-

Divided US Fed set for contentious interest rate meeting

Divided US Fed set for contentious interest rate meeting

-

India nightclub fire kills 23 in Goa

-

France's Ugo Bienvenu ready to take animated 'Arco' to Oscars

France's Ugo Bienvenu ready to take animated 'Arco' to Oscars

-

Trump's Pentagon chief under fire as scandals mount

-

England's Archer takes pillow to second Ashes Test in 'shocking look'

England's Archer takes pillow to second Ashes Test in 'shocking look'

-

Australia skipper Cummins 'good to go' for Adelaide Test

-

Mexico's Sheinbaum holds huge rally following major protests

Mexico's Sheinbaum holds huge rally following major protests

-

Salah tirade adds to Slot's troubles during Liverpool slump

-

Torres treble helps Barca extend Liga lead, Atletico slip

Torres treble helps Barca extend Liga lead, Atletico slip

-

PSG thump Rennes but Lens remain top in France

-

Salah opens door to Liverpool exit with 'thrown under the bus' rant

Salah opens door to Liverpool exit with 'thrown under the bus' rant

-

Two eagles lift Straka to World Challenge lead over Scheffler

-

Messi dazzles as Miami beat Vancouver to win MLS title

Messi dazzles as Miami beat Vancouver to win MLS title

-

Bielle-Biarrey strikes twice as Bordeaux-Begles win Champions Cup opener in S.Africa

-

Bilbao's Berenguer deals Atletico another Liga defeat

Bilbao's Berenguer deals Atletico another Liga defeat

-

Salah opens door to Liverpool exit after being 'thrown under the bus'

-

Bethlehem Christmas tree lit up for first time since Gaza war

Bethlehem Christmas tree lit up for first time since Gaza war

-

Slot shows no sign of finding answers to Liverpool slump

-

New Zealand's Robinson wins giant slalom at Mont Tremblant

New Zealand's Robinson wins giant slalom at Mont Tremblant

-

Liverpool slump self-inflicted, says Slot

-

Hundreds in Tunisia protest against government

Hundreds in Tunisia protest against government

-

Mofokeng's first goal wins cup final for Orlando Pirates

-

Torres hat-trick helps Barca down Betis to extend Liga lead

Torres hat-trick helps Barca down Betis to extend Liga lead

-

Bielle-Biarrey strikes twice as Bordeaux win Champions Cup opener in S.Africa

-

Liverpool humbled again by Leeds fightback for 3-3 draw

Liverpool humbled again by Leeds fightback for 3-3 draw

-

'Democracy has crumbled!': Four arrested in UK Crown Jewels protest

-

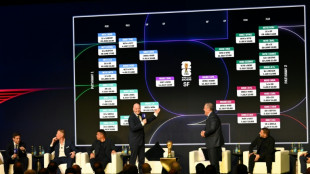

Contenders plot path to 2026 World Cup glory as FIFA reveals tournament schedule

Contenders plot path to 2026 World Cup glory as FIFA reveals tournament schedule

-

Inter thump Como to top Serie A ahead of Liverpool visit

-

Maresca fears Chelsea striker Delap faces fresh injury setback

Maresca fears Chelsea striker Delap faces fresh injury setback

-

Consistency the key to Man City title charge – Guardiola

-

Thauvin on target again as Lens remain top in France

Thauvin on target again as Lens remain top in France

-

Greyness and solitude: French ex-president describes prison stay

-

Frank relieved after Spurs ease pressure on under-fire boss

Frank relieved after Spurs ease pressure on under-fire boss

-

England kick off World Cup bid in Dallas as 2026 schedule confirmed

-

Milei welcomes Argentina's first F-16 fighter jets

Milei welcomes Argentina's first F-16 fighter jets

-

No breakthrough at 'constructive' Ukraine-US talks

-

Bielle-Biarrey double helps Bordeaux-Begles open Champions Cup defence with Bulls win

Bielle-Biarrey double helps Bordeaux-Begles open Champions Cup defence with Bulls win

