-

Swiss send dozens injured in bar fire abroad for treatment

Swiss send dozens injured in bar fire abroad for treatment

-

Stokes urges England to stick with McCullum despite Ashes defeat

-

Yemen separatists announce two-year independence transition in shock move

Yemen separatists announce two-year independence transition in shock move

-

USA Olympic squad of NHL stars heavy on Four Nations talent

-

Milei eases tax evasion rules to draw out 'mattress dollars'

Milei eases tax evasion rules to draw out 'mattress dollars'

-

France hooker Mauvaka returns after eight-month layoff

-

Nigeria police charge fatal Joshua crash driver with dangerous driving

Nigeria police charge fatal Joshua crash driver with dangerous driving

-

Russia scores highest Ukraine gains since first year of war

-

Guardiola reaffirms City contract as Maresca speculation builds

Guardiola reaffirms City contract as Maresca speculation builds

-

Iran's protests: What we know

-

2025 was UK's hottest and sunniest year on record

2025 was UK's hottest and sunniest year on record

-

Strasbourg's Rosenior coy on Chelsea speculation

-

Swiss bar blaze suspicions fall on sparklers waved by staff

Swiss bar blaze suspicions fall on sparklers waved by staff

-

US woman killed in rare suspected mountain lion attack

-

Slot admits Liverpool's season has been 'constant battle'

Slot admits Liverpool's season has been 'constant battle'

