-

What next for Belarus after US deal on prisoners, sanctions?

What next for Belarus after US deal on prisoners, sanctions?

-

Brazil Senate debates bill that could slash Bolsonaro jail term

-

Coe shares 'frustration' over marathon record despite Kenyan's doping ban

Coe shares 'frustration' over marathon record despite Kenyan's doping ban

-

Stolen Bruce Lee statue 'returns' to Bosnia town

-

Veteran Suarez signs new Inter Miami contract

Veteran Suarez signs new Inter Miami contract

-

Warner Bros rejects Paramount bid, sticks with Netflix

-

Crude prices surge after Trump orders Venezuela oil blockade

Crude prices surge after Trump orders Venezuela oil blockade

-

Balkan nations offer lessons on handling cow virus sowing turmoil

-

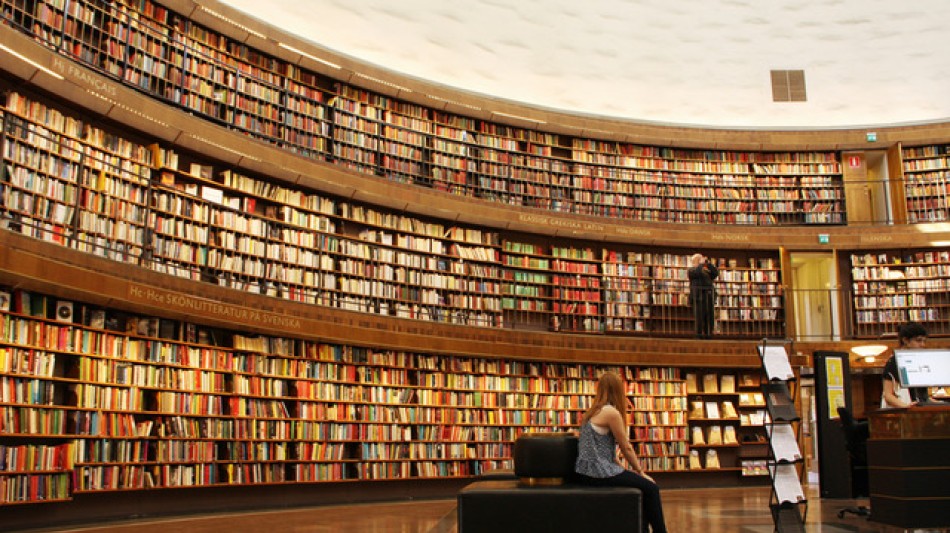

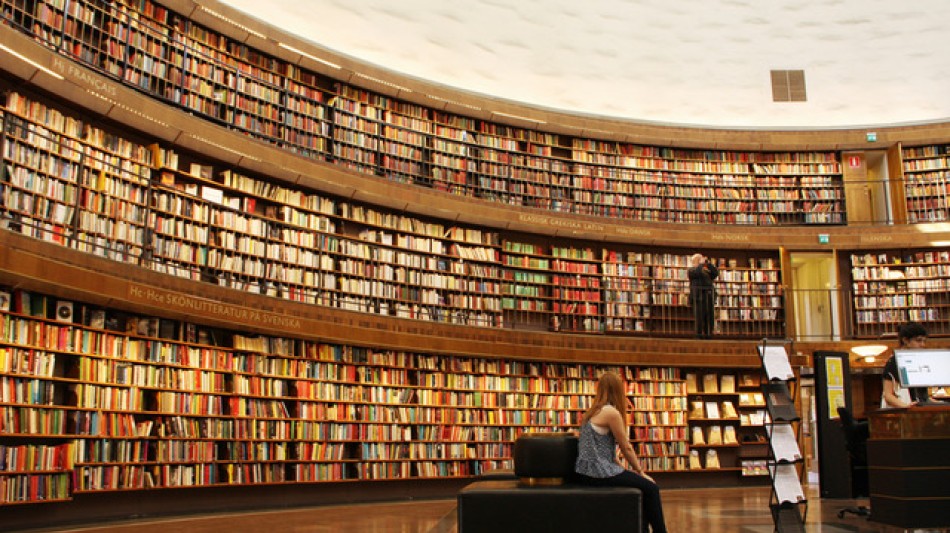

French readers lap up Sarkozy's prison diaries

French readers lap up Sarkozy's prison diaries

-

UK PM warns Abramovich 'clock is ticking' over Chelsea sale fund

-

Warner Bros. Discovery rejects Paramount bid

Warner Bros. Discovery rejects Paramount bid

-

Winners of 2026 World Cup to pocket $50 million in prize money

-

World no. 1 Alcaraz ends 'incredible ride' with coach Ferrero

World no. 1 Alcaraz ends 'incredible ride' with coach Ferrero

-

World number one Alcaraz announces 'difficult' split with coach Ferrero

-

Iran boxer sentenced to death at 'imminent' risk of execution: rights groups

Iran boxer sentenced to death at 'imminent' risk of execution: rights groups

-

Snicko operator admits error that led to Carey's Ashes reprieve

-

Finland PM apologises to Asian countries over MPs' mocking posts

Finland PM apologises to Asian countries over MPs' mocking posts

-

Doctors in England go on strike for 14th time

-

Romania journalists back media outlet that sparked graft protests

Romania journalists back media outlet that sparked graft protests

-

Rob Reiner's son awaiting court appearance on murder charges

-

Ghana's Highlife finds its rhythm on UNESCO world stage

Ghana's Highlife finds its rhythm on UNESCO world stage

-

Stocks gain as traders bet on interest rate moves

-

France probes 'foreign interference' after malware found on ferry

France probes 'foreign interference' after malware found on ferry

-

Europe's Ariane 6 rocket puts EU navigation satellites in orbit

-

