-

England underline World Cup

credentials with series win over Sri Lanka

England underline World Cup

credentials with series win over Sri Lanka

-

Guirassy brace helps Dortmund move six behind Bayern

-

Man City held by Solanke stunner, Sesko delivers 'best feeling' for Man Utd

Man City held by Solanke stunner, Sesko delivers 'best feeling' for Man Utd

-

'Send Help' debuts atop N.America box office

-

Ukraine war talks delayed to Wednesday, says Zelensky

Ukraine war talks delayed to Wednesday, says Zelensky

-

Iguanas fall from trees in Florida as icy weather bites southern US

-

Carrick revels in 'best feeling' after Man Utd leave it late

Carrick revels in 'best feeling' after Man Utd leave it late

-

Olympic chiefs admit 'still work to do' on main ice hockey venue

-

Pope says Winter Olympics 'rekindle hope' for world peace

Pope says Winter Olympics 'rekindle hope' for world peace

-

Last-gasp Demirovic strike sends Stuttgart fourth

-

Sesko strikes to rescue Man Utd, Villa beaten by Brentford

Sesko strikes to rescue Man Utd, Villa beaten by Brentford

-

'At least 200' feared dead in DR Congo landslide: government

-

Coventry says 'sad' about ICE, Wasserman 'distractions' before Olympics

Coventry says 'sad' about ICE, Wasserman 'distractions' before Olympics

-

In-form Lyon make it 10 wins in a row

-

Man Utd strike late as Carrick extends perfect start in Fulham thriller

Man Utd strike late as Carrick extends perfect start in Fulham thriller

-

Van der Poel romps to record eighth cyclo-cross world title

-

Mbappe penalty earns Real Madrid late win over nine-man Rayo

Mbappe penalty earns Real Madrid late win over nine-man Rayo

-

Resurgent Pakistan seal T20 sweep of Australia

-

Fiji top sevens standings after comeback win in Singapore

Fiji top sevens standings after comeback win in Singapore

-

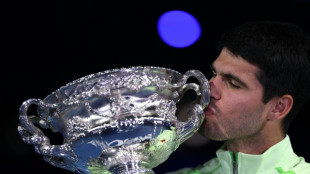

Alcaraz sweeps past Djokovic to win 'dream' Australian Open

-

Death toll from Swiss New Year bar fire rises to 41

Death toll from Swiss New Year bar fire rises to 41

-

Alcaraz says Nadal inspired him to 'special' Australian Open title

-

Pakistan seeks out perpetrators after deadly separatist attacks

Pakistan seeks out perpetrators after deadly separatist attacks

-

Ukraine war talks delayed to Wednesday, Zelensky says

-

Djokovic says 'been a great ride' after Melbourne final loss

Djokovic says 'been a great ride' after Melbourne final loss

-

Von Allmen storms to downhill win in final Olympic tune-up

-

Carlos Alcaraz: tennis history-maker with shades of Federer

Carlos Alcaraz: tennis history-maker with shades of Federer

-

Alcaraz sweeps past Djokovic to win maiden Australian Open title

-

Israel says partially reopening Gaza's Rafah crossing

Israel says partially reopening Gaza's Rafah crossing

-

French IT giant Capgemini to sell US subsidiary after row over ICE links

-

Iran's Khamenei likens protests to 'coup', warns of regional war

Iran's Khamenei likens protests to 'coup', warns of regional war

-

New Epstein accuser claims sexual encounter with ex-prince Andrew: report

-

Italy's extrovert Olympic icon Alberto Tomba insists he is 'shy guy'

Italy's extrovert Olympic icon Alberto Tomba insists he is 'shy guy'

-

Chloe Kim goes for unprecedented snowboard halfpipe Olympic treble

-

Pakistan combing for perpetrators after deadly separatist attacks

Pakistan combing for perpetrators after deadly separatist attacks

-

Israel partially reopens Gaza's Rafah crossing

-

Iran declares European armies 'terrorist groups' after IRGC designation

Iran declares European armies 'terrorist groups' after IRGC designation

-

Snowstorm disrupts travel in southern US as blast of icy weather widens

-

Denmark's Andresen swoops to win Cadel Evans Road Race

Denmark's Andresen swoops to win Cadel Evans Road Race

-

Volkanovski beats Lopes in rematch to defend UFC featherweight title

-

Sea of colour as Malaysia's Hindus mark Thaipusam with piercings and prayer

Sea of colour as Malaysia's Hindus mark Thaipusam with piercings and prayer

-

Exiled Tibetans choose leaders for lost homeland

-

Afghan returnees in Bamiyan struggle despite new homes

Afghan returnees in Bamiyan struggle despite new homes

-

Mired in economic trouble, Bangladesh pins hopes on election boost

-

Chinese cash in jewellery at automated gold recyclers as prices soar

Chinese cash in jewellery at automated gold recyclers as prices soar

-

Israel to partially reopen Gaza's Rafah crossing

-

'Quiet assassin' Rybakina targets world number one after Melbourne win

'Quiet assassin' Rybakina targets world number one after Melbourne win

-

Deportation raids drive Minneapolis immigrant family into hiding

-

Nvidia boss insists 'huge' investment in OpenAI on track

Nvidia boss insists 'huge' investment in OpenAI on track

-

'Immortal' Indian comics keep up with changing times

Highlander Silver Announces Full Exercise and Closing of Over-Allotment Option

NOT FOR DISTRIBUTION TO U.S. NEWS WIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