-

Spurs forward Johnson completes Palace switch

-

Endrick absent from Lyon year opener but 'adapting well': coach

Endrick absent from Lyon year opener but 'adapting well': coach

-

Ukraine says 19 wounded in Russian strike on Kharkiv housing area

-

6.5-magnitude quake shakes Mexico City

6.5-magnitude quake shakes Mexico City

-

Tesla sales slip as it loses EV crown to China's BYD in 2025

-

UK sees record-high electricity from renewables in 2025: study

UK sees record-high electricity from renewables in 2025: study

-

Budanov: Enigmatic spy chief set to become Zelensky's top aide

-

Greece and Argentina make winning starts at United Cup

Greece and Argentina make winning starts at United Cup

-

Agonizing wait as Switzerland works to ID New Year's fire victims

-

Nortje gets nod for South Africa's T20 World Cup campaign

Nortje gets nod for South Africa's T20 World Cup campaign

-

Arteta urges Arsenal to break New Year Premier League curse

-

Norway closes in on objective of 100% electric car sales

Norway closes in on objective of 100% electric car sales

-

Dani Alves invests in Portuguese third division club

-

London stocks hit record as 2026 kicks off with global gains

London stocks hit record as 2026 kicks off with global gains

-

Trump says US will 'come to their rescue' if Iran kills protesters

-

Orsted files lawsuit against US suspension of wind turbine leases

Orsted files lawsuit against US suspension of wind turbine leases

-

South Koreans now free to read North's newspaper, once banned as seditious

-

Stocks make bright start to 2026

Stocks make bright start to 2026

-

Bashir, Potts in England squad for final Ashes Test

-

Argentina topple Spain for winning United Cup start

Argentina topple Spain for winning United Cup start

-

Champions Narvaez and Ruegg to defend Tour Down Under titles

-

'Are they OK?': desperate search for the missing after Swiss fire

'Are they OK?': desperate search for the missing after Swiss fire

-

'Are they OK?': desparate search for the missing after Swiss fire

-

Asia stocks make bright start to 2026

Asia stocks make bright start to 2026

-

Miami and Houston stretch NBA win streaks to four games

-

Swiss investigators rush to identify victims of New Year's fire

Swiss investigators rush to identify victims of New Year's fire

-

Bicycle kick king El Kaabi is new AFCON hero for hosts Morocco

-

What to look out for in the Premier League transfer window

What to look out for in the Premier League transfer window

-

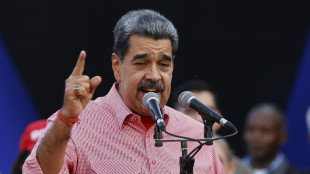

Maduro elusive on US attack, open to dialogue

-

Venus Williams gets Australian Open wildcard aged 45

Venus Williams gets Australian Open wildcard aged 45

-

Trump blames bruised hand on aspirin, denies falling asleep

-

Dress for success: Mexican president's ideological attire

Dress for success: Mexican president's ideological attire

-

Best of frenemies: Saudi, UAE rivalry bursts into view

-

'Positive signs' on hospitalised Australian cricket great Martyn

'Positive signs' on hospitalised Australian cricket great Martyn

-

North Korean leader's daughter in first visit to symbolic mausoleum

BCII Enterprises Coupon Token: Next-Generation Shareholder Engagement Model

Comprehensive Comparison Analysis: BCII vs. Other Distribution Strategies

VERO BEACH, FL / ACCESS Newswire / January 2, 2026 / BCII Enterprises Inc. (OTCID:BCII) announces comprehensive analysis of its innovative Coupon Token distribution model, demonstrating superior shareholder loyalty mechanisms, economic functionality, and revenue generation capabilities compared to recently announced utility token programs by major publicly traded companies.

EXECUTIVE SUMMARY

BCII's patent-pending Coupon Token architecture represents a breakthrough in shareholder engagement technology, combining traditional securities infrastructure with blockchain innovation to create sustainable, multi-year retention mechanisms validated by academic research in token vesting, dividend policy, and Web3 distribution strategies.

Key Advantages:

55-month recurring engagement vs. single-event distributions

5 separate distribution cycles creating vesting-like retention

Transferable secondary markets enabling liquidity and price discovery

Sustainable revenue generation through transaction fees and platform licensing

Proven regulatory framework aligned with gift card resale precedent and SEC utility token guidance

REVOLUTIONARY MULTI-PERIOD DISTRIBUTION MODEL

The BCII Advantage: Recurring Engagement Architecture

BCII's Coupon Token distributes shareholder rewards across 5 equal distributions over separate 11-month periods, creating approximately 55 months (4.5+ years) of sustained engagement between company and shareholders.

How It Works:

Shareholders receive coupon tokens in 5 equal installments

Each token expires after 11 months, with trading ceasing at 10 months

Shareholders must deliver shares to the transfer agent each period to collect coupons

Token value is capped at the product discount amount, preventing speculation

New shareholders who acquire stock receive remaining distribution periods

Research-Backed Design:

Academic studies demonstrate that multi-period releases create optimal stakeholder retention:

Token Vesting Research: 4-year vesting schedules reduce price volatility by 2.4x compared to immediate liquidity unlocks, with staggered releases "drastically reducing price uncertainty"

Dividend Policy Research: Consistent, predictable dividend distributions strengthen investor loyalty by 50%, with firms committed to "routine dividend distributions demonstrating financial resilience and long-term profitability"

Multi-Phase Airdrop Research: Optimism's 5-wave token distribution "significantly increased subsequent network usage by recipients," with research confirming that "paced, targeted airdrops bolster engagement"

Critical Retention Mechanism:

Shareholders contemplating sale at any point must weigh foregone future coupon value:

Selling after Distribution 1 = 80% of total value forfeited

Selling after Distribution 3 = 40% of total value forfeited

Rational shareholders hold through all 5 periods to maximize returns

This creates vesting-like retention without legal complexity, aligning incentives for multi-year commitment.

TRANSFERABILITY: LIQUIDITY WITH REGULATORY COMPLIANCE

Active Secondary Markets Enable Economic Efficiency

Unlike non-transferable token models, BCII's Coupon Token is freely tradeable for 10 months within each 11-month cycle, then enters a 1-month redemption-only period.

Economic Benefits:

1. Liquidity Premium: Research demonstrates that tradeable assets command 20-30% valuation premiums compared to illiquid alternatives, as investors pay more for exit optionality

2. Efficient Allocation: Secondary markets enable tokens to reach highest-value users through price discovery mechanisms, maximizing consumptive utility across diverse holder populations

3. Network Effects: Trading activity creates positive feedback loops where "increased participation drives value for all stakeholders," with each transaction validating token utility and attracting additional market participants

4. Price Discovery: Active markets provide transparent, real-time valuation signals reflecting supply/demand dynamics rather than arbitrary company-set reward values

Established Legal Precedent:

BCII's transferable coupon model directly parallels gift card resale markets operating without SEC regulation:

CardCash, Raise, Cardpool: Billions in annual secondary market transactions

First Sale Doctrine: Supreme Court's Kirtsaeng v. John Wiley & Sons (2013) establishes that lawfully purchased discount instruments can be freely resold

