-

US stocks edge lower from records as precious metals surge

US stocks edge lower from records as precious metals surge

-

Somalia denounces Israeli recognition of Somaliland

-

The Cure guitarist and keyboard player Perry Bamonte dies aged 65

The Cure guitarist and keyboard player Perry Bamonte dies aged 65

-

Draper to miss Australian Open

-

Former Ivory Coast coach Gasset dies at 72

Former Ivory Coast coach Gasset dies at 72

-

Police arrest suspect after man stabs 3 women in Paris metro

-

Former Montpellier coach Gasset dies at 72

Former Montpellier coach Gasset dies at 72

-

Trump's Christmas gospel: bombs, blessings and blame

-

Salah helps 10-man Egypt beat South Africa and book last-16 place

Salah helps 10-man Egypt beat South Africa and book last-16 place

-

Russia lashes out at Zelensky ahead of new Trump meeting on Ukraine plan

-

Salah helps Egypt beat South Africa and book last-16 place

Salah helps Egypt beat South Africa and book last-16 place

-

Australia's Ikitau facing lengthy lay-off after shoulder injury

-

Another 1,100 refugees cross into Mauritania from Mali: UN

Another 1,100 refugees cross into Mauritania from Mali: UN

-

Guardiola proud of Man City players' response to weighty issues

-

Deadly blast hits mosque in Alawite area of Syria's Homs

Deadly blast hits mosque in Alawite area of Syria's Homs

-

The Jukebox Man on song as Redknapp records 'dream' King George win

-

Liverpool boss Slot says Ekitike reaping rewards for greater physicality

Liverpool boss Slot says Ekitike reaping rewards for greater physicality

-

Judge jails ex-Malaysian PM Najib for 15 more years after new graft conviction

-

Musona rescues Zimbabwe in AFCON draw with Angola

Musona rescues Zimbabwe in AFCON draw with Angola

-

Zelensky to meet Trump in Florida on Sunday

-

'Personality' the key for Celtic boss Nancy when it comes to new signings

'Personality' the key for Celtic boss Nancy when it comes to new signings

-

Arteta eager to avoid repeat of Rice red card against Brighton

-

Nigeria signals more strikes likely in 'joint' US operations

Nigeria signals more strikes likely in 'joint' US operations

-

Malaysia's former PM Najib convicted in 1MDB graft trial

-

Elusive wild cat feared extinct rediscovered in Thailand

Elusive wild cat feared extinct rediscovered in Thailand

-

Japan govt approves record budget, including for defence

-

Malaysia's Najib convicted of abuse of power in 1MDB graft trial

Malaysia's Najib convicted of abuse of power in 1MDB graft trial

-

Seoul to ease access to North Korean newspaper

-

History-maker Tongue wants more of the same from England attack

History-maker Tongue wants more of the same from England attack

-

Australia lead England by 46 after 20 wickets fall on crazy day at MCG

-

Asia markets edge up as precious metals surge

Asia markets edge up as precious metals surge

-

Twenty wickets fall on day one as Australia gain edge in 4th Ashes Test

-

'No winner': Kosovo snap poll unlikely to end damaging deadlock

'No winner': Kosovo snap poll unlikely to end damaging deadlock

-

Culture being strangled by Kosovo's political crisis

-

Main contenders in Kosovo's snap election

Main contenders in Kosovo's snap election

-

Australia all out for 152 as England take charge of 4th Ashes Test

-

Boys recount 'torment' at hands of armed rebels in DR Congo

Boys recount 'torment' at hands of armed rebels in DR Congo

-

Inside Chernobyl, Ukraine scrambles to repair radiation shield

-

Bondi victims honoured as Sydney-Hobart race sets sail

Bondi victims honoured as Sydney-Hobart race sets sail

-

North Korea's Kim orders factories to make more missiles in 2026

-

Palladino's Atalanta on the up as Serie A leaders Inter visit

Palladino's Atalanta on the up as Serie A leaders Inter visit

-

Hooked on the claw: how crane games conquered Japan's arcades

-

Shanghai's elderly waltz back to the past at lunchtime dance halls

Shanghai's elderly waltz back to the past at lunchtime dance halls

-

Japan govt approves record 122 trillion yen budget

-

US launches Christmas Day strikes on IS targets in Nigeria

US launches Christmas Day strikes on IS targets in Nigeria

-

Australia reeling on 72-4 at lunch as England strike in 4th Ashes Test

-

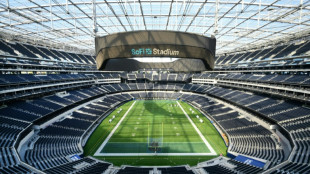

Too hot to handle? Searing heat looming over 2026 World Cup

Too hot to handle? Searing heat looming over 2026 World Cup

-

Packers clinch NFL playoff spot as Lions lose to Vikings

-

Guinea's presidential candidates hold final rallies before Sunday's vote

Guinea's presidential candidates hold final rallies before Sunday's vote

-

TGI Solar Power Group Inc. and Genesys Info X Announce Strategic Partnership to Launch FUSED88.com, a Next-Generation AI & ASI Driven Management Platform

Stocks drop after Fed comments as Mideast fears lift crude

Equities fell Thursday after the Federal Reserve warned Donald Trump's trade war could reignite US inflation and dampen economic growth, while oil rose on Middle East concerns as investors awaited developments in the Israel-Iran conflict.

