-

US talking deal with 'highest people' in Cuba: Trump

US talking deal with 'highest people' in Cuba: Trump

-

UK ex-ambassador quits Labour over new reports of Epstein links

-

Trump says closing Kennedy Center arts complex for two years

Trump says closing Kennedy Center arts complex for two years

-

Reigning world champs Tinch, Hocker among Millrose winners

-

Venezuelan activist ends '1,675 days' of suffering in prison

Venezuelan activist ends '1,675 days' of suffering in prison

-

Real Madrid scrape win over Rayo, Athletic claim derby draw

-

PSG beat Strasbourg after Hakimi red to retake top spot in Ligue 1

PSG beat Strasbourg after Hakimi red to retake top spot in Ligue 1

-

NFL Cardinals hire Rams' assistant LaFleur as head coach

-

Arsenal scoop $2m prize for winning FIFA Women's Champions Cup

Arsenal scoop $2m prize for winning FIFA Women's Champions Cup

-

Atletico agree deal to sign Lookman from Atalanta

-

Real Madrid's Bellingham set for month out with hamstring injury

Real Madrid's Bellingham set for month out with hamstring injury

-

Man City won't surrender in title race: Guardiola

-

Korda captures weather-shortened LPGA season opener

Korda captures weather-shortened LPGA season opener

-

Czechs rally to back president locking horns with government

-

Prominent Venezuelan activist released after over four years in jail

Prominent Venezuelan activist released after over four years in jail

-

Emery riled by 'unfair' VAR call as Villa's title hopes fade

-

Guirassy double helps Dortmund move six points behind Bayern

Guirassy double helps Dortmund move six points behind Bayern

-

Nigeria's president pays tribute to Fela Kuti after Grammys Award

-

Inter eight clear after win at Cremonese marred by fans' flare flinging

Inter eight clear after win at Cremonese marred by fans' flare flinging

-

England underline World Cup

credentials with series win over Sri Lanka

-

Guirassy brace helps Dortmund move six behind Bayern

Guirassy brace helps Dortmund move six behind Bayern

-

Man City held by Solanke stunner, Sesko delivers 'best feeling' for Man Utd

-

'Send Help' debuts atop N.America box office

'Send Help' debuts atop N.America box office

-

Ukraine war talks delayed to Wednesday, says Zelensky

-

Iguanas fall from trees in Florida as icy weather bites southern US

Iguanas fall from trees in Florida as icy weather bites southern US

-

Carrick revels in 'best feeling' after Man Utd leave it late

-

Olympic chiefs admit 'still work to do' on main ice hockey venue

Olympic chiefs admit 'still work to do' on main ice hockey venue

-

Pope says Winter Olympics 'rekindle hope' for world peace

-

Last-gasp Demirovic strike sends Stuttgart fourth

Last-gasp Demirovic strike sends Stuttgart fourth

-

Sesko strikes to rescue Man Utd, Villa beaten by Brentford

-

'At least 200' feared dead in DR Congo landslide: government

'At least 200' feared dead in DR Congo landslide: government

-

Coventry says 'sad' about ICE, Wasserman 'distractions' before Olympics

-

In-form Lyon make it 10 wins in a row

In-form Lyon make it 10 wins in a row

-

Man Utd strike late as Carrick extends perfect start in Fulham thriller

-

Van der Poel romps to record eighth cyclo-cross world title

Van der Poel romps to record eighth cyclo-cross world title

-

Mbappe penalty earns Real Madrid late win over nine-man Rayo

-

Resurgent Pakistan seal T20 sweep of Australia

Resurgent Pakistan seal T20 sweep of Australia

-

Fiji top sevens standings after comeback win in Singapore

-

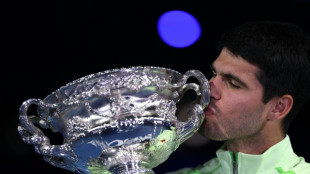

Alcaraz sweeps past Djokovic to win 'dream' Australian Open

Alcaraz sweeps past Djokovic to win 'dream' Australian Open

-

Death toll from Swiss New Year bar fire rises to 41

-

Alcaraz says Nadal inspired him to 'special' Australian Open title

Alcaraz says Nadal inspired him to 'special' Australian Open title

-

Pakistan seeks out perpetrators after deadly separatist attacks

-

Ukraine war talks delayed to Wednesday, Zelensky says

Ukraine war talks delayed to Wednesday, Zelensky says

-

Djokovic says 'been a great ride' after Melbourne final loss

-

Von Allmen storms to downhill win in final Olympic tune-up

Von Allmen storms to downhill win in final Olympic tune-up

-

Carlos Alcaraz: tennis history-maker with shades of Federer

-

Alcaraz sweeps past Djokovic to win maiden Australian Open title

Alcaraz sweeps past Djokovic to win maiden Australian Open title

