-

Swiss Von Allmen pips Odermatt to Val Gardena downhill

Swiss Von Allmen pips Odermatt to Val Gardena downhill

-

Vonn claims third podium of the season at Val d'Isere

-

India drops Shubman Gill from T20 World Cup squad

India drops Shubman Gill from T20 World Cup squad

-

Tens of thousands attend funeral of killed Bangladesh student leader

-

England 'flat' as Crawley admits Australia a better side

England 'flat' as Crawley admits Australia a better side

-

Australia four wickets from Ashes glory as England cling on

-

Beetles block mining of Europe's biggest rare earths deposit

Beetles block mining of Europe's biggest rare earths deposit

-

French culture boss accused of mass drinks spiking to humiliate women

-

NBA champions Thunder suffer rare loss to Timberwolves

NBA champions Thunder suffer rare loss to Timberwolves

-

Burning effigy, bamboo crafts at once-a-decade Hong Kong festival

-

Joshua knocks out Paul to win Netflix boxing bout

Joshua knocks out Paul to win Netflix boxing bout

-

Dogged Hodge ton sees West Indies save follow-on against New Zealand

-

England dig in as they chase a record 435 to keep Ashes alive

England dig in as they chase a record 435 to keep Ashes alive

-

Wembanyama 26-point bench cameo takes Spurs to Hawks win

-

Hodge edges towards century as West Indies 310-4, trail by 265

Hodge edges towards century as West Indies 310-4, trail by 265

-

US Afghans in limbo after Washington soldier attack

-

England lose Duckett in chase of record 435 to keep Ashes alive

England lose Duckett in chase of record 435 to keep Ashes alive

-

Australia all out for 349, set England 435 to win 3rd Ashes Test

-

US strikes over 70 IS targets in Syria after attack on troops

US strikes over 70 IS targets in Syria after attack on troops

-

Australian lifeguards fall silent for Bondi Beach victims

-

Trump's name added to Kennedy Center facade, a day after change

Trump's name added to Kennedy Center facade, a day after change

-

West Indies 206-2, trail by 369, after Duffy's double strike

-

US strikes Islamic State group in Syria after deadly attack on troops

US strikes Islamic State group in Syria after deadly attack on troops

-

Awake Breast Augmentation: Gruber Plastic Surgery Highlights Live Implant Sizing Under Local Anesthesia With No Sedation for Eligible Patients

-

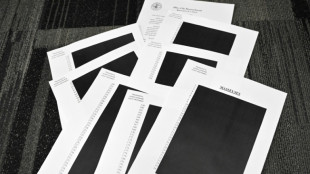

Epstein files opened: famous faces, many blacked-out pages

Epstein files opened: famous faces, many blacked-out pages

-

Ravens face 'special' Patriots clash as playoffs come into focus

-

Newly released Epstein files: what we know

Newly released Epstein files: what we know

-

Musk wins US court appeal of $56 bn Tesla pay package

-

US judge voids murder conviction in Jam Master Jay killing

US judge voids murder conviction in Jam Master Jay killing

-

Trump doesn't rule out war with Venezuela

-

Haller, Aouar out of AFCON, Zambia coach drama

Haller, Aouar out of AFCON, Zambia coach drama

-

Nasdaq rallies again while yen falls despite BOJ rate hike

-

Bologna win shoot-out with Inter to reach Italian Super Cup final

Bologna win shoot-out with Inter to reach Italian Super Cup final

-

Brandt and Beier send Dortmund second in Bundesliga

-

Trump administration begins release of Epstein files

Trump administration begins release of Epstein files

-

UN Security Council votes to extend DR Congo mission by one year

-

Family of Angels pitcher, club settle case over 2019 death

Family of Angels pitcher, club settle case over 2019 death

-

US university killer's mystery motive sought after suicide

-

Rubio says won't force deal on Ukraine as Europeans join Miami talks

Rubio says won't force deal on Ukraine as Europeans join Miami talks

-

Burkinabe teen behind viral French 'coup' video has no regrets

-

Brazil court rejects new Bolsonaro appeal against coup conviction

Brazil court rejects new Bolsonaro appeal against coup conviction

-

Three-time Grand Slam winner Wawrinka to retire in 2026

-

Man Utd can fight for Premier League title in next few years: Amorim

Man Utd can fight for Premier League title in next few years: Amorim

-

Pandya blitz powers India to T20 series win over South Africa

-

Misinformation complicated Brown University shooting probe: police

Misinformation complicated Brown University shooting probe: police

-

IMF approves $206 mn aid to Sri Lanka after Cyclone Ditwah

-

US halts green card lottery after MIT professor, Brown University killings

US halts green card lottery after MIT professor, Brown University killings

-

Stocks advance as markets cheer weak inflation

-

Emery says rising expectations driving red-hot Villa

Emery says rising expectations driving red-hot Villa

-

Three killed in Taipei metro attacks, suspect dead

At CES 2025, METAVISIO - THOMSON Computing Signed an Agreement with ARC Group Limited for a Listing on Nasdaq or NYSE, Based on a Minimum Indicative Valuation Estimated at $70 Million (Derived From Audited Annual Data for FY 2023 and Audited Data for H1 2024)

