-

Nigerian government frees 130 kidnapped Catholic schoolchildren

Nigerian government frees 130 kidnapped Catholic schoolchildren

-

Captain Kane helps undermanned Bayern go nine clear in Bundesliga

-

Trump administration denies cover-up over redacted Epstein files

Trump administration denies cover-up over redacted Epstein files

-

Captain Kane helps undermanned Bayern go nine clear

-

Rogers stars as Villa beat Man Utd to boost title bid

Rogers stars as Villa beat Man Utd to boost title bid

-

Barca strengthen Liga lead at Villarreal, Atletico go third

-

Third 'Avatar' film soars to top in N. American box office debut

Third 'Avatar' film soars to top in N. American box office debut

-

Third day of Ukraine settlement talks to begin in Miami

-

Barcelona's Raphinha, Yamal strike in Villarreal win

Barcelona's Raphinha, Yamal strike in Villarreal win

-

Macron, on UAE visit, announces new French aircraft carrier

-

Barca's Raphinha, Yamal strike in Villarreal win

Barca's Raphinha, Yamal strike in Villarreal win

-

Gunmen kill 9, wound 10 in South Africa bar attack

-

Allegations of new cover-up over Epstein files

Allegations of new cover-up over Epstein files

-

Atletico go third with comfortable win at Girona

-

Schwarz breaks World Cup duck with Alta Badia giant slalom victory

Schwarz breaks World Cup duck with Alta Badia giant slalom victory

-

Salah unaffected by Liverpool turmoil ahead of AFCON opener - Egypt coach

-

Goggia eases her pain with World Cup super-G win as Vonn takes third

Goggia eases her pain with World Cup super-G win as Vonn takes third

-

Goggia wins World Cup super-G as Vonn takes third

-

Cambodia says Thai border clashes displace over half a million

Cambodia says Thai border clashes displace over half a million

-

Kremlin denies three-way US-Ukraine-Russia talks in preparation

-

Williamson says 'series by series' call on New Zealand Test future

Williamson says 'series by series' call on New Zealand Test future

-

Taiwan police rule out 'terrorism' in metro stabbing

-

Australia falls silent, lights candles for Bondi Beach shooting victims

Australia falls silent, lights candles for Bondi Beach shooting victims

-

DR Congo's amputees bear scars of years of conflict

-

Venison butts beef off menus at UK venues

Venison butts beef off menus at UK venues

-

Cummins, Lyon doubts for Melbourne after 'hugely satsfying' Ashes

-

West Indies 43-0, need 419 more to win after Conway joins elite

West Indies 43-0, need 419 more to win after Conway joins elite

-

'It sucks': Stokes vows England will bounce back after losing Ashes

-

Australia probes security services after Bondi Beach attack

Australia probes security services after Bondi Beach attack

-

West Indies need 462 to win after Conway's historic century

-

Thai border clashes displace over half a million in Cambodia

Thai border clashes displace over half a million in Cambodia

-

Australia beat England by 82 runs to win third Test and retain Ashes

-

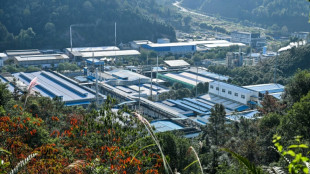

China's rare earths El Dorado gives strategic edge

China's rare earths El Dorado gives strategic edge

-

Japan footballer 'King Kazu' to play on at the age of 58

-

New Zealand's Conway joins elite club with century, double ton in same Test

New Zealand's Conway joins elite club with century, double ton in same Test

-

Australian PM orders police, intelligence review after Bondi attack

-

Durant shines as Rockets avenge Nuggets loss

Durant shines as Rockets avenge Nuggets loss

-

Pressure on Morocco to deliver as Africa Cup of Nations kicks off

-

Australia remove Smith as England still need 126 to keep Ashes alive

Australia remove Smith as England still need 126 to keep Ashes alive

-

Myanmar mystics divine future after ill-augured election

-

From the Andes to Darfur: Colombians lured to Sudan's killing fields

From the Andes to Darfur: Colombians lured to Sudan's killing fields

-

Eagles win division as Commanders clash descends into brawl

-

US again seizes oil tanker off coast of Venezuela

US again seizes oil tanker off coast of Venezuela

-

New Zealand 35-0, lead by 190, after racing through West Indies tail

-

How Can Gum Disease Lead to Tooth Loss in Kyle, TX?

How Can Gum Disease Lead to Tooth Loss in Kyle, TX?

