-

Prominent Venezuelan activist released after over four years in jail

Prominent Venezuelan activist released after over four years in jail

-

Emery riled by 'unfair' VAR call as Villa's title hopes fade

-

Guirassy double helps Dortmund move six points behind Bayern

Guirassy double helps Dortmund move six points behind Bayern

-

Nigeria's president pays tribute to Fela Kuti after Grammys Award

-

Inter eight clear after win at Cremonese marred by fans' flare flinging

Inter eight clear after win at Cremonese marred by fans' flare flinging

-

England underline World Cup

credentials with series win over Sri Lanka

-

Guirassy brace helps Dortmund move six behind Bayern

Guirassy brace helps Dortmund move six behind Bayern

-

Man City held by Solanke stunner, Sesko delivers 'best feeling' for Man Utd

-

'Send Help' debuts atop N.America box office

'Send Help' debuts atop N.America box office

-

Ukraine war talks delayed to Wednesday, says Zelensky

-

Iguanas fall from trees in Florida as icy weather bites southern US

Iguanas fall from trees in Florida as icy weather bites southern US

-

Carrick revels in 'best feeling' after Man Utd leave it late

-

Olympic chiefs admit 'still work to do' on main ice hockey venue

Olympic chiefs admit 'still work to do' on main ice hockey venue

-

Pope says Winter Olympics 'rekindle hope' for world peace

-

Last-gasp Demirovic strike sends Stuttgart fourth

Last-gasp Demirovic strike sends Stuttgart fourth

-

Sesko strikes to rescue Man Utd, Villa beaten by Brentford

-

'At least 200' feared dead in DR Congo landslide: government

'At least 200' feared dead in DR Congo landslide: government

-

Coventry says 'sad' about ICE, Wasserman 'distractions' before Olympics

-

In-form Lyon make it 10 wins in a row

In-form Lyon make it 10 wins in a row

-

Man Utd strike late as Carrick extends perfect start in Fulham thriller

-

Van der Poel romps to record eighth cyclo-cross world title

Van der Poel romps to record eighth cyclo-cross world title

-

Mbappe penalty earns Real Madrid late win over nine-man Rayo

-

Resurgent Pakistan seal T20 sweep of Australia

Resurgent Pakistan seal T20 sweep of Australia

-

Fiji top sevens standings after comeback win in Singapore

-

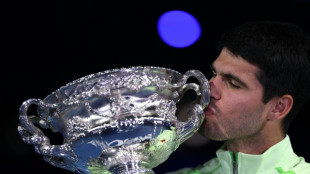

Alcaraz sweeps past Djokovic to win 'dream' Australian Open

Alcaraz sweeps past Djokovic to win 'dream' Australian Open

-

Death toll from Swiss New Year bar fire rises to 41

-

Alcaraz says Nadal inspired him to 'special' Australian Open title

Alcaraz says Nadal inspired him to 'special' Australian Open title

-

Pakistan seeks out perpetrators after deadly separatist attacks

-

Ukraine war talks delayed to Wednesday, Zelensky says

Ukraine war talks delayed to Wednesday, Zelensky says

-

Djokovic says 'been a great ride' after Melbourne final loss

-

Von Allmen storms to downhill win in final Olympic tune-up

Von Allmen storms to downhill win in final Olympic tune-up

-

Carlos Alcaraz: tennis history-maker with shades of Federer

-

Alcaraz sweeps past Djokovic to win maiden Australian Open title

Alcaraz sweeps past Djokovic to win maiden Australian Open title

-

Israel says partially reopening Gaza's Rafah crossing

-

French IT giant Capgemini to sell US subsidiary after row over ICE links

French IT giant Capgemini to sell US subsidiary after row over ICE links

-

Iran's Khamenei likens protests to 'coup', warns of regional war

-

New Epstein accuser claims sexual encounter with ex-prince Andrew: report

New Epstein accuser claims sexual encounter with ex-prince Andrew: report

-

Italy's extrovert Olympic icon Alberto Tomba insists he is 'shy guy'

