-

Olympic chiefs admit 'still work to do' on main ice hockey venue

Olympic chiefs admit 'still work to do' on main ice hockey venue

-

Pope says Winter Olympics 'rekindle hope' for world peace

-

Last-gasp Demirovic strike sends Stuttgart fourth

Last-gasp Demirovic strike sends Stuttgart fourth

-

Sesko strikes to rescue Man Utd, Villa beaten by Brentford

-

'At least 200' feared dead in DR Congo landslide: government

'At least 200' feared dead in DR Congo landslide: government

-

Coventry says 'sad' about ICE, Wasserman 'distractions' before Olympics

-

In-form Lyon make it 10 wins in a row

In-form Lyon make it 10 wins in a row

-

Man Utd strike late as Carrick extends perfect start in Fulham thriller

-

Van der Poel romps to record eighth cyclo-cross world title

Van der Poel romps to record eighth cyclo-cross world title

-

Mbappe penalty earns Real Madrid late win over nine-man Rayo

-

Resurgent Pakistan seal T20 sweep of Australia

Resurgent Pakistan seal T20 sweep of Australia

-

Fiji top sevens standings after comeback win in Singapore

-

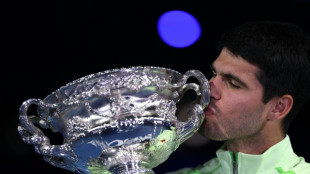

Alcaraz sweeps past Djokovic to win 'dream' Australian Open

Alcaraz sweeps past Djokovic to win 'dream' Australian Open

-

Death toll from Swiss New Year bar fire rises to 41

-

Alcaraz says Nadal inspired him to 'special' Australian Open title

Alcaraz says Nadal inspired him to 'special' Australian Open title

-

Pakistan seeks out perpetrators after deadly separatist attacks

-

Ukraine war talks delayed to Wednesday, Zelensky says

Ukraine war talks delayed to Wednesday, Zelensky says

-

Djokovic says 'been a great ride' after Melbourne final loss

-

Von Allmen storms to downhill win in final Olympic tune-up

Von Allmen storms to downhill win in final Olympic tune-up

-

Carlos Alcaraz: tennis history-maker with shades of Federer

-

Alcaraz sweeps past Djokovic to win maiden Australian Open title

Alcaraz sweeps past Djokovic to win maiden Australian Open title

-

Israel says partially reopening Gaza's Rafah crossing

-

French IT giant Capgemini to sell US subsidiary after row over ICE links

French IT giant Capgemini to sell US subsidiary after row over ICE links

-

Iran's Khamenei likens protests to 'coup', warns of regional war

-

New Epstein accuser claims sexual encounter with ex-prince Andrew: report

New Epstein accuser claims sexual encounter with ex-prince Andrew: report

-

Italy's extrovert Olympic icon Alberto Tomba insists he is 'shy guy'

-

Chloe Kim goes for unprecedented snowboard halfpipe Olympic treble

Chloe Kim goes for unprecedented snowboard halfpipe Olympic treble

-

Pakistan combing for perpetrators after deadly separatist attacks

-

Israel partially reopens Gaza's Rafah crossing

Israel partially reopens Gaza's Rafah crossing

-

Iran declares European armies 'terrorist groups' after IRGC designation

-

Snowstorm disrupts travel in southern US as blast of icy weather widens

Snowstorm disrupts travel in southern US as blast of icy weather widens

-

Denmark's Andresen swoops to win Cadel Evans Road Race

-

Volkanovski beats Lopes in rematch to defend UFC featherweight title

Volkanovski beats Lopes in rematch to defend UFC featherweight title

-

Sea of colour as Malaysia's Hindus mark Thaipusam with piercings and prayer

-

Exiled Tibetans choose leaders for lost homeland

Exiled Tibetans choose leaders for lost homeland

-

Afghan returnees in Bamiyan struggle despite new homes

-

Mired in economic trouble, Bangladesh pins hopes on election boost

Mired in economic trouble, Bangladesh pins hopes on election boost

-

Chinese cash in jewellery at automated gold recyclers as prices soar

-

Israel to partially reopen Gaza's Rafah crossing

Israel to partially reopen Gaza's Rafah crossing

-

'Quiet assassin' Rybakina targets world number one after Melbourne win

-

Deportation raids drive Minneapolis immigrant family into hiding

Deportation raids drive Minneapolis immigrant family into hiding

-

Nvidia boss insists 'huge' investment in OpenAI on track

-

'Immortal' Indian comics keep up with changing times

'Immortal' Indian comics keep up with changing times

-

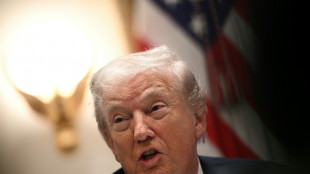

With Trump mum, last US-Russia nuclear pact set to end

-

In Sudan's old port of Suakin, dreams of a tourism revival

In Sudan's old port of Suakin, dreams of a tourism revival

-

Narco violence dominates as Costa Rica votes for president

-

Snowstorm barrels into southern US as blast of icy weather widens

Snowstorm barrels into southern US as blast of icy weather widens

-

LA Olympic chief 'deeply regrets' flirty Maxwell emails in Epstein files

-

Rose powers to commanding six-shot lead at Torrey Pines

Rose powers to commanding six-shot lead at Torrey Pines

-

BusinessHotels Launches AI Hotel Price Finder for Real-Time Rate Verification

Atlas Salt Announces Closing of Brokered LIFE Private Placement and Participation of Strategic Investor

THIS NEWS RELEASE IS NOT FOR DISTRIBUTION TO U.S. NEWS WIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES.

