-

Swiss Von Allmen pips Odermatt to Val Gardena downhill

Swiss Von Allmen pips Odermatt to Val Gardena downhill

-

Vonn claims third podium of the season at Val d'Isere

-

India drops Shubman Gill from T20 World Cup squad

India drops Shubman Gill from T20 World Cup squad

-

Tens of thousands attend funeral of killed Bangladesh student leader

-

England 'flat' as Crawley admits Australia a better side

England 'flat' as Crawley admits Australia a better side

-

Australia four wickets from Ashes glory as England cling on

-

Beetles block mining of Europe's biggest rare earths deposit

Beetles block mining of Europe's biggest rare earths deposit

-

French culture boss accused of mass drinks spiking to humiliate women

-

NBA champions Thunder suffer rare loss to Timberwolves

NBA champions Thunder suffer rare loss to Timberwolves

-

Burning effigy, bamboo crafts at once-a-decade Hong Kong festival

-

Joshua knocks out Paul to win Netflix boxing bout

Joshua knocks out Paul to win Netflix boxing bout

-

Dogged Hodge ton sees West Indies save follow-on against New Zealand

-

England dig in as they chase a record 435 to keep Ashes alive

England dig in as they chase a record 435 to keep Ashes alive

-

Wembanyama 26-point bench cameo takes Spurs to Hawks win

-

Hodge edges towards century as West Indies 310-4, trail by 265

Hodge edges towards century as West Indies 310-4, trail by 265

-

US Afghans in limbo after Washington soldier attack

-

England lose Duckett in chase of record 435 to keep Ashes alive

England lose Duckett in chase of record 435 to keep Ashes alive

-

Australia all out for 349, set England 435 to win 3rd Ashes Test

-

US strikes over 70 IS targets in Syria after attack on troops

US strikes over 70 IS targets in Syria after attack on troops

-

Australian lifeguards fall silent for Bondi Beach victims

-

Trump's name added to Kennedy Center facade, a day after change

Trump's name added to Kennedy Center facade, a day after change

-

West Indies 206-2, trail by 369, after Duffy's double strike

-

US strikes Islamic State group in Syria after deadly attack on troops

US strikes Islamic State group in Syria after deadly attack on troops

-

Awake Breast Augmentation: Gruber Plastic Surgery Highlights Live Implant Sizing Under Local Anesthesia With No Sedation for Eligible Patients

-

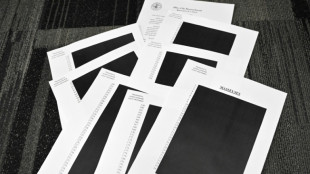

Epstein files opened: famous faces, many blacked-out pages

Epstein files opened: famous faces, many blacked-out pages

-

Ravens face 'special' Patriots clash as playoffs come into focus

-

Newly released Epstein files: what we know

Newly released Epstein files: what we know

-

Musk wins US court appeal of $56 bn Tesla pay package

-

US judge voids murder conviction in Jam Master Jay killing

US judge voids murder conviction in Jam Master Jay killing

-

Trump doesn't rule out war with Venezuela

-

Haller, Aouar out of AFCON, Zambia coach drama

Haller, Aouar out of AFCON, Zambia coach drama

-

Nasdaq rallies again while yen falls despite BOJ rate hike

-

Bologna win shoot-out with Inter to reach Italian Super Cup final

Bologna win shoot-out with Inter to reach Italian Super Cup final

-

Brandt and Beier send Dortmund second in Bundesliga

-

Trump administration begins release of Epstein files

Trump administration begins release of Epstein files

-

UN Security Council votes to extend DR Congo mission by one year

-

Family of Angels pitcher, club settle case over 2019 death

Family of Angels pitcher, club settle case over 2019 death

-

US university killer's mystery motive sought after suicide

-

Rubio says won't force deal on Ukraine as Europeans join Miami talks

Rubio says won't force deal on Ukraine as Europeans join Miami talks

-

Burkinabe teen behind viral French 'coup' video has no regrets

-

Brazil court rejects new Bolsonaro appeal against coup conviction

Brazil court rejects new Bolsonaro appeal against coup conviction

-

Three-time Grand Slam winner Wawrinka to retire in 2026

-

Man Utd can fight for Premier League title in next few years: Amorim

Man Utd can fight for Premier League title in next few years: Amorim

-

Pandya blitz powers India to T20 series win over South Africa

-

Misinformation complicated Brown University shooting probe: police

Misinformation complicated Brown University shooting probe: police

-

IMF approves $206 mn aid to Sri Lanka after Cyclone Ditwah

-

US halts green card lottery after MIT professor, Brown University killings

US halts green card lottery after MIT professor, Brown University killings

-

Stocks advance as markets cheer weak inflation

-

Emery says rising expectations driving red-hot Villa

Emery says rising expectations driving red-hot Villa

-

Three killed in Taipei metro attacks, suspect dead

ClearPoint Neuro Announces Investment of up to $110 Million by Oberland Capital with $33.5 Million Funded at Closing

SOLANA BEACH, CALIFORNIA / ACCESS Newswire / May 12, 2025 / ClearPoint Neuro, Inc. (NASDAQ:CLPT) (the "Company"), a global device, cell, and gene therapy-enabling company offering precise navigation to the brain and spine, today announced that it has entered into a note financing arrangement with Oberland Capital Management LLC ("Oberland Capital") of up to $105 Million, with $30.0 million of gross proceeds funded at closing. Additional note financing will be provided to the Company by Oberland Capital under the following terms:

An additional $25.0 million at the option of the Company any time prior to December 31, 2026; and

An additional $50.0 million at the option of the Company and Oberland Capital any time prior to December 31, 2026.