-

Chloe Kim goes for unprecedented snowboard halfpipe Olympic treble

Chloe Kim goes for unprecedented snowboard halfpipe Olympic treble

-

Pakistan combing for perpetrators after deadly separatist attacks

-

Israel partially reopens Gaza's Rafah crossing

Israel partially reopens Gaza's Rafah crossing

-

Iran declares European armies 'terrorist groups' after IRGC designation

-

Snowstorm disrupts travel in southern US as blast of icy weather widens

Snowstorm disrupts travel in southern US as blast of icy weather widens

-

Denmark's Andresen swoops to win Cadel Evans Road Race

-

Volkanovski beats Lopes in rematch to defend UFC featherweight title

Volkanovski beats Lopes in rematch to defend UFC featherweight title

-

Sea of colour as Malaysia's Hindus mark Thaipusam with piercings and prayer

-

Exiled Tibetans choose leaders for lost homeland

Exiled Tibetans choose leaders for lost homeland

-

Afghan returnees in Bamiyan struggle despite new homes

-

Mired in economic trouble, Bangladesh pins hopes on election boost

Mired in economic trouble, Bangladesh pins hopes on election boost

-

Chinese cash in jewellery at automated gold recyclers as prices soar

Avino's Q3 Results Demonstrate Production Consistency and Advancement of La Preciosa Ahead of Schedule

VANCOUVER, BC / ACCESS Newswire / October 14, 2025 / Avino Silver & Gold Mines Ltd. (TSX:ASM)(NYSE American:ASM)(FSE:GV6) a long-standing silver producer in Mexico , reports production has remained strong during the quarter, with 580,780 silver equivalent ounces, reflecting steady operational performance, although slightly lower than the previous quarter due to normal mine sequencing. Overall results continue to support the Company's original production estimate of 2.5 to 2.8 million silver equivalent ounces.

PRODUCTION HIGHLIGHTS - Q3 2025 (COMPARED TO Q3 2024)

Silver Equivalent Production Decreased 13%: Avino produced 580,780 silver equivalent ounces in Q3 2025, representing a decrease from Q3 of 2024. The decrease was driven by lower feed grades in all three metals (silver, gold and copper), as we moved through a lower grade section of the mine plan and was partially offset by significantly improved mill availability of 21%.

Continued Elevated Mill Throughput: In Q3 2025, Avino achieved 21% higher mill throughput versus Q3 2024, totalling 188,757 tonnes of material. These throughput levels built of last quarter's record and were a result of previous upgrades and automation enhancements made by our operations team, demonstrating significant improvements in mill availability.

Gold Production Increased 19%: Q3 2025 production of 1,935 gold ounces represented a 19% increase compared to Q3 2024. This improved production resulted from the increased tonnes processed, alongside significant improvements in gold recoveries to 74% from 69% in Q3 of 2024.

Silver and Copper Production Decreased 7% and 26%: Avino produced 263,231 silver ounces and 1.3 million pounds of copper in Q3 2025, a decrease in both metals from Q3 of 2024. This decrease was result of lower feed grade from certain areas in our planned mine sequencing, which did have an impact on recoveries as well. This was partially offset by significantly improved mill availability of 21%.

Avino Mine Production Results

Q3 | Q3 | Change | YTD | YTD | Change | |

188,757 | 156,512 | 21% | Total Mill Feed (dry tonnes) | 547,597 | 467,041 | 17% |

52 | 63 | -18% | Feed Grade Silver (g/t) | 54 | 63 | -14% |

0.43 | 0.46 | -6% | Feed Grade Gold (g/t) | 0.45 | 0.47 | -4% |

0.39 | 0.58 | -33% | Feed Grade Copper (%) | 0.43 | 0.50 | -13% |

84% | 89% | -6% | Recovery Silver (%) | 85% | 88% | -4% |

74% | 69% | 7% | Recovery Gold (%) | 74% | 70% | 6% |

81% | 88% | -8% | Recovery Copper (%) | 84% | 87% | -4% |

263,231 | 281,831 | -7% | Total Silver Produced (oz) | 812,530 | 825,420 | -2% |

1,935 | 1,625 | 19% | Total Gold Produced (oz) | 5,933 | 4,917 | 21% |

1,307,429 | 1,771,250 | -26% | Total Copper Produced (lbs) | 4,372,752 | 4,423,909 | -1% |

580,780 | 670,887 | -13% | Total Silver Equivalent Produced (oz) 1 | 1,904,840 | 1,916,940 | -1% |

"This quarter's results reflect the natural variability in our mining sequence, but our overall performance remains solid, and we're on track to meet our annual production guidance range," said David Wolfin, President and CEO of Avino. "We have continued to focus on operational excellence, and it's demonstrated in our high mill availability and sustained throughput. The progress at La Preciosa has been exceptional. We are excited to start transporting stockpiled material from La Preciosa to the mill at Avino, well ahead of expectations, as we move closer to announcing first production. In addition, the incredible rise in metal prices has provided a welcome boost to our margins, supporting our continued growth."

