-

Steelers receiver Metcalf strikes Lions fan

Steelers receiver Metcalf strikes Lions fan

-

Morocco coach 'taking no risks' with Hakimi fitness

-

Gang members given hundreds-years-long sentences in El Salvador

Gang members given hundreds-years-long sentences in El Salvador

-

Chargers, Bills edge closer to playoff berths

-

US, Ukraine hail 'productive' Miami talks but no breakthrough

US, Ukraine hail 'productive' Miami talks but no breakthrough

-

Gang members given hundred-years-long sentences in El Salvador

-

Hosts Morocco off to winning start at Africa Cup of Nations

Hosts Morocco off to winning start at Africa Cup of Nations

-

No jacket required for Emery as Villa dream of title glory

-

Amorim fears United captain Fernandes will be out 'a while'

Amorim fears United captain Fernandes will be out 'a while'

-

Nigerian government frees 130 kidnapped Catholic schoolchildren

-

Captain Kane helps undermanned Bayern go nine clear in Bundesliga

Captain Kane helps undermanned Bayern go nine clear in Bundesliga

-

Trump administration denies cover-up over redacted Epstein files

-

Captain Kane helps undermanned Bayern go nine clear

Captain Kane helps undermanned Bayern go nine clear

-

Rogers stars as Villa beat Man Utd to boost title bid

-

Barca strengthen Liga lead at Villarreal, Atletico go third

Barca strengthen Liga lead at Villarreal, Atletico go third

-

Third 'Avatar' film soars to top in N. American box office debut

-

Third day of Ukraine settlement talks to begin in Miami

Third day of Ukraine settlement talks to begin in Miami

-

Barcelona's Raphinha, Yamal strike in Villarreal win

-

Macron, on UAE visit, announces new French aircraft carrier

Macron, on UAE visit, announces new French aircraft carrier

-

Barca's Raphinha, Yamal strike in Villarreal win

-

Gunmen kill 9, wound 10 in South Africa bar attack

Gunmen kill 9, wound 10 in South Africa bar attack

-

Allegations of new cover-up over Epstein files

-

Atletico go third with comfortable win at Girona

Atletico go third with comfortable win at Girona

-

Schwarz breaks World Cup duck with Alta Badia giant slalom victory

-

Salah unaffected by Liverpool turmoil ahead of AFCON opener - Egypt coach

Salah unaffected by Liverpool turmoil ahead of AFCON opener - Egypt coach

-

Goggia eases her pain with World Cup super-G win as Vonn takes third

-

Goggia wins World Cup super-G as Vonn takes third

Goggia wins World Cup super-G as Vonn takes third

-

Cambodia says Thai border clashes displace over half a million

-

Kremlin denies three-way US-Ukraine-Russia talks in preparation

Kremlin denies three-way US-Ukraine-Russia talks in preparation

-

Williamson says 'series by series' call on New Zealand Test future

-

Taiwan police rule out 'terrorism' in metro stabbing

Taiwan police rule out 'terrorism' in metro stabbing

-

Australia falls silent, lights candles for Bondi Beach shooting victims

-

DR Congo's amputees bear scars of years of conflict

DR Congo's amputees bear scars of years of conflict

-

Venison butts beef off menus at UK venues

-

Cummins, Lyon doubts for Melbourne after 'hugely satsfying' Ashes

Cummins, Lyon doubts for Melbourne after 'hugely satsfying' Ashes

-

West Indies 43-0, need 419 more to win after Conway joins elite

-

'It sucks': Stokes vows England will bounce back after losing Ashes

'It sucks': Stokes vows England will bounce back after losing Ashes

-

Australia probes security services after Bondi Beach attack

-

West Indies need 462 to win after Conway's historic century

West Indies need 462 to win after Conway's historic century

-

Thai border clashes displace over half a million in Cambodia

-

Australia beat England by 82 runs to win third Test and retain Ashes

Australia beat England by 82 runs to win third Test and retain Ashes

-

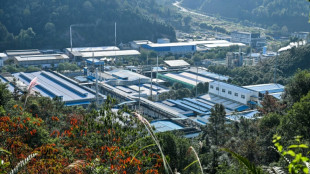

China's rare earths El Dorado gives strategic edge

-

Japan footballer 'King Kazu' to play on at the age of 58

Japan footballer 'King Kazu' to play on at the age of 58

-

New Zealand's Conway joins elite club with century, double ton in same Test

-

Australian PM orders police, intelligence review after Bondi attack

Australian PM orders police, intelligence review after Bondi attack

-

Durant shines as Rockets avenge Nuggets loss