While geopolitical tensions are the key focus for markets, traders eyed the US central bank's latest meeting Wednesday as officials discussed monetary policy in light of the president's tariff blitz.

The Fed kept borrowing rates on hold, as expected, and said in a statement that "uncertainty about the economic outlook has diminished but remains elevated".

It also cut its economic growth forecast for this year and raised inflation and unemployment expectations, in its first updated projections since Trump unveiled his levies on most trading partners at the start of April.

Boss Jerome Powell called the economy "still solid" but added that "increases in tariffs this year are likely to push up prices and weigh on economic activity".

He said the bank was "well-positioned to wait to learn more" before considering changes to rates. Still, the Fed's so-called dot-plot chart predicted two cuts this year.

"Ultimately, the cost of the tariff has to be paid and some of it will fall on the end consumer," he added. "We know that's coming and we just want to see a little bit of that before we make judgements prematurely."

The Fed's decision drew the ire of Trump, who has repeatedly pressured the independent central bank for rate cuts. He wrote on his Truth Social platform that Powell was "the WORST" and a "real dummy, who's costing America $Billions!".

Hours before the meeting, he had told reporters "We have a stupid person, frankly, at the Fed."

"We have no inflation, we have only success, and I'd like to see interest rates get down," he said at the White House. "Maybe I should go to the Fed. Am I allowed to appoint myself?"

- 'A heavy price' -

Tai Hui at JP Morgan Asset Management said: "The Fed's assessment indicates that the economy is in good shape, aligning with current economic data.

"However, trade policy, fiscal policy, and unintended consequences of policies from the Trump administration are contributing to market volatility in the second half of this year."

Hong Kong led share losses, falling more than two percent, while Tokyo shed one percent, with Bangkok also well down as a political crisis involving Thailand's Prime Minister Paetongtarn Shinawatra put her government on the brink of collapse.

Shanghai, Sydney, Singapore, Wellington, Taipei, Mumbai and Jakarta were also down, while London, Paris and Frankfurt opened on the back foot.

The Fed comments compounded the already weak sentiment as Trump considers joining Israeli strikes against Iran.

He indicated he was still looking into such a move and that Iran had reached out seeking negotiations, saying: "I may do it, I may not do it. I mean, nobody knows what I'm going to do."

Without providing more details, he added: "The next week is going to be very big."

Iran's supreme leader Ayatollah Ali Khamenei earlier sounded a defiant note, rejecting Trump's call for "unconditional surrender".

Crude prices edged up in afternoon Asian trade after fluctuating through the day as traders tracked developments.

Israel's army said Thursday it had struck an "inactive nuclear reactor" in Iran overnight, while the Islamic republic's Natanz nuclear site was targeted again.

Meanwhile, Prime Minister Benjamin Netanyahu said Tehran would "pay a heavy price" after a missile hit a hospital in Israel's south.

Analysts said the main worry for traders was the possibility Tehran will shut a key shipping lane through which an estimated fifth of global oil supply flows.

"We don't see it as a likely scenario at this time, but given the precarious state that the Iran regime is in right now, I think everybody should be watching" the Strait of Hormuz, Mike Sommers, president of the American Petroleum Institute, told Bloomberg television in an interview.

- Key figures at around 0230 GMT -

Tokyo - Nikkei 225: DOWN 1.0 percent at 38,488.34 (close)

Hong Kong - Hang Seng Index: DOWN 2.1 percent at 23,205.97

Shanghai - Composite: DOWN 0.8 percent at 3,362.11 (close)

London - FTSE 100: DOWN 0.3 percent at 8,813.43

West Texas Intermediate: UP 0.6 percent at $75.58 per barrel

Brent North Sea Crude: UP 0.2 percent at $76.86 per barrel

Euro/dollar: DOWN at $1.1463 from $1.1485 on Wednesday

Pound/dollar: DOWN at $1.3404 from $1.3420

Dollar/yen: UP at 145.25 yen from 145.09 yen

Euro/pound: DOWN at 85.52 pence from 85.55 pence

New York - Dow: DOWN 0.1 percent at 42,171.66 (close)

A.Ruiz--AT