-

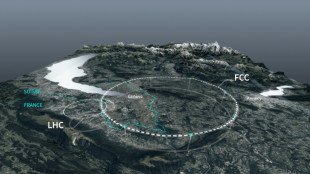

Private donors pledge $1 bn for CERN particle accelerator

Private donors pledge $1 bn for CERN particle accelerator

-

Russian court orders Austrian bank Raiffeisen to pay compensation

-

US, Qatar, Turkey, Egypt to hold Gaza talks in Miami

US, Qatar, Turkey, Egypt to hold Gaza talks in Miami

-

Lula open to mediate between US, Venezuela to 'avoid armed conflict'

-

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

-

US imposes sanctions on two more ICC judges for Israel probe

-

US accuses S. Africa of harassing US officials working with Afrikaners

US accuses S. Africa of harassing US officials working with Afrikaners

-

ECB holds rates as Lagarde stresses heightened uncertainty

-

Trump Media announces merger with fusion power company

Trump Media announces merger with fusion power company

-

Stocks rise as US inflation cools, tech stocks bounce

-

Zelensky presses EU to tap Russian assets at crunch summit

Zelensky presses EU to tap Russian assets at crunch summit

-

Pope replaces New York's Cardinal Dolan with pro-migrant bishop

-

Odermatt takes foggy downhill for 50th World Cup win

Odermatt takes foggy downhill for 50th World Cup win

-

France exonerates women convicted over abortions before legalisation

-

UK teachers to tackle misogyny in classroom

UK teachers to tackle misogyny in classroom

-

Historic Afghan cinema torn down for a mall

-

US consumer inflation cools unexpectedly in November

US consumer inflation cools unexpectedly in November

-

Danish 'ghetto' residents upbeat after EU court ruling

-

ECB holds rates but debate swirls over future

ECB holds rates but debate swirls over future

-

Pope replaces New York's Cardinal Timothy Dolan with little-known bishop

-

Bank of England cuts interest rate after UK inflation slides

Bank of England cuts interest rate after UK inflation slides

-

Have Iran's authorities given up on the mandatory hijab?

-

Spain to buy 100 military helicopters from Airbus

Spain to buy 100 military helicopters from Airbus

-

US strike on alleged drug boat in Pacific kills four

-

Thailand strikes building in Cambodia's border casino hub

Thailand strikes building in Cambodia's border casino hub

-

Protests in Bangladesh as India cites security concerns

-

European stocks rise before central bank decisions on rates

European stocks rise before central bank decisions on rates

-

Tractors clog Brussels in anger at EU-Mercosur trade deal

-

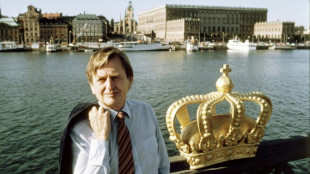

Not enough evidence against Swedish PM murder suspect: prosecutor

Not enough evidence against Swedish PM murder suspect: prosecutor

-

Nepal's ousted PM Oli re-elected as party leader

-

British energy giant BP extends shakeup with new CEO pick

British energy giant BP extends shakeup with new CEO pick

-

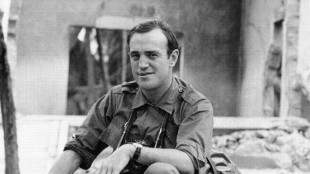

Pulitzer-winning combat reporter Peter Arnett dies at 91

-

EU kicks off crunch summit on Russian asset plan for Ukraine

EU kicks off crunch summit on Russian asset plan for Ukraine

-

Lyon humbled to surpass childhood hero McGrath's wicket tally

-

Sri Lanka plans $1.6 bn in cyclone recovery spending in 2026

Sri Lanka plans $1.6 bn in cyclone recovery spending in 2026

-

England vow to keep 'fighting and scrapping' as Ashes slip away

-

'Never enough': Conway leans on McKenzie wisdom in epic 300 stand

'Never enough': Conway leans on McKenzie wisdom in epic 300 stand

-

Most Asian markets track Wall St lower as AI fears mount

-

Cambodia says Thailand bombs casino hub on border

Cambodia says Thailand bombs casino hub on border

-

Thai queen wins SEA Games gold in sailing

-

England Ashes dreams on life-support as Australia rip through batting

England Ashes dreams on life-support as Australia rip through batting

-

Masterful Conway, Latham in 323 opening stand as West Indies wilt

-

Danish 'ghetto' tenants hope for EU discrimination win

Danish 'ghetto' tenants hope for EU discrimination win

-

Cricket Australia boss slams technology as Snicko confusion continues

-

Conway and Latham's 323-run opening stand batters hapless West Indies

Conway and Latham's 323-run opening stand batters hapless West Indies

-

Alleged Bondi shooters holed up in hotel for most of Philippines visit

-

Japan govt sued over 'unconstitutional' climate inaction

Japan govt sued over 'unconstitutional' climate inaction

-

US approves $11 billion in arms sales to Taiwan: Taipei

-

England battle to save Ashes as Australia rip through top-order

England battle to save Ashes as Australia rip through top-order

-

Guarded and formal: Pope Leo XIV sets different tone

Bausch Health Announces Filing of Supplement to Proxy Statement

Supplement In Response to Company Learning that Carl Icahn and Affiliates Have Cash-Settled Equity Swaps for Approximately 90 Million of Its Common Shares

