-

Williamson says 'series by series' call on New Zealand Test future

Williamson says 'series by series' call on New Zealand Test future

-

Taiwan police rule out 'terrorism' in metro stabbing

-

Australia falls silent, lights candles for Bondi Beach shooting victims

Australia falls silent, lights candles for Bondi Beach shooting victims

-

DR Congo's amputees bear scars of years of conflict

-

Venison butts beef off menus at UK venues

Venison butts beef off menus at UK venues

-

Cummins, Lyon doubts for Melbourne after 'hugely satsfying' Ashes

-

West Indies 43-0, need 419 more to win after Conway joins elite

West Indies 43-0, need 419 more to win after Conway joins elite

-

'It sucks': Stokes vows England will bounce back after losing Ashes

-

Australia probes security services after Bondi Beach attack

Australia probes security services after Bondi Beach attack

-

West Indies need 462 to win after Conway's historic century

-

Thai border clashes displace over half a million in Cambodia

Thai border clashes displace over half a million in Cambodia

-

Australia beat England by 82 runs to win third Test and retain Ashes

-

China's rare earths El Dorado gives strategic edge

China's rare earths El Dorado gives strategic edge

-

Japan footballer 'King Kazu' to play on at the age of 58

-

New Zealand's Conway joins elite club with century, double ton in same Test

New Zealand's Conway joins elite club with century, double ton in same Test

-

Australian PM orders police, intelligence review after Bondi attack

-

Durant shines as Rockets avenge Nuggets loss

Durant shines as Rockets avenge Nuggets loss

-

Pressure on Morocco to deliver as Africa Cup of Nations kicks off

-

Australia remove Smith as England still need 126 to keep Ashes alive

Australia remove Smith as England still need 126 to keep Ashes alive

-

Myanmar mystics divine future after ill-augured election

-

From the Andes to Darfur: Colombians lured to Sudan's killing fields

From the Andes to Darfur: Colombians lured to Sudan's killing fields

-

Eagles win division as Commanders clash descends into brawl

-

US again seizes oil tanker off coast of Venezuela

US again seizes oil tanker off coast of Venezuela

-

New Zealand 35-0, lead by 190, after racing through West Indies tail

-

West Indies 420 all out to trail New Zealand by 155

West Indies 420 all out to trail New Zealand by 155

-

Arteta tells leaders Arsenal to 'learn' while winning

-

Honour to match idol Ronaldo's Real Madrid calendar year goal record: Mbappe

Honour to match idol Ronaldo's Real Madrid calendar year goal record: Mbappe

-

Dupont helps Toulouse bounce back in Top 14 after turbulent week

-

Mbappe matches Ronaldo record as Real Madrid beat Sevilla

Mbappe matches Ronaldo record as Real Madrid beat Sevilla

-

Gyokeres ends drought to gift Arsenal top spot for Christmas

-

Arsenal stay top despite Man City win, Liverpool beat nine-man Spurs

Arsenal stay top despite Man City win, Liverpool beat nine-man Spurs

-

US intercepts oil tanker off coast of Venezuela

-

PSG cruise past fifth-tier Fontenay in French Cup

PSG cruise past fifth-tier Fontenay in French Cup

-

Isak injury leaves Slot counting cost of Liverpool win at Spurs

-

Juve beat Roma to close in on Serie A leaders Inter