-

Verstappen looking for a slice of luck to claim fifth title

-

Kane cameo hat-trick as Bayern blast past Stuttgart

Kane cameo hat-trick as Bayern blast past Stuttgart

-

King Kohli says 'free in mind' after stellar ODI show

-

Arsenal rocked by Aston Villa, Man City cut gap to two points

Arsenal rocked by Aston Villa, Man City cut gap to two points

-

Crestfallen Hamilton hits new low with Q1 exit

-

Sleepless in Abu Dhabi - nervy times for Norris says Rosberg

Sleepless in Abu Dhabi - nervy times for Norris says Rosberg

-

Arsenal will bounce back from Villa blow: Arteta

-

UN Security Council delegation urges all sides to stick to Lebanon truce

UN Security Council delegation urges all sides to stick to Lebanon truce

-

Verstappen outguns McLarens to take key pole in Abu Dhabi

-

Syria's Kurds hail 'positive impact' of Turkey peace talks

Syria's Kurds hail 'positive impact' of Turkey peace talks

-

Verstappen takes pole position for season-ending Abu Dhabi GP

-

Jaiswal hits ton as India thrash S. Africa to clinch ODI series

Jaiswal hits ton as India thrash S. Africa to clinch ODI series

-

UK's Farage rallies in Scottish town hit by immigration protests

| RIO | -0.92% | 73.06 | $ | |

| BTI | -1.81% | 57.01 | $ | |

| BP | -3.91% | 35.83 | $ | |

| RBGPF | 0% | 78.35 | $ | |

| CMSC | -0.21% | 23.43 | $ | |

| NGG | -0.66% | 75.41 | $ | |

| GSK | -0.33% | 48.41 | $ | |

| SCS | -0.56% | 16.14 | $ | |

| RELX | -0.55% | 40.32 | $ | |

| RYCEF | -0.34% | 14.62 | $ | |

| BCC | -1.66% | 73.05 | $ | |

| AZN | 0.17% | 90.18 | $ | |

| CMSD | -0.3% | 23.25 | $ | |

| JRI | 0.29% | 13.79 | $ | |

| VOD | -1.31% | 12.47 | $ | |

| BCE | 1.4% | 23.55 | $ |

Goldcliff Announces Unit and Flow Through "LIFE" Offerings

NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

VANCOUVER, BC / ACCESS Newswire / September 4, 2025 / Goldcliff Resource Corporation ("Goldcliff" or the "Company") (TSXV:GCN)(OTCBB PINKS:GCFFF) is pleased to re-announce, in accordance with the requirements of the TSX Venture Exchange ("TSXV"), its proposed non-brokered private placement for aggregate gross proceeds of up to $825,000 (the "Private Placement"). There are no changes to the terms of the Private Placement, which was first announced on August 25, 2025.

The Company confirms the Private Placement will consist of the issuance of: (i) up to 5,000,000 units (each, a "NFT Unit"), at a price of $0.045 per NFT Unit (the "NFT Unit Offering"), with each NFT Unit comprising one common share of the Company (each, a "Common Share") and one half of one non-transferrable Common Share purchase warrant (each whole warrant, a "Warrant"); and (ii) up to 10,000,000 flow-through shares ("FT Shares"), at a price of $0.06 per FT Share (the "FT Share Offering"), with each FT Share comprising one Common Share which qualifies as a "flow-through share" within the meaning of the Income Tax Act (Canada). Each Warrant will entitle the holder to acquire an additional Common Share at an exercise price of $0.08 per Common Share for a period of 24 months from the Closing Date.

Subject to compliance with applicable regulatory requirements and in accordance with National Instrument 45-106 - Prospectus Exemptions ("NI 45-105"), the securities sold under the Private Placement will be offered in all Provinces of Canada except Québec pursuant to the Listed Issuer Financing Exemption under Part 5A of NI 45-106 (the "Listed Issuer Financing Exemption"). Subject to the rules and policies of the TSXV, the securities issuable from the sale of Units to Canadian resident subscribers will not be subject to a hold period under applicable Canadian securities laws. There is an offering document dated August 25, 2025 (the "Offering Document") related to this Private Placement that can be accessed under the Company's profile at www.sedarplus.ca and at www.goldcliff.com. Prospective investors should read this Offering Document before making an investment decision.