SEC No-Action Letters: TurnKey Jet (2019) and Pocketful of Quarters (2019) confirmed transferable utility tokens avoid securities classification when offering immediate consumptive use

Regulatory Strength Through Value Caps:

The SEC's Framework for Investment Contract Analysis emphasizes that "prospects for appreciation in the value of the digital asset are limited" weighs against security classification. BCII's structure creates mathematical limits on speculation:

Token value capped at discount amount (e.g., 2% mortgage rate discount, $24,000 housing grant)

11-month expiration enforces consumption rather than indefinite holding

Time-limited trading window enables arbitrage, not speculation

Result: Howey-compliant utility token with full economic functionality

TRANSFER AGENT INTEGRATION: INSTITUTIONAL-GRADE COMPLIANCE

Active Participation Filters Passive Holders

BCII's requirement that shareholders deliver shares to the transfer agent each distribution period creates multiple strategic advantages:

1. Commitment Filtering: Only dedicated shareholders justify administrative effort 5 separate times, self-selecting for long-term investors

2. Sustained Engagement: Research on claim-based distributions shows they create "sustained engagement loops that align user incentives with protocol growth," contrasting with passive airdrops that attract opportunists

3. Psychological Attachment: Repeated procedural participation (5 cycles over 55 months) builds deeper shareholder-company bonds than one-time automatic distributions

4. Regulatory Compliance: Transfer agents ensure proper ownership verification, accurate recordkeeping, and prevention of fraudulent claims

5. Proven Infrastructure: Leverages decades-reliable DTC/Computershare systems processing billions in distributions annually

SUSTAINABLE REVENUE MODEL VS. COST CENTER APPROACH

Multi-Stream Income Generation

BCII's transferable token architecture enables four distinct revenue streams:

1. Transaction Fees: 0.035% on all secondary market trading

Projected: $550 million to $1.65 billion annually across programs

2. Token Allocations: 10% of each program's total issuance

Example: 30 million tokens per 300 million housing program implementation

3. Platform Licensing: Infrastructure, compliance, and integration fees

Range: $50 million to $500 million per major deployment

4. SaaS Fees: Corporate client subscriptions

$150,000 annually + $350,000 implementation per client

Positive Feedback Loop: Secondary market activity increases token utility while generating platform revenue-trading benefits both holders and BCII simultaneously.

Contrast with Non-Transferable Models:

Tokens that cannot be traded generate no direct revenue:

Function solely as shareholder relations expenses

Require ongoing reward fulfillment costs

Provide no measurable ROI beyond potential platform usage increases

Represent pure cost centers on company balance sheets

COMPARATIVE ANALYSIS: BCII VS. SINGLE-DISTRIBUTION MODELS

Comprehensive Metrics Comparison

Dimension | BCII Coupon Token | One-Time Distribution Models |

Engagement Period | 55+ months (5 cycles) | Single record date |

Shareholder Touchpoints | 5 (recurring) | 1 (automatic) |

Retention Mechanism | Vesting-like forfeit structure | None post-distribution |

Transferability | Yes (10-month trading windows) | No (non-transferable) |

Secondary Markets | Active price discovery | None possible |

Liquidity | Tradeable exit options | Zero liquidity |

Value Structure | Capped at discount amount | Undefined reward value |

Expiration | 11 months per cycle | Not specified |

Active Participation | Required (TA delivery) | Automatic (passive) |

Revenue Model | Multi-stream income | Cost center |

Market Precedent | CardCash, Raise (billions traded) | Airline miles, hotel points |

Research Validation | Vesting + dividend + airdrop studies | Loyalty program models |

Network Effects | Trading creates viral growth | Closed-loop, no expansion |

Economic Functionality | High (liquid, tradeable) | Low (locked, platform-specific) |

Regulatory Risk | Low (consumptive utility + caps) | Very Low (non-transferable) |

BLOCKCHAIN INFRASTRUCTURE: BASE L2 ADVANTAGES

Institutional-Grade Technology Stack

BCII deploys on Coinbase's Base Layer-2 network, offering strategic advantages:

Technical Specifications:

Ethereum Layer-2 scaling solution built on OP Stack

EVM compatibility enabling seamless smart contract deployment

Significantly lower transaction costs than Ethereum mainnet

Institutional backing from Coinbase, the largest U.S. crypto exchange

Strategic Benefits:

Regulatory clarity through Coinbase's SEC-registered operations

Established custody and compliance infrastructure

Integration with traditional financial rails

Proven security and uptime track record

DIVERSE APPLICATION ECOSYSTEM

Solving Major Policy Challenges

BCII's Coupon Token architecture addresses critical economic issues:

1. Housing Affordability Crisis

Target: 46 million U.S. renters

Benefits: 2% permanent mortgage rate discount + $24,000 federal down payment grant

Mechanism: Discount transferable with token; grant claimable only by original holder

2. Tax Relief Implementation

Target: 175 million individual tax filers

Benefits: 10% permanent tax reduction five years post-activation

Revenue: Transaction fees from trading fund program operations

3. Corporate Digital Dividends

Target: Public companies seeking innovative shareholder rewards

Benefits: Blockchain-verified distributions, anti-naked-shorting mechanisms

Value: Companies deploy tokens as customer loyalty rewards or equity incentives

Breadth Advantage: Multi-industry applications vs. platform-specific rewards limited to proprietary ecosystems

STAKEHOLDER BENEFITS ACROSS CONSTITUENTS

Win-Win-Win Value Creation

For Shareholders:

Predictable value: 5 equal distributions on known schedule

Exit options: Tradeable tokens provide liquidity when needed

Maximum returns: Hold through all periods to capture full value

Consumptive utility: Discounts on desired products/services

For Companies:

Sustained loyalty: 55-month engagement vs. one-time touchpoint

Revenue generation: Transaction fees create sustainable income

Regulatory compliance: Proven framework aligned with SEC guidance

Competitive differentiation: Next-generation shareholder engagement

For Markets:

Efficient allocation: Secondary trading moves tokens to highest-value users

Price discovery: Market mechanisms reveal true valuation

Network effects: Growing ecosystem benefits all participants

Innovation leadership: Hybrid model combining TradFi + DeFi

ACADEMIC & INDUSTRY VALIDATION

Research-Backed Design Principles

Token Vesting Literature:

"Stakeholders' long-term commitment is the primary objective of vesting, achieved by aligning their interests with the project's success"

Dividend Policy Research:

"Consistent dividend payout strengthens investor loyalty, particularly during economic uncertainty, by signaling sound financial health and commitment to profit distribution"

Multi-Phase Airdrop Studies:

"Preventing Token Sell-Offs: Gradual releases discourage users from liquidating their entire allocation at once. Encouraging Commitment: Users are motivated to remain active to receive future allocations"

Network Effects Analysis:

"Tradable utility tokens generate positive network effects where increased participation drives value for all stakeholders, with each transaction validating utility and attracting additional market participants"

Case Study Evidence:

Uniswap (2020): Claim-based 400 UNI airdrop "rewarded early adopters and helped build community trust at scale"

Optimism (2022-2024): 5-wave distribution "significantly increased subsequent network usage by recipients"

Terra Protocol: Shifting from cliff unlocks to linear vesting "drastically reduced price uncertainty"

REGULATORY CLARITY: THREE-PILLAR COMPLIANCE FRAMEWORK

Howey Test Analysis

BCII's Coupon Token avoids securities classification through three structural features:

Pillar 1: Consumptive Use Primary Purpose

The SEC's Framework emphasizes that "economic benefit that comes solely from the use of the application is not considered 'profits' under Howey". BCII's tokens:

Provide immediate product discounts (mortgage rates, tax reductions, corporate products)

Function as digital coupons with time-limited redemption windows

Create value through consumption, not speculation on others' efforts

Pillar 2: Limited Appreciation Prospects

SEC guidance states that "prospects for appreciation in the value of the digital asset are limited" weighs against security classification. BCII's design:

Caps value at discount amount (mathematical ceiling)

11-month expiration enforces consumption pressure

Trading enables arbitrage (known price differences) not speculation (uncertain future appreciation)

Pillar 3: Established Non-Securities Precedent

Gift card resale markets process billions annually without SEC registration:

CardCash, Raise, Cardpool operate freely under first sale doctrine

Supreme Court confirmed resale rights for lawfully purchased discount instruments

BCII's model parallels this established, validated framework

Result: Time-limited, value-capped, consumption-focused utility token with transferability that enhances efficiency without triggering securities regulation

MANAGEMENT COMMENTARY

Joseph Salvani, CEO, BCII Enterprises:

"Our Coupon Token represents the convergence of 80 years of securities transfer agent infrastructure with cutting-edge blockchain technology. By requiring shareholders to actively deliver shares five times over 55 months, we've created retention mechanics that research proves drive loyalty far beyond one-time distributions.