Juve beat Roma to close in on Serie A leaders Inter

-

US intercepts oil tanker off coast of Venezuela: US media

-

Zelensky says US must pile pressure on Russia to end war

Zelensky says US must pile pressure on Russia to end war

-

Haaland sends Man City top, Liverpool beat nine-man Spurs

-

Epstein victims, lawmakers criticize partial release and redactions

Epstein victims, lawmakers criticize partial release and redactions

-

Leverkusen beat Leipzig to move third in Bundesliga

-

Lakers guard Smart fined $35,000 for swearing at refs

Lakers guard Smart fined $35,000 for swearing at refs

-

Liverpool sink nine-man Spurs but Isak limps off after rare goal

-

Guardiola urges Man City to 'improve' after dispatching West Ham

Guardiola urges Man City to 'improve' after dispatching West Ham

-

Syria monitor says US strikes killed at least five IS members

-

Australia stops in silence for Bondi Beach shooting victims

Australia stops in silence for Bondi Beach shooting victims

-

Olympic champion Joseph helps Perpignan to first Top 14 win despite red card

-

Zelensky says US mooted direct Ukraine-Russia talks on ending war

Zelensky says US mooted direct Ukraine-Russia talks on ending war

-

Wheelchair user flies into space, a first

-

Brazil's Lula, Argentina's Milei clash over Venezuela at Mercosur summit

Brazil's Lula, Argentina's Milei clash over Venezuela at Mercosur summit

-

Haaland sends Man City top, Chelsea fightback frustrates Newcastle

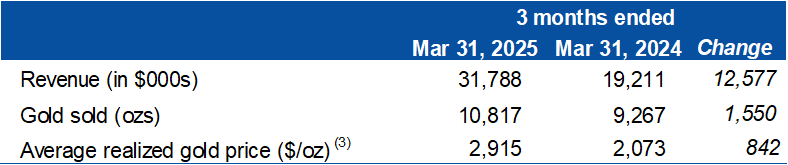

Mako Mining Reports First Quarter 2025 Financial Results, Including Record Mine Operating Cash Flow of US$19.9 million, Adjusted EBITDA of US$16.1 million and EPS of US$0.12/share from 10,817 oz Gold Sold at US$2,915/oz

VANCOUVER, BC / ACCESS Newswire / June 2, 2025 / Mako Mining Corp. (TSX-V:MKO)(OTCQX:MAKOF) ("Mako" or the "Company") is pleased to provide financial results for the three months ended March 31st, 2025 ("Q1 2025"). All dollar amounts referred to herein are expressed in United States dollars unless otherwise stated.

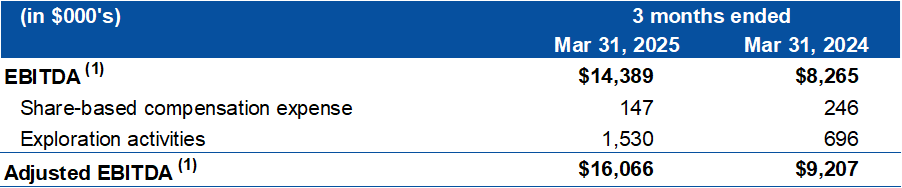

The Company's financial results for Q1 2025 reflect record gold sales from its San Albino and Moss Mine of $31.8 million (vs. $19.2 million in Q1 2024), which generated $19.9 million in Mine Operating Cash Flow (1) (4), $16.1 million in Adjusted EBITDA(1), and $9.4 million in Net Income. The Company sold 10,817 oz of gold at an average price of $2,915/oz with a $1,239 Cash Cost and $1,411 All-In Sustaining Cost ("AISC") ($/oz sold). (1) (2)

On March 27th, 2025, Mako completed the acquisition of EGA (the "Moss Acquisition"), which owned the Moss gold mine in Arizona, and these financial results reflect the consolidation of the Moss Acquisition into Mako's Q1 2025 Financial Statements and MD&A. Finished products in the amount of 936 oz of gold and 8,562 oz of silver were acquired at the time of acquisition, held on the balance sheet at market value of $3.2 million and sold immediately thereafter with a Cost of Goods Sold also amounting to $3.2 million. This had the effect of increasing our reported Cash Cost and AISC by $202/oz and $186/oz. Without the effect of the Moss Acquisition, the Company's Cash Cost and AISC would be $1,037/oz and $1,225/oz, respectively.

