-

Arsenal scoop $2m prize for winning FIFA Women's Champions Cup

Arsenal scoop $2m prize for winning FIFA Women's Champions Cup

-

Atletico agree deal to sign Lookman from Atalanta

-

Real Madrid's Bellingham set for month out with hamstring injury

Real Madrid's Bellingham set for month out with hamstring injury

-

Man City won't surrender in title race: Guardiola

-

Korda captures weather-shortened LPGA season opener

Korda captures weather-shortened LPGA season opener

-

Czechs rally to back president locking horns with government

-

Prominent Venezuelan activist released after over four years in jail

Prominent Venezuelan activist released after over four years in jail

-

Emery riled by 'unfair' VAR call as Villa's title hopes fade

-

Guirassy double helps Dortmund move six points behind Bayern

Guirassy double helps Dortmund move six points behind Bayern

-

Nigeria's president pays tribute to Fela Kuti after Grammys Award

-

Inter eight clear after win at Cremonese marred by fans' flare flinging

Inter eight clear after win at Cremonese marred by fans' flare flinging

-

England underline World Cup

credentials with series win over Sri Lanka

-

Guirassy brace helps Dortmund move six behind Bayern

Guirassy brace helps Dortmund move six behind Bayern

-

Man City held by Solanke stunner, Sesko delivers 'best feeling' for Man Utd

-

'Send Help' debuts atop N.America box office

'Send Help' debuts atop N.America box office

-

Ukraine war talks delayed to Wednesday, says Zelensky

-

Iguanas fall from trees in Florida as icy weather bites southern US

Iguanas fall from trees in Florida as icy weather bites southern US

-

Carrick revels in 'best feeling' after Man Utd leave it late

-

Olympic chiefs admit 'still work to do' on main ice hockey venue

Olympic chiefs admit 'still work to do' on main ice hockey venue

-

Pope says Winter Olympics 'rekindle hope' for world peace

-

Last-gasp Demirovic strike sends Stuttgart fourth

Last-gasp Demirovic strike sends Stuttgart fourth

-

Sesko strikes to rescue Man Utd, Villa beaten by Brentford

-

'At least 200' feared dead in DR Congo landslide: government

'At least 200' feared dead in DR Congo landslide: government

-

Coventry says 'sad' about ICE, Wasserman 'distractions' before Olympics

-

In-form Lyon make it 10 wins in a row

In-form Lyon make it 10 wins in a row

-

Man Utd strike late as Carrick extends perfect start in Fulham thriller

-

Van der Poel romps to record eighth cyclo-cross world title

Van der Poel romps to record eighth cyclo-cross world title

-

Mbappe penalty earns Real Madrid late win over nine-man Rayo

-

Resurgent Pakistan seal T20 sweep of Australia

Resurgent Pakistan seal T20 sweep of Australia

-

Fiji top sevens standings after comeback win in Singapore

-

Alcaraz sweeps past Djokovic to win 'dream' Australian Open

Alcaraz sweeps past Djokovic to win 'dream' Australian Open

-

Death toll from Swiss New Year bar fire rises to 41

-

Alcaraz says Nadal inspired him to 'special' Australian Open title

Alcaraz says Nadal inspired him to 'special' Australian Open title

-

Pakistan seeks out perpetrators after deadly separatist attacks

-

Ukraine war talks delayed to Wednesday, Zelensky says

Ukraine war talks delayed to Wednesday, Zelensky says

-

Djokovic says 'been a great ride' after Melbourne final loss

-

Von Allmen storms to downhill win in final Olympic tune-up

Von Allmen storms to downhill win in final Olympic tune-up

-

Carlos Alcaraz: tennis history-maker with shades of Federer

-

Alcaraz sweeps past Djokovic to win maiden Australian Open title

Alcaraz sweeps past Djokovic to win maiden Australian Open title

-

Israel says partially reopening Gaza's Rafah crossing

-

French IT giant Capgemini to sell US subsidiary after row over ICE links

French IT giant Capgemini to sell US subsidiary after row over ICE links

-

Iran's Khamenei likens protests to 'coup', warns of regional war

-

New Epstein accuser claims sexual encounter with ex-prince Andrew: report

New Epstein accuser claims sexual encounter with ex-prince Andrew: report

-

Italy's extrovert Olympic icon Alberto Tomba insists he is 'shy guy'