-

Israel says partially reopening Gaza's Rafah crossing

-

French IT giant Capgemini to sell US subsidiary after row over ICE links

French IT giant Capgemini to sell US subsidiary after row over ICE links

-

Iran's Khamenei likens protests to 'coup', warns of regional war

Clean energy drives massive BHP takeover bid

BHP's multi-billion-dollar bid to buy rival Anglo American promises to be the largest mining merger deal in decades, and one driven by the race for cleaner energy and green metals.

Analysts say the rationale behind BHP's near US$40 billion bid can be summed up in one word: copper.

A ready conductor of heat and electricity, copper has long been used in wiring, piping, industrial machinery and roofing.

But today it is increasingly used in solar panels, electricity networks, electric vehicles and rechargeable batteries.

Copper prices have increased about 400 percent in the past quarter century, and broke US$10,000 a tonne on Friday for the first time in two years.

Global demand is expected to grow by up to 2.5 percent a year as more plug-in electric vehicles hit the road -- they use about three times more copper than petrol or diesel vehicles.

The boom has already prompted a wave of investment, with BHP snapping up Australian copper producer OZ Minerals for more than US$6 billion last year.

Rival Rio Tinto, has invested heavily in mines in Chile, Mongolia and the United States.

BHP pitched the Anglo deal to investors Friday, saying it would improve their "exposure to future-facing commodities through Anglo American's world-class copper assets".

That might be understating it.

Buying Anglo American would give BHP control of key mines in Chile and Peru, and put it in charge of about 10 percent of world copper production.

- 'Monster' deal -

Neil Wilson, analyst at financial services firm Finalto, described it as a "monster" deal that "would create the world's largest listed miner and copper producer".

The world's largest copper deposits are found in Chile, Peru, Australia and Democratic Republic of Congo.

For BHP, Latin America seems the logical target, according to Hayden Bairstow, head of research at advisory firm Argonaut.

The firm has "sort of mopped everything up in Australia already", he told AFP, and does not appear to want to develop a massive project in Africa.

With BHP already operating two massive copper projects in Chile, they already know the terrain well.

There is a sense that Anglo American is also a juicy target -- having struggled compared with other copper mining companies.

"When you look across the copper space in general, most of the copper names are up a lot," said Bairstow. Anglo has "been a bit of an underperformer".

But the deal is far from done.

Anglo American's board on Friday rejected the initial US$38.8-billion takeover offer saying it "significantly undervalues" the firm.

In 2009 Xstrata -- now Glencore -- tried and failed to merge with Anglo American, whose investors at the time also argued the company was undervalued.

- Anglo's complex structure -

To get the deal done, most analysts expect BHP to force the sale of Anglo American's platinum, diamond and iron ore businesses -- perhaps saving only copper and a few other assets.

"They don't really want most of it," said Bairstow. "I'd argue probably the rest of the asset base would be potentially up for sale."

Spinning those non-copper assets off might be easier said than done.

Anglo is more of a conglomerate than a single company, with some complex ownership structures.

In South Africa alone it owns Anglo American Platinum, Kumba Iron Ore, and controls diamond giant De Beers.

Its platinum business in South Africa is highly politically sensitive -- with mines located in North West province, an area that is the heartland of South Africa's mining industry, but one that has been beset with political and industrial relations problems.

South Africa's mining minister -- a former Communist Party and mining union boss -- has already weighed in on the potential deal, telling the Financial Times his opinion of BHP is "not positive".

To complicate matters further, the South African government is one of Anglo's biggest shareholders.

The clock is now ticking for BHP to win over Anglo American's board and investors. Under UK competition rules it has until May 22 to design a deal.

"It doesn't leave you a lot of time to orchestrate all these things," said Bairstow.

E.Hall--AT