In addition to the note financing, the Company entered into a stock purchase agreement with Oberland Capital whereby Oberland Capital purchased 275,808 shares of the Company's common stock at a price of $12.69 per share in a registered direct offering, representing an additional $3,500,003.52 of gross proceeds to the Company. The price per share was equal to the trailing 30-trading days volume-weighted average price for the period ending on the day prior to the date of the stock purchase agreement. Oberland Capital also has the right to participate in a future offering of the Company's common stock in an amount of $1.5 million on or before December 31, 2026.

The Company intends to use the proceeds from the offerings for general corporate purposes, which may include capital expenditures, working capital, and general and administrative expenses.

"We are thrilled to begin this partnership with Oberland Capital, as their goal of supporting the development and commercialization of innovative medical technologies such as cell and gene therapy is perfectly aligned with our vision, our products, and our partners," commented Danilo D'Alessandro, Chief Financial Officer of ClearPoint Neuro. "Even as the global economic landscape continues to evolve, many of our 60+ pharmaceutical partners are routinely asking us to accelerate our new product introductions, expand our installed base, and prepare hospitals for the influx of new patients who will seek treatment once these advanced therapies become available. Oberland Capital has provided us with a substantial, creative, and flexible source of capital that will allow us to respond to our cell and gene therapy partners who depend on us to support their key clinical trials and eventual commercialization over the next few years."

William Clifford, Partner at Oberland Capital, stated, "ClearPoint Neuro has a market leading portfolio of medical devices for neurosurgical navigation and a large and growing pipeline of cell and gene therapy delivery partnerships with pharmaceutical companies to serve patients with high unmet medical needs. We are excited to partner with ClearPoint Neuro through this structured financing, which includes a combination of debt, royalty and equity, and look forward to helping the Company achieve its long-term objectives."

The shares of common stock in the registered direct offering are being offered pursuant to a shelf registration statement on Form S-3 (File No. 333-275476), which was declared effective by the U.S. Securities and Exchange Commission (the "SEC") on November 20, 2023. The notes are offered pursuant to an exemption from the registration requirements of the Act under Section 4(a)(2) thereof and have not been registered under the Act or applicable state securities laws. A prospectus supplement relating to the shares of common stock will be filed by the Company with the SEC. When available, copies of the prospectus supplement relating to the registered direct offering, together with the accompanying prospectus, can be obtained at the SEC's website at www.sec.gov.

Covington & Burling LLP served as legal advisor to ClearPoint Neuro on the financings and Sheppard, Mullin, Richter & Hampton LLP served as legal advisor to ClearPoint Neuro on the registered direct offering. Cooley LLP advised Oberland Capital in these transactions.

This press release does not constitute an offer to sell or the solicitation of an offer to buy, nor will there be any sales of these securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction.

About ClearPoint Neuro

ClearPoint Neuro is a device, cell, and gene therapy-enabling company offering precise navigation to the brain and spine. The Company uniquely provides both established clinical products as well as preclinical development services for controlled drug and device delivery. The Company's flagship product, the ClearPoint Neuro Navigation System, has FDA clearance and is CE-marked. ClearPoint Neuro is engaged with healthcare and research centers in North America, Europe, Asia, and South America. The Company is also partnered with the most innovative pharmaceutical/biotech companies, academic centers, and contract research organizations, providing solutions for direct central nervous system delivery of therapeutics in preclinical studies and clinical trials worldwide. To date, thousands of procedures have been performed and supported by the Company's field-based clinical specialist team, which offers support and services to our customers and partners worldwide. For more information, please visit www.clearpointneuro.com.

About Oberland Capital

Oberland Capital is a private investment firm formed in 2013 with assets under management in excess of $3.0 billion, focused exclusively on investing in the global healthcare industry and specializing in flexible investment structures customized to meet the specific needs of its transaction partners. Oberland Capital's broad suite of financing solutions includes monetization of royalty streams, acquisition of future product revenues, creation of project-based financing structures, and investments in traditional debt and equity. With a combination of deep industry knowledge and extensive structured finance experience, the Oberland Capital team has a history of creating value for its transaction partners. For more information, please visit www.oberlandcapital.com.

Forward Looking Statements

This press release contains "forward-looking statements" that are subject to substantial risks and uncertainties. All statements, other than statements of historical fact, contained in this press release are forward-looking statements. Forward-looking statements contained in this press release include, but are not limited to, our intended use of proceeds from the offering, our ability to respond to and support our pharmaceutical partners by introducing new products, expanding our installed base and preparing hospitals for new patients, and patient demand for the expansion of our products and services. Forward-looking statements are based on the Company's current expectations and are subject to inherent uncertainties, risks and assumptions that are difficult to predict. Further, certain forward-looking statements are based on assumptions as to future events that may not prove to be accurate. These and other risks and uncertainties are described more fully in the "Risk Factors" section of the Company's Annual Report on Form 10-K for the year ended December 31, 2024. The Company does not assume any obligation to update these forward-looking statements.

Contact Information

Danilo D'Alessandro

Chief Financial Officer

[email protected]

(888) 287-9109 ext. 3

SOURCE: ClearPoint Neuro, Inc.

View the original press release on ACCESS Newswire

A.Clark--AT