METAVISIO (THOMSON Computing) (FR00140066X4; code mnemo / Ticker: ALTHO), a pioneer in innovative computing solutions, announces at CES 2025 the signing of a letter of engagement with ARC Group Limited. This partnership aims to support METAVISIO in its listing on the Nasdaq or New York Stock Exchange in the United States, based on a minimum indicative valuation of $70 million, derived from audited annual data for FY 2023 and audited data for H1 2024.

According to the terms of the agreement, ARC Group will act as METAVISIO's exclusive financial advisor, providing strategic guidance for accessing U.S. public markets through a De-SPAC, a reverse takeover (RTO), or an initial public offering (IPO).

This important milestone reflects METAVISIO's ambition to strengthen its European leadership and expand its global presence in the technology industry by leveraging the significantly more lucrative opportunities offered by U.S. financial markets.

Key Objectives of the Engagement

Comprehensive Market Strategy: ARC Group will analyze current market conditions to determine the best strategy for METAVISIO's entry into U.S. public markets.

Capital Market Services: This includes SPAC sourcing, company valuation, and corporate restructuring for De-SPAC/RTO, or drafting S-1 filings for an IPO.

Pre-IPO Capital Raising: ARC Group will assist the company in raising the necessary funds to support METAVISIO's ambitious growth strategy, based on a higher valuation reflecting the efforts and positive results achieved in 2023, 2024, and projected for 2025.

In 2022, during its transfer to the Euronext Growth market through a capital increase of €4.2 million, the company's post-IPO valuation already stood at €44.9 million.

The new valuation of METAVISIO is expected to be determined based on the estimated revenue and EBITDA for 2025, providing a clear and updated financial benchmark in preparation for the initial public offering.

For example, if the revenue in 2025 reaches $120 million, the estimated valuation would range between $420 million and $600 million, based on a revenue multiple of 3.5x to 5.0x.

"We are excited to support METAVISIO in their process to enter the US Capital markets and unlock the huge potential behind the Company's innovative solutions by listing in the deepest, most sophisticated market in the world." said Jesus Hoyos, Managing Partner of ARC Group

"This partnership marks a key milestone in METAVISIO's evolution, providing access to the U.S. financial market, one of the largest and most dynamic in the world. We are thrilled to partner with ARC Group to achieve our goal of becoming a global leader in computing solutions," added Stephan Français, President of METAVISIO.

The agreement complies with the regulatory requirements of the SEC in the United States and the AMF in France, ensuring full compliance throughout the process.

The 2025 presentation of METAVISIO, including its latest updates and plans for 2025, is available on the company's website at: https://www.metavisio.eu/#intro25

About ARC Group

ARC Group is a Global Investment Bank and Management Consultancy Firm with deep roots in Asia, specializing in bridging markets across Asia, the US, and Europe. Since 2015, we have become a global leader in IPO and SPAC advisory, earning accolades such as Best Global Mid-Market Investment Bank (2020) and Deal of the Year (2024). Combining investment banking and management consulting expertise, we deliver tailored solutions in IPOs, SPACs, M&A, strategic consulting, and asset management. With a presence in 12 countries across 3 continents, we are united by a shared vision: Your achievement is the reason for our existence, and your growth is our passion.

ARC Group was the financial advisor for the near 9 billion USD merger of Digital World Acquisition with Trump Media & Technology Group.

For more information: www.arc-group.com

About METAVISIO-THOMSON Computing

Founded in 2013, METAVISIO - THOMSON Computing (FR00140066X4 - ALTHO), designs and markets innovative computing solutions. With a strong commitment to quality and sustainability, the company has become synonymous with technological excellence in the global market.

METAVISIO is eligible for the PEA-PME (French SME Equity Savings Plan) and holds the status of an Innovative Company (FCPI).

For More information: www.metavisio.eu

Contact press and investors: Gabriel Rafaty [email protected]

SOURCE: METAVISIO (THOMSON COMPUTING)

A.Anderson--AT