-

La Rochelle suffer defeat after shock Atonio retirement

La Rochelle suffer defeat after shock Atonio retirement

-

'It wasn't working': Canada province ends drug decriminalization

-

Kishan, Arshdeep star as India down New Zealand in T20 finale

Kishan, Arshdeep star as India down New Zealand in T20 finale

-

Moreno bags brace but Villarreal held at Osasuna

-

Kramaric keeps in-form Hoffenheim rolling in Bundesliga

Kramaric keeps in-form Hoffenheim rolling in Bundesliga

-

'Skimo': Adrenalin-packed sprint to make Olympic debut

-

Venezuela's 'Helicoide' prison synonymous with torture of dissenters

Venezuela's 'Helicoide' prison synonymous with torture of dissenters

-

Arsenal thrash Leeds to stretch Premier League advantage

-

Russia's Valieva returns to ice after doping ban

Russia's Valieva returns to ice after doping ban

-

Snow storm barrels into southern US as blast of icy weather widens

-

Ukraine sees mass power outages from 'technical malfunction'

Ukraine sees mass power outages from 'technical malfunction'

-

Gaza civil defence says Israeli strikes kill 32

-

Kirsty Coventry set to give clues to her Olympic vision in Milan

Kirsty Coventry set to give clues to her Olympic vision in Milan

-

I'm no angel, Italy's PM says amid church fresco row

-

Thousands join Danish war vets' silent march after Trump 'insult'

Thousands join Danish war vets' silent march after Trump 'insult'

-

Gaza civil defence says Israeli strikes kill 28

-

Pakistan spin out Australia in second T20I to take series

Pakistan spin out Australia in second T20I to take series

-

Melbourne champion Rybakina never doubted return to Wimbledon form

-

Luis Enrique welcomes Ligue 1 challenge from Lens

Luis Enrique welcomes Ligue 1 challenge from Lens

-

Long truck lines at Colombia-Ecuador border as tariffs loom

-

Ex-prince Andrew dogged again by Epstein scandal

Ex-prince Andrew dogged again by Epstein scandal

-

Separatist attacks in Pakistan kill 21, dozens of militants dead

-

'Malfunction' cuts power in Ukraine. Here's what we know

'Malfunction' cuts power in Ukraine. Here's what we know

-

Arbeloa backs five Real Madrid stars he 'always' wants playing

-

Sabalenka 'really upset' at blowing chances in Melbourne final loss

Sabalenka 'really upset' at blowing chances in Melbourne final loss

-

Britain, Japan agree to deepen defence and security cooperation

-

Rybakina keeps her cool to beat Sabalenka in tense Melbourne final

Rybakina keeps her cool to beat Sabalenka in tense Melbourne final

-

France tightens infant formula rules after toxin scare

-

Blanc wins final women's race before Winter Olympics

Blanc wins final women's race before Winter Olympics

-

Elena Rybakina: Kazakhstan's Moscow-born Melbourne champion

-

Ice-cool Rybakina beats Sabalenka in tense Australian Open final

Ice-cool Rybakina beats Sabalenka in tense Australian Open final

-

Pakistan attacks kill 15, dozens of militants dead: official

-

Ten security officials, 37 militants killed in SW Pakistan attacks: official

Ten security officials, 37 militants killed in SW Pakistan attacks: official

-

Epstein survivors say abusers 'remain hidden' after latest files release

-

'Full respect' for Djokovic but Nadal tips Alcaraz for Melbourne title

'Full respect' for Djokovic but Nadal tips Alcaraz for Melbourne title

-

Wollaston goes back-to-back in the Cadel Evans road race

-

Women in ties return as feminism faces pushback

Women in ties return as feminism faces pushback

-

Ship ahoy! Prague's homeless find safe haven on river boat

-

Britain's Starmer ends China trip aimed at reset despite Trump warning

Britain's Starmer ends China trip aimed at reset despite Trump warning

-

Carlos Alcaraz: rare tennis talent with shades of Federer

-

Novak Djokovic: divisive tennis great on brink of history

Novak Djokovic: divisive tennis great on brink of history

-

History beckons for Djokovic and Alcaraz in Australian Open final

-

Harrison, Skupski win Australian Open men's doubles title

Harrison, Skupski win Australian Open men's doubles title

-

Epstein offered ex-prince Andrew meeting with Russian woman: files

-

Jokic scores 31 to propel Nuggets over Clippers in injury return

Jokic scores 31 to propel Nuggets over Clippers in injury return

-

Montreal studio rises from dark basement office to 'Stranger Things'

-

US government shuts down but quick resolution expected

US government shuts down but quick resolution expected

-

Mertens and Zhang win Australian Open women's doubles title

-

Venezuelan interim president announces mass amnesty push

Venezuelan interim president announces mass amnesty push

-

China factory activity loses steam in January

SMX's Valuation Is Shifting From Speculation to Demonstrated Performance

NEW YORK, NY / ACCESS Newswire / January 15, 2026 / A subtle but important change is underway in how SMX (NASDAQ:SMX) is being evaluated by the market. The company is no longer positioned as a technology story waiting to be proven. That phase has largely passed. What remains is the market's adjustment to evidence that already exists.

