-

Conway falls for 227 as New Zealand pass 500 in West Indies Test

Conway falls for 227 as New Zealand pass 500 in West Indies Test

-

'We are ghosts': Britain's migrant night workers

-

Asian markets rise as US inflation eases, Micron soothes tech fears

Asian markets rise as US inflation eases, Micron soothes tech fears

-

Giant lanterns light up Christmas in Catholic Philippines

-

TikTok: key things to know

TikTok: key things to know

-

Putin, emboldened by Ukraine gains, to hold annual presser

-

Deportation fears spur US migrants to entrust guardianship of their children

Deportation fears spur US migrants to entrust guardianship of their children

-

Upstart gangsters shake Japan's yakuza

-

Trump signs $900 bn defense policy bill into law

Trump signs $900 bn defense policy bill into law

-

Stokes's 83 gives England hope as Australia lead by 102 in 3rd Test

-

Go long: the rise and rise of the NFL field goal

Go long: the rise and rise of the NFL field goal

-

Australia announces gun buyback, day of 'reflection' after Bondi shooting

-

New Zealand Cricket chief quits after split over new T20 league

New Zealand Cricket chief quits after split over new T20 league

-

England all out for 286, trail Australia by 85 in 3rd Test

-

Australian announces gun buyback, day of 'reflection' after Bondi shooting

Australian announces gun buyback, day of 'reflection' after Bondi shooting

-

Joshua takes huge weight advantage into Paul fight

-

TikTok signs joint venture deal to end US ban threat

TikTok signs joint venture deal to end US ban threat

-

Conway's glorious 200 powers New Zealand to 424-3 against West Indies

-

WNBA lockout looms closer after player vote authorizes strike

WNBA lockout looms closer after player vote authorizes strike

-

Honduras begins partial vote recount in Trump-dominated election

-

Nike shares slump as China struggles continue

Nike shares slump as China struggles continue

-

Hundreds swim, float at Bondi Beach to honour shooting victims

-

Crunch time for EU leaders on tapping Russian assets for Ukraine

Crunch time for EU leaders on tapping Russian assets for Ukraine

-

Pope replaces New York's pro-Trump Cardinal with pro-migrant Chicagoan

-

Trump orders marijuana reclassified as less dangerous drug

Trump orders marijuana reclassified as less dangerous drug

-

Rams ace Nacua apologizes over 'antisemitic' gesture furor

-

McIlroy wins BBC sports personality award for 2025 heroics

McIlroy wins BBC sports personality award for 2025 heroics

-

Napoli beat Milan in Italian Super Cup semi-final

-

Violence erupts in Bangladesh after wounded youth leader dies

Violence erupts in Bangladesh after wounded youth leader dies

-

EU-Mercosur deal delayed as farmers stage Brussels show of force

-

US hosting new Gaza talks to push next phase of deal

US hosting new Gaza talks to push next phase of deal

-

Chicago Bears mulling Indiana home over public funding standoff

-

Trump renames Kennedy arts center after himself

Trump renames Kennedy arts center after himself

-

Trump rebrands housing supplement as $1,776 bonuses for US troops

-

Harrison Ford to get lifetime acting award

Harrison Ford to get lifetime acting award

-

Trump health chief seeks to bar trans youth from gender-affirming care

-

Argentine unions in the street over Milei labor reforms

Argentine unions in the street over Milei labor reforms

-

Trump signs order reclassifying marijuana as less dangerous

-

Famed Kennedy arts center to be renamed 'Trump-Kennedy Center'

Famed Kennedy arts center to be renamed 'Trump-Kennedy Center'

-

US accuses S.Africa of harassing US officials working with Afrikaners

-

Brazil open to EU-Mercosur deal delay as farmers protest in Brussels

Brazil open to EU-Mercosur deal delay as farmers protest in Brussels

-

Wounded Bangladesh youth leader dies in Singapore hospital

-

New photo dump fuels Capitol Hill push on Epstein files release

New photo dump fuels Capitol Hill push on Epstein files release

-

Brazil, Mexico seek to defuse US-Venezuela crisis

-

Assange files complaint against Nobel Foundation over Machado win

Assange files complaint against Nobel Foundation over Machado win

-

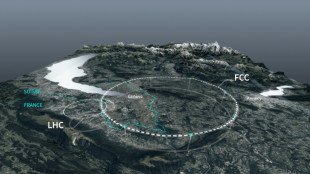

Private donors pledge $1 bn for CERN particle accelerator

-

Russian court orders Austrian bank Raiffeisen to pay compensation

Russian court orders Austrian bank Raiffeisen to pay compensation

-

US, Qatar, Turkey, Egypt to hold Gaza talks in Miami

-

Lula open to mediate between US, Venezuela to 'avoid armed conflict'

Lula open to mediate between US, Venezuela to 'avoid armed conflict'

-

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

UBS in talks to save Credit Suisse

Credit Suisse is in advanced talks with its larger Swiss rival UBS about a deal to salvage Switzerland's second-biggest bank, in a bid to reassure investors before the markets open next week, several media reported Saturday.

