-

Hojlund double shoots Napoli past Juventus and top of Serie A

Hojlund double shoots Napoli past Juventus and top of Serie A

-

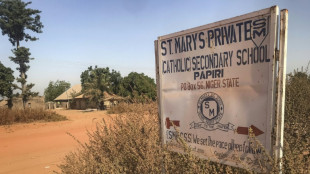

100 kidnapped Nigerian schoolchildren released: UN source, presidency

-

Odermatt wins Beaver Creek giant slalom

Odermatt wins Beaver Creek giant slalom

-

Singer Katy Perry and Canada's Justin Trudeau make romance official

-

'I did it my way': Norris proud of way he won F1 title

'I did it my way': Norris proud of way he won F1 title

-

Palestine, Syria celebrate reaching Arab Cup quarter-finals

-

Colts blow as quarterback Jones suffers Achilles injury

Colts blow as quarterback Jones suffers Achilles injury

-

Benin president says situation 'under control' after coup attempt

-

Scheib bounces back to win Mont Tremblant giant slalom

Scheib bounces back to win Mont Tremblant giant slalom

-

'Five Nights at Freddy's' sequel slashes to top of box office

-

Palace sink Fulham to reach fourth place, Rutter rescues Brighton

Palace sink Fulham to reach fourth place, Rutter rescues Brighton

-

Dortmund beat Hoffenheim to cement third spot

-

Second-lowest turnout ever for HK legislative election

Second-lowest turnout ever for HK legislative election

-

Capuozzo grabs hat-trick as Toulouse win Champions Cup opener

-

Emotional Norris triumph prompts widespread affection and respect

Emotional Norris triumph prompts widespread affection and respect

-

Louvre says hundreds of works damaged by water leak

-

UN calls on Taliban to lift ban on Afghan women in its offices

UN calls on Taliban to lift ban on Afghan women in its offices

-

Rutter rescues Brighton in West Ham draw

-

England trained 'too much' prior to Ashes collapse, says McCullum

England trained 'too much' prior to Ashes collapse, says McCullum

-

How Lando Norris won the F1 title

-

Tearful Norris completes 'long journey' to become F1 world champion

Tearful Norris completes 'long journey' to become F1 world champion

-

'It's all over': how Iran abandoned Assad to his fate days before fall

-

Lando Norris: England's F1 prince charming with a ruthless streak

Lando Norris: England's F1 prince charming with a ruthless streak

-

Lando Norris crowned Formula One world champion

-

What next for Salah and Liverpool after explosive outburst?

What next for Salah and Liverpool after explosive outburst?

-

Netanyahu expects to move to Gaza truce second phase soon

-

Nervous Norwegian winner Reitan overshadows Hovland in Sun City

Nervous Norwegian winner Reitan overshadows Hovland in Sun City

-

Benin government says 'foiled' coup attempt

-

British photographer Martin Parr dies aged 73: Foundation

British photographer Martin Parr dies aged 73: Foundation

-

Benin govt says 'foiled' coup attempt

-

Stokes refuses to give up hope as Ashes ambitions hang by thread

Stokes refuses to give up hope as Ashes ambitions hang by thread

-

'Good banter': Smith and Archer clash in Gabba Ashes Test

-

Sri Lanka issues landslide warnings as cyclone toll hits 627

Sri Lanka issues landslide warnings as cyclone toll hits 627

-

Macron threatens China with tariffs over trade surplus

-

Palestinian coach gets hope, advice from mum in Gaza tent

Palestinian coach gets hope, advice from mum in Gaza tent

-

Undercooked, arrogant? Beaten England's Ashes build-up under scrutiny

-

Benin presidency says still in control despite coup attempt

Benin presidency says still in control despite coup attempt

-

In Jerusalem, Merz reaffirms Germany's support for Israel

-

Australia crush England by eight wickets for 2-0 Ashes lead

Australia crush England by eight wickets for 2-0 Ashes lead

-

Star UK chef redesigns menu for dieters on skinny jabs

-

Australia on brink of victory at Gabba for 2-0 Ashes lead

Australia on brink of victory at Gabba for 2-0 Ashes lead

-

South Africa coach Conrad says meant no malice with 'grovel' remark

-

Neergaard-Petersen edges out Smith for maiden DP World Tour win

Neergaard-Petersen edges out Smith for maiden DP World Tour win

-

Stokes and Jacks lead rearguard action to keep England alive

-

Sri Lanka issues landslide warnings as cyclone toll hits 618

Sri Lanka issues landslide warnings as cyclone toll hits 618

-

McIlroy going to enjoy 'a few wines' to reflect on 'unbelievable year'