Q1 2025 Mako Mining Highlights

Financial

$31.8 million in Revenue

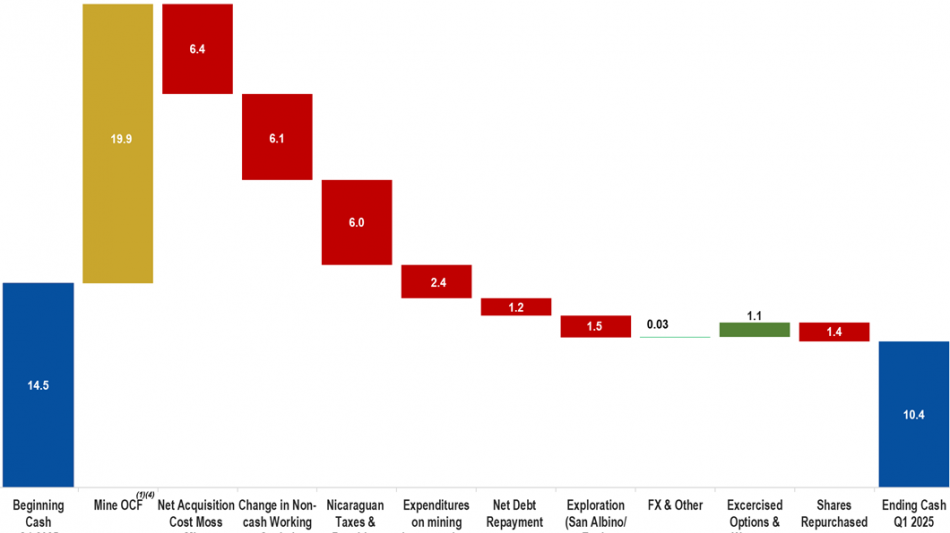

$19.9 million in Mine Operating Cash Flow ("MineOCF") (1) (4)

$16.1 million in Adjusted EBITDA (1)

$9.4 million Net Income

$1,239 Cash Costs ($/oz sold) (1) (2)

$1,411 All-In Sustaining Costs ("AISC") ($/oz sold) (1) (2)

Twelve Trailing Months ("TTM") Return on Equity ("ROE") (1) of 47.5% and Return on Assets ("ROA") of 30.9% (1)

Delivered 40,500 oz of silver in Q1 2025 to the Sailfish Silver Loan. The final 13,500 oz installment was delivered in April 2025

$4.0 million payment of Income Tax Payable previously accrued in Fiscal Year 2024

The Company purchased 0.5 million common shares under the normal course issuer bid ("NCIB") for $1.4 million (C$2.0 million) in Q1 2025

On March 27th, 2025, the Company completed the Moss Acquisition

Growth

$1.5 million in exploration and evaluation expenses ($0.5 million in areas surrounding San Albino in Nicaragua and approximately $1.0 million at Eagle Mountain, Guyana)

Subsequent to March 31, 2025

Delivered the final installment of 13,500 oz of silver on the Sailfish Silver Loan

On April 28th, 2025, Sailfish exercised its option to purchase all refined silver produced from the Company's San Albino operations for an additional payment of $1.0 million

The Company granted 740,000 stock options with a C$4.47 exercise price, 502,785 RSUs and 145,000 DSUs to its executive officers, directors and certain other employees and consultants

Q2 2025 (through May 31st) - Mako Mining Financial Highlights

$25.1 million in Revenue from 7,409 oz of gold at $3,327/oz and 13,529 oz of silver at $33.03/oz

$22.0 million in Cash and Receivables and $3.3 million in Restricted Cash (50% will become unrestricted in June 2025)

Akiba Leisman, Chief Executive Officer, states that "Q1 was a transformative quarter for Mako. We acquired our second operating mine at Moss, which produces gold and silver through its residual leach operations. The acquisition was financed using a small fraction of this quarter's Mine Operating Cash Flow from San Albino. A new mining contractor for Moss was selected and will be mobilized to restart mining operations later this month. The San Albino mine continues to perform well, which helped Mako generate record Mine Operating Cash flow of US$19.9 million and US$9.4 million (US$0.12/share) of Net Income, while generating industry leading ROA and ROE of 30.9% and 47.5%, respectively. At the end of May, the Company's cash and receivable balance was US$22.0 million, with an additional US$3.3 million in restricted cash, 50% of which will be released imminently. Mako's rapidly growing cash position will be used for the development of the Eagle Mountain in Guyana, which we expect to be permitted for construction by Q2 2026".

