-

'It sucks': Stokes vows England will bounce back after losing Ashes

'It sucks': Stokes vows England will bounce back after losing Ashes

-

Australia probes security services after Bondi Beach attack

-

West Indies need 462 to win after Conway's historic century

West Indies need 462 to win after Conway's historic century

-

Thai border clashes displace over half a million in Cambodia

-

Australia beat England by 82 runs to win third Test and retain Ashes

Australia beat England by 82 runs to win third Test and retain Ashes

-

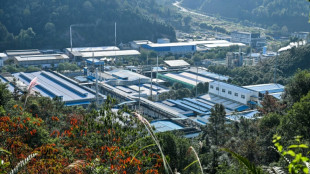

China's rare earths El Dorado gives strategic edge

-

Japan footballer 'King Kazu' to play on at the age of 58

Japan footballer 'King Kazu' to play on at the age of 58

-

New Zealand's Conway joins elite club with century, double ton in same Test

-

Australian PM orders police, intelligence review after Bondi attack

Australian PM orders police, intelligence review after Bondi attack

-

Durant shines as Rockets avenge Nuggets loss

-

Pressure on Morocco to deliver as Africa Cup of Nations kicks off

Pressure on Morocco to deliver as Africa Cup of Nations kicks off

-

Australia remove Smith as England still need 126 to keep Ashes alive

-

Myanmar mystics divine future after ill-augured election

Myanmar mystics divine future after ill-augured election

-

From the Andes to Darfur: Colombians lured to Sudan's killing fields

-

Eagles win division as Commanders clash descends into brawl

Eagles win division as Commanders clash descends into brawl

-

US again seizes oil tanker off coast of Venezuela

-

New Zealand 35-0, lead by 190, after racing through West Indies tail

New Zealand 35-0, lead by 190, after racing through West Indies tail

-

West Indies 420 all out to trail New Zealand by 155

-

Arteta tells leaders Arsenal to 'learn' while winning

Arteta tells leaders Arsenal to 'learn' while winning

-

Honour to match idol Ronaldo's Real Madrid calendar year goal record: Mbappe

-

Dupont helps Toulouse bounce back in Top 14 after turbulent week

Dupont helps Toulouse bounce back in Top 14 after turbulent week

-

Mbappe matches Ronaldo record as Real Madrid beat Sevilla

-

Gyokeres ends drought to gift Arsenal top spot for Christmas

Gyokeres ends drought to gift Arsenal top spot for Christmas

-

Arsenal stay top despite Man City win, Liverpool beat nine-man Spurs

-

US intercepts oil tanker off coast of Venezuela

US intercepts oil tanker off coast of Venezuela

-

PSG cruise past fifth-tier Fontenay in French Cup

-

Isak injury leaves Slot counting cost of Liverpool win at Spurs

Isak injury leaves Slot counting cost of Liverpool win at Spurs

-

Juve beat Roma to close in on Serie A leaders Inter

-

US intercepts oil tanker off coast of Venezuela: US media

US intercepts oil tanker off coast of Venezuela: US media

-

Zelensky says US must pile pressure on Russia to end war

-

Haaland sends Man City top, Liverpool beat nine-man Spurs

Haaland sends Man City top, Liverpool beat nine-man Spurs

-

Epstein victims, lawmakers criticize partial release and redactions

-

Leverkusen beat Leipzig to move third in Bundesliga

Leverkusen beat Leipzig to move third in Bundesliga

-

Lakers guard Smart fined $35,000 for swearing at refs

-

Liverpool sink nine-man Spurs but Isak limps off after rare goal

Liverpool sink nine-man Spurs but Isak limps off after rare goal

-

Guardiola urges Man City to 'improve' after dispatching West Ham

-

Syria monitor says US strikes killed at least five IS members

Syria monitor says US strikes killed at least five IS members

-

Australia stops in silence for Bondi Beach shooting victims

-

Olympic champion Joseph helps Perpignan to first Top 14 win despite red card

Olympic champion Joseph helps Perpignan to first Top 14 win despite red card

-

Zelensky says US mooted direct Ukraine-Russia talks on ending war

-

Wheelchair user flies into space, a first

Wheelchair user flies into space, a first

-

Brazil's Lula, Argentina's Milei clash over Venezuela at Mercosur summit

-

Haaland sends Man City top, Chelsea fightback frustrates Newcastle

Haaland sends Man City top, Chelsea fightback frustrates Newcastle

-

Thailand on top at SEA Games clouded by border conflict

-

Chelsea chaos not a distraction for Maresca

Chelsea chaos not a distraction for Maresca

-

Brazil's Lula asks EU to show 'courage' and sign Mercosur trade deal

-

Africa Cup of Nations to be held every four years after 2028 edition

Africa Cup of Nations to be held every four years after 2028 edition

-

Zelensky says US mooted direct Ukraine-Russia talks on ending war in Miami

-

Armed conflict in Venezuela would be 'humanitarian catastrophe': Lula

Armed conflict in Venezuela would be 'humanitarian catastrophe': Lula

-

Chelsea fightback in Newcastle draw eases pressure on Maresca

Dollar rallies, stocks sink as traders prepare for big rate hikes

The dollar surged Wednesday against other major currencies and equities sank after a forecast-beating US economic report gave new life to talk of a third straight blockbuster interest rate hike next month.

