-

South Korea football bosses in talks to avert Women's Asian Cup boycott

South Korea football bosses in talks to avert Women's Asian Cup boycott

-

Level playing field? Tech at forefront of US immigration fight

-

British singer Olivia Dean wins Best New Artist Grammy

British singer Olivia Dean wins Best New Artist Grammy

-

Hatred of losing drives relentless Alcaraz to tennis history

-

Kendrick Lamar, Bad Bunny, Lady Gaga win early at Grammys

Kendrick Lamar, Bad Bunny, Lady Gaga win early at Grammys

-

Surging euro presents new headache for ECB

-

Djokovic hints at retirement as time seeps away on history bid

Djokovic hints at retirement as time seeps away on history bid

-

US talking deal with 'highest people' in Cuba: Trump

-

UK ex-ambassador quits Labour over new reports of Epstein links

UK ex-ambassador quits Labour over new reports of Epstein links

-

Trump says closing Kennedy Center arts complex for two years

-

Reigning world champs Tinch, Hocker among Millrose winners

Reigning world champs Tinch, Hocker among Millrose winners

-

Venezuelan activist ends '1,675 days' of suffering in prison

-

Real Madrid scrape win over Rayo, Athletic claim derby draw

Real Madrid scrape win over Rayo, Athletic claim derby draw

-

PSG beat Strasbourg after Hakimi red to retake top spot in Ligue 1

-

NFL Cardinals hire Rams' assistant LaFleur as head coach

NFL Cardinals hire Rams' assistant LaFleur as head coach

-

Arsenal scoop $2m prize for winning FIFA Women's Champions Cup

-

Atletico agree deal to sign Lookman from Atalanta

Atletico agree deal to sign Lookman from Atalanta

-

Real Madrid's Bellingham set for month out with hamstring injury

-

Man City won't surrender in title race: Guardiola

Man City won't surrender in title race: Guardiola

-

Korda captures weather-shortened LPGA season opener

-

Czechs rally to back president locking horns with government

Czechs rally to back president locking horns with government

-

Prominent Venezuelan activist released after over four years in jail

-

Emery riled by 'unfair' VAR call as Villa's title hopes fade

Emery riled by 'unfair' VAR call as Villa's title hopes fade

-

Guirassy double helps Dortmund move six points behind Bayern

-

Nigeria's president pays tribute to Fela Kuti after Grammys Award

Nigeria's president pays tribute to Fela Kuti after Grammys Award

-

Inter eight clear after win at Cremonese marred by fans' flare flinging

-

England underline World Cup

credentials with series win over Sri Lanka

England underline World Cup

credentials with series win over Sri Lanka

-

Guirassy brace helps Dortmund move six behind Bayern

-

Man City held by Solanke stunner, Sesko delivers 'best feeling' for Man Utd

Man City held by Solanke stunner, Sesko delivers 'best feeling' for Man Utd

-

'Send Help' debuts atop N.America box office

-

Ukraine war talks delayed to Wednesday, says Zelensky

Ukraine war talks delayed to Wednesday, says Zelensky

-

Iguanas fall from trees in Florida as icy weather bites southern US

-

Carrick revels in 'best feeling' after Man Utd leave it late

Carrick revels in 'best feeling' after Man Utd leave it late

-

Olympic chiefs admit 'still work to do' on main ice hockey venue

-

Pope says Winter Olympics 'rekindle hope' for world peace

Pope says Winter Olympics 'rekindle hope' for world peace

-

Last-gasp Demirovic strike sends Stuttgart fourth

-

Sesko strikes to rescue Man Utd, Villa beaten by Brentford

Sesko strikes to rescue Man Utd, Villa beaten by Brentford

-

'At least 200' feared dead in DR Congo landslide: government

-

Coventry says 'sad' about ICE, Wasserman 'distractions' before Olympics

Coventry says 'sad' about ICE, Wasserman 'distractions' before Olympics

-

In-form Lyon make it 10 wins in a row

-

Man Utd strike late as Carrick extends perfect start in Fulham thriller

Man Utd strike late as Carrick extends perfect start in Fulham thriller

-

Van der Poel romps to record eighth cyclo-cross world title

-

Mbappe penalty earns Real Madrid late win over nine-man Rayo

Mbappe penalty earns Real Madrid late win over nine-man Rayo

-

Resurgent Pakistan seal T20 sweep of Australia

-

Fiji top sevens standings after comeback win in Singapore

Fiji top sevens standings after comeback win in Singapore

-

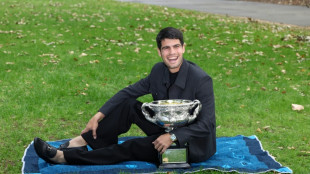

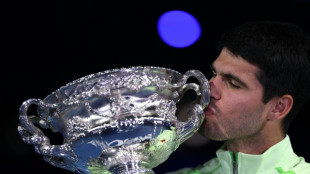

Alcaraz sweeps past Djokovic to win 'dream' Australian Open

-

Death toll from Swiss New Year bar fire rises to 41

Death toll from Swiss New Year bar fire rises to 41

-

Alcaraz says Nadal inspired him to 'special' Australian Open title

-

Pakistan seeks out perpetrators after deadly separatist attacks

Pakistan seeks out perpetrators after deadly separatist attacks

-

Ukraine war talks delayed to Wednesday, Zelensky says

Brookmount Gold Announces Agreement Eliminating Stock Conversions Resulting from Convertible Debt and Repricing of Reg.A Offering

