-

Steelers receiver Metcalf strikes Lions fan

Steelers receiver Metcalf strikes Lions fan

-

Morocco coach 'taking no risks' with Hakimi fitness

-

Gang members given hundreds-years-long sentences in El Salvador

Gang members given hundreds-years-long sentences in El Salvador

-

Chargers, Bills edge closer to playoff berths

-

US, Ukraine hail 'productive' Miami talks but no breakthrough

US, Ukraine hail 'productive' Miami talks but no breakthrough

-

Gang members given hundred-years-long sentences in El Salvador

-

Hosts Morocco off to winning start at Africa Cup of Nations

Hosts Morocco off to winning start at Africa Cup of Nations

-

No jacket required for Emery as Villa dream of title glory

-

Amorim fears United captain Fernandes will be out 'a while'

Amorim fears United captain Fernandes will be out 'a while'

-

Nigerian government frees 130 kidnapped Catholic schoolchildren

-

Captain Kane helps undermanned Bayern go nine clear in Bundesliga

Captain Kane helps undermanned Bayern go nine clear in Bundesliga

-

Trump administration denies cover-up over redacted Epstein files

-

Captain Kane helps undermanned Bayern go nine clear

Captain Kane helps undermanned Bayern go nine clear

-

Rogers stars as Villa beat Man Utd to boost title bid

-

Barca strengthen Liga lead at Villarreal, Atletico go third

Barca strengthen Liga lead at Villarreal, Atletico go third

-

Third 'Avatar' film soars to top in N. American box office debut

-

Third day of Ukraine settlement talks to begin in Miami

Third day of Ukraine settlement talks to begin in Miami

-

Barcelona's Raphinha, Yamal strike in Villarreal win

-

Macron, on UAE visit, announces new French aircraft carrier

Macron, on UAE visit, announces new French aircraft carrier

-

Barca's Raphinha, Yamal strike in Villarreal win

-

Gunmen kill 9, wound 10 in South Africa bar attack

Gunmen kill 9, wound 10 in South Africa bar attack

-

Allegations of new cover-up over Epstein files

-

Atletico go third with comfortable win at Girona

Atletico go third with comfortable win at Girona

-

Schwarz breaks World Cup duck with Alta Badia giant slalom victory

-

Salah unaffected by Liverpool turmoil ahead of AFCON opener - Egypt coach

Salah unaffected by Liverpool turmoil ahead of AFCON opener - Egypt coach

-

Goggia eases her pain with World Cup super-G win as Vonn takes third

-

Goggia wins World Cup super-G as Vonn takes third

Goggia wins World Cup super-G as Vonn takes third

-

Cambodia says Thai border clashes displace over half a million

-

Kremlin denies three-way US-Ukraine-Russia talks in preparation

Kremlin denies three-way US-Ukraine-Russia talks in preparation

-

Williamson says 'series by series' call on New Zealand Test future

-

Taiwan police rule out 'terrorism' in metro stabbing

Taiwan police rule out 'terrorism' in metro stabbing

-

Australia falls silent, lights candles for Bondi Beach shooting victims

-

DR Congo's amputees bear scars of years of conflict

DR Congo's amputees bear scars of years of conflict

-

Venison butts beef off menus at UK venues

-

Cummins, Lyon doubts for Melbourne after 'hugely satsfying' Ashes

Cummins, Lyon doubts for Melbourne after 'hugely satsfying' Ashes

-

West Indies 43-0, need 419 more to win after Conway joins elite

-

'It sucks': Stokes vows England will bounce back after losing Ashes

'It sucks': Stokes vows England will bounce back after losing Ashes

-

Australia probes security services after Bondi Beach attack

-

West Indies need 462 to win after Conway's historic century

West Indies need 462 to win after Conway's historic century

-

Thai border clashes displace over half a million in Cambodia

-

Australia beat England by 82 runs to win third Test and retain Ashes

Australia beat England by 82 runs to win third Test and retain Ashes

-

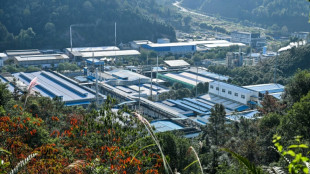

China's rare earths El Dorado gives strategic edge

-

Japan footballer 'King Kazu' to play on at the age of 58

Japan footballer 'King Kazu' to play on at the age of 58

-

New Zealand's Conway joins elite club with century, double ton in same Test

-

Australian PM orders police, intelligence review after Bondi attack

Australian PM orders police, intelligence review after Bondi attack

-

Durant shines as Rockets avenge Nuggets loss

-