The services sector data showed the world's top economy remained resilient in the face of surging prices and borrowing costs, highlighting the job the Federal Reserve has in taming inflation while trying to prevent a recession -- a goal many observers doubt can be achieved.

The reading added to the gloom blanketing trading floors as investors face a range of headwinds including a worsening energy crisis in Europe, Russia's war in Ukraine and Chinese economic woes caused by Covid-19 lockdowns.

"Overall, the (services) survey paints a picture of solid activity in the services sector of the US economy supported by wages growth suggesting the Fed still has more work to do in order to cool the economy," said National Australia Bank's Rodrigo Catril.

All three main indexes on Wall Street finished in the red Tuesday as they reopened after a long weekend, with expectations growing that the Fed will announce a third successive 75 basis-point rate hike later this month.

Several top Fed officials -- including head Jerome Powell -- have lined up in recent weeks to say their main focus is bringing inflation down from four-decade highs, even if that means tipping the economy into recession.

The prospect of more big rate hikes has sent the dollar soaring this year, and on Wednesday it hit a new 24-year high of 144.38 yen.

The yen's losses continued to mount despite comments from government officials hinting at possible intervention to provide support, though there was no sign the Bank of Japan would shift from its ultra-loose monetary policies aimed at kickstarting the economy.

The euro remained lodged below parity with the dollar and at a 20-year low, even as the European Central Bank prepares to ramp up rates, having done so in July for the first time in eight years.

And the greenback was also pushing towards a 37-year peak against sterling, which saw a brief rally Tuesday on reports new UK Prime Minister Liz Truss was planning a £130 billion ($150 billion) package to freeze energy bills.

- China export weakness -

The losses in New York were tracked by Asia, where Hong Kong, Tokyo, Sydney, Seoul, Singapore, Taipei, Wellington, Mumbai, Bangkok, Jakarta and Manila all fell, though Shanghai edged up.

London, Paris and Frankfurt joined the sell-off at the start of trade.

"The September swoon is in play as a resilient economy paves the way for more Fed tightening," said OANDA's Edward Moya.

"Stocks are going to struggle because too much of the (US) economy is doing well. The dovish pivot and the end of interest rate hikes with the December (Fed meeting) is not how this will play out."

In a sign of the weakness in the global economy and the impact China's zero-Covid policies are having, Beijing released data showing the country's exports grew far sharper in August than in July.

The figures, which were also well off forecasts, "merely serve to underscore how weak domestic demand still is, and how far away that end of year GDP target of 5.5 percent is", said CMC Markets' Michael Hewson.

"The target may well have been downgraded to an aspiration only last month, but it's further away than ever after today’s data and we could be lucky to see half that number at this rate."

China's lockdown and the stronger dollar and expectations that leading economies will tip into recession continue to push oil prices lower, with both main contracts down more than one percent Wednesday.

Bets on a plunge in demand have seen the commodity tank about 20 percent in recent months, putting them below the levels seen just before Russia invaded Ukraine and sent prices skyrocketing.

And while concerns remain about supplies, OANDA's Moya added: "The short-term crude demand outlook appears to be poised for another wave of China Covid-related lockdowns.

"Despite some better-than-expected US services data, global growth isn't looking good at all and that is trouble for crude prices."

- Key figures at around 0720 GMT -

Tokyo - Nikkei 225: DOWN 0.7 percent at 27,430.30 (close)

Hong Kong - Hang Seng Index: DOWN 1.1 percent at 18,996.61

Shanghai - Composite: UP 0.1 percent at 3,246.29 (close)

London - FTSE 100: DOWN 0.8 percent at 7,243.79

Euro/dollar: DOWN at $0.9907 from $0.9905 on Tuesday

Pound/dollar: DOWN at $1.1492 from $1.1519

Dollar/yen: UP at 144.00 yen from 142.80 yen

Euro/pound: UP at 86.21 pence from 85.97 pence

West Texas Intermediate: DOWN 1.4 percent at $85.64 per barrel

Brent North Sea crude: DOWN 1.2 percent at $91.72 per barrel

New York - Dow: DOWN 0.6 percent at 31145.30 (close)

W.Nelson--AT