-

Steven Spielberg earns coveted EGOT status with Grammy win

Steven Spielberg earns coveted EGOT status with Grammy win

-

Knicks boost win streak to six by beating LeBron's Lakers

-

Kendrick Lamar, Bad Bunny, Lady Gaga triumph at Grammys

Kendrick Lamar, Bad Bunny, Lady Gaga triumph at Grammys

-

Japan says rare earth found in sediment retrieved on deep-sea mission

-

San Siro prepares for last dance with Winter Olympics' opening ceremony

San Siro prepares for last dance with Winter Olympics' opening ceremony

-

France great Benazzi relishing 'genius' Dupont's Six Nations return

-

Grammy red carpet: black and white, barely there and no ICE

Grammy red carpet: black and white, barely there and no ICE

-

Oil tumbles on Iran hopes, precious metals hit by stronger dollar

-

South Korea football bosses in talks to avert Women's Asian Cup boycott

South Korea football bosses in talks to avert Women's Asian Cup boycott

-

Level playing field? Tech at forefront of US immigration fight

-

British singer Olivia Dean wins Best New Artist Grammy

British singer Olivia Dean wins Best New Artist Grammy

-

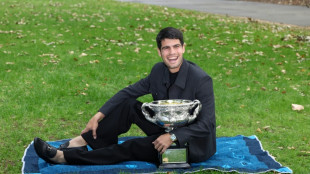

Hatred of losing drives relentless Alcaraz to tennis history

-

Kendrick Lamar, Bad Bunny, Lady Gaga win early at Grammys

Kendrick Lamar, Bad Bunny, Lady Gaga win early at Grammys

-

Surging euro presents new headache for ECB

-

Djokovic hints at retirement as time seeps away on history bid

Djokovic hints at retirement as time seeps away on history bid

-

US talking deal with 'highest people' in Cuba: Trump

-

UK ex-ambassador quits Labour over new reports of Epstein links

UK ex-ambassador quits Labour over new reports of Epstein links

-

Trump says closing Kennedy Center arts complex for two years

-

Reigning world champs Tinch, Hocker among Millrose winners

Reigning world champs Tinch, Hocker among Millrose winners

-

Venezuelan activist ends '1,675 days' of suffering in prison

-

Real Madrid scrape win over Rayo, Athletic claim derby draw

Real Madrid scrape win over Rayo, Athletic claim derby draw

-

PSG beat Strasbourg after Hakimi red to retake top spot in Ligue 1

-

NFL Cardinals hire Rams' assistant LaFleur as head coach

NFL Cardinals hire Rams' assistant LaFleur as head coach

-

Arsenal scoop $2m prize for winning FIFA Women's Champions Cup

-

Atletico agree deal to sign Lookman from Atalanta

Atletico agree deal to sign Lookman from Atalanta

-

Real Madrid's Bellingham set for month out with hamstring injury

-

Man City won't surrender in title race: Guardiola

Man City won't surrender in title race: Guardiola

-

Korda captures weather-shortened LPGA season opener

-

Czechs rally to back president locking horns with government

Czechs rally to back president locking horns with government

-

Prominent Venezuelan activist released after over four years in jail

-

Emery riled by 'unfair' VAR call as Villa's title hopes fade

Emery riled by 'unfair' VAR call as Villa's title hopes fade

-

Guirassy double helps Dortmund move six points behind Bayern

-

Nigeria's president pays tribute to Fela Kuti after Grammys Award

Nigeria's president pays tribute to Fela Kuti after Grammys Award

-

Inter eight clear after win at Cremonese marred by fans' flare flinging

-

England underline World Cup

credentials with series win over Sri Lanka

England underline World Cup

credentials with series win over Sri Lanka

-

Guirassy brace helps Dortmund move six behind Bayern

-

Man City held by Solanke stunner, Sesko delivers 'best feeling' for Man Utd

Man City held by Solanke stunner, Sesko delivers 'best feeling' for Man Utd

-

'Send Help' debuts atop N.America box office

-

Ukraine war talks delayed to Wednesday, says Zelensky

Ukraine war talks delayed to Wednesday, says Zelensky

-

Iguanas fall from trees in Florida as icy weather bites southern US

-

Carrick revels in 'best feeling' after Man Utd leave it late

Carrick revels in 'best feeling' after Man Utd leave it late

-

Olympic chiefs admit 'still work to do' on main ice hockey venue

-

Pope says Winter Olympics 'rekindle hope' for world peace

Pope says Winter Olympics 'rekindle hope' for world peace

-

Last-gasp Demirovic strike sends Stuttgart fourth

-

Sesko strikes to rescue Man Utd, Villa beaten by Brentford

Sesko strikes to rescue Man Utd, Villa beaten by Brentford

-

'At least 200' feared dead in DR Congo landslide: government

-

Coventry says 'sad' about ICE, Wasserman 'distractions' before Olympics

Coventry says 'sad' about ICE, Wasserman 'distractions' before Olympics

-

In-form Lyon make it 10 wins in a row

-

Man Utd strike late as Carrick extends perfect start in Fulham thriller

Man Utd strike late as Carrick extends perfect start in Fulham thriller

-

Van der Poel romps to record eighth cyclo-cross world title

Highlander Silver Closes $86 Million Bought Deal Public Offering

NOT FOR DISTRIBUTION TO U.S. NEWS WIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

NOT FOR DISTRIBUTION TO U.S. NEWS WIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

TORONTO, ONTARIO / ACCESS Newswire / September 29, 2025 / Highlander Silver Corp. (TSX:HSLV) ("Highlander" or the "Company") is pleased to announce that it has closed its previously announced bought deal public offering, pursuant to which the Company sold 23,000,000 common shares of the Company (the "Common Shares") at a price of C$3.75 per Common Share (the "Offering Price") for aggregate gross proceeds of C$86,250,000 (the "Offering"). The Company has also granted the Underwriters an option to purchase up to an additional 2,330,000 Common Shares, on the same terms and conditions, exercisable in whole or in part, at any time and from time to time, on or prior the 30th day following the closing of the Offering.

