-

Thousands join Danish war vets' silent march after Trump 'insult'

Thousands join Danish war vets' silent march after Trump 'insult'

-

Gaza civil defence says Israeli strikes kill 28

-

Pakistan spin out Australia in second T20I to take series

Pakistan spin out Australia in second T20I to take series

-

Melbourne champion Rybakina never doubted return to Wimbledon form

-

Luis Enrique welcomes Ligue 1 challenge from Lens

Luis Enrique welcomes Ligue 1 challenge from Lens

-

Long truck lines at Colombia-Ecuador border as tariffs loom

-

Ex-prince Andrew dogged again by Epstein scandal

Ex-prince Andrew dogged again by Epstein scandal

-

Separatist attacks in Pakistan kill 21, dozens of militants dead

-

'Malfunction' cuts power in Ukraine. Here's what we know

'Malfunction' cuts power in Ukraine. Here's what we know

-

Arbeloa backs five Real Madrid stars he 'always' wants playing

-

Sabalenka 'really upset' at blowing chances in Melbourne final loss

Sabalenka 'really upset' at blowing chances in Melbourne final loss

-

Britain, Japan agree to deepen defence and security cooperation

-

Rybakina keeps her cool to beat Sabalenka in tense Melbourne final

Rybakina keeps her cool to beat Sabalenka in tense Melbourne final

-

France tightens infant formula rules after toxin scare

-

Blanc wins final women's race before Winter Olympics

Blanc wins final women's race before Winter Olympics

-

Elena Rybakina: Kazakhstan's Moscow-born Melbourne champion

-

Ice-cool Rybakina beats Sabalenka in tense Australian Open final

Ice-cool Rybakina beats Sabalenka in tense Australian Open final

-

Pakistan attacks kill 15, dozens of militants dead: official

-

Ten security officials, 37 militants killed in SW Pakistan attacks: official

Ten security officials, 37 militants killed in SW Pakistan attacks: official

-

Epstein survivors say abusers 'remain hidden' after latest files release

-

'Full respect' for Djokovic but Nadal tips Alcaraz for Melbourne title

'Full respect' for Djokovic but Nadal tips Alcaraz for Melbourne title

-

Wollaston goes back-to-back in the Cadel Evans road race

-

Women in ties return as feminism faces pushback

Women in ties return as feminism faces pushback

-

Ship ahoy! Prague's homeless find safe haven on river boat

-

Britain's Starmer ends China trip aimed at reset despite Trump warning

Britain's Starmer ends China trip aimed at reset despite Trump warning

-

Carlos Alcaraz: rare tennis talent with shades of Federer

-

Novak Djokovic: divisive tennis great on brink of history

Novak Djokovic: divisive tennis great on brink of history

-

History beckons for Djokovic and Alcaraz in Australian Open final

-

Harrison, Skupski win Australian Open men's doubles title

Harrison, Skupski win Australian Open men's doubles title

-

Epstein offered ex-prince Andrew meeting with Russian woman: files

-

Jokic scores 31 to propel Nuggets over Clippers in injury return

Jokic scores 31 to propel Nuggets over Clippers in injury return

-

Montreal studio rises from dark basement office to 'Stranger Things'

-

US government shuts down but quick resolution expected

US government shuts down but quick resolution expected

-

Mertens and Zhang win Australian Open women's doubles title

-

Venezuelan interim president announces mass amnesty push

Venezuelan interim president announces mass amnesty push

-

China factory activity loses steam in January

-

Melania Trump's atypical, divisive doc opens in theatres

Melania Trump's atypical, divisive doc opens in theatres

-

Bad Bunny set for historic one-two punch at Grammys, Super Bowl

-

Five things to watch for on Grammys night Sunday

Five things to watch for on Grammys night Sunday

-

Venezuelan interim president proposes mass amnesty law

-

Rose stretches lead at Torrey Pines as Koepka makes cut

Rose stretches lead at Torrey Pines as Koepka makes cut

-

Online foes Trump, Petro set for White House face-to-face

-

Seattle Seahawks deny plans for post-Super Bowl sale

Seattle Seahawks deny plans for post-Super Bowl sale

-

New to The Street Broadcasts Today on Bloomberg Across the U.S., MENA, and Latin America

-

AI-Era Position Statement to Protect the Integrity of Healthcare, Technology, and Services Benchmarking published by Black Book Research

AI-Era Position Statement to Protect the Integrity of Healthcare, Technology, and Services Benchmarking published by Black Book Research

-

US Senate passes deal expected to shorten shutdown

-

'Misrepresent reality': AI-altered shooting image surfaces in US Senate

'Misrepresent reality': AI-altered shooting image surfaces in US Senate

-

Thousands rally in Minneapolis as immigration anger boils

-

US judge blocks death penalty for alleged health CEO killer Mangione

US judge blocks death penalty for alleged health CEO killer Mangione

-

Lens win to reclaim top spot in Ligue 1 from PSG

Grande Portage Resources Announces C$5Million Investment by Eric Sprott

Not for distribution to United States newswire services or for dissemination in the United States.

