-

China surplus pushing EU to take 'offensive' trade measures: business lobby

China surplus pushing EU to take 'offensive' trade measures: business lobby

-

Japanese ivory trade attracts fresh global scrutiny

-

Tickner rushed to hospital as New Zealand bowl out West Indies for 205

Tickner rushed to hospital as New Zealand bowl out West Indies for 205

-

Cambodia-Thailand border clashes send half a million into shelters

-

Cambodia pull out of SEA Games in Thailand over border conflict

Cambodia pull out of SEA Games in Thailand over border conflict

-

Orlando to face New York in NBA Cup semis at Vegas

-

Cambodia pull out of SEA Games in Thailand: organisers

Cambodia pull out of SEA Games in Thailand: organisers

-

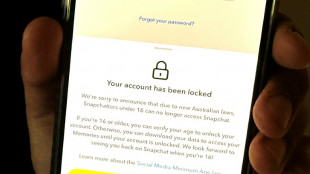

Australian mum of late teen says social media ban 'bittersweet'

-

Oil-rich UAE turns to AI to grease economy

Oil-rich UAE turns to AI to grease economy

-

West Indies 175-4 after Tickner takes three in second New Zealand Test

-

Nepal faces economic fallout of September protest

Nepal faces economic fallout of September protest

-

Asian stocks in retreat as traders eye Fed decision, tech earnings

-

Australia bans under-16s from social media in world-first crackdown

Australia bans under-16s from social media in world-first crackdown

-

US Fed appears set for third rate cut despite sharp divides

-

Veggie 'burgers' at stake in EU negotiations

Veggie 'burgers' at stake in EU negotiations

-

Haitians dance with joy over UNESCO musical listing

-

Suspense swirls if Nobel peace laureate will attend ceremony

Suspense swirls if Nobel peace laureate will attend ceremony

-

UK public urged to keep eyes peeled for washed-up bananas

-

South Korea chip giant SK hynix mulls US stock market listing

South Korea chip giant SK hynix mulls US stock market listing

-

Captain Cummins back in Australia squad for third Ashes Test

-

NFL Colts to bring 44-year-old QB Rivers out of retirement: reports

NFL Colts to bring 44-year-old QB Rivers out of retirement: reports

-

West Indies 92-2 after being asked to bat in second New Zealand Test

-

Ruckus in Brazil Congress over bid to reduce Bolsonaro jail term

Ruckus in Brazil Congress over bid to reduce Bolsonaro jail term

-

ExxonMobil slows low-carbon investment push through 2030

-

Liverpool's Slot swerves further Salah talk after late Inter win

Liverpool's Slot swerves further Salah talk after late Inter win

-

Maresca concerned as Atalanta fight back to beat Chelsea

-

Liverpool edge Inter in Champions League as Chelsea lose in Italy

Liverpool edge Inter in Champions League as Chelsea lose in Italy

-

Spurs sink Slavia Prague to boost last-16 bid in front of Son

-

Arsenal ensure Women's Champions League play-off berth

Arsenal ensure Women's Champions League play-off berth

-

Late penalty drama helps Liverpool defy Salah crisis at angry Inter

-

Canada launches billion dollar plan to recruit top researchers

Canada launches billion dollar plan to recruit top researchers

-

Liverpool defy Salah crisis by beating Inter Milan in Champions League

-

Honduran leader alleges vote tampering, US interference

Honduran leader alleges vote tampering, US interference

-

De Ketelaere inspires Atalanta fightback to beat Chelsea

-

Kounde double helps Barcelona claim Frankfurt comeback win

Kounde double helps Barcelona claim Frankfurt comeback win

-

US Supreme Court weighs campaign finance case

-

Zelensky says ready to hold Ukraine elections, with US help

Zelensky says ready to hold Ukraine elections, with US help

-

Autistic Scottish artist Nnena Kalu smashes Turner Prize 'glass ceiling'