Table 1 - Revenue

Table 2 - Operating and Financial Data

Table 3 - EBITDA Reconciliation

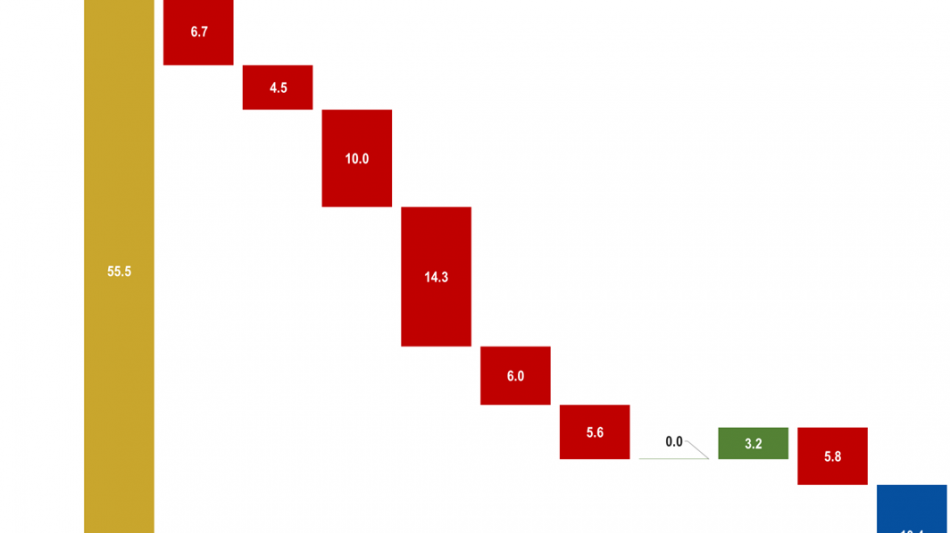

Chart 1

Q1 2025 - Mine OCF Calculation and Cash Reconciliation (in $ million)

Chart 2

2025 - Mine OCF Calculation and Cash Reconciliation (in $ million)

End Notes

Refers to a Non-GAAP financial measure within the meaning of National Instrument 52-112 - Non-GAAP and Other Financial Measures Disclosure ("NI 52-112"). Refer to information under the heading "Non-GAAP Measures" as well as the reconciliations later in this press release.

Refers to a Non-GAAP ratio within the meaning of NI-52-112. Refer to information under the heading "Non-GAAP Measures" later in this press release.

Realized price before deductions from Sailfish gold streaming agreement.

Refer to "Chart 1 & 2 - Mine OCF Calculation and Cash Reconciliation (in $ millions)" for a reconciliation of the beginning and ending cash position of the Company, including OCF.

Includes Repayment Silver Loan, Wexford Loan, Wexford Bridge Loan related to Goldsource Acquisition, Payment to GR Silver and other lease payments

For complete details, please refer to condensed interim consolidated financial statements and the associated management discussion and analysis for the three months ended March 31st, 2025, available on SEDAR+ (www.sedarplus.ca) or on the Company's website (www.makominingcorp.com).

Non-GAAP Measures

The Company has included certain non-GAAP financial measures and non-GAAP ratios in this press release such as EBITDA, Adjusted EBITDA, Mine Operating Cash Flow cash cost per ounce sold, total cash cost per ounce sold, AISC per ounce sold. These non-GAAP measures are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. In the gold mining industry, these are commonly used performance measures and ratios, but do not have any standardized meaning prescribed under IFRS and therefore may not be comparable to other issuers. The Company believes that, in addition to conventional measures prepared in accordance with IFRS, certain investors use this information to evaluate the Company's underlying performance of its core operations and its ability to generate cash flow.

"EBITDA" represents earnings before interest (including non-cash accretion of financial obligation and lease obligations), income taxes and depreciation, depletion and amortization.

"Adjusted EBITDA" represents EBITDA, adjusted to exclude exploration activities, share-based compensation and change in provision for reclamation and rehabilitation.

"Cash costs per ounce sold" is calculated by deducting revenues from silver sales and dividing the sum of mining, milling and mine site administration cost.

"Total cash costs per ounce sold" is calculated by deducting revenues from silver sales from production cash costs and production taxes and royalties and dividing the sum by the number of gold ounces sold. Production cash costs include mining, milling, mine site security and mine site administration costs.

"AISC per ounce sold" includes total cash costs (as defined above) and adds the sum of G&A, sustaining capital and certain exploration and evaluation ("E&E") costs, sustaining lease payments, provision for environmental fees, if applicable, and rehabilitation costs paid, all divided by the number of ounces sold. As this measure seeks to reflect the full cost of gold production from current operations, capital and E&E costs related to expansion or growth projects are not included in the calculation of AISC per ounce. Additionally, certain other cash expenditures, including income and other tax payments, financing costs and debt repayments, are not included in AISC per ounce.

"Mine OCF" represents operating cash flow, excluding Nicaraguan taxes and royalties, changes in non-cash working capital and exploration expense

"ROE" is calculated by dividing the twelve trailing months Net Income by the average shareholder's equity. The average shareholder's equity is calculated by adding the total equity at the end of the period to the total equity at the beginning of the period and dividing by two.