VANCOUVER, BC / ACCESS Newswire / December 4, 2025 / Grande Portage Resources Ltd. (TSXV:GPG)(OTCQB:GPTRF)(FSE:GPB) ("Grande Portage" or the "Company") is pleased to announce a non-brokered private placement offering of 20,000,000 units of the Company (the "Units") at a price of $0.25 per Unit for aggregate gross proceeds of C$5,000,000 (the "Offering") to be completed with Mr. Eric Sprott, through 2176423 Ontario Ltd., , who will subscribe for the entire Offering. Each Unit will consist of one common share (a "Common Share") and one-half of one common share purchase warrant, with each whole warrant (a "Warrant") being exercisable to purchase one Common Share at a price of $0.35 per Common Share for a period of two (2) years from the date of grant.

The Company intends to use the net proceeds raised from the Offering for exploration and development of the New Amalga Gold deposit as well as general working capital. The securities issued under the Offering will be subject to a four month plus 1 day hold period. Closing of the Offering is subject to customary closing conditions, including final approval of the TSX Venture Exchange (the "TSXV"). In addition, Mr. Sprott will covenant not to exercise any of the Warrants if such exercise will result in him holding in excess of 19.99% of the outstanding Common Shares of the Company, until the Company has obtained the shareholder approval for him to become a new Control Person (as such term is defined in the policies of the TSXV).

Ian Klassen, President and CEO, commented: "We are very pleased to see Mr. Sprott increase his equity position in Grande Portage, where he continues to be our largest shareholder. His ongoing support has enabled the Company to advance our high-grade gold project through successive drilling campaigns, baseline pre-NEPA studies, and preparations for next quarter's PEA. This latest capital infusion is significant, positioning the Company to end the year with approximately $10 million in working capital-our strongest financial position to date-as we continue to advance the development of the New Amalga Gold Project in Southeast Alaska."

The New Amalga Gold Project remains open to expansion in multiple directions and hosts an Indicated Resource of 1,438,500 ounces of gold at an average grade of 9.47 g/t Au (4,726,000 tonnes) and an Inferred Resource of 515,700 ounces of gold at an average grade of 8.85 g/t Au (1,813,000 tonnes) with an effective date of July 17, 2024. The current development concept envisions a small-footprint underground mining operation with third-party offsite processing, eliminating the need for an onsite mill or tailings storage facility.

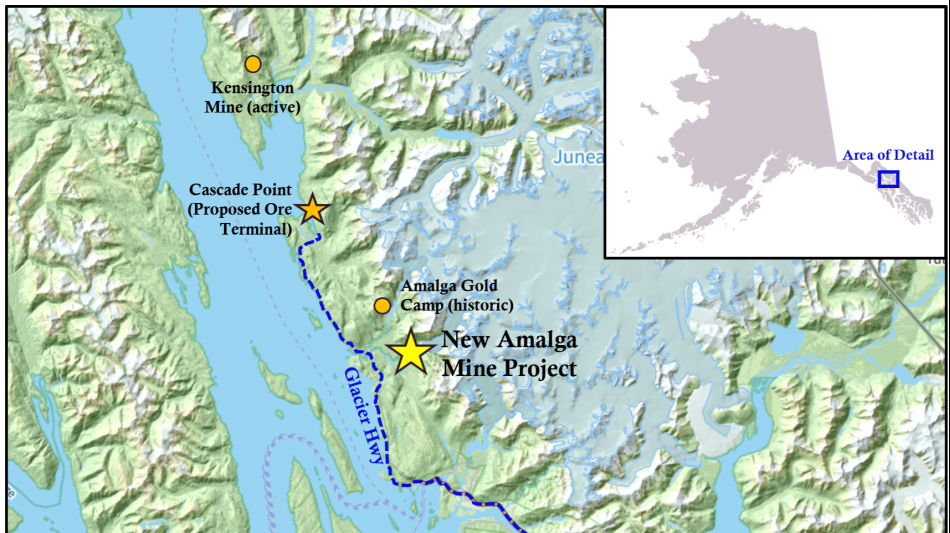

Fig. 1: Location of New Amalga Mine Project

Kyle Mehalek, P.E.., is the QP within the meaning of NI 43-101 and has reviewed and approved the technical disclosure in this release. Mr. Mehalek is independent of Grande Portage within the meaning of NI 43-101.

