-

New Zealand 35-0, lead by 190, after racing through West Indies tail

New Zealand 35-0, lead by 190, after racing through West Indies tail

-

West Indies 420 all out to trail New Zealand by 155

-

Arteta tells leaders Arsenal to 'learn' while winning

Arteta tells leaders Arsenal to 'learn' while winning

-

Honour to match idol Ronaldo's Real Madrid calendar year goal record: Mbappe

-

Dupont helps Toulouse bounce back in Top 14 after turbulent week

Dupont helps Toulouse bounce back in Top 14 after turbulent week

-

Mbappe matches Ronaldo record as Real Madrid beat Sevilla

-

Gyokeres ends drought to gift Arsenal top spot for Christmas

Gyokeres ends drought to gift Arsenal top spot for Christmas

-

Arsenal stay top despite Man City win, Liverpool beat nine-man Spurs

-

US intercepts oil tanker off coast of Venezuela

US intercepts oil tanker off coast of Venezuela

-

PSG cruise past fifth-tier Fontenay in French Cup

-

Isak injury leaves Slot counting cost of Liverpool win at Spurs

Isak injury leaves Slot counting cost of Liverpool win at Spurs

-

Juve beat Roma to close in on Serie A leaders Inter

-

US intercepts oil tanker off coast of Venezuela: US media

US intercepts oil tanker off coast of Venezuela: US media

-

Zelensky says US must pile pressure on Russia to end war

-

Haaland sends Man City top, Liverpool beat nine-man Spurs

Haaland sends Man City top, Liverpool beat nine-man Spurs

-

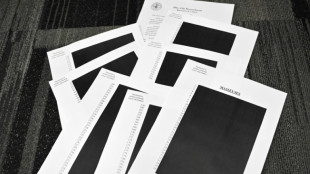

Epstein victims, lawmakers criticize partial release and redactions

-

Leverkusen beat Leipzig to move third in Bundesliga

Leverkusen beat Leipzig to move third in Bundesliga

-

Lakers guard Smart fined $35,000 for swearing at refs

-

Liverpool sink nine-man Spurs but Isak limps off after rare goal

Liverpool sink nine-man Spurs but Isak limps off after rare goal

-

Guardiola urges Man City to 'improve' after dispatching West Ham

-

Syria monitor says US strikes killed at least five IS members

Syria monitor says US strikes killed at least five IS members

-

Australia stops in silence for Bondi Beach shooting victims

-

Olympic champion Joseph helps Perpignan to first Top 14 win despite red card

Olympic champion Joseph helps Perpignan to first Top 14 win despite red card

-

Zelensky says US mooted direct Ukraine-Russia talks on ending war

-

Wheelchair user flies into space, a first

Wheelchair user flies into space, a first

-

Brazil's Lula, Argentina's Milei clash over Venezuela at Mercosur summit

-

Haaland sends Man City top, Chelsea fightback frustrates Newcastle

Haaland sends Man City top, Chelsea fightback frustrates Newcastle

-

Thailand on top at SEA Games clouded by border conflict

-

Chelsea chaos not a distraction for Maresca

Chelsea chaos not a distraction for Maresca

-

Brazil's Lula asks EU to show 'courage' and sign Mercosur trade deal

-

Africa Cup of Nations to be held every four years after 2028 edition

Africa Cup of Nations to be held every four years after 2028 edition

-

Zelensky says US mooted direct Ukraine-Russia talks on ending war in Miami

-

Armed conflict in Venezuela would be 'humanitarian catastrophe': Lula

Armed conflict in Venezuela would be 'humanitarian catastrophe': Lula

-

Chelsea fightback in Newcastle draw eases pressure on Maresca

-

FIFA Best XI 'a joke' rages Flick over Raphinha snub

FIFA Best XI 'a joke' rages Flick over Raphinha snub

-

Swiss Von Allmen pips Odermatt to Val Gardena downhill

-

Vonn claims third podium of the season at Val d'Isere

Vonn claims third podium of the season at Val d'Isere

-

India drops Shubman Gill from T20 World Cup squad

-

Tens of thousands attend funeral of killed Bangladesh student leader

Tens of thousands attend funeral of killed Bangladesh student leader

-

England 'flat' as Crawley admits Australia a better side

-

Australia four wickets from Ashes glory as England cling on

Australia four wickets from Ashes glory as England cling on

-

Beetles block mining of Europe's biggest rare earths deposit

-

French culture boss accused of mass drinks spiking to humiliate women

French culture boss accused of mass drinks spiking to humiliate women

-

NBA champions Thunder suffer rare loss to Timberwolves

-

Burning effigy, bamboo crafts at once-a-decade Hong Kong festival

Burning effigy, bamboo crafts at once-a-decade Hong Kong festival

-