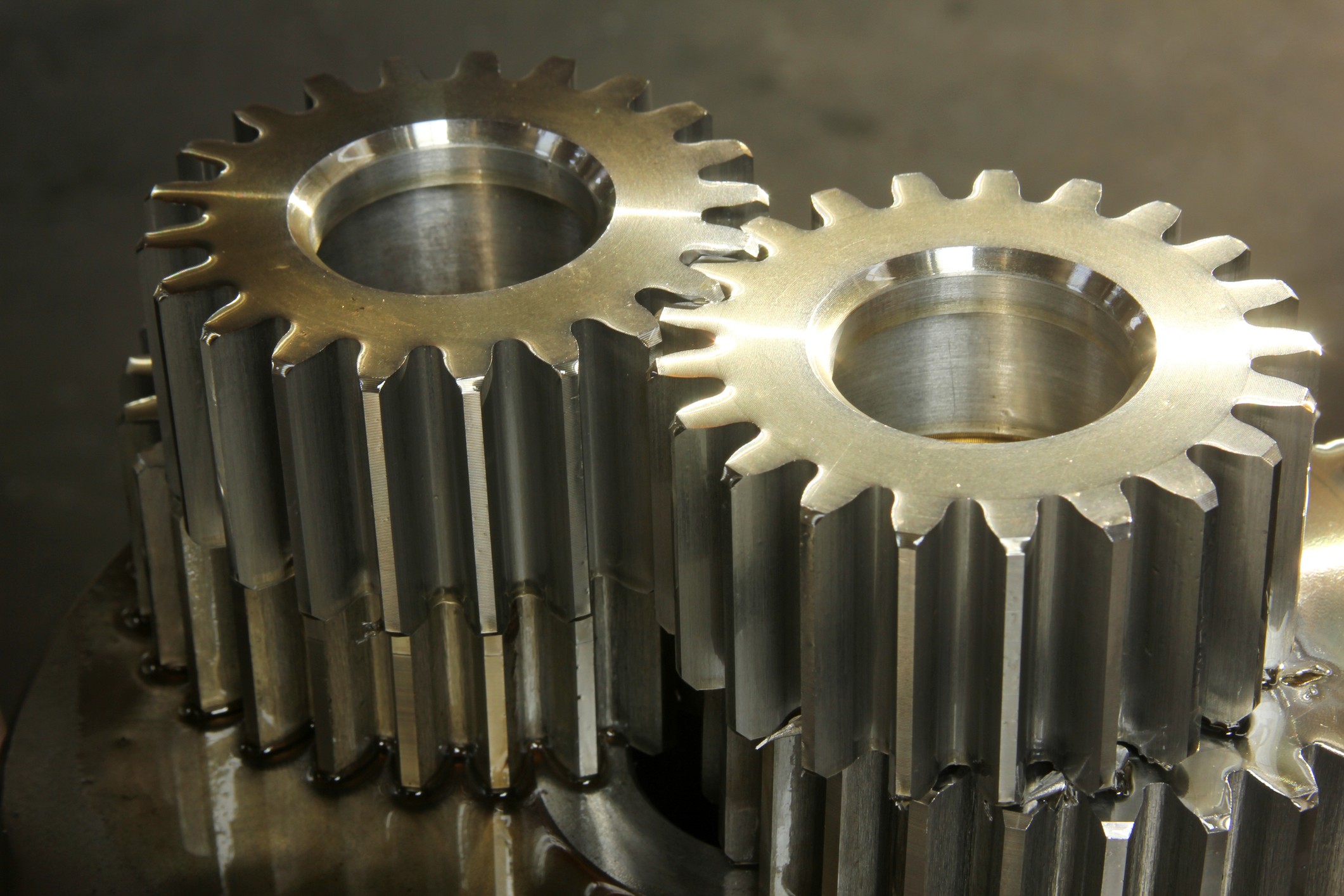

