-

Protests in Bangladesh as India cites security concerns

Protests in Bangladesh as India cites security concerns

-

European stocks rise before central bank decisions on rates

-

Tractors clog Brussels in anger at EU-Mercosur trade deal

Tractors clog Brussels in anger at EU-Mercosur trade deal

-

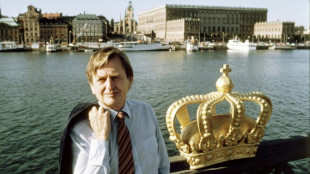

Not enough evidence against Swedish PM murder suspect: prosecutor

-

Nepal's ousted PM Oli re-elected as party leader

Nepal's ousted PM Oli re-elected as party leader

-

British energy giant BP extends shakeup with new CEO pick

-

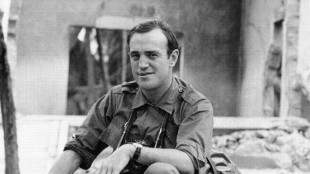

Pulitzer-winning combat reporter Peter Arnett dies at 91

Pulitzer-winning combat reporter Peter Arnett dies at 91

-

EU kicks off crunch summit on Russian asset plan for Ukraine

-

Lyon humbled to surpass childhood hero McGrath's wicket tally

Lyon humbled to surpass childhood hero McGrath's wicket tally

-

Sri Lanka plans $1.6 bn in cyclone recovery spending in 2026

-

England vow to keep 'fighting and scrapping' as Ashes slip away

England vow to keep 'fighting and scrapping' as Ashes slip away

-

'Never enough': Conway leans on McKenzie wisdom in epic 300 stand

-

Most Asian markets track Wall St lower as AI fears mount

Most Asian markets track Wall St lower as AI fears mount

-

Cambodia says Thailand bombs casino hub on border

-

Thai queen wins SEA Games gold in sailing

Thai queen wins SEA Games gold in sailing

-

England Ashes dreams on life-support as Australia rip through batting

-

Masterful Conway, Latham in 323 opening stand as West Indies wilt

Masterful Conway, Latham in 323 opening stand as West Indies wilt

-

Danish 'ghetto' tenants hope for EU discrimination win

-

Cricket Australia boss slams technology as Snicko confusion continues

Cricket Australia boss slams technology as Snicko confusion continues

-

Conway and Latham's 323-run opening stand batters hapless West Indies

-

Alleged Bondi shooters holed up in hotel for most of Philippines visit

Alleged Bondi shooters holed up in hotel for most of Philippines visit

-

Japan govt sued over 'unconstitutional' climate inaction

-

US approves $11 billion in arms sales to Taiwan: Taipei

US approves $11 billion in arms sales to Taiwan: Taipei

-

England battle to save Ashes as Australia rip through top-order

-

Guarded and formal: Pope Leo XIV sets different tone

Guarded and formal: Pope Leo XIV sets different tone

-

What to know about the EU-Mercosur deal

-

Trump vows economic boom, blames Biden in address to nation

Trump vows economic boom, blames Biden in address to nation

-

Conway 120 as New Zealand in command at 216-0 against West Indies

-

Taiwan eyes fresh diplomatic ties with Honduras

Taiwan eyes fresh diplomatic ties with Honduras

-

ECB set to hold rates but debate swirls over future

-

Asian markets track Wall St lower as AI fears mount

Asian markets track Wall St lower as AI fears mount

-

EU holds crunch summit on Russian asset plan for Ukraine

-

Australia PM vows to stamp out hatred as nation mourns youngest Bondi Beach victim

Australia PM vows to stamp out hatred as nation mourns youngest Bondi Beach victim

-

Australian PM vows hate speech crackdown after Bondi Beach attack

-

Turkmenistan's battle against desert sand

Turkmenistan's battle against desert sand

-

Ukraine's Zelensky in Poland for first meeting with nationalist president

-

England in disarray at 59-3 in crunch Test as Lyon, Cummins pounce

England in disarray at 59-3 in crunch Test as Lyon, Cummins pounce

-

Japan faces lawsuit over 'unconstitutional' climate inaction

-

Migrants forced to leave Canada after policy change feel 'betrayed'

Migrants forced to leave Canada after policy change feel 'betrayed'

-

What's next for Venezuela under the US oil blockade?

