-

Iran rights group warns of 'mass killing' of protesters

Iran rights group warns of 'mass killing' of protesters

-

Demonstrators in London, Paris, Istanbul back Iran protests

-

Olise sparkles as Bayern fire eight past Wolfsburg

Olise sparkles as Bayern fire eight past Wolfsburg

-

Man Utd knocked out of FA Cup by Brighton, Martinelli hits hat-trick for Arsenal

-

Troubled Man Utd crash out of FA Cup against Brighton

Troubled Man Utd crash out of FA Cup against Brighton

-

Danish PM says Greenland showdown at 'decisive moment' after new Trump threats

-

AC Milan snatch late draw at Fiorentina as title rivals Inter face Napoli

AC Milan snatch late draw at Fiorentina as title rivals Inter face Napoli

-

Venezuelans demand political prisoners' release, Maduro 'doing well'

-

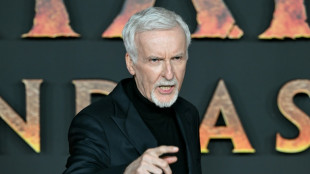

'Avatar: Fire and Ashe' leads in N.America for fourth week

'Avatar: Fire and Ashe' leads in N.America for fourth week

-

Bordeaux-Begles rout Northampton in Champions Cup final rematch

-

NHL players will compete at Olympics, says international ice hockey chief

NHL players will compete at Olympics, says international ice hockey chief

-

Kohli surpasses Sangakkara as second-highest scorer in international cricket

-

Young mother seeks five relatives in Venezuela jail

Young mother seeks five relatives in Venezuela jail

-

Arsenal villain Martinelli turns FA Cup hat-trick hero

-

Syrians in Kurdish area of Aleppo pick up pieces after clashes

Syrians in Kurdish area of Aleppo pick up pieces after clashes

-

Kohli hits 93 as India edge New Zealand in ODI opener

-

Trump tells Cuba to 'make a deal, before it is too late'

Trump tells Cuba to 'make a deal, before it is too late'

-

Toulon win Munster thriller as Quins progress in Champions Cup

-

NHL players will complete at Olympics, says international ice hockey chief

NHL players will complete at Olympics, says international ice hockey chief

-

Leeds rally to avoid FA Cup shock at Derby

-

Rassat sweeps to slalom victory to take World cup lead

Rassat sweeps to slalom victory to take World cup lead

-

Liverpool's Bradley out for the season with 'significant' knee injury

-

Syria govt forces take control of Aleppo's Kurdish neighbourhoods

Syria govt forces take control of Aleppo's Kurdish neighbourhoods

-

Comeback kid Hurkacz inspires Poland to first United Cup title

-

Kyiv shivers without heat, but battles on

Kyiv shivers without heat, but battles on

-

Salah and fellow stars aim to deny Morocco as AFCON reaches semi-final stage

-

Mitchell lifts New Zealand to 300-8 in ODI opener against India

Mitchell lifts New Zealand to 300-8 in ODI opener against India

-

Iran protest death toll rises as alarm grows over crackdown 'massacre'

-

Malaysia suspends access to Musk's Grok AI: regulator

Malaysia suspends access to Musk's Grok AI: regulator

-

Venezuelans await release of more political prisoners, Maduro 'doing well'

-

Kunlavut seals Malaysia Open title after injured Shi retires

Kunlavut seals Malaysia Open title after injured Shi retires

-

Medvedev warms up in style for Australian Open with Brisbane win

-

Bublik powers into top 10 ahead of Australian Open after Hong Kong win

Bublik powers into top 10 ahead of Australian Open after Hong Kong win

-

Sabalenka fires Australian Open warning with Brisbane domination

-

In Gaza hospital, patients cling to MSF as Israel orders it out

In Gaza hospital, patients cling to MSF as Israel orders it out

-

New protests hit Iran as alarm grows over crackdown 'massacre'

-

Svitolina powers to Auckland title in Australian Open warm-up

Svitolina powers to Auckland title in Australian Open warm-up

-

Keys draws on happy Adelaide memories before Australian Open defence

-

Scores of homes razed, one dead in Australian bushfires

Scores of homes razed, one dead in Australian bushfires

-

Ugandan opposition turns national flag into protest symbol

-

Bears banish Packers, Rams survive Panthers playoff scare

Bears banish Packers, Rams survive Panthers playoff scare

-

'Quad God' Malinin warms up for Olympics with US skating crown

-

India eyes new markets with US trade deal limbo

India eyes new markets with US trade deal limbo

-

Syria's Kurdish fighters agree to leave Aleppo after deadly clashes

-

New York's Chrysler Building, an art deco jewel, seeks new owner

New York's Chrysler Building, an art deco jewel, seeks new owner

-

AI toys look for bright side after troubled start

-

AI pendants back in vogue at tech show after early setback

AI pendants back in vogue at tech show after early setback

-

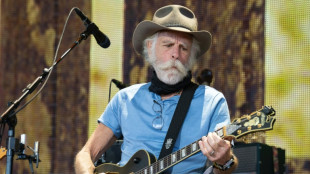

Grateful Dead co-founder and guitarist Bob Weir dies aged 78

-

Myanmar votes in second phase of junta-run election

Myanmar votes in second phase of junta-run election

-

'One Battle After Another' heads into Golden Globes as favorite

Pre-JPM Investor Pulse Signals 2026 Capital Rotation Toward "AI That Ships," Admin Cost Takeout, and Differentiated Metabolic Assets With Special-Situations Capital Back in Scope

Preliminary, directional read of planned 88-investor sample indicates heightened proof thresholds (unit economics, reimbursement, outcomes) and renewed appetite for carve-outs, milestone bridges, and structured financings heading into JPM Week 2026 from Black Book Research flash polls.