LAVAL, QC / ACCESS Newswire / April 22, 2025 / Bausch Health Companies Inc. (NYSE:BHC)(TSX: BHC) (the "Company" or "Bausch Health") today announced that it has filed a supplement (the "Proxy Statement Supplement") to its proxy statement dated April 2, 2025 (the "Proxy Statement") in respect of the Company's upcoming annual general meeting of shareholders on May 13, 2025. The Company is updating the Proxy Statement to disclose, in addition to the 34,721,118 common shares reported as being beneficially owned (9.4%), Mr. Carl C. Icahn and his affiliates (collectively, "Icahn") had entered into cash-settled equity swap agreements covering 90,720,000 of the Company's common shares (24.6%), with a single maturity date of February 28, 2028. Taken together Icahn now has an economic interest covering approximately 34% of the Company's outstanding common shares.

On March 12, 2025, the Board of Directors of the Company (the "Board") adopted a resolution directing the Company's General Counsel to review the Icahn's position in equity swaps and certain bonds held by John Paulson, the Chairman of the Board. The General Counsel hired Sidley Austin, LLP ("Sidley"), as independent counsel, to conduct such review. Sidley presented its findings to the Board on April 9, 2025. As part of its review, Sidley sought information regarding Icahn's swap positions and requested copies of the swap agreements themselves. Icahn refused to provide the copies of the swap agreements, but Icahn informed Sidley that (i) their additional long economic exposure to 90.72 million Company shares through equity swaps was accumulated over more than one hundred trades, executed between May 26, 2021 and September 8, 2023; (ii) the agreements provide for early termination via cash settlement; (iii) the agreements do not confer voting or dispositive power over the referenced shares; and (iv) the agreements do not "allow for" physical settlement.

Regarding Mr. Paulson's bond position, (i) Mr. Paulson purchased an aggregate of $50 million Bausch Health bonds prior to rejoining the Board of Bausch Health; (ii) he purchased the bonds in the open market; and (iii) he obtained pre-approval for the bond purchase from the General Counsel of Bausch + Lomb, where he was a Board member. Based on the available facts and the review conducted by Sidley, the Company determined that Mr. Paulson's bond purchase was not required to be disclosed under Item 404 of Regulation S-K as a related party transaction. Nevertheless, Mr. Paulson has requested that the Company update the Proxy Statement to reflect his bond position and informed the Company that he intends to dispose of his debt securities when the Company's trading window is open in order to eliminate even the appearance of a conflict of interest and to demonstrate that his interests have always been fully aligned with those of all the Company's shareholders.

Finally, as previously announced on April 14, 2025, the Company adopted a shareholder rights plan agreement (the "SRP"). The SRP is intended to prevent a person or group from acquiring beneficial ownership of 20% or more of the Company's outstanding common shares (including by way of a "creeping" take-over bid) without complying with the permitted exemptions under the plan. The SRP protects against such "creeping" take-over bids that may serve to benefit certain shareholders to the detriment of others. The SRP provides the Board with an opportunity to identify, solicit, develop and negotiate value-enhancing alternatives that benefit all shareholders. Bausch Health is confident that the SRP is in the best interests of the Company and its shareholders.

Except as expressly provided in the Proxy Statement Supplement, the Proxy Statement remains unchanged from the version that was previously filed on SEDAR+ and EDGAR. The Proxy Statement Supplement is available under the Company's profile on the SEDAR+ website at www.sedarplus.ca and the EDGAR website at www.sec.gov/edgar.

About Bausch Health

Bausch Health Companies Inc. (NYSE:BHC)(TSX:BHC) is a global, diversified pharmaceutical company enriching lives through our relentless drive to deliver better health care outcomes. We develop, manufacture and market a range of products primarily in gastroenterology, hepatology, neurology, dermatology, dentistry, aesthetics, international pharmaceuticals, and eye health, through our controlling interest in Bausch + Lomb Corporation. Our ambition is to be a globally integrated healthcare company, trusted and valued by patients, HCPs, employees, and investors.

Forward-Looking Statements

This press release may contain forward-looking statements within the meaning of applicable securities laws, including the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements may generally be identified by the use of the words "will," "anticipates," "hopes," "expects," "intends," "plans," "should," "could," "would," "may," "believes," "subject to" and variations or similar expressions. Forward-looking statements, by their nature, are based on assumptions and are subject to known and unknown risks and uncertainties, both general and specific, that contribute to the possibility that the forward-looking statement will not occur. The forward-looking statements in this press release speak only as of the date hereof and reflect several material factors, expectations and assumptions. Undue reliance should not be placed on any predictions or forward-looking statements as these may be affected by, among other things, changing external events and general uncertainties of the business. Actual results are subject to other risks and uncertainties that relate more broadly to Bausch Health's overall business, including those more fully described in Bausch Health's most recent annual and quarterly reports and detailed from time to time in Bausch Health's other filings with the SEC and the Canadian Securities Administrators, which factors are incorporated herein by reference. The Company undertakes no obligation to update any of these forward-looking statements to reflect events, information, or circumstances after the date of this press release or to reflect actual outcomes, unless required by law.

Investor Contact:

Garen Sarafian

[email protected]

(877) 281-6642 (toll free)

Media Contact:

Katie Savastano

[email protected]

(908) 541-3785

SOURCE: Bausch Health Companies Inc.

View the original press release on ACCESS Newswire

A.O.Scott--AT