ST. GEORGE'S, NEWFOUNDLAND AND LABRADOR, 479 / ACCESS Newswire / October 21, 2025 / Atlas Salt Inc. ("Atlas Salt" or the "Company") (TSXV:SALT)(OTCQB:REMRF)(FRA:9D00) announces that it has closed its brokered private placement financing (the "Offering") previously announced on October 14, 2025, raising gross proceeds of $8,704,400. Under the Offering, 10,880,500 common shares of the Company ("Common Shares") at a price of $0.80 per Common Share (the "Offering Price") were issued pursuant to National Instrument 45-106 Prospectus Exemptions ("NI 45-106") in accordance with Part 5A of NI 45-106, as amended by the Canadian Securities Administrators' Coordinated Blanket Order 45-935 Exemptions from Certain Conditions of the Listed Issuer Financing Exemption (the "Listed Issuer Financing Exemption"). The Common Shares offered under the Listed Issuer Financing Exemption are not subject to a hold period in accordance with applicable Canadian securities laws.

Participants in the Offering included a strategic investor with whom the Company is excited to build and strengthen its relationship. This investor's interest in the Company and its flagship Great Atlantic Salt Project aligns with its long-term strategic objectives.

Nolan Peterson, CEO of Atlas Salt, commented: "The commitment and interest of both new and existing shareholders underscores the strength of the results of our recent Updated Feasibility Study, which demonstrated improved project economics and cash flow potential at Great Atlantic, in conjunction with significant de-risking. The participation of this strategic investor marks a major milestone for the Company and further reinforces our confidence in the direction we are taking with the Great Atlantic Salt Project. The rapid and positive response to the Updated Feasibility Study, the resulting market interest and the rapid closing of this financing have provided us with a timely opportunity to advance our early works program. Collectively, these developments position Atlas Salt as an increasingly attractive investment opportunity."

The Offering was conducted pursuant to the terms of an agency agreement entered into among the Company and Raymond James Ltd., as co-lead agent and joint bookrunner, and Ventum Financial Corp., as co-lead agent and joint bookrunner, on behalf of a syndicate of agents, including Desjardins Capital Markets (collectively, the "Agents"). As consideration for their services, the Company has paid the Agents an aggregate cash fee totaling $522,264. The Company also issued to the Agents an aggregate of 652,830 compensation warrants (each, a "Compensation Warrant"), with each Compensation Warrant entitling the holder thereof to acquire one Common Share at the Offering Price for a period of 24 months from the closing date of the Offering.

The net proceeds received from the Offering will be used for civil engineering work related to advancing the Great Atlantic Salt Project towards development and for general corporate and working capital purposes, as further described in the offering document in connection with the Offering, which can be accessed under the Company's profile at www.sedarplus.ca and on the Company's website at www.atlassalt.com.

As previously disclosed, certain insiders of the Company participated in the Offering, and such participation by insiders constitutes a related party transaction as defined in Multilateral Instrument 61-101 Protection of Minority Security Holders in Special Transactions ("MI 61-101"). The Company is relying on exemptions from the formal valuation and minority shareholder requirements provided under sections 5.5(a) and 5.7(1)(a) of MI 61-101 on the basis that neither the fair market value of the securities issued under the Offering nor the consideration paid by insiders of the Company exceed 25% of the Company's market capitalization.

The securities offered have not been registered under the U.S. Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements. This press release shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of the securities in any State in which such offer, solicitation or sale would be unlawful.

About Atlas Salt Inc.

Atlas Salt is developing Canada's next salt mine and is committed to responsible and sustainable mining practices. With a focus on innovation and efficiency, the company is poised to make significant contributions to the North American salt market while upholding its values of environmental stewardship and community engagement.

For more information, please contact:

Jeff Kilborn, CFO & VP Corporate Development

[email protected]

(709) 275-2009

Cautionary Statement

Neither the TSX Venture Exchange nor its Regulation Services Provider (as the term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This press release includes certain "forward-looking information" and "forward-looking statements" (collectively "forward-looking statements") within the meaning of applicable Canadian securities legislation. All statements, other than statements of historical fact, included herein, without limitation, statements relating to the intended use of proceeds of the Offering, are forward-looking statements. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements reflect the beliefs, opinions and projections on the date the statements are made and are based upon a number of assumptions and estimates that, while considered reasonable by the respective parties, are inherently subject to significant business, technical, economic, and competitive uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements and the parties have made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: the timing, completion and delivery of required permits, supply arrangements and financing. Readers should not place undue reliance on the forward-looking statements and information contained in this news release concerning these times. Except as required by law, the Company does not assume any obligation to update the forward-looking statements of beliefs, opinions, projections, or other factors, should they change, except as required by law.

SOURCE: Atlas Salt

View the original press release on ACCESS Newswire

Ch.P.Lewis--AT