-

Chloe Kim goes for unprecedented snowboard halfpipe Olympic treble

Chloe Kim goes for unprecedented snowboard halfpipe Olympic treble

-

Pakistan combing for perpetrators after deadly separatist attacks

-

Israel partially reopens Gaza's Rafah crossing

Israel partially reopens Gaza's Rafah crossing

-

Iran declares European armies 'terrorist groups' after IRGC designation

-

Snowstorm disrupts travel in southern US as blast of icy weather widens

Snowstorm disrupts travel in southern US as blast of icy weather widens

-

Denmark's Andresen swoops to win Cadel Evans Road Race

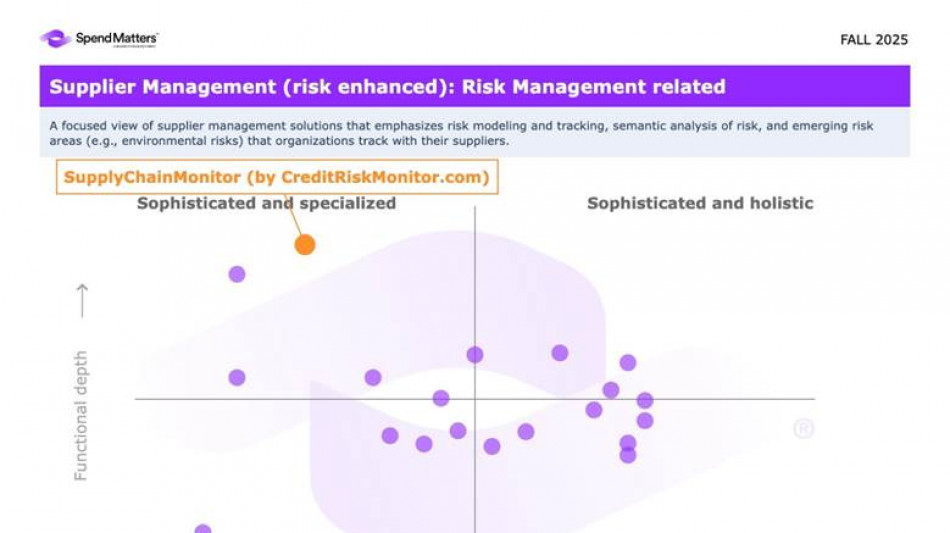

CreditRiskMonitor.com Recognized by Spend Matters Fall 2025 SolutionMap

TARRYTOWN, NY / ACCESS Newswire / November 3, 2025 / CreditRiskMonitor.com, Inc. (OTCQX:CRMZ) is pleased to announce that its SupplyChainMonitor™solution has been recognized once again as a top procurement technology - now in the Spend Matters Fall 2025 SolutionMap.

In October, we released our proprietary FAST Rating, which provides financial risk evaluations on 3.5+ million foreign private companies with limited financial data. The FAST Rating is modeled after the collective intelligence of our expert financial analyst team. The approach leverages Reinforcement Learning from Human Feedback (RLHF), a type of machine learning. Additionally, we introduced Risk Level, which provides high, medium, or low risk classifications on 10+ million public and private companies worldwide. Our clients use the Risk Level to easily compare different companies globally, simplify reporting, and accelerate their business decisions.

We continue to rank well across Risk Management TPRM/SCRM (third-party risk management and supply chain risk management) category with a focus on financial risk, solidifying SupplyChainMonitor™'s place as a leading point solution for such use cases. We earned a top rank in Supplier Risk Management, in addition to above benchmark rankings in the Supplier Performance Management and Analytics categories. By expanding the businesses covered with our financial risk analytics in 2025, including new ratings on millions of private companies, we're providing clients with the depth and breadth required to easily monitor their suppliers.

Spend Matters' SolutionMap is a trusted industry resource that allows practitioners, consultants and investors to evaluate and compare procurement technology solutions based on feature sets and customer satisfaction metrics. The platform enables businesses to make informed decisions through data-driven comparison of leading solutions.

Commenting on the acknowledgment, Mike Flum, CEO & President of CreditRiskMonitor.com, highlighted his appreciation for this continued recognition:

"We are glad to be recognized again by Spend Matters in Third Party Risk Management with an emphasis on financial risk reporting and analytics. The recent and significant increase in vendor bankruptcies, particularly in the manufacturing sector, has underlined the importance of having an accurate and timely early warning system to monitor business financial risk for our clients. Macro factors including interest rates, cost inflation, tariffs, and generally high corporate debt levels continue to point at increased bankruptcy risk across sectors. We've also seen a swath of adverse events on specific suppliers leading to disruptions. Leading organizations recognize that proactive monitoring of supplier financial risk is critical to maintaining supplier continuity. SupplyChainMonitor™'s AI-driven financial risk models, advanced alerting, and holistic risk management capabilities support early identification of threats, so our clients can implement contingency planning and risk mitigation strategies before operational issues become material."