Pressure on Morocco to deliver as Africa Cup of Nations kicks off

Pressure on Morocco to deliver as Africa Cup of Nations kicks off

-

Australia remove Smith as England still need 126 to keep Ashes alive

-

Myanmar mystics divine future after ill-augured election

Myanmar mystics divine future after ill-augured election

-

From the Andes to Darfur: Colombians lured to Sudan's killing fields

Markets looking for clarity but tuning out Fed message

US central bankers have been hammering home a single message: Interest rates will rise until inflation begins to come down. But financial markets keep hoping to hear a different tune, one indicating the pace of rate hikes will slow.

All eyes will be on this week's annual gathering of policymakers in Jackson Hole, Wyoming to hear Federal Reserve Chair Jerome Powell explain his stance -- again -- with market watchers hoping to get something more to their liking.

The Fed could be a victim of its own success.

After keeping the benchmark borrowing rate at zero throughout the pandemic, the steep spike in prices, which surged to a 40-year high following Russia's invasion of Ukraine, prompted the central bank to take aggressive action.

In the battle to contain red-hot inflation, which topped nine percent in June, the Fed has hiked rates four times, including massive, three-quarter point increases in June and July -- steep moves unheard of since the early 1980s.

But in recent weeks signs of easing price pressures and a slowing economy, along with falling energy costs and indications global supply chain snarls have lessened, caused financial markets to become optimistic the Fed will dial back or even pause rate increases -- and even begin to cut next year.

Stocks on Wall Street have risen for four straight weeks, despite a string of officials repeating the message that rates will continue to rise, even though annual inflation slowed in July as oil prices fell.

While the annual gathering often becomes a place for global central bankers to signal shifting policy, Powell is expected to repeat that message Friday -- though he may acknowledge that a slowdown will come later in the year.

"It does seem like what we've heard from Powell so far suggests there's quite a high bar for them to transition from aggressive hikes" to a slower pace of 25 basis point steps, said Jonathan Millar of Barclays.

Millar, who served as a Fed economist and forecaster under four central bank chiefs, told AFP that markets are looking further ahead, anticipating the rate hikes will be successful in slowing inflation.

But for policymakers "One thing they definitely want to communicate is that they remain very much focused on issues with price stability and that they will react very cautiously to any signs of improvements in the inflation data."

That means indications prices are coming down more broadly, not just because of falling oil.

Managing the market's expectations "is really job one," Millar said. "They have to enforce that credibility."

But like other economists he believes the Fed's policy-setting Federal Open Market Committee (FOMC) at its September meeting will step down to a 0.5 percentage point increase, taking the range of the key lending rate up to 2.75 to 3.0 percent, to be followed up with quarter-point hikes in November and December

- Walking a narrow line -

Kathy Bostjancic of Oxford Economics said the dilemma for Powell is to recognize the progress towards achieving a soft landing -- bringing inflation back down towards the two percent target, without derailing economic growth -- while confirming the Fed's resolve.

He "continues to have to walk kind of a narrow line," she told AFP. "You don't want to be too pessimistic."

And with housing prices and sales cooling from their torrid pace along with other encouraging data "he has the wind at his back."

But she said, "The message he really has to give is that we're still going to be looking to raise rates to restrictive level to really make sure inflation is still our number one priority."

The annual monetary policy symposium hosted by the Kansas City Federal Reserve Bank runs August 25-27. It often is a place for officials from around the world to come to discuss policy changes in the works, but so far no major global central bank chief has confirmed they speak at the event other than Powell.

M.O.Allen--AT