About Grande Portage:

Grande Portage Resources Ltd. is a publicly traded mineral exploration company focused on advancing the New Amalga Mine project, the outgrowth of the Herbert Gold discovery situated approximately 25 km north of Juneau, Alaska. The Company holds a 100% interest in the New Amalga property. The New Amalga Gold property system is open to length and depth and is host to at least six main composite vein-fault structures that contain ribbon structure quartz-sulfide veins. The project lies prominently within the 160km long Juneau Gold Belt, which has produced over eight million ounces of gold.

The Company's updated NI 43-101 Mineral Resource estimate reported at a base case mineral resources cut-off grade of 2.5 grams per tonne gold (g/t Au) and consists of: an Indicated Resource of 1,438,500 ounces of gold at an average grade of 9.47 g/t Au (4,726,000 tonnes); and an Inferred Resource of 515,700 ounces of gold at an average grade of 8.85 g/t Au (1,813,000 tonnes), as well as an Indicated Resource of 891,600 ounces of silver at an average grade of 5.86 g/t Ag (4,726,000 tonnes); and an Inferred Resource of 390,600 ounces of silver at an average grade of 7.33 g/t silver (1,813,000 tonnes). The mineral resource estimate was prepared by Dr. David R. Webb, Ph.D., P.Geol., P.Eng. (DRW Geological Consultants Ltd.) with an effective date of July 17, 2024. Additional information on the New Amalga Mine project is available in the technical report titled "Technical Report of the Herbert Gold Property, Juneau District, Southeast Alaska" dated July 17, 2024, which is available under Grande Portage's SEDAR+ profile at www.sedarplus.ca.

ON BEHALF OF THE BOARD

"Ian Klassen"

Ian M. Klassen

President & Chief Executive Officer

Tel: (604) 899-0106

Email: [email protected]

Cautionary Statement Regarding Forward-Looking Information

This news release includes certain "forward-looking statements" under applicable Canadian securities legislation. Forward-looking statements include estimates and statements that describe the Company's future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as "believes", "anticipates", "expects", "estimates", "may", "could", "would", "will", or "plan". Forward-looking statements or information contained in this release include, but are not limited to, statements or information with respect to: the Offering, including timing, ability to meet the applicable closing conditions and completion thereof, statutory hold periods, ability to obtain shareholder approval for a new Control Person, and the use of proceeds, and expectations regarding the New Amalga Mine project, including the Company's mineral resources. Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties as described in the Company's filings with Canadian securities regulators. These risks, uncertainties and other factors include, among others, the ability to complete the Offering, including the timing and ability to meet the applicable closing conditions, including all necessary approvals, the final use of proceeds of the Offering, the ability to obtain shareholder approval for a new Control Person and risks associated with the exploration and development of the New Amalga Mine and our mineral resources. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

Please note that under National Instrument 43-101, the Company is required to disclose that it has not based any production decision on NI 43-101-compliant reserve estimates, preliminary economic assessments, or feasibility studies, and historically production decisions made without such reports have increased uncertainty and higher technical and economic risks of failure. These risks include, among others, areas that are analyzed in more detail in a feasibility study or preliminary economic assessment, such as the application of economic analysis to mineral resources, more detailed metallurgical and other specialized studies in areas such as mining and recovery methods, market analysis, and environmental, social, and community impacts. Any decision to place the New Amalga Mine into operation at levels intended by management, expand a mine, make other production-related decisions, or otherwise carry out mining and processing operations would be largely based on internal non-public Company data, and on reports based on exploration and mining work by the Company and by geologists and engineers engaged by the Company.

This news release does not constitute an offer to sell or a solicitation of an offer to sell any securities in the United States. The securities described herein have not been and will not be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act") or any state securities laws and may not be offered or sold within the United States or to U.S. Persons unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICE PROVIDER (AS THAT TERM IS DEFINED UNDER THE POLICIES OF THE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS NEWS RELEASE

SOURCE: Grande Portage Resources Limited

View the original press release on ACCESS Newswire

E.Hall--AT