Balance Sheet Update

Avino had approximately US$55 million in cash at September 30th, 2025. Our balance sheet continues to strengthen as we execute on our transformational growth strategy.

La Preciosa Update

The Gloria and Abundancia veins have been intercepted on the San Fernando ramp that has been driven from surface. The ramp continues to be driven, with progress currently down to Level 4. Over 6,700 tons of mineralized material had been stockpiled as of the end of Q3 2025, and trucking to the Avino Mill for processing is now underway. Hiring and training of equipment operators is ongoing and currently employs seventy people working across three shifts. All requirement mining equipment is on site already and standby equipment has been purchased to ensure continuous operation of site services. Offices and other building infrastructure are also being added. Recent photos showcasing the work at La Preciosa are available on the Avino website - click here to view them.

Exploration Program and Resource & Reserve Update

At Avino, the ramp at the Elena Tolosa ("ET") area has been driven down to Level 17.5, as we continue with development for future production mining. The 2025 drilling program commenced in April with a program consisting of nine planned holes from surface, with six now complete. The objective of the ET Area drill program is two-fold; One to test the downdip extension of the system below the current lowest mining level, following the trend of previous drilling reported on September 14, 2023 as well as to test the extension of the system along strike to the west. The Avino Vein remains open at depth and along strike, and earlier results have shown comparable grades and widths to those currently being mined. Drilling continues with over 3500m drilled to date. The latest results will be publicized when the assays have been received, and all data has been verified.

A second surface drill was deployed at La Preciosa to confirm prior drill results from previous operators and to improve the understanding of the grade zonation close to the scheduled mining areas near the ramp. Earlier drill core from previous operators, was extensively utilized to provide sample data for earlier technical reports, so remaining samples were limited. Since the last drill results were release ( August 18, 2025 ) drilling has continued and the latest results will be publicized when all the assays have been receive and all data has been verified. Drilling information will be utilized in underground mine planning, 3D modelling as well as an update to the Resource estimate that is due in Q1 2026. In addition, Avino is planning on releasing its first mineral reserve estimate at the same time as the Company has now met the requirements for a Producing Issuer under the NI 43-101 standards of disclosure for mineral projects.

Earnings Announcement

The Company's unaudited condensed consolidated interim financial statements for the Third Quarter 2025, will be released after the market closes on Thursday, November 6, 2025.

A conference call to discuss the Company's Q3 2025 operational and financial results will be held on Friday, November 7, 2025, at 8:00 a.m. PT / 11:00 a.m. ET. To participate in the conference call or follow the webcast, please see the details below.

Shareholders, analysts, investors, and media are invited to join the webcast and conference call by logging in here Avino's Q3 2025 Financial Results or by dialing the following numbers five to ten minutes prior to the start time.

Toll Free: 888-506-0062

International: +1 973-528-0011

Participant Access Code: 530885

Participants will be greeted by an operator and asked for the access code. If a caller does not have the code, they can reference the Company name. Participants will have the opportunity to ask questions during the Q&A portion.

The conference call and webcast will be recorded, and the replay will be available on the Company's website later that day.

Quality Assurance/Quality Control

Mill assays are performed at the Avino property's on-site lab. Check samples were submitted to SGS Labs in Durango, Mexico for verification. Gold and silver assays are performed by the fire assay method with a gravimetric finish for concentrates and AAS (Atomic Absorption Spectrometry) methods for copper, lead, zinc and silver for feed and tail grade samples. All concentrate shipments are assayed by one of the following independent third-party labs: Inspectorate in the UK, LSI in the Netherlands, and AHK.

Qualified Person(s)

Peter Latta, P.Eng., MBA, Avino's VP Technical Services, is a qualified person within the context of National Instrument 43-101, has reviewed and approved the technical data in this news release.

About Avino

Avino is a silver producer from its wholly owned Avino Mine near Durango, Mexico. The Company's silver, gold and copper production remains unhedged. The Company intends to maintain long term sustainable and profitable mining operations to reward shareholders and the community alike through our growth at the historic Avino Property and the strategic acquisition of the adjacent La Preciosa which was finalized in Q1 2022. Early in 2024, the pre-feasibility Study on the Oxide Tailings Project was completed. This study is a key milestone in our growth trajectory. As part of Avino's commitment to adopting sustainable practices, we have been operating a dry-stack tailings facility for more than two years now with excellent results. We are committed to managing all business activities in a safe, environmentally responsible, and cost-effective manner, while contributing to the well-being of the communities in which we operate. We encourage you to connect with us on X (formerly Twitter) at @Avino_ASM and on LinkedIn at Avino Silver & Gold Mines . To view the Avino Mine VRIFY tour, please click here .