-

Salvadorans freed with conditional sentence for Bukele protest

Salvadorans freed with conditional sentence for Bukele protest

-

Brazil Congress passes bill to cut Bolsonaro prison term

-

Cricket Australia boss slams technology 'howler' in Ashes Test

Cricket Australia boss slams technology 'howler' in Ashes Test

-

New Zealand 83-0 at lunch on day one of third West Indies Test

-

Ecuadorean footballer Mario Pineida shot and killed

Ecuadorean footballer Mario Pineida shot and killed

-

US government admits liability in deadly DC air collision

-

Wasatch Property Management Launches Fully Integrated AI Voice Agent, Elevating the Prospect Experience Across Its Portfolio

Wasatch Property Management Launches Fully Integrated AI Voice Agent, Elevating the Prospect Experience Across Its Portfolio

-

Classover Advances Next-Generation AI Tutor: Real-Time Adaptive Instruction for K-12 at Scale

-

Hemogenyx Pharmaceuticals PLC - Issue of Equity

Hemogenyx Pharmaceuticals PLC - Issue of Equity

-

SolePursuit Capital Syndicate Establishes Strategic Coordination Office and Appoints Laurence Kingsley as Head

| SCS | 0.12% | 16.14 | $ | |

| RBGPF | -2.23% | 80.22 | $ | |

| CMSC | -0.34% | 23.26 | $ | |

| JRI | -0.6% | 13.43 | $ | |

| NGG | 1.8% | 77.16 | $ | |

| RIO | 1.55% | 77.19 | $ | |

| RELX | -0.64% | 40.56 | $ | |

| BCC | 0.59% | 76.29 | $ | |

| BTI | -0.21% | 57.17 | $ | |

| GSK | -0.14% | 48.71 | $ | |

| BCE | -0.78% | 23.15 | $ | |

| RYCEF | 1.48% | 14.86 | $ | |

| AZN | -1.66% | 89.86 | $ | |

| CMSD | -0.43% | 23.28 | $ | |

| BP | 2.06% | 34.47 | $ | |

| VOD | 0.86% | 12.81 | $ |

Stocks climb, dollar down before US inflation data

Stock markets rose slightly and the dollar extended recent losses Tuesday with all eyes on the latest US inflation print.

While traders expect Tuesday's data to show the pace of price rises cooling in the world's biggest economy, they still expect the Federal Reserve to continue hiking US interest rates by sizeable amounts in the coming months.

The dollar, which has reached multi-year highs against the yen and pound in recent weeks, is reversing direction after investors priced in more aggressive tightening of American borrowing costs.

"The last few days have seen a notable improvement in market sentiment," noted Craig Erlam, senior market analyst at Oanda trading group.

"It's not always easy to pinpoint what's driving such a turnaround but the fact that it's happening in the days leading up to the US inflation report is certainly interesting."

Erlam said a drop in the inflation rate could "trigger a broader risk rebound in the markets.

"It may not be enough to tip the Fed balance in favour of a more modest 50 basis point rate hike next week but it may slow the pace of tightening thereafter."

Analysts' consensus is for inflation to slow to eight percent, driven mostly by falling gasoline prices. US inflation hit a 40-year high in June, touching 9.1 percent.

Markets are largely pricing in another 75-basis-point interest rate hike by the Fed at its next gathering.

This after the US central bank has already made consecutive hikes of that amount, while Fed boss Jerome Powell has indicated the increases would continue until inflation is tamed.

The European Central Bank last week raised its key interest rate by 75 basis points, a record-amount for the eurozone.

Inflation has soared around the globe this year owing to sky-high energy and food bills.

This has been caused to a large extent by supply constraints after economies reopened from pandemic lockdowns and in the wake of Russia's invasion of Ukraine.

- Key figures at around 1100 GMT -

London - FTSE 100: UP 0.4 percent at 7,499.19 points

Frankfurt - DAX: UP 0.7 percent at 13,492.77

Paris - CAC 40: UP 0.6 percent at 6,371.48

EURO STOXX 50: UP 0.7 percent at 3,671.60

Tokyo - Nikkei 225: UP 0.3 percent at 28,614.63 (close)

Hong Kong - Hang Seng Index: DOWN 0.2 percent at 19,326.86 (close)

Shanghai - Composite: UP 0.1 percent at 3,263.80 (close)

New York - Dow: UP 0.7 percent at 32,381.34 (close)

Euro/dollar: UP at $1.0178 from $1.0120

Pound/dollar: UP at $1.1729 from $1.1680

Euro/pound: UP at 86.77 pence from 86.64 pence

Dollar/yen: DOWN at 142.11 yen from 142.82 yen

Brent North Sea crude: UP 1.2 percent at $95.17 per barrel

West Texas Intermediate: UP 1.2 percent at $88.83 per barrel

J.Gomez--AT