Proceeds from the NFT Unit Offering will be applied to property payments on Aurora West and Kettle Valley projects, and to general working capital. In accordance with the requirements of the TSXV, no payments from the proceeds of the NFT Unit Offering will be made to "Non-Arm's Length Parties" of the Company or to persons conducting "Investor Relations Activities", as such terms are defined in the policies of the TSXV.

Proceeds from the FT Share Offering will be applied to drilling at Kettle Valley, sample collection for metallurgical test work and geochemical sampling at Panorama Ridge, and additional geochemical and geophysical surveys at the Ainsworth silver project, as Canadian exploration expenses that will qualify as "flow-through mining expenditures" within the meaning of the Income Tax Act (Canada), and which will be incurred on or before December 31, 2026 and renounced with an effective date no later than December 31, 2025 to the initial purchasers of FT Shares. All three projects are located in British Columbia.

The Private Placement is anticipated to close on or about October 6, 2025 ("Closing Date"), or such other date(s) as the Company may determine. Closing of the Private Placement is subject to certain conditions including, but not limited to, the receipt of all necessary regulatory and other approvals, including the approval of the TSXV. Goldcliff advises that insiders of the Company may participate in the Private Placement, which subscriptions will be completed pursuant to available related party exemptions under Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions and will be subject to the TSXV hold period.

At Closing, the Company may pay a cash finder's fee equal to 7% of gross proceeds introduced by eligible finders. Also, the Company may grant to eligible finders, finder's warrants equal to 7% of the number of NFT Units and/or FT Shares introduced by the finder on the same terms and conditions as the Warrants comprising the NFT Units.

This news release does not constitute an offer to sell or a solicitation of an offer to buy nor shall there be any sale of any of the securities in the United States or in any jurisdiction in which such offer, solicitation or sale would be unlawful. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the "1933 Act"), or any state securities laws and may not be offered or sold within the United States or to, or for account or benefit of, U.S. Persons (as defined in Regulation S under the 1933 Act) unless registered under the 1933 Act and applicable state securities laws, or an exemption from such registration requirements is available.

For further information, please contact George W. Sanders, President, at 250-764-8879, toll free at 1-866-769-4802 or email at [email protected].

GOLDCLIFF RESOURCE CORPORATION

Per: "George W. Sanders"

George W. Sanders, President

Neither TSX Venture Exchange nor its Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange) accept responsibility for the adequacy or the accuracy of this news release.

Forward-Looking Information: This news release includes certain "forward-looking information" and "forward-looking statements" (collectively, "forward-looking statements") within the meaning of applicable Canadian securities legislation. All statements in this news release that address events or developments that we expect to occur in the future are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, although not always, identified by words such as "expect", "plan", "anticipate", "project", "target", "potential", "schedule", "forecast", "budget", "estimate", "intend" or "believe" and similar expressions or their negative connotations, or that events or conditions "will", "would", "may", "could", "should" or "might" occur. All such forward-looking statements are based on the opinions and estimates of management as of the date such statements are made. Forward-looking statements in this news release include statements regarding, among others, the anticipated closing of the Private Placement, the anticipated size of the Private Placement, the receipt of all regulatory approvals in respect of the Private Placement, including approval of the TSXV, the participation of insiders, the expected use of proceeds from the Private Placement, certain expenses qualifying as flow though mining expenditures, and the expected timing for incurrence and renouncement of expenses. Although Goldcliff believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those forward-looking statements. Factors that could cause actual results to differ materially from those in forward-looking statements include market prices, exploration successes, continued availability of capital and financing, general economic and market or business conditions. These forward-looking statements are based on a number of assumptions including, among other things, assumptions regarding general business and economic conditions, the timing and receipt of regulatory and governmental approvals, the ability of Goldcliff and other parties to satisfy stock exchange and other regulatory requirements in a timely manner, the availability of financing for Goldcliff's proposed transactions and programs on reasonable terms, and the ability of third party service providers to deliver services in a timely manner. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. Goldcliff does not assume any obligation to update or revise its forward-looking statements, whether as a result of new information, future or otherwise, except as required by applicable law.

SOURCE: Goldcliff Resource Corp.

View the original press release on ACCESS Newswire

B.Torres--AT