-

Rahm says golfers should be 'free' to play where they want after LIV defections

Rahm says golfers should be 'free' to play where they want after LIV defections

-

More baby milk recalls in France after new toxin rules

-

Rosenior will not rush Estevao return from Brazil

Rosenior will not rush Estevao return from Brazil

-

Mercedes ready to win F1 world title, says Russell

-

Germany hit by nationwide public transport strike

Germany hit by nationwide public transport strike

-

Barca coach Flick 'not happy' with Raphinha thigh strain

-

WHO chief says turmoil creates chance for reset

WHO chief says turmoil creates chance for reset

-

European stocks rise as gold, oil prices tumble

-

Rink issues resolved, NHL stars chase Olympic gold at Milan

Rink issues resolved, NHL stars chase Olympic gold at Milan

-

S. Korea celebrates breakthrough K-pop Grammy win for 'Golden'

-

Rodri rages that officials 'don't want' Man City to win

Rodri rages that officials 'don't want' Man City to win

-

Gaza's Rafah crossing makes limited reopening after two-year war

-

African players in Europe: Ouattara dents Villa title hopes

African players in Europe: Ouattara dents Villa title hopes

-

Liverpool beat Chelsea to Rennes defender Jacquet - reports

-

S. Korea celebrates breakthrough Grammy win for K-pop's 'Golden'

S. Korea celebrates breakthrough Grammy win for K-pop's 'Golden'

-

Trump says US talking deal with 'highest people' in Cuba

-

Trump threatens legal action against Grammy host over Epstein comment

Trump threatens legal action against Grammy host over Epstein comment

-

Olympic Games in northern Italy have German twist

-

Bad Bunny: the Puerto Rican phenom on top of the music world

Bad Bunny: the Puerto Rican phenom on top of the music world

-

Snapchat blocks 415,000 underage accounts in Australia

-

At Grammys, 'ICE out' message loud and clear

At Grammys, 'ICE out' message loud and clear

-

Dalai Lama's 'gratitude' at first Grammy win

-

Bad Bunny makes Grammys history with Album of the Year win

Bad Bunny makes Grammys history with Album of the Year win

-

Stocks, oil, precious metals plunge on volatile start to the week

-

Steven Spielberg earns coveted EGOT status with Grammy win

Steven Spielberg earns coveted EGOT status with Grammy win

-

Knicks boost win streak to six by beating LeBron's Lakers

-

Kendrick Lamar, Bad Bunny, Lady Gaga triumph at Grammys

Kendrick Lamar, Bad Bunny, Lady Gaga triumph at Grammys

-

Japan says rare earth found in sediment retrieved on deep-sea mission

-

San Siro prepares for last dance with Winter Olympics' opening ceremony

San Siro prepares for last dance with Winter Olympics' opening ceremony

-

France great Benazzi relishing 'genius' Dupont's Six Nations return

-

Grammy red carpet: black and white, barely there and no ICE

Grammy red carpet: black and white, barely there and no ICE

-

Oil tumbles on Iran hopes, precious metals hit by stronger dollar

-

South Korea football bosses in talks to avert Women's Asian Cup boycott

South Korea football bosses in talks to avert Women's Asian Cup boycott

-

Level playing field? Tech at forefront of US immigration fight

-

British singer Olivia Dean wins Best New Artist Grammy

British singer Olivia Dean wins Best New Artist Grammy

-

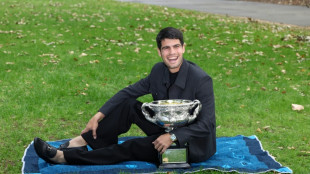

Hatred of losing drives relentless Alcaraz to tennis history

-

Kendrick Lamar, Bad Bunny, Lady Gaga win early at Grammys

Kendrick Lamar, Bad Bunny, Lady Gaga win early at Grammys

-

Surging euro presents new headache for ECB

-

Djokovic hints at retirement as time seeps away on history bid

Djokovic hints at retirement as time seeps away on history bid

-

US talking deal with 'highest people' in Cuba: Trump

-

UK ex-ambassador quits Labour over new reports of Epstein links

UK ex-ambassador quits Labour over new reports of Epstein links

-

Trump says closing Kennedy Center arts complex for two years

-

TaxBandits Offers E-Filing Support as Feb. 2 Deadline Arrives for 1099, W-2 and 94x Forms

TaxBandits Offers E-Filing Support as Feb. 2 Deadline Arrives for 1099, W-2 and 94x Forms

-

Bank of San Francisco Reports Fourth Quarter and Year Ended December 31, 2025 Financial Results

-

Jericho Energy Ventures Strategically Terminates SmartKem LOI to Advance Independent Data Center Energy Infrastructure Platform

Jericho Energy Ventures Strategically Terminates SmartKem LOI to Advance Independent Data Center Energy Infrastructure Platform