"ROA" is calculated by dividing the twelve trailing months Net Income by the average total assets. The average total assets is calculated by adding the total assets at the end of the period to the total assets at the beginning of the period and dividing by two.

On behalf of the Board,

Akiba Leisman

Chief Executive Officer

About Mako

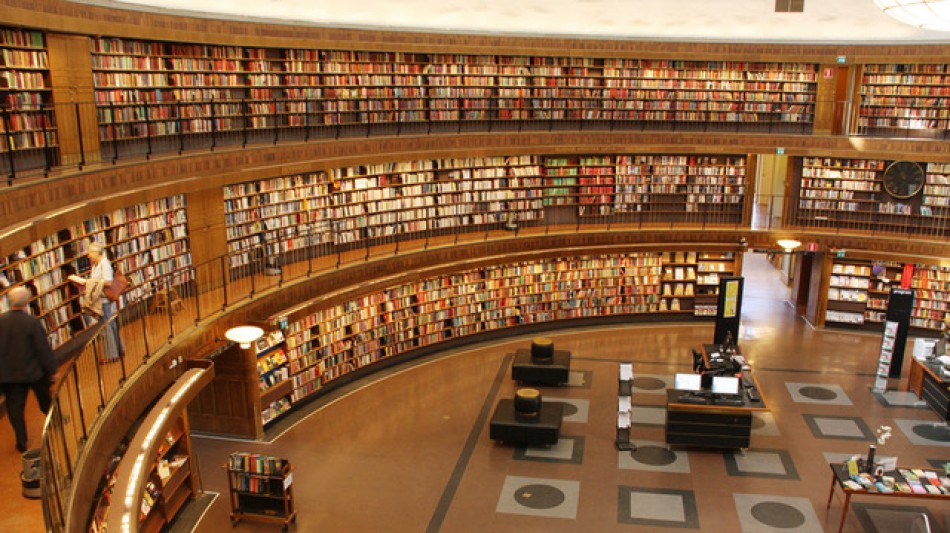

Mako Mining Corp. is a publicly listed gold mining, development and exploration company. The Company operates the high-grade San Albino gold mine in Nueva Segovia, Nicaragua, which ranks as one of the highest-grade open pit gold mines globally and offers district-scale exploration potential. Mako also owns the Moss Mine in Arizona, an open pit gold mine in northwestern Arizona. Mako also holds a 100% interest in the PEA-stage Eagle Mountain Project in Guyana, South America. Eagle Mountain is the subject of engineering, environmental and mine permitting activity.

For further information: Mako Mining Corp., Akiba Leisman, Chief Executive Officer, Telephone: 917-558-5289, E-mail: [email protected] or visit our website at www.makominingcorp.com and SEDAR www.sedar.ca.

Forward-Looking Information: Some of the statements contained herein may be considered "forward-looking information" within the meaning of applicable securities laws. Forward-looking information can be identified by words such as, without limitation, "estimate", "project", "believe", "anticipate", "intend", "expect", "plan", "predict", "may" or "should" or variations thereon or comparable terminology. The forward-looking information contained herein reflects the Company's current beliefs and expectations, based on management's reasonable assumptions, and includes, without limitation, management's expectation that 50% of an additional US$3.3 million in restricted cash, will be released imminently for Mako, that the Moss will select and mobilize a new mining contractor to restart mining operations later this month of June, that growing cash position will be used for the development of the Eagle Mountain in Guyana, which is expect to be permitted for construction by Q2 2026. Such forward-looking information is subject to a variety of risks and uncertainties which could cause actual events or results to differ materially from those reflected in the forward-looking information, including, without limitation, changes in the Company's exploration and development plans and growth parameters and its ability to fund its growth to reach its expected new record production numbers; unanticipated costs; the October 24 measures having impacts on business operations not current expected, or new sanctions being imposed by the U.S. Treasury Department or other government entity in Nicaragua in the future; and other risks and uncertainties as disclosed in the Company's public disclosure filings on SEDAR+ at www.sedarplus.ca. Such information contained herein represents management's best judgment as of the date hereof, based on information currently available and is included for the purposes of providing investors with information regarding the Company's Q1 2025 and full year 2024 financial results and may not be appropriate for other purposes. Mako does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

View the original press release on ACCESS Newswire

M.White--AT