Bleak end to the year as German business morale drops

Bleak end to the year as German business morale drops

-

Hundreds queue at Louvre museum as strike vote delays opening

-

Bondi shooting shocks, angers Australia's Jewish community

Bondi shooting shocks, angers Australia's Jewish community

-

Markets rise even as US jobs data fail to boost rate cut bets

-

Senegal talisman Mane overcame grief to become an African icon

Senegal talisman Mane overcame grief to become an African icon

-

Carey pays tribute to late father after home Ashes century

-

'Many lessons to be learned' from Winter Games preparations, says ski chief

'Many lessons to be learned' from Winter Games preparations, says ski chief

-

Emotional Carey slams ton to give Australia upper hand in 3rd Ashes Test

-

Asian markets mixed as US jobs data fails to boost rate cut hopes

Asian markets mixed as US jobs data fails to boost rate cut hopes

-

Carey slams ton as Australia seize upper hand in third Ashes Test

-

Bondi shooting shocks, angers Australia Jewish community

Bondi shooting shocks, angers Australia Jewish community

-

Myanmar junta seeks to prosecute hundreds for election 'disruption'

-

West Indies hope Christmas comes early in must-win New Zealand Test

West Indies hope Christmas comes early in must-win New Zealand Test

-

Knicks beat Spurs in NBA Cup final to end 52-year trophy drought

-

Khawaja revels in late lifeline as Australia 194-5 in 3rd Ashes Test

Khawaja revels in late lifeline as Australia 194-5 in 3rd Ashes Test

-

Grief and fear as Sydney's Jewish community mourns 'Bondi rabbi'

-

Trump orders blockade of 'sanctioned' Venezuela oil tankers

Trump orders blockade of 'sanctioned' Venezuela oil tankers

-

Brazil Senate to debate bill to slash Bolsonaro jail term

-

New Zealand ex-top cop avoids jail time for child abuse, bestiality offences

New Zealand ex-top cop avoids jail time for child abuse, bestiality offences

-

Eurovision facing fractious 2026 as unity unravels

-

'Extremely exciting': the ice cores that could help save glaciers

'Extremely exciting': the ice cores that could help save glaciers

-

Asian markets drift as US jobs data fails to boost rate cut hopes

-

What we know about Trump's $10 billion BBC lawsuit

What we know about Trump's $10 billion BBC lawsuit

-

Ukraine's lost generation caught in 'eternal lockdown'

