-

Divided US Fed set for contentious interest rate meeting

Divided US Fed set for contentious interest rate meeting

-

India nightclub fire kills 23 in Goa

-

France's Ugo Bienvenu ready to take animated 'Arco' to Oscars

France's Ugo Bienvenu ready to take animated 'Arco' to Oscars

-

Trump's Pentagon chief under fire as scandals mount

-

England's Archer takes pillow to second Ashes Test in 'shocking look'

England's Archer takes pillow to second Ashes Test in 'shocking look'

-

Australia skipper Cummins 'good to go' for Adelaide Test

-

Mexico's Sheinbaum holds huge rally following major protests

Mexico's Sheinbaum holds huge rally following major protests

-

Salah tirade adds to Slot's troubles during Liverpool slump

-

Torres treble helps Barca extend Liga lead, Atletico slip

Torres treble helps Barca extend Liga lead, Atletico slip

-

PSG thump Rennes but Lens remain top in France

-

Salah opens door to Liverpool exit with 'thrown under the bus' rant

Salah opens door to Liverpool exit with 'thrown under the bus' rant

-

Two eagles lift Straka to World Challenge lead over Scheffler

-

Messi dazzles as Miami beat Vancouver to win MLS title

Messi dazzles as Miami beat Vancouver to win MLS title

-

Bielle-Biarrey strikes twice as Bordeaux-Begles win Champions Cup opener in S.Africa

-

Bilbao's Berenguer deals Atletico another Liga defeat

Bilbao's Berenguer deals Atletico another Liga defeat

-

Salah opens door to Liverpool exit after being 'thrown under the bus'

-

Bethlehem Christmas tree lit up for first time since Gaza war

Bethlehem Christmas tree lit up for first time since Gaza war

-

Slot shows no sign of finding answers to Liverpool slump

-

New Zealand's Robinson wins giant slalom at Mont Tremblant

New Zealand's Robinson wins giant slalom at Mont Tremblant

-

Liverpool slump self-inflicted, says Slot

-

Hundreds in Tunisia protest against government

Hundreds in Tunisia protest against government

-

Mofokeng's first goal wins cup final for Orlando Pirates

-

Torres hat-trick helps Barca down Betis to extend Liga lead

Torres hat-trick helps Barca down Betis to extend Liga lead

-

Bielle-Biarrey strikes twice as Bordeaux win Champions Cup opener in S.Africa

-

Liverpool humbled again by Leeds fightback for 3-3 draw

Liverpool humbled again by Leeds fightback for 3-3 draw

-

'Democracy has crumbled!': Four arrested in UK Crown Jewels protest

-

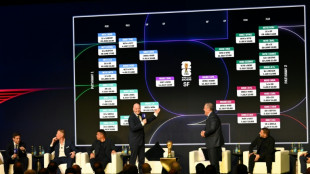

Contenders plot path to 2026 World Cup glory as FIFA reveals tournament schedule

Contenders plot path to 2026 World Cup glory as FIFA reveals tournament schedule

-

Inter thump Como to top Serie A ahead of Liverpool visit

-

Maresca fears Chelsea striker Delap faces fresh injury setback

Maresca fears Chelsea striker Delap faces fresh injury setback

-

Consistency the key to Man City title charge – Guardiola

-

Thauvin on target again as Lens remain top in France

Thauvin on target again as Lens remain top in France

-

Greyness and solitude: French ex-president describes prison stay

-

Frank relieved after Spurs ease pressure on under-fire boss

Frank relieved after Spurs ease pressure on under-fire boss

-

England kick off World Cup bid in Dallas as 2026 schedule confirmed

-

Milei welcomes Argentina's first F-16 fighter jets

Milei welcomes Argentina's first F-16 fighter jets

-

No breakthrough at 'constructive' Ukraine-US talks

-

Bielle-Biarrey double helps Bordeaux-Begles open Champions Cup defence with Bulls win

Bielle-Biarrey double helps Bordeaux-Begles open Champions Cup defence with Bulls win

