "is a bitter pill to swallow for those who want to move and those with fixed terms due to end", said Tim Bannister, a director at online property firm Rightmove.

"And it will impact buyers' budgets, especially those who were already stretching themselves."

Richard Donell, executive director of online property group Zoopla, said rising mortgage rates "have been brewing for some time".

The Bank of England has in less than a year hiked its interest rate to 2.25 percent from a record-low 0.1 percent in a bid to cool decades-high inflation.

Experts are predicting the BoE's rate will peak close to six percent in the first half of next year. Before the budget, the market consensus forecast had been for a four-percent pinnacle.

- House prices to slump? -

Analysts are meanwhile predicting that British house prices are heading for a protracted slump after soaring in recent times as demand outpaces supply.

The average British home price surged 9.5 percent in September from a year earlier, home loans provider Nationwide revealed on Friday.

However prices were flat last month compared with August.

"The stall in house prices in September was little surprise given the growing downward pressure on demand from rising mortgage rates," said Capital Economics analyst Andrew Wishart.

"This marks the beginning of the most significant correction in house prices since 2007", when the global financial crisis began to emerge.

In his budget, finance minister Kwasi Kwarteng lifted the point at which tax is levied on purchases of residential properties -- a benefit that has seemingly been wiped out by the shake up of mortgage rates.

A.Moore--AT