Key Achievements

CreditRiskMonitor.com's SupplyChainMonitor™platform exceeded competitive benchmarks in SXM (Supplier Risk Management), particularly in managing and mitigating supplier-related risks, while also meeting or nearing the top of industry benchmarks across categories.

The CEO of Spend Matters provided insight into the development of the Fall 2025 SolutionMap:

"As CEO of Spend Matters, I want to express my appreciation for all 115 procurement technology providers who engaged in our Fall 2025 SolutionMap assessment. We recognize that participation is a significant commitment, demanding considerable time and effort from your teams. The process involves submitting data against over 500 detailed functional and capability requirements across 16 source-to-pay categories, conducting mandatory demonstrations, and actively collecting impartial, anonymized customer ratings. This rigorous, data-driven methodology, updated every six months, is what underpins SolutionMap's reputation as the gold standard for evaluating procurement technologies. Your dedication to this comprehensive and transparent assessment allows us to provide unmatched clarity and deep, unbiased insights into a highly dynamic and competitive market, ultimately empowering procurement leaders to make truly informed technology decisions." - Carina Kuhl, CEO, Spend Matters, A Hackett Group Division

SupplyChainMonitor™'s powerful features and latest capabilities include:

Financial Risk Analytics: Our 96%-accurate FRISK® Score predicts financial stress and bankruptcy risk over a 12-month period, which solidifies our leadership in financial risk management within the SXM/Supplier Risk Management category. Our proprietary suite of AI-driven financial risk analytics includes the FRISK® Score, PAYCE® Score, and FAST Rating. Clients use these models to proactively manage supplier financial risk, which can impact supply continuity, product quality, and production capacity. Moreover, these analytics empower continuous monitoring to stay ahead of highly disruptive supplier bankruptcies.

Dashboards & Industry Peer Benchmarking: our platform combines our financial risk analytics against client metadata, including supplier spend, criticality, sole source, and other customized data types. These dashboards help supply professionals quickly understand and prioritize their most important suppliers and threats to their operations. Industry Peer Benchmarking enables comparisons across millions of suppliers using our financial risk analytics; primarily to evaluate existing suppliers and supplier alternatives.

Supplier Onboarding & Data Management: we ranked above the benchmark for SXM/Supplier Risk Management, which is partially attributed to supplier list data management including data cleansing and profile management. We are committed to improving our data matching technology and techniques to maximize client-specific business coverage. By mapping suppliers, locations, and spend data, clients can deeply understand their risk exposure and mitigate disruptions before they impact revenue and profitability.

Comprehensive Service Support: Our Platform/Services are directly supported by our Client Success Managers, who provide dedicated onboarding, training, platform customization, and ongoing support. Additionally, our expert financial analysts support inquiries around suppliers, bankruptcies, our proprietary models, adverse news, and other insights available on SupplyChainMonitor™.

About CreditRiskMonitor

CreditRiskMonitor.com, Inc. is a leader in global business intelligence and predictive financial risk analytics. For over 25 years, our Company has been trusted to mitigate business-to-business (B2B) financial risk for thousands of companies worldwide, including nearly 40% of the Fortune 1000. We provide comprehensive counterparty risk management solutions to assess, manage, and anticipate business risk with the highest accuracy in the market. Our web-based SaaS subscription solutions, powered by Artificial Intelligence / Machine Learning, are paired with human analyst oversight to deliver high-quality, trustworthy information. We offer two distinct solutions for counterparty risk evaluations:

CreditRiskMonitor® empowers credit, finance, treasury, and risk professionals to make more informed decisions in trade credit management and related activities.

SupplyChainMonitor™ empowers supply chain, procurement, vendor management, and finance professionals to make more informed supplier relationship decisions for risk mitigation and resilience strategies.

Learn more about how CreditRiskMonitor.com helps protect your supply chain at www.creditriskmonitor.com.

About Spend Matters

Acquired by The Hackett Group® in 2025, Spend Matters™ started as one of the first blog and social media sites in the procurement and supply chain sector and has since grown into one of the leading sources for data-backed technology and solutions intelligence. Serving private and public sector organizations, consultants, private equity, and services and solution providers, the company drives strategic technology purchasing decisions and superior marketing and sales, product, and investment outcomes for clients. Spend Matters™ is the only tech-enabled, proprietary data platform with exclusive intellectual property that serves the global procurement, finance and supply chain technology ecosystem.

CreditRiskMonitor Contact

Mike Flum

[email protected]

(845) 230-3037

Spend Matters Contact

Dina Cutrone

[email protected]

SOURCE: CreditRiskMonitor.com, Inc.

View the original press release on ACCESS Newswire

P.A.Mendoza--AT