-

Verstappen looking for a slice of luck to claim fifth title

-

Kane cameo hat-trick as Bayern blast past Stuttgart

Kane cameo hat-trick as Bayern blast past Stuttgart

-

King Kohli says 'free in mind' after stellar ODI show

-

Arsenal rocked by Aston Villa, Man City cut gap to two points

Arsenal rocked by Aston Villa, Man City cut gap to two points

-

Crestfallen Hamilton hits new low with Q1 exit

-

Sleepless in Abu Dhabi - nervy times for Norris says Rosberg

Sleepless in Abu Dhabi - nervy times for Norris says Rosberg

-

Arsenal will bounce back from Villa blow: Arteta

-

UN Security Council delegation urges all sides to stick to Lebanon truce

UN Security Council delegation urges all sides to stick to Lebanon truce

-

Verstappen outguns McLarens to take key pole in Abu Dhabi

-

Syria's Kurds hail 'positive impact' of Turkey peace talks

Syria's Kurds hail 'positive impact' of Turkey peace talks

-

Verstappen takes pole position for season-ending Abu Dhabi GP

-

Jaiswal hits ton as India thrash S. Africa to clinch ODI series

Jaiswal hits ton as India thrash S. Africa to clinch ODI series

-

UK's Farage rallies in Scottish town hit by immigration protests

| RIO | -0.92% | 73.06 | $ | |

| BTI | -1.81% | 57.01 | $ | |

| BP | -3.91% | 35.83 | $ | |

| RBGPF | 0% | 78.35 | $ | |

| CMSC | -0.21% | 23.43 | $ | |

| NGG | -0.66% | 75.41 | $ | |

| GSK | -0.33% | 48.41 | $ | |

| SCS | -0.56% | 16.14 | $ | |

| RELX | -0.55% | 40.32 | $ | |

| RYCEF | -0.34% | 14.62 | $ | |

| BCC | -1.66% | 73.05 | $ | |

| AZN | 0.17% | 90.18 | $ | |

| CMSD | -0.3% | 23.25 | $ | |

| JRI | 0.29% | 13.79 | $ | |

| VOD | -1.31% | 12.47 | $ | |

| BCE | 1.4% | 23.55 | $ |

Snowline Closes Oversubscribed Bought Deal Financing and Concurrent Private Placement for Gross Proceeds of $102 Million

NOT FOR DISTRIBUTION TO U.S. NEWS WIRE SERVICES OR DISSEMINATION IN THE UNITED STATES.

VANCOUVER, BC / ACCESS Newswire / September 4, 2025 / SNOWLINE GOLD CORP. (TSX-V:SGD)(US OTCQB:SNWGF) (the "Company" or "Snowline") is pleased to announce that it has completed its previously announced "bought deal" public offering of 10,222,200 common shares of the Company (the "Common Shares") at a price of $9.00 per Common Share (the "Offering Price") for aggregate gross proceeds of $91,999,800, including $11,999,700 from the full exercise of the underwriters' over-allotment option (the "Offering").

The Company also completed a concurrent non-brokered private placement of 1,123,194 Common Shares at the Offering Price for additional gross proceeds of $10,108,746, pursuant to which existing shareholder B2Gold Corp. (TSX: BTO, NYSE American: BTG, NSX: B2G) subscribed to maintain its 9.9% interest in the Company (the "Private Placement"). No commission was payable in connection with the Private Placement. The Common Shares issued in connection with the Private Placement are subject to a hold period of four months and one day from the closing of the Private Placement, in accordance with applicable Canadian securities laws, expiring on January 5, 2026.

Total gross proceeds from the Offering and the Private Placement are $102,108,546.

Scott Berdahl, CEO & Director of Snowline, comments: "Our strengthened treasury is an asset in its own right, allowing us to focus for multiple years on rapid and responsible advancement of our Valley deposit alongside continued exploration across our emerging, district-scale portfolio. We are entering an exciting phase as a company as we advance a globally relevant gold discovery in a top tier jurisdiction amidst a strong market backdrop."

The Company will use the net proceeds from the Offering and the Private Placement to advance the Company's projects in the Yukon Territory, as well as for working capital and general corporate purposes.