Joshua knocks out Paul to win Netflix boxing bout

-

Dogged Hodge ton sees West Indies save follow-on against New Zealand

Dogged Hodge ton sees West Indies save follow-on against New Zealand

-

England dig in as they chase a record 435 to keep Ashes alive

-

Wembanyama 26-point bench cameo takes Spurs to Hawks win

Wembanyama 26-point bench cameo takes Spurs to Hawks win

-

Hodge edges towards century as West Indies 310-4, trail by 265

Euro and eurozone stocks fall as ECB warns of rate hikes, recession

Eurozone stocks and the euro slid on Thursday as the European Central Bank warned of more interest rate hikes and a possible recession to get a grip on soaring inflation.

Meanwhile, the pound remained close to a 37-year low against the dollar that was struck Wednesday, as new British Prime Minister Liz Truss announced that she will freeze domestic fuel bills for two years to help ease the burden of a UK cost-of-living crisis.

The ECB warned that inflation was "far too high" and likely to stay above target for "an extended period" as it announced its record 0.75 percentage point hike.

The euro whipped around parity but then slid back as ECB chief Christine Lagarde began her post-meeting press conference where she made clear interest rates were far from where they need be to bring inflation down.

"We actually took the decision today that we would continue to raise interest rates... because we believe that we are far away from the rate at which we hope we'll see inflation return to the two percent medium term target," she said.

Lagarde also warned the eurozone risks recession if Russia completely cuts off gas, which it has nearly done.

"The ECB made it clear that they were not going to let the prospect of a looming recession stand in the way of trying to control inflation with aggressive rate increases..." said City Index and FOREX.com analyst Fawad Razaqzada.

Eurozone stocks, which had been holding steady before the ECB decision, slid lower.

Wall Street stocks fell at the opening bell after the latest unemployment data showed a drop in first-time claims for benefits, which strengthens the case for another sharp hike in interest rates by the Federal Reserve.

"The key takeaway from the report remains the same: initial claims are running at levels indicative of a tight labor market that is still running against the grain of the Fed's policy aim," said Patrick J. O'Hare at Briefing.com.

The Fed has made it clear it plans to continue to aggressively raise interest rates to rein in surging inflation, even at the cost of causing some economic pain.

Fed chief Jerome Powell reiterated that message on Thursday.

"We need to act now forthrightly, strongly as we have been doing and we need to keep at it until the job is done to avoid ... the kind of very high social costs" of the surge in inflation in the 1970s and 1980s, Powell said.

The dollar has moved ever higher against its major peers in recent weeks as investors flood into the currency hoping for better returns as the Fed raises rates and as they seek a haven in the face of economic turmoil.

The US unit is closing in on a 32-year peak against the yen owing to the Bank of Japan's refusal to raise interest rates.

It recently set a 20-year peak against the dollar and hasn't been this strong against the pound since 1985.

Observers expect the dollar to keep attracting strong interest as long as the Federal Reserve keeps ramping up US interest rates by sizeable amounts.

The Fed holds its next policy meeting on September 21, with a third successive 75-basis-point lift forecast.

- Key figures at around 1330 GMT -

London - FTSE 100: DOWN 0.7 percent at 7,184.97 points

Frankfurt - DAX: DOWN 1.6 percent at 12,706.08

Paris - CAC 40: DOWN 1.0 percent at 6,043.65

EURO STOXX 50: DOWN 1.2 percent at 3,458.94

New York - Dow: DOWN 0.7 percent at 31,364.70

Tokyo - Nikkei 225: UP 2.3 percent at 28,065.28 (close)

Hong Kong - Hang Seng Index: DOWN 1.0 percent at 18,854.62 (close)

Shanghai - Composite: DOWN 0.3 percent at 3,235.59 (close)

Euro/dollar: DOWN at $0.9959 from $1.0012 on Wednesday

Pound/dollar: DOWN at $1.1425 from $1.1535

Euro/pound: UP at 86.81 pence from 86.74 pence

Dollar/yen: UP at 144.25 yen from 143.79 yen

West Texas Intermediate: UP 1.5 percent at $83.14 per barrel

Brent North Sea crude: UP 1.1 percent at $88.92 per barrel

burs-rl/cdw

G.P.Martin--AT