-

'Catastrophic mismatch': Safety fears as Jake Paul faces Anthony Joshua

'Catastrophic mismatch': Safety fears as Jake Paul faces Anthony Joshua

-

Australia's Steve Smith ruled out of third Ashes Test

Three Kentucky Citizens and America's Top Precious Metals Retailer Sue Gov. Andy Beshear for Illegal Sales Tax Seizures

FRANKFORT, KY / ACCESS Newswire / March 27, 2025 / Three Kentucky taxpayers and one of America's largest precious metals dealers today filed a class-action lawsuit against Governor Andrew Beshear, the Commonwealth of Kentucky, and the Kentucky Department of Revenue for their illegal sales tax collections in connection with retail purchases of physical gold and silver.

Money Metals Exchange, Jill Stahl Huston, Stacie Earl, and Karen Strayer filed the state court complaint in the Boone Circuit Court on behalf of themselves and all similarly situated Kentucky taxpayers and precious metals dealers across America.

The class-action suit comes immediately on the heels of overwhelming votes by both the Kentucky House and Senate to override Gov. Beshear's veto this week of House Bill 2, a measure which expanded last year's new sales tax exemption for precious metals purchases.

HB 2, which became law today, provides a right for full recovery of unlawfully collected taxes (plus interest), stiff penalties on state officials (acting in their official capacities and potentially, their personal capacities), and attorney's fees for the Department of Revenue's flagrant violation of a sales tax exemption that had taken effect on August 1, 2024.

Rep. TJ Roberts (R-66) and Rep. Steve Doan (R-69) introduced HB 2 in January, and the bill was championed by the Sound Money Defense League and Money Metals Exchange who had backed efforts since 2020 to end Kentucky's taxation of gold and silver purchases,.

In 2024, the Kentucky legislature passed House Bill 8 to remove the state's 6% sales tax on purchases of gold and silver coins, bars, and rounds. Gov. Beshear had attempted to exercise a line-item veto that the Constitution of the Commonwealth of Kentucky had only created for appropriations bills.

Rather than override the veto of HB 8 last year, however, the legislature deemed the veto invalid and the Revisor of Statutes codified the sales tax exemption in accordance with the state Attorney General Russell Coleman's legal opinion.

Governor Beshear and his Department of Revenue nevertheless insisted that all Kentucky citizens must pay, and all businesses that sell gold and silver must continue to collect and remit, such taxes or face prosecution.

"Governor Beshear's brazen and illegal actions have put online precious metals dealers like my company in an untenable position, but we refuse to be the bagman in his illegal money grab," said Stefan Gleason, CEO of Idaho-based Money Metals Exchange, a U.S. focused dealer and depository recently named "Best Overall" online precious metals by Investopedia.

"We are proud to stand with our three brave co-plaintiffs to take on this scofflaw governor to protect the rights of tens of thousands of Kentucky savers and investors," continued Gleason.

"Gold and silver are money, and folks should not be taxed for saving gold and silver to protect themselves from inflation and currency debasement. Almost every other state in our nation agrees and has already removed sales taxes from constitutional money."

In addition to recovery of back taxes, interest, and attorney's fees, the class-action suit seeks temporary and permanent injunctive relief preventing further collection of sales taxes on gold and silver and any enforcement actions taken by the Beshear administration against citizens of Kentucky or precious metals dealers like Money Metals.

CONTACT:

[email protected]

www.moneymetals.com

SOURCE: Money Metals Exchange

View the original press release on ACCESS Newswire

P.A.Mendoza--AT