TORONTO, ONTARIO / ACCESS Newswire / October 17, 2025 / Highlander Silver Corp. (TSX:HSLV) ("Highlander" or the "Company") is pleased to announce that, further to its bought deal public offering of common shares of the Company (the "Common Shares") which closed on September 29, 2025 (the "Offering"), the underwriters have exercised their over-allotment option (the "Over-Allotment Option") in full, to purchase an additional 2,330,000 Common Shares at a price of C$3.75 per Common Share. Upon closing of the Over-Allotment Option, the Company received additional gross proceeds of C$8,737,500, resulting in total gross proceeds from the Offering of C$94,987,500.

The Offering was conducted by a syndicate of underwriters led by National Bank Financial Inc. as lead underwriter and sole bookrunner, and including Canaccord Genuity Corp., Velocity Trade Capital Ltd., CIBC World Markets Inc., Ventum Financial Corp., BMO Nesbitt Burns Inc. and Cormark Securities Inc.

As previously announced, the net proceeds from the Offering will be used to fund the advancement of exploration and development activities, project studies and permitting at the Company's San Luis gold-silver project in Peru, as well as for property investigation and acquisition activities and for working capital and general corporate purposes.

The Offering was completed in all provinces and territories of Canada, except Quebec, pursuant to a prospectus supplement (the "Prospectus Supplement") to the Company's short form base shelf prospectus dated April 10, 2025 (the "Base Shelf Prospectus"), and in the United States on a private placement basis pursuant to an exemption from the registration requirements of the U.S. Securities Act of 1933, as amended (the "U.S. Securities Act") and applicable state securities laws and other jurisdictions. Copies of the Supplement, the Base Shelf Prospectus and the Underwriting Agreement are available under the Company's profile on SEDAR+ at www.sedarplus.ca.

The Common Shares have not been and will not be registered under the U.S. Securities Act, and accordingly will not be offered, sold or delivered, directly or indirectly within the United States, its possessions and other areas subject to its jurisdiction or to, or for the account or for the benefit of a United States person, except pursuant to applicable exemptions from the registration requirements.

About Highlander Silver Corp.

Highlander Silver is primarily focused on advancing the bonanza grade San Luis gold-silver project that is located adjacent to the past-producing Pierina mine in Central Peru. San Luis hosts Indicated Mineral Resources of 356 koz Au at 24.4 g/t Au and 8.4 Moz Ag at 579 g/t Ag and ranks among the 10 highest grade projects globally in both gold and silver categories.1 The Company's significant shareholders include the Augusta Group, which boasts an exceptional track record of value creation totaling over $4.5 billion in exit transactions, and strategic shareholders, the Lundin family and Eric Sprott.

[1]S&P Global rankings including the San Luis gold-silver project.

The mineral resource estimate disclosed herein is derived from Highlander Silver's technical report titled "Technical Report on the San Luis Property" with an effective date of January 15, 2025, prepared by independent qualified person, Martin Mount, MSc MCSM FGS CGeol FIMMM Ceng, and available on SEDAR+ at www.sedarplus.ca.

For further information, please contact:

Arun Lamba, Vice President Corporate Development

[email protected]

Forward-Looking Statements

Certain information contained in this news release constitutes "forward-looking information" under Canadian securities legislation. This includes, but is not limited to, information or statements with respect to the anticipated use of the net proceeds therefrom and any other activities, events or developments that the Company expects or anticipates will or may occur in the future. Such forward looking information or statements can be identified by the use of words such as "believes", "plans", "suggests", "targets" or "prospects" or variations (including negative variations) of such words and phrases, or state that certain actions, events or results "will" be taken, occur, or be achieved. Forward-looking information involves known and unknown risks, uncertainties, and other factors which may cause the actual results, performance, or achievements of the Company and/or its subsidiaries to be materially different from any future results, performance, or achievements expressed or implied by the forward-looking information. Such factors include, among others, general business, economic, competitive, political and social uncertainties, the actual results of current exploration activities, changes in project parameters as plans continue to be refined, future prices of precious and base metals, accident, labour disputes and other risks of the mining industry, and delays in obtaining governmental or stock exchange approvals or financing. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that could cause actions, events or results to differ from those anticipated, estimated or intended. Forward-looking information contained herein are made as of the date of this news release. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. The Company undertakes no obligation to update forward-looking information if circumstances or management's estimates or opinions should change, except as required by applicable securities laws. Accordingly, the reader is cautioned not to place undue reliance on forward-looking information.

SOURCE: Highlander Silver Corp.

View the original press release on ACCESS Newswire

A.Moore--AT