Embattled Credit Suisse was holding crisis talks this weekend and urgent meetings with national banking and regulatory authorities, said reports.

According to the Financial Times newspaper, Switzerland's largest bank UBS was negotiating to buy all or part of Credit Suisse, with the blessing of the Swiss regulators. An agreement could even be reached as early as Saturday evening, the paper reported.

The Swiss National Bank (SNB) -- the country's central bank -- "wants the lenders to agree on a simple and straightforward solution before markets open on Monday", the FT's source said, while acknowledging there was "no guarantee" of a deal.

Credit Suisse, the SNB and the Swiss financial watchdog FINMA all declined to comment when AFP contacted them Saturday about the possibility of a UBS takeover.

An acquisition of this size is dauntingly complex.

UBS would require public guarantees to cover legal costs and potential losses, according to a report by Bloomberg, citing anonymous sources.

The Swiss competition commission could also raise eyebrows depending on how any takeover by UBS might be configured.

- Too big to fail? -

The Swiss government held an urgent meeting to discuss the Credit Suisse situation on Saturday evening in the capital Bern. The government's spokesman refused to comment on the talks, Swiss news agency ATS reported.

The Neue Zurcher Zeitung newspaper said the government met at the finance ministry for a meeting that lasted around two hours, with several experts and officials taking part.

Like UBS, Credit Suisse is one of 30 banks around the world deemed to be Global Systemically Important Banks -- of such importance to the international banking system that they are deemed too big to fail.

"We are now awaiting a definitive and structural solution to the problems of this bank," French Finance Minister Bruno Le Maire told Le Parisien newspaper. "We remain extremely vigilant and mobilised."

According to the FT, citing two unnamed sources, Credit Suisse customers withdrew 10 billion Swiss francs in deposits in a single day late last week -- a measure of how trust in the bank has fallen.

After a turbulent week on the stock market, which forced the SNB to step in with a $54 billion lifeline, Credit Suisse was worth just over $8.7 billion on Friday evening -- precious little for a bank considered as one of 30 key institutions worldwide.

While FINMA and the SNB have said that Credit Suisse "meets the capital and liquidity requirements" imposed on such banks, mistrust remains.

- Stock market plunge -

Amid fears of contagion after the collapse of two banks in the United States, Credit Suisse's biggest shareholder said Wednesday it would "absolutely not" up its stake in the bank, for regulatory reasons.

That sent share prices plunging by more than 30 percent to a new record low of 1.55 Swiss francs.

After recovering some ground on Thursday, Credit Suisse shares closed down eight percent on Friday at 1.86 Swiss francs each as the Zurich-based lender struggled to regain the confidence of investors.

All eyes are on how Credit Suisse can stop another slide once the Swiss stock exchange reopens at 0800 GMT on Monday.

Credit Suisse has been scandal-plagued for the past two years with its own management admitting "material weaknesses" in their "internal control over financial reporting".

In 2022, the bank suffered a net loss of $7.9 billion, against the backdrop of massive withdrawals of money from its customers. It still expects a "substantial" pre-tax loss this year.

"This is a bank that never seems to get its house in order," IG analyst Chris Beauchamp commented in a market note this week.

- Status quo not an option -

Analysts at financial services giant JPMorgan, insisting that "status quo is no longer an option", considered the scenario of a takeover by another bank, with UBS "the most likely".

The idea of Switzerland's biggest banks joining forces regularly resurfaces, but is generally dismissed due to competition issues and risks to the Swiss financial system's stability, given the size of the bank that would be created by such a merger.

"The question arises because there are many candidates which might be interested," said David Benamou, chief investment officer of Paris-based Axiom Alternative Investments.

"However, the Credit Suisse management, even if forced to do so by the authorities, would only choose (this option) if they have no other solution," he said.

The bank is starting to roll out its restructuring plan laid out in October, while UBS has spent several years addressing its own issues.

W.Moreno--AT