-

India nightclub fire kills 25 in Goa

India nightclub fire kills 25 in Goa

-

Hong Kong heads to the polls after deadly fire

-

Harden moves to 10th on NBA all-time scoring list in Clippers defeat

Harden moves to 10th on NBA all-time scoring list in Clippers defeat

-

Number's up: Calculators hold out against AI

| RIO | -0.92% | 73.06 | $ | |

| SCS | -0.56% | 16.14 | $ | |

| CMSC | -0.21% | 23.43 | $ | |

| CMSD | -0.3% | 23.25 | $ | |

| BCC | -1.66% | 73.05 | $ | |

| RBGPF | 0% | 78.35 | $ | |

| NGG | -0.66% | 75.41 | $ | |

| BCE | 1.4% | 23.55 | $ | |

| JRI | 0.29% | 13.79 | $ | |

| GSK | -0.33% | 48.41 | $ | |

| AZN | 0.17% | 90.18 | $ | |

| RELX | -0.55% | 40.32 | $ | |

| BTI | -1.81% | 57.01 | $ | |

| RYCEF | -0.34% | 14.62 | $ | |

| BP | -3.91% | 35.83 | $ | |

| VOD | -1.31% | 12.47 | $ |

Stocks largely shrug off sticky inflation data

European and US stocks mostly advanced Thursday as investors shrugged off sticky inflation data and its impact on future central bank policy on interest rates.

Both the US Federal Reserve and the European Central Bank have adopted a more data-dependent approach on whether to increase interest rates further.

That made the latest inflation data all the more important ahead of the next monetary policy meetings due in September.

The Fed's preferred measure of inflation, the PCE Price Index, rose to a 3.3 percent annual increase in July, versus a 3.0 percent increase in June.

The 0.2 percent month-over-month in the headline and core price index which excludes volatile food and fuel prices were in line with expectations.

"The key takeaway from the report would have to be the uptick in the year-over-year inflation readings," said Briefing.com analyst Patrick O'Hare.

While the increases weren't "eye-popping", said O'Hare, "they should catch the Fed's eye as a basis not to cut rates anytime soon".

The latest data on unemployment claims, a dip of first-time claims for benefits, showed the US labour market remains tight.

Investors have largely been worrying about the possibility of a further increase in interest rates by the Fed, but the data didn't seem to cause worry.

Wall Street's major stock indices rose at the start of trading.

Meanwhile, stocks in Frankfurt rose while Paris was flat after data showed the annual rate of inflation in the eurozone remained unchanged in August at 5.3 percent as a smaller drop in energy prices balanced out a slowdown in the rise of food and drinks costs.

Analysts said the data increased the chance of the European Central Bank deciding against a further hike to interest rates in the eurozone next month.

That in turn weighed on the euro.

In Asia, China revealed that factory activity shrank again this month while services weakened, which will likely pile further pressure on authorities to press ahead with measures to kickstart the sputtering economy.

Officials have announced a series of pledges to help various sectors -- particularly the property industry -- and there is an expectation that more is on the way.

In the latest measure, local reports Thursday said the central bank is drawing up policies that will make it easier for private firms, including developers, to access funding.

However, analysts say the only thing that will appease investors is a wide-ranging "bazooka" of big spending.

Fresh data showing the country's manufacturing sector contracted for a fifth straight month in August added to the arguments for more help.

And the need to provide support to the embattled real estate sector was highlighted Wednesday when industry giant Country Garden reported losses of about $6.7 billion for the first half of the year and warned of possible default.

The company's cash flow problems have ignited fears that it could collapse and spread turbulence through China's economy and financial system.

On the corporate front, shares in UBS jumped six percent after the bank giant said it would fully absorb the Swiss unit of its recently-swallowed rival Credit Suisse.

Switzerland's largest bank, which was strongarmed into a takeover of its closest domestic rival in March to keep it from going under, said it aimed to complete most of the integration by the end of 2026 following cost cuts of more than $10 billion.

- Key figures around 1330 GMT -

New York - Dow: UP 0.4 percent at 35,025.06 points

London - FTSE 100: UP 0.1 at 7,481.38

Frankfurt - DAX: UP 0.7 percent at 16,004.92

Paris - CAC 40: FLAT at 7,361.47

EURO STOXX 50: UP 0.1 percent at 4,320.41

Tokyo - Nikkei 225: UP 0.9 percent at 32,619.34 (close)

Hong Kong - Hang Seng Index: DOWN 0.6 percent at 18,382.06 (close)

Shanghai - Composite: DOWN 0.6 percent at 3,119.88 (close)

Euro/dollar: DOWN at $1.0862 from $1.0925 Thursday

Pound/dollar: DOWN at $1.2683 from $1.2719

Dollar/yen: DOWN at 146.07 yen from 146.23 yen

Euro/pound: DOWN at 85.65 pence from 85.87 pence

Brent North Sea crude: UP 0.9 percent at $86.65 per barrel

West Texas Intermediate: UP 1.4 percent at $82.76 per barrel

burs-rl/giv

O.Brown--AT