SAN FRANCISCO, CA / ACCESS Newswire / January 11, 2026 / Black Book Market Research today published a preliminary, directional preview of a Pre-JPM Investor Pulse, designed to quantify what venture capital, private equity, and investment banking participants are most actively seeking to fund, advise, acquire, or syndicate during JPM Week 2026 (Jan. 12-15). The preview summarizes modeled/indicative findings based on early outreach patterns and a targeted respondent mix of 88 industry investors.

Directional highlights

Black Book's preview indicates that capital allocators are entering JPM Week 2026 with a clear bias toward deployable, integration-ready healthcare AI, measurable administrative cost takeout, and category-defining differentiation in metabolic disease, while maintaining rigorous standards for evidence and commercialization readiness.

Theme concentration (share selecting theme; multiple selections allowed):

AI documentation / clinician workflow automation: ~58% (≈51/88)

Revenue cycle / denials / prior auth automation: ~52% (≈46/88)

Obesity / metabolic innovation (incl. oral convenience and next-gen differentiation): ~47% (≈41/88)

Oncology modalities (targeted, ADC, radiopharma narratives): ~40% (≈35/88)

Diagnostics + imaging AI / cardiology medtech momentum: ~36% (≈32/88)

Care navigation + specialty value-based enablement: ~32% (≈28/88)

____________________

Proof thresholds gating investor engagement (share selecting "must-have" criteria):

Unit economics clarity (CAC/LTV, margin, payback): ~65%

Reimbursement pathway confidence (coverage/payment logic): ~61%

Clinical evidence (prospective or outcomes-grade real-world data): ~55%

Reference customers + renewals: ~48%

Defensible data asset / switching costs: ~44%

Regulatory pathway clarity: ~39%

____________________

Special situations ("reset") appetite re-emerges (directional):

Actively seeking reset opportunities: ~27% (≈24/88)

Opportunistic reset participation: ~46% (≈40/88)

Not pursuing resets: ~27% (≈24/88)

Among those open to resets (≈64 respondents), the most cited structures in-scope include:

Asset carve-outs / non-core divestitures: ~45%

Milestone-tied bridge financings: ~41%

Down-round / inside recapitalizations: ~36%

Structured equity / PIPE-like solutions: ~33%

Royalty/alternative capital solutions: ~22%

Distressed M&A / IP purchase: ~20%

____________________

Black Book Interpretation: investors want "operational alpha," not theoretical narratives

Across categories, the preview suggests a consistent investor posture: fund fewer things, fund them faster, and demand cleaner proof. In practical terms, buyers and financiers are prioritizing solutions that:

Integrate into real operating environments (EHR workflows, billing stacks, procurement realities),

Demonstrate measurable ROI on compressed timelines (weeks-not quarters), and

Translate clinical or technical advantage into reimbursable, defensible revenue.

____________________

"JPM Week 2026 is shaping up to be a high-precision capital market where credibility is priced in at the data layer," said Doug Brown, Founder, Black Book Market Research. "Investors are effectively underwriting a new stack: workflow-native AI, economics-first automation, and clinically differentiated assets that can clear reimbursement and adoption without heroics. The common denominator is execution velocity with verifiable proof-and we're seeing renewed sophistication around 'reset' structures that convert uncertainty into milestone-driven optionality. In this market, the winners aren't the loudest stories, they're the teams that can instrument outcomes, de-risk commercialization, and compound operating leverage."

What this means for founders, operators, and deal teams at JPM per Black Book Research

Black Book's preview points to several immediate implications for conference positioning:

Bring the "proof packet," not the pitch deck: quantified ROI, renewal signals, outcomes evidence, and reimbursement logic appear to be the fastest path to meetings.

AI must be embedded, not bolted on: investors are signaling preference for products that live inside existing workflows, with low-friction deployment and governance readiness.

Reset capital is strategic, not rescue: carve-outs and milestone bridges are being evaluated as engineered pathways to clarity, not merely valuation repair.

Differentiation is tightening in metabolic/obesity: investors appear to be focusing on mechanisms, tolerability, adherence, and payer strategy, not broad market enthusiasm.

About Black Book Market Research

Black Book Market Research provides market intelligence and investor-focused research across healthcare and health technology, supporting investment theses, go-to-market strategy, and transaction diligence. Doug Brown, Founder of Black Book Research will be attending the JPM week on site in San Francisco and can be reached during the event at [email protected]

SOURCE: Black Book Research

View the original press release on ACCESS Newswire

R.Garcia--AT