-

Trump slams 'decaying' and 'weak' Europe

Trump slams 'decaying' and 'weak' Europe

-

Injury-hit Arsenal in 'dangerous circle' but Arteta defends training methods

-

Thousands flee DR Congo fighting as M23 enters key city

Thousands flee DR Congo fighting as M23 enters key city

-

Karl and Gnabry spark Bayern to comeback win over Sporting

-

Thousands flee DR Congo fighting as M23 closes on key city

Thousands flee DR Congo fighting as M23 closes on key city

-

Zelensky says ready to hold Ukraine elections

-

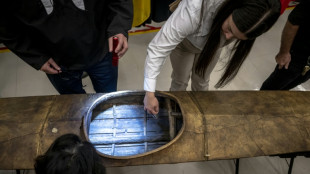

Indigenous artifacts returned by Vatican unveiled in Canada

Indigenous artifacts returned by Vatican unveiled in Canada

-

Ivory Coast recall Zaha for AFCON title defence

-

Communist vs Catholic - Chile prepares to choose a new president

Communist vs Catholic - Chile prepares to choose a new president

-

Trump's FIFA peace prize breached neutrality, claims rights group

-

NHL 'optimistic' about Olympic rink but could pull out

NHL 'optimistic' about Olympic rink but could pull out

-

Thousands reported to have fled DR Congo fighting as M23 closes on key city

US stocks tumble again as oil prices reach multi-year highs

Wall Street stocks tumbled again Wednesday following a volatile session as markets grapple with the prospect of higher interest rates, while oil prices scaled new multi-year highs.

After an up day in European equity markets, Wall Street stocks began the session on positive ground following good results from Procter & Gamble and other companies.

But stocks faltered in the afternoon, falling especially hard in the last hour of trading on weakening sentiment.

The early gains "looked like a good set-up for an equity rebound, but unfortunately, that didn't happen," Briefing.com said. "The inability to rebound from sizable losses deterred risk sentiment, fueling a belief that more downside was ahead."

All three major indices dropped one percent or more in the session, pushing the Nasdaq into a correction -- a decline of greater than 10 percent from its most recent peak.

Stocks have been under pressure for most of 2022 so far as the Federal Reserve has signaled a significant pivot in monetary policy with an accelerated phase-out of stimulus and interest rate cuts.

Investors were spooked Tuesday as the yield on the 10-year Treasury note jumped above 1.85 percent, amid expectations the Fed could hike interest rates as many as four times this year. The rate, a proxy for the interest rate outlook, remained near that level on Wednesday.

World oil prices zoomed to more seven-year peaks on renewed unrest in the crude-rich Middle East, and on expectations of resurgent post-pandemic demand.

The International Energy Agency lifted its forecast for 2022 oil consumption, now seen at 99.7 million barrels per day, above the pre-Covid level.

"If demand continues to grow strongly or supply disappoints, the low level of stocks and shrinking spare capacity mean that oil markets could be in for another volatile year in 2022," the IEA said.

- Key figures around 2125 GMT -

New York - Dow: DOWN 1.0 percent at 35,028.65 (close)

New York - S&P 500: DOWN 1.0 percent at 4,532.76 (close)

New York - Nasdaq: DOWN 1.2 percent at 14,340.26 (close)

London - FTSE 100: UP 0.4 percent at 7,589.66 (close)

Frankfurt - DAX: UP 0.2 percent at 15,809.72 (close)

Paris - CAC 40: UP 0.6 percent at 7,172.98 (close)

EURO STOXX 50: UP 0.3 percent at 4,268.28 (close)

Tokyo - Nikkei 225: DOWN 2.8 percent at 27,467.23 (close)

Hong Kong - Hang Seng Index: UP 0.1 percent at 24,127.85 (close)

Shanghai - Composite: DOWN 0.3 percent at 3,558.18 (close)

Euro/dollar: UP at $1.1351 from $1.1325 late Tuesday

Pound/dollar: UP at $1.3610 from $1.3596

Euro/pound: UP at 83.31 pence from 83.30 pence

Dollar/yen: DOWN at 114.33 yen from 114.61 yen

Brent North Sea crude: UP 1.1 percent at $88.44 per barrel

West Texas Intermediate: UP 1.8 percent at $86.96 per barrel

burs-jmb/cs

R.Chavez--AT