-

American Antimony Advances ALS-Led Flotation Testing on MTA Samples to Develop U.S.-Sourced High-Grade Concentrates as Initial Head Grades Exceed 30% Sb, Placing Bernice Canyon Among the Highest Antimony Head Grades Evaluated Globally

-

30% Healthcare Surge vs. The Remote Work Ceiling: Defining the 2026 U.S. Employment Shift

30% Healthcare Surge vs. The Remote Work Ceiling: Defining the 2026 U.S. Employment Shift

-

Formerra and Evonik Expand Distribution Partnership for Healthcare Grades

-

Ondas to Acquire Rotron Aero, Expanding Long‑Range Attack Capabilities and Unmanned Vehicle Technologies for Advanced Defense Missions

Ondas to Acquire Rotron Aero, Expanding Long‑Range Attack Capabilities and Unmanned Vehicle Technologies for Advanced Defense Missions

-

Auri Inc ("AURI") Releases Corporate Update Regarding subsidiary Companies

Moderna Secures $1.5 Billion Five-Year Credit Facility from Ares Management

Non-dilutive financing from premier lender bolsters strong balance sheet and provides increased flexibility

Company reiterates 2025 financial guidance provided on 3Q25 earnings call and targets cash breakeven by 2028

CAMBRIDGE, MA / ACCESS Newswire / November 20, 2025 / Moderna, Inc. (NASDAQ:MRNA) today announced it has closed a five-year term loan facility for up to $1.5 billion of capital from Ares Management Credit Funds (Ares), a leading global alternative investment manager, to increase flexibility.

The non-dilutive debt financing consists of three tranches over five years, including:

A $600 million initial term loan funded at closing

A $400 million delayed draw term loan facility (DDTL), available in multiple draws at Moderna's discretion through November 2027

An additional $500 million DDTL, available in multiple draws at Moderna's discretion through November 2028. This tranche is contingent on the achievement of key regulatory milestones aligned with Moderna's late-stage clinical pipeline

"While we remain well-positioned to achieve our 2028 cash breakeven target, this additional capital enhances our strong balance sheet and enables increased flexibility over the coming years," said Jamey Mock, Chief Financial Officer of Moderna. "Ares is a highly reputable lender in the healthcare space, and we are proud to have their valuable financial backing in pursuit of our long-term financial targets."

"We are pleased to provide flexible capital to Moderna at this pivotal moment in their growth trajectory," said Doug Dieter, DrPH, Co-Head of Ares Specialty Healthcare. "Moderna has already demonstrated the power of its mRNA platform with multiple commercial products and has an impressive and differentiated clinical pipeline. This investment reflects Moderna's disciplined approach to capital management and our support of their long-term financial strategy."

Moderna will host its Analyst Day event for investors at 9:00 a.m. ET on November 20, 2025. A live webcast of the presentation will be available under "Events and Presentations" in the Investors section of the Moderna website: https://investors.modernatx.com/. A replay of the webcast will be archived on Moderna's website for at least 30 days following the presentation.

About Moderna

Moderna is a pioneer and leader in the field of mRNA medicine. Through the advancement of its technology platform, Moderna is reimagining how medicines are made to transform how we treat and prevent diseases. Since its founding, Moderna's mRNA platform has enabled the development of vaccines and therapeutics across infectious diseases, cancer, rare diseases and more.

With a global team and a unique culture, driven by the company's values and mindsets, Moderna's mission is to deliver the greatest possible impact to people through mRNA medicines. For more information about Moderna, please visit modernatx.com and connect with us on X, Facebook, Instagram, YouTube and LinkedIn.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended, including statements regarding: Moderna's credit facility with Ares; Moderna's financial condition and operational flexibility; Moderna's 2025 financial guidance; Moderna's 2028 cash breakeven target; and Moderna's ability to achieve key regulatory milestones aligned with its late-stage pipeline and to draw on future tranches. The forward-looking statements in this press release are neither promises nor guarantees, and you should not place undue reliance on these forward-looking statements because they involve known and unknown risks, uncertainties, and other factors, many of which are beyond Moderna's control and which could cause actual results to differ materially from those expressed or implied by these forward-looking statements. These risks, uncertainties, and other factors include, among others, those risks and uncertainties described under the heading "Risk Factors" in Moderna's Annual Report on Form 10-K for the fiscal year ended December 31, 2024, and in subsequent filings made by Moderna with the U.S. Securities and Exchange Commission, which are available on the SEC's website at www.sec.gov. Except as required by law, Moderna disclaims any intention or responsibility for updating or revising any forward-looking statements contained in this press release in the event of new information, future developments or otherwise. These forward-looking statements are based on Moderna's current expectations and speak only as of the date of this press release.

Moderna Contacts

Media:

Chris Ridley

Head of Global Media Relations

+1 617-800-3651

[email protected]

Investors:

Lavina Talukdar

Senior Vice President & Head of Investor Relations

+1 617-209-5834

[email protected]

SOURCE: Moderna, Inc.

View the original press release on ACCESS Newswire

T.Perez--AT