-

Venezuelan activist ends '1,675 days' of suffering in prison

Venezuelan activist ends '1,675 days' of suffering in prison

-

Real Madrid scrape win over Rayo, Athletic claim derby draw

-

PSG beat Strasbourg after Hakimi red to retake top spot in Ligue 1

PSG beat Strasbourg after Hakimi red to retake top spot in Ligue 1

-

NFL Cardinals hire Rams' assistant LaFleur as head coach

-

Arsenal scoop $2m prize for winning FIFA Women's Champions Cup

Arsenal scoop $2m prize for winning FIFA Women's Champions Cup

-

Atletico agree deal to sign Lookman from Atalanta

-

Real Madrid's Bellingham set for month out with hamstring injury

Real Madrid's Bellingham set for month out with hamstring injury

-

Man City won't surrender in title race: Guardiola

-

Korda captures weather-shortened LPGA season opener

Korda captures weather-shortened LPGA season opener

-

Czechs rally to back president locking horns with government

-

Prominent Venezuelan activist released after over four years in jail

Prominent Venezuelan activist released after over four years in jail

-

Emery riled by 'unfair' VAR call as Villa's title hopes fade

-

Guirassy double helps Dortmund move six points behind Bayern

Guirassy double helps Dortmund move six points behind Bayern

-

Nigeria's president pays tribute to Fela Kuti after Grammys Award

-

Inter eight clear after win at Cremonese marred by fans' flare flinging

Inter eight clear after win at Cremonese marred by fans' flare flinging

-

England underline World Cup

credentials with series win over Sri Lanka

-

Guirassy brace helps Dortmund move six behind Bayern

Guirassy brace helps Dortmund move six behind Bayern

-

Man City held by Solanke stunner, Sesko delivers 'best feeling' for Man Utd

-

'Send Help' debuts atop N.America box office

'Send Help' debuts atop N.America box office

-

Ukraine war talks delayed to Wednesday, says Zelensky

-

Iguanas fall from trees in Florida as icy weather bites southern US

Iguanas fall from trees in Florida as icy weather bites southern US

-

Carrick revels in 'best feeling' after Man Utd leave it late

-

Olympic chiefs admit 'still work to do' on main ice hockey venue

Olympic chiefs admit 'still work to do' on main ice hockey venue

-

Pope says Winter Olympics 'rekindle hope' for world peace

-

Last-gasp Demirovic strike sends Stuttgart fourth

Last-gasp Demirovic strike sends Stuttgart fourth

-

Sesko strikes to rescue Man Utd, Villa beaten by Brentford

-

'At least 200' feared dead in DR Congo landslide: government

'At least 200' feared dead in DR Congo landslide: government

-

Coventry says 'sad' about ICE, Wasserman 'distractions' before Olympics

-

In-form Lyon make it 10 wins in a row

In-form Lyon make it 10 wins in a row

-

Man Utd strike late as Carrick extends perfect start in Fulham thriller

-

Van der Poel romps to record eighth cyclo-cross world title

Van der Poel romps to record eighth cyclo-cross world title

-

Mbappe penalty earns Real Madrid late win over nine-man Rayo

-

Resurgent Pakistan seal T20 sweep of Australia

Resurgent Pakistan seal T20 sweep of Australia

-

Fiji top sevens standings after comeback win in Singapore

-

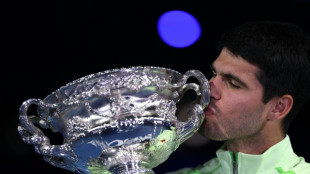

Alcaraz sweeps past Djokovic to win 'dream' Australian Open

Alcaraz sweeps past Djokovic to win 'dream' Australian Open

-

Death toll from Swiss New Year bar fire rises to 41

-

Alcaraz says Nadal inspired him to 'special' Australian Open title

Alcaraz says Nadal inspired him to 'special' Australian Open title

-

Pakistan seeks out perpetrators after deadly separatist attacks

-

Ukraine war talks delayed to Wednesday, Zelensky says

Ukraine war talks delayed to Wednesday, Zelensky says

-

Djokovic says 'been a great ride' after Melbourne final loss

-

Von Allmen storms to downhill win in final Olympic tune-up

Von Allmen storms to downhill win in final Olympic tune-up

-

Carlos Alcaraz: tennis history-maker with shades of Federer

-

Alcaraz sweeps past Djokovic to win maiden Australian Open title

Alcaraz sweeps past Djokovic to win maiden Australian Open title

-

Israel says partially reopening Gaza's Rafah crossing