RENO, NEVADA / ACCESS Newswire / October 2, 2025 / Brookmount Gold (sic. Brookmount Explorations Inc.) (OTC:BMXI), a gold exploration and production company, announced that a repayment and settlement agreement has now been executed with its convertible note lender. The agreement confirms that there will be no further conversions on this debt, nor stock issuances pursuant thereto. Repayment of the remaining balance, which commenced on September 20, will be completed on or before December 2026 and no prepayment penalties will apply.

In addition to its convertible debt settlement, Brookmount confirmed that it will no longer be issuing additional stock under the currently qualified Reg.A offering. The Company is in the process of filing a post-qualification amendment (PQA) to reprice the offering at a significant premium to the existing offering price of $0.02c per share. The offering price is being raised for a number of reasons, including strong demand, current Company growth metrics and corporate expectations for future stock price movements. This process will involve a new review by the SEC and effectively suspends the current Reg A offering qualification until the review process is completed.

CEO Nils Ollquist commented: "The Company believes that limiting future dilution is currently the most critical element for building shareholder value. Over the past several months, we have been active in the process of raising sufficient capital to fund both expansion of our Indonesian gold operations and to accelerate the extinguishing of our remaining convertible debt. Conversions and share issuances pursuant to this debt have represented a significant obstacle to achieving a share price performance both reflective of our present status and satisfactory to both management and our shareholders."

Mr Ollquist continued: "This month we will announce our 26th consecutive quarter of profitability. Since the Company will now continue to operate, expand, and thrive as a cash flow positive entity, there is no further need to limit our share price growth by issuing further dilutive equity. As cash flow continues to grow, we anticipate accelerating and completing our previously announced stock buyback program during the next few months. Brookmount should be able to expand this program with additional tranches during 2026. The Company's financial health and operational viability have never been stronger. We will now be moving forward, at pace, with implementation of several strategic initiatives alluded to in our past releases, including the spin off of our North American assets and progressing with exchange listing".

About Brookmount Gold

Founded in 2018, Brookmount Gold is a high-growth gold-producing company quoted on OTC Markets in the United States (OTC:BMXI). With operating gold mines in Southeast Asia and exploration and production assets in North America, the company is focused on acquiring and developing high-quality gold assets with JORC/NI 43-101 verified resources.

Safe Harbor Statements:

Except for the historical information contained herein, certain of the matters discussed in this communication constitute "forward-looking statements" within the meaning of the Securities Litigation Reform Act of 1995. Words such as "may," "might," "will," "should," "could," "anticipate," "estimate," "expect," "predict," "project," "future," "potential," "intend," "seek to," "plan," "assume," "believe," "target," "forecast," "goal," "objective," "continue" or the negative of such terms or other variations thereof and words and terms of similar substance used in connection with any discussion of future plans, actions, or events identify forward-looking statements. These forward-looking statements include, but are not limited to, statements regarding benefits of the proposed license, expected synergies, anticipated future financial and operating performance and results, including estimates of growth. There are a number of risks and uncertainties that could cause actual results to differ materially from the forward-looking statements included in this communication. For example, the expected timing and likelihood of completion of the pending transaction, including the timing, receipt and terms and conditions of any required governmental and regulatory approvals of the pending transaction that could reduce anticipated benefits or cause the parties to abandon the transaction, the ability to successfully integrate the businesses, the occurrence of any event, change or other circumstance that could give rise to the termination of the negotiations, the risk that the parties may not be able to satisfy the conditions to the proposed transaction in a timely manner or at all, risks related to disruption of management time from ongoing business operations due to the proposed transaction, the risk that any announcements relating to the proposed transaction could have adverse effects on the market price of Brookmount's common stock. All such factors are difficult to predict and are beyond our control. We disclaim and do not undertake any obligation to update or revise any forward-looking statement in this report, except as required by applicable law or regulations.

Website: https://www.brookmountgold.com

Corporate Contact:

[email protected]

Social Links: Brookmount Gold X (Formerly Twitter);

https://x.com/brookmountgold (@BrookmountAu)

SOURCE: Brookmount Explorations, Inc.

View the original press release on ACCESS Newswire

M.King--AT