The genius lies in simplicity: time limits prevent speculation, value caps ensure consumptive focus, and recurring distributions create vesting-like commitment-all while maintaining free transferability that respects market efficiency and shareholder choice.

We've studied what works: dividend consistency drives 50% higher retention, multi-phase airdrops significantly boost engagement, and tradeable assets command 20-30% valuation premiums. BCII's token synthesizes these proven principles into institutional-grade shareholder engagement infrastructure."

Daniel Walsh, Strategic Advisor:

"The contrast with single-distribution models is stark. When you give shareholders one token with no future value and no transferability, you've created an engagement dead-end. Our five-distribution structure over 4.5 years means shareholders at any moment must ask: 'Do I hold for future coupons worth potentially 80% of total value, or do I sell now?'

That's not lock-up-that's intelligent incentive design. Shareholders choose freely, but the choice favors long-term commitment. Combined with transfer agent delivery requirements that filter out passive holders, we've built systematic loyalty into the token's DNA."

LOOKING FORWARD: INDUSTRY IMPLICATIONS

Next-Generation Shareholder Engagement Standard

BCII's Coupon Token model offers public companies a proven framework for blockchain-based shareholder rewards that:

✓ Generate sustainable revenue (not cost centers)

✓ Create multi-year retention (not one-time events)

✓ Enable market efficiency (tradeable, liquid)

✓ Maintain regulatory clarity (utility, not security)

✓ Leverage proven infrastructure (transfer agents + blockchain)

✓ Deliver measurable ROI (transaction fees, loyalty metrics)

As traditional corporations explore Web3 integration, the choice between operational simplicity (non-transferable, one-time) and economic optimization (transferable, recurring) will define competitive advantages in shareholder relations.

BCII's model demonstrates that companies need not sacrifice functionality for compliance-intelligent design achieves both.

ABOUT BCII ENTERPRISES INC.

BCII Enterprises Inc. (OTCID: BCII) develops patent-pending tokenized coupon infrastructure for corporate clients, government programs, and public policy applications. Through its 50/50 joint venture with Digital Landia, BCII deploys coupon tokens on Coinbase's Base Layer-2 blockchain, addressing housing affordability, tax relief, and corporate shareholder engagement challenges.

The company's innovative transfer agent integration combines traditional securities compliance with blockchain transparency, creating institutional-grade token distribution systems for mainstream adoption.

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements regarding BCII's business prospects, token distribution projections, revenue estimates, and market opportunities. Actual results may differ materially due to regulatory developments, market adoption rates, technical implementation challenges, and competitive dynamics. Token distribution mechanisms remain subject to legal review, and projected transaction volumes represent estimates based on addressable market assumptions rather than committed deployments. Investors should carefully review BCII's SEC filings and consider all risk factors before making investment decisions.

CONTACT INFORMATION

BCII Enterprises Inc.

Joe Salvani

Email: [email protected]

Website: www.bciienterprises.com

RESEARCH REFERENCES

This analysis incorporates peer-reviewed academic research, SEC regulatory guidance, industry case studies, and market data from:

Token vesting and distribution strategies (TokenMinds, Chainforce, Decubate)

Corporate dividend policy research (ScienceDirect, University financial journals)

Web3 airdrop best practices (Optimism, Uniswap, Arbitrum case studies)

Securities transfer agent operations (DTC, Computershare, SEC service guides)

Gift card secondary market data (CardCash, Raise, consumer finance sources)

SEC utility token framework (Framework for Investment Contract Analysis, no-action letters)

Network effects and tokenomics theory (Wharton, Columbia, MIT research)

Full citation list available upon request.

For downloadable comparison charts, research summaries, and technical specifications, visit www.bcii-enterprises.com/coupon-token-whitepaper

SOURCE: BCII Enterprises Inc.

View the original press release on ACCESS Newswire

P.A.Mendoza--AT