The Offering was led by Canaccord Genuity Corp. and BMO Capital Markets, as joint bookrunners, on behalf of a syndicate of underwriters, including Cormark Securities Inc., Agentis Capital Markets, National Bank Financial Inc., CIBC World Markets Inc. and Scotia Capital Inc. (collectively, the "Underwriters"). The Underwriters received a cash commission equal to 4.5% of the gross proceeds of the Offering, other than on gross proceeds from certain subscribers on a president's list of purchasers identified by the Company, for which the Underwriters received a cash commission equal to 2.25%.

The Offering was completed by way of a short form prospectus filed in British Columbia, Alberta, Ontario and New Brunswick, and Common Shares were also sold by way of private placement in the United States pursuant to an exemption from the registration requirements of the United States Securities Act of 1933, as amended (the "U.S. Securities Act").

The securities referred to in this news release have not been, nor will they be, registered under the U.S. Securities Act, and may not be offered or sold within the United States absent U.S. registration or an applicable exemption from the U.S. registration requirements. This news release does not constitute an offer for sale of securities, nor a solicitation for offers to buy any securities in the United States, nor in any other jurisdiction in which such offer, solicitation or sale would be unlawful.

ABOUT SNOWLINE GOLD CORP.

Snowline Gold Corp. is a Yukon Territory-focused gold exploration and development company with a mineral claim portfolio covering roughly 360,000 ha (3,600 km2). The Company is advancing its Valley gold deposit-a large, low-strip, near surface, >1 g/t Au bulk tonnage gold system located in the eastern Yukon-while continuing regional exploration of surrounding targets on the Rogue Project and the broader district in the highly prospective yet underexplored Selwyn Basin.

Valley hosts an open mineral resource estimate ("MRE") of 7.94 million ounces gold at 1.21 g/t Au in the Measured and Indicated categories (3.15 million ounces gold at 1.41 g/t Au Measured mineral resources and 4.79 million ounces gold at 1.11 g/t Au Indicated mineral resources) and an additional 0.89 million ounces gold at 0.62 g/t Au in the Inferred category1. Results of a preliminary economic assessment ("PEA") of Valley suggest the potential for the deposit to support a long-life mining operation with a strong production profile and low production costs. The MRE and PEA are supported by the recent technical report for Rogue, prepared in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") standards, entitled "Independent Preliminary Economic Assessment for the Rogue Project Yukon, Canada," dated August 27, 2025, with an effective date of March 1, 2025 and available on SEDAR+ and the Company's website.

Snowline's project portfolio sits within the prolific Tintina Gold Province, host to multiple million-ounce-plus gold mines and deposits across the central Yukon and Alaska. The Company's comprehensive first-mover position and extensive exploration database provide a distinct competitive advantage and a unique opportunity for investors to be part of multiple discoveries, the advancement of a significant gold deposit, and the creation of a new gold district.

1Mineral resources are not mineral reserves and do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by metal prices, economic factors, environmental, permitting, legal, title, or other relevant issues.

QUALIFIED PERSON

Information in this news release has been prepared under supervision of and approved by Thomas Branson, M.Sc., P. Geo., VP Exploration for Snowline, as Qualified Person for the purposes of NI 43-101.

ON BEHALF OF THE BOARD

Scott Berdahl

CEO & Director

For further information, please contact:

Snowline Gold Corp.

+1 778 650 5485

[email protected]

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements, including statements regarding the expected use of proceeds from the Offering and the Private Placement, the mineral resource estimates, advancement of the Valley deposit, continued exploration and the creation of a new gold district. Wherever possible, words such as "may", "will", "should", "could", "expect", "plan", "intend", "anticipate", "believe", "estimate", "predict" or "potential" or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. These statements reflect management's current beliefs and are based on information currently available to management as at the date hereof.

Forward-looking statements involve significant risk, uncertainties and assumptions. Many factors could cause actual results, performance or achievements to differ materially from the results discussed or implied in the forward-looking statements. Such factors include, among other things: risks related to uncertainties inherent in drill results and the estimation of mineral resources; and risks associated with executing the Company's plans and intentions. These factors should be considered carefully, and readers should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this news release are based upon what management believes to be reasonable assumptions, the Company cannot assure readers that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release, and the Company assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law.

SOURCE: Snowline Gold Corp.

View the original press release on ACCESS Newswire

L.Adams--AT