-

West Indies 420 all out to trail New Zealand by 155

-

Arteta tells leaders Arsenal to 'learn' while winning

Arteta tells leaders Arsenal to 'learn' while winning

-

Honour to match idol Ronaldo's Real Madrid calendar year goal record: Mbappe

-

Dupont helps Toulouse bounce back in Top 14 after turbulent week

Dupont helps Toulouse bounce back in Top 14 after turbulent week

-

Mbappe matches Ronaldo record as Real Madrid beat Sevilla

Welcome to Green Rain Energy’s Investor Relations Hub

Empowering the Clean Energy Transition—One Project at a Time

BEVERLY HILLS, CA / ACCESS Newswire / June 27, 2025 / At Green Rain Energy Holdings Inc. (OTC PINK:NWPND), we're not just riding the clean energy wave-we're building the infrastructure that powers it. As a next-generation Energy Services Company (ESCO), our focus spans EV charging infrastructure, community solar development, and grid-integrated renewable solutions in markets primed for long-term growth and regulatory support.

This page is designed to give current and prospective investors access to key company information, industry trends, and insights into why GREH is positioned for outsized returns in the decade of the energy transition.

Why Invest in Green Rain Energy?

1. A Multi-Trillion Dollar Market Opportunity

The global clean energy infrastructure market is projected to surpass $1 trillion annually by 2030 (IEA).

U.S. federal legislation, including the Inflation Reduction Act, earmarks $369 billion for climate and energy funding-creating a once-in-a-generation investment tailwind.

EV adoption is projected to reach over 30 million vehicles in the U.S. by 2030 (McKinsey), fueling explosive demand for fast-charging infrastructure.

2. Two Engines of Recurring Revenue

EV Fast Charging: DCFC (Level 3) stations deployed in strategic corridors across California, Texas, Arizona, and New York create real asset ownership and ongoing revenue from charging fees.

Community Solar: GREH is developing solar projects in top incentive markets like New York, Hawaii, and Massachusetts-generating long-term power purchase agreement (PPA) revenue backed by utilities and state programs.

3. A Vertically Integrated ESCO Model

Unlike pure developers, we control the full value chain-from development and engineering to construction and financing-creating higher margins, lower execution risk, and compounding cash flow opportunities.

Industry Comparables: A Look at Our Competitive Landscape

While GREH is still in its growth phase, our business model shares DNA with several high-growth clean energy leaders:

Company | Market Cap | Focus Area | Notes |

Beam Global (BEEM) | ~$200M | Solar-powered EV infrastructure | Trades at high revenue multiples despite early-stage revenues |

ChargePoint (CHPT) | ~$1B | EV charging network | Focused on hardware/software subscriptions; GREH focuses on asset ownership |

Altus Power (AMPS) | ~$800M | Community solar and storage | Similar PPA model, now trading at ~6x forward revenue |

Sunrun (RUN) | ~$2.5B | Residential & community solar | Institutional interest in recurring clean energy revenues |

GREH represents an early-stage, undervalued entry point into this market-with vertical integration, public listing (OTC: GREH), and high-potential assets under development.

Our Current Strategy: Growth with Discipline

Pipeline Focus: 2025-2026 installations in NY, CA, HI, and TX under NEVI and state-funded programs

Revenue Model: Long-term ownership of assets → Recurring revenue → Scalable margins

Partnership-Driven Execution: Licensed EPC contractors, utilities, and local agencies ensure fast, compliant deployment

Funding Strategy: Targeting non-dilutive project finance & ESG-aligned institutional capital

The Green Rain Difference

✔ Policy-Aligned: Every GREH project aligns with federal and state decarbonization goals

✔ Scalable: Modular deployments allow us to grow regionally with predictable capex

✔ Data-Driven: Site selection, energy production, and ROI are modeled for precision

✔ High Impact: Every asset contributes to real emissions reductions and energy equity

A Note to Shareholders and Future Investors

The energy sector is transforming-fast. As fossil fuels phase out and decentralized infrastructure becomes the norm, companies like Green Rain Energy Holdings are poised to lead the way.

We invite you to be part of this journey-not just as an investor, but as a stakeholder in a cleaner, smarter energy future.

VISIT OUR WEBSITE:

Follow us on X: https://x.com/greenrainenergy?s=21&t=4aBBZJDCiSDq8-AhB3YIfA

Contact information:

Alfredo Papadakis

[email protected]

(310) 228-8897

SOURCE: Green Rain Energy Holdings Inc.

View the original press release on ACCESS Newswire

M.King--AT