-

Pressure on Morocco to deliver as Africa Cup of Nations kicks off

Pressure on Morocco to deliver as Africa Cup of Nations kicks off

-

Australia remove Smith as England still need 126 to keep Ashes alive

-

Myanmar mystics divine future after ill-augured election

Myanmar mystics divine future after ill-augured election

-

From the Andes to Darfur: Colombians lured to Sudan's killing fields

Asian, European markets drop as investors assess Fed outlook

Most stocks swung lower on Friday as investors fret over the Federal Reserve's plans for lifting interest rates to fight inflation, with mixed data and differing opinions by bank officials providing little clarity.

The rally across markets from their June lows appears to have run out of steam this week after minutes from the Fed's most recent meeting showed it was determined to keep lifting borrowing costs until prices were brought under control.

The gains have come in the face of a number of problems that have caused unease on trading floors, including China-US tensions, the Ukraine war, supply chain snarls and extreme weather across much of the northern hemisphere.

A statement by policymakers and comments from Fed boss Jerome Powell after last month's board meeting suggested they could be considering slowing the pace of rate hikes as the economy slows.

That was followed by a drop in inflation, which lifted markets, but was followed by several officials reasserting the need to continue to tighten monetary policy to get inflation down from four-decade highs.

This week's minutes and comments from a number of Fed top brass reinforced that view, with some pouring cold water on hopes for possible rate cuts in the new year.

All eyes are now on next week's central bankers symposium in Jackson Hole, Wyoming, where finance chiefs and central bankers will speak, with all attention on the utterances of Powell.

"We don't see how the Fed can pivot when they haven't achieved anything pretty much," said Marco Pirondini, of Amundi US. "The market will have to become more realistic on this."

Still, Wall Street's three main indexes edged up after Wednesday's losses.

But Asian traders moved a little more cautiously.

Hong Kong, Shanghai, Singapore, Seoul, Wellington, Mumbai and Bangkok all fell, while Tokyo was marginally lower. Sydney was barely up, with Taipei, Manila and Jakarta inching higher.

London, Paris and Frankfurt edged down at the open.

The prospect of tighter US monetary policy for an extended period lifted the dollar back up to multi-year highs against its peers.

And OANDA's Edward Moya warned that markets would remain wobbly for a while.

"Stocks will most likely struggle for direction for the rest of the summer as Wall Street is still uncertain with how aggressive the Fed will be in September," he said in a note.

"Traders however will continue to pay close attention to developments with the war in Ukraine.

"Turkish President (Recep Tayyip) Erdogan noted that he discussed ways on ending the war with (Ukrainian) President (Volodymyr) Zelensky. An imminent end to the war seems unlikely, but any de-escalations or improved passages for Ukraine grain exports would be welcome news for risk appetite.

However, others remained optimistic that the recent gains could be maintained.

Lewis Grant, of Federated Hermes, added: "We remain optimistic that the current rally will build into a longer term bull market, but cognisant that geopolitical risks remain elevated and it is too early to dismiss the possibility that we are witnessing a bear market rally.

"Investor risk appetite remains fragile."

- Key figures at around 0720 GMT -

Tokyo - Nikkei 225: FLAT at 28,930.33 (close)

Hong Kong - Hang Seng Index: DOWN 0.3 percent at 19,712.12

Shanghai - Composite: DOWN 0.6 percent at 3,3258.08 (close)

London - FTSE 100: DOWN 0.2 percent at 7,526.46

Euro/dollar: DOWN at $1.0085 from $1.0095 Thursday

Pound/dollar: DOWN at $1.1915 from $1.1937

Euro/pound: UP at 84.65 pence from 84.56 pence

Dollar/yen: UP at 136.57 yen from 135.88 yen

West Texas Intermediate: DOWN 0.7 percent at $89.90 per barrel

Brent North Sea crude: DOWN 0.7 percent at $95.96 per barrel

New York - Dow: UP 0.1 percent at 33,999.04 (close)

-- Bloomberg News contributed to this story --

W.Moreno--AT