-

French IT giant Capgemini to sell US subsidiary after row over ICE links

French IT giant Capgemini to sell US subsidiary after row over ICE links

-

Iran's Khamenei likens protests to 'coup', warns of regional war

-

New Epstein accuser claims sexual encounter with ex-prince Andrew: report

New Epstein accuser claims sexual encounter with ex-prince Andrew: report

-

Italy's extrovert Olympic icon Alberto Tomba insists he is 'shy guy'

-

Chloe Kim goes for unprecedented snowboard halfpipe Olympic treble

Chloe Kim goes for unprecedented snowboard halfpipe Olympic treble

-

Pakistan combing for perpetrators after deadly separatist attacks

AI chip giant Nvidia becomes world's first $5 trillion company

AI chip juggernaut Nvidia became the world's first $5 trillion company on Wednesday, as investors remain confident that artificial intelligence will deliver a new wave of innovation and growth.

The California-based tech giant saw its share price rise by 4.91 percent to $210.90 at the open of trading on Wall Street, pushing Nvidia's market capitalization past the never-before-seen threshold.

By way of comparison, the level was greater than the GDP of France or Germany or higher than that of Tesla, Meta (Facebook), and Netflix combined.

Microsoft and Apple, the two other largest global market capitalizations, only just exceed $4 trillion in valuation each.

The surge in Nvidia's share price follows continued strong sales, a flurry of new deals -- including a partnership with Europe's Nokia announced on Tuesday -- as well as expectations that the company may soon regain access to China.

The company is "largely ahead of any competitor who finds it hard to catch up in the world that Nvidia lives in," Art Hogan of B. Riley Wealth Management told AFP.

"While it's almost unfathomable to think about a company reaching this milestone, it comes from a company with so many operational efficiencies that seems to announce massive deals on a daily or weekly basis."

Nvidia CEO Jensen Huang is expected in South Korea this week, where he will attend the sidelines of the APEC summit at which US President Donald Trump will meet his Chinese counterpart Xi Jinping, with issues related to AI development expected to be discussed.

Nvidia chips are currently not sold in China due to a combination of Chinese government bans, national security concerns, and ongoing trade tensions between the United States and China.

The Trump administration favors a more nuanced approach to selling AI chips to Beijing, but faces deep skepticism from China hawks across the US political spectrum who favor tougher bans on AI technology.

Nvidia has announced a series of partnerships in recent weeks, including an intention to invest up to $100 billion in ChatGPT-maker OpenAI over the coming years.

It also said it would invest $5 billion in struggling chip rival Intel, in response to the Trump administration's desire to bring back more manufacturing of semiconductors to the United States.

- 'Better, not worse' -

Nvidia produces the advanced graphics processing units (GPUs) that power most generative AI systems, including those behind ChatGPT and other large language models.

Although it was not the first to develop GPUs, the California-based group made them its specialty in the late 1990s, quickly pivoting from video games to the then-emerging field of cloud computing, and thus has unique experience in the area.

The eyewatering valuations linked to artificial intelligence also include OpenAI becoming the world's most valuable private company, currently valued at $500 billion.

This has sparked talk that the AI frenzy may have entered bubble territory, reminiscent of the 1990s internet investment boom that saw a major reckoning in 2000, when high-flying companies saw their share prices collapse suddenly.

Analyst Sam Stovall of CFRA, a research firm, said Nvidia's expected growth was still very strong and that investors should expect news surrounding the company "will only get better, not worse."

Still, "valuations are elevated... and could therefore be vulnerable to any upsetting news," he added.

Ch.Campbell--AT