For Further Information, Please Contact:

Investor Relations

Tel: 604-682-3701

Email: [email protected]

This news release contains "forward-looking information" and "forward-looking statements" (together, the "forward looking statements") within the meaning of applicable securities laws and the United States Private Securities Litigation Reform Act of 1995, including the mineral resource estimate for the Company's Avino properties, including La Preciosa, located near Durango in west-central Mexico (the "Avino Property") with an effective date of October 16, 2023, and can be viewed within Avino's latest technical report dated February 5, 2024 for the Pre-feasibility Study and references to Measured, Indicated Resources, and Proven and Probable Mineral Reserves referred to in this press release. This information and these statements, referred to herein as "forward-looking statements" are made as of the date of this document. Forward-looking statements relate to future events or future performance and reflect current estimates, predictions, expectations or beliefs regarding future events and include, but are not limited to, statements with respect to: (i) the estimated amount and grade of mineral reserves and mineral resources, including the cut-off grade; (ii) estimates of the capital costs of constructing mine facilities and bringing a mine into production, of operating the mine, of sustaining capital, of strip ratios and the duration of financing payback periods; (iii) the estimated amount of future production, both ore processed and metal recovered and recovery rates; (iv) estimates of operating costs, life of mine costs, net cash flow, net present value (NPV) and economic returns from an operating mine; and (v) the completion of the full Technical Report, including a Preliminary Economic Assessment, and its timing. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives or future events or performance (often, but not always, using words or phrases such as "expects", "anticipates", "plans", "projects", "estimates", "envisages", "assumes", "intends", "strategy", "goals", "objectives" or variations thereof or stating that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and may be forward-looking statements. These forward-looking statements are made as of the date of this news release and the dates of technical reports, as applicable. Readers are cautioned not to place undue reliance on forward-looking statements, as there can be no assurance that the future circumstances, outcomes or results anticipated in or implied by such forward-looking statements will occur or that plans, intentions or expectations upon which the forward-looking statements are based will occur. While we have based these forward-looking statements on our expectations about future events at the date that such statements were prepared, the statements are not a guarantee that such future events will occur and are subject to risks, uncertainties, assumptions and other factors which could cause events or outcomes to differ materially from those expressed or implied by such forward-looking statements.

Cautionary note to U.S. Investors concerning estimates of Mineral Reserves and Mineral Resources

All reserve and resource estimates reported by Avino were estimated in accordance with the Canadian National Instrument 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") Definition Standards. The U.S. Securities and Exchange Commission ("SEC") now recognizes estimates of "measured mineral resources," "indicated mineral resources" and "inferred mineral resources" and uses new definitions of "proven mineral reserves" and "probable mineral reserves" that are substantially similar to the corresponding CIM Definition Standards. However, the CIM Definition Standards differ from the requirements applicable to US domestic issuers. US investors are cautioned not to assume that any "measured mineral resources," "indicated mineral resources," "inferred mineral resources", "proven mineral reserves", or "probable mineral reserves" that the Issuer reports are or will be economically or legally mineable. Further, "inferred mineral resources" are that part of a mineral resource for which quantity and grade are estimated on the basis of limited geologic evidence and sampling. Mineral resources which are not mineral reserves do not have demonstrated economic viability.

Neither TSX nor its Regulation Services Provider (as that term is defined in the policies of the TSX) accepts responsibility for the adequacy or accuracy of this release.

Footnotes:

In Q3 2025, AgEq was calculated using metal prices of $39.38 per oz Ag, $3,454 per oz Au and $4.45 per lb Cu. In Q3 2024, AgEq was calculated using $29.42 per oz Ag, $2,476 per oz Au and $4.18 per lb Cu. For YTD 2025, AgEq was calculated using metal prices of $34.98 per oz Ag, $3,199 per oz Au and $4.34 per lb Cu. For YTD 2024, AgEq was calculated using metal prices of $28.24 per oz Ag, $2,387 per oz Au and $4.15 per lb Cu. Calculated figures may not add up due to rounding.

SOURCE: Avino Silver & Gold Mines Ltd.

View the original press release on ACCESS Newswire

P.Hernandez--AT