The Offering was conducted by a syndicate of underwriters led by National Bank Financial Inc. as lead underwriter and sole bookrunner, and including Canaccord Genuity Corp., Velocity Trade Capital Ltd., CIBC World Markets Inc., Ventum Financial Corp., BMO Nesbitt Burns Inc. and Cormark Securities Inc.

Daniel Earle, President and CEO, commented, "We greatly appreciate the steadfast support of our largest shareholders, Augusta Capital, the Lundin family and Eric Sprott. We are also delighted to welcome new global institutional investors to our shareholder base. The oversubscribed offering puts us in the enviable position of substantially funding our San Luis plans, with major investments in community development and infrastructure, while accelerating our capacity for growth."

The net proceeds from the Offering will be used to fund the advancement of exploration and development activities, project studies and permitting at the Company's San Luis gold-silver project in Peru, as well as for property investigation and acquisition activities and for working capital and general corporate purposes.

The Offering was completed in all provinces and territories of Canada, except Quebec, pursuant to a prospectus supplement (the "Prospectus Supplement") to the Company's short form base shelf prospectus dated April 10, 2025 (the "Base Shelf Prospectus"), and in the United States on a private placement basis pursuant to an exemption from the registration requirements of the U.S. Securities Act of 1933, as amended (the "U.S. Securities Act") and applicable state securities laws and other jurisdictions. Copies of the Supplement, the Base Shelf Prospectus and the Underwriting Agreement are available under the Company's profile on SEDAR+ at www.sedarplus.ca.

The Common Shares have not been and will not be registered under the U.S. Securities Act, and accordingly will not be offered, sold or delivered, directly or indirectly within the United States, its possessions and other areas subject to its jurisdiction or to, or for the account or for the benefit of a United States person, except pursuant to applicable exemptions from the registration requirements.

Certain insiders of the Company subscribed for Common Shares under the Offering. Each of the insiders' participation constitutes a "related party transaction" as defined under Multilateral Instrument 61-101 Protection of Minority Security Holders in Special Transactions ("MI 61-101"). The Company is relying on the exemptions from the formal valuation requirements contained in section 5.5(a) of MI 61-101 and the minority shareholder approval requirement contained in section 5.7(1)(a) of MI 61-101, as the fair market value of the securities to be distributed to the insiders is not more than 25% of the Company's market capitalization, as calculated in accordance with MI 61-101. The Company did not file a material change report in respect of the related party transactions at least 21 days before the closing of the Offering, as the details of the participation by the related parties were not settled until shortly prior to closing of the Offering.

About Highlander Silver Corp.

Highlander Silver is primarily focused on advancing the bonanza grade San Luis gold-silver project that is located adjacent to the past-producing Pierina mine in Central Peru. San Luis hosts Indicated Mineral Resources of 356 koz Au at 24.4 g/t Au and 8.4 Moz Ag at 579 g/t Ag and ranks among the 10 highest grade projects globally in both gold and silver categories.1 The Company's significant shareholders include the Augusta Group, which boasts an exceptional track record of value creation totaling over $4.5 billion in exit transactions, and strategic shareholders, the Lundin family and Eric Sprott.

[1]S&P Global rankings including the San Luis gold-silver project.

The mineral resource estimate disclosed herein is derived from Highlander Silver's technical report titled "Technical Report on the San Luis Property" with an effective date of January 15, 2025, prepared by independent qualified person, Martin Mount, MSc MCSM FGS CGeol FIMMM Ceng, and available on SEDAR+ at www.sedarplus.ca.

For further information, please contact:

Arun Lamba, Vice President Corporate Development

[email protected]

Forward-Looking Statements

Certain information contained in this news release constitutes "forward-looking information" under Canadian securities legislation. This includes, but is not limited to, information or statements with respect to the anticipated use of the net proceeds therefrom and any other activities, events or developments that the Company expects or anticipates will or may occur in the future. Such forward looking information or statements can be identified by the use of words such as "believes", "plans", "suggests", "targets" or "prospects" or variations (including negative variations) of such words and phrases, or state that certain actions, events or results "will" be taken, occur, or be achieved. Forward-looking information involves known and unknown risks, uncertainties, and other factors which may cause the actual results, performance, or achievements of the Company and/or its subsidiaries to be materially different from any future results, performance, or achievements expressed or implied by the forward-looking information. Such factors include, among others, general business, economic, competitive, political and social uncertainties, the actual results of current exploration activities, changes in project parameters as plans continue to be refined, future prices of precious and base metals, accident, labour disputes and other risks of the mining industry, and delays in obtaining governmental or stock exchange approvals or financing. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that could cause actions, events or results to differ from those anticipated, estimated or intended. Forward-looking information contained herein are made as of the date of this news release. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. The Company undertakes no obligation to update forward-looking information if circumstances or management's estimates or opinions should change, except as required by applicable securities laws. Accordingly, the reader is cautioned not to place undue reliance on forward-looking information.

SOURCE: Highlander Silver Corp.

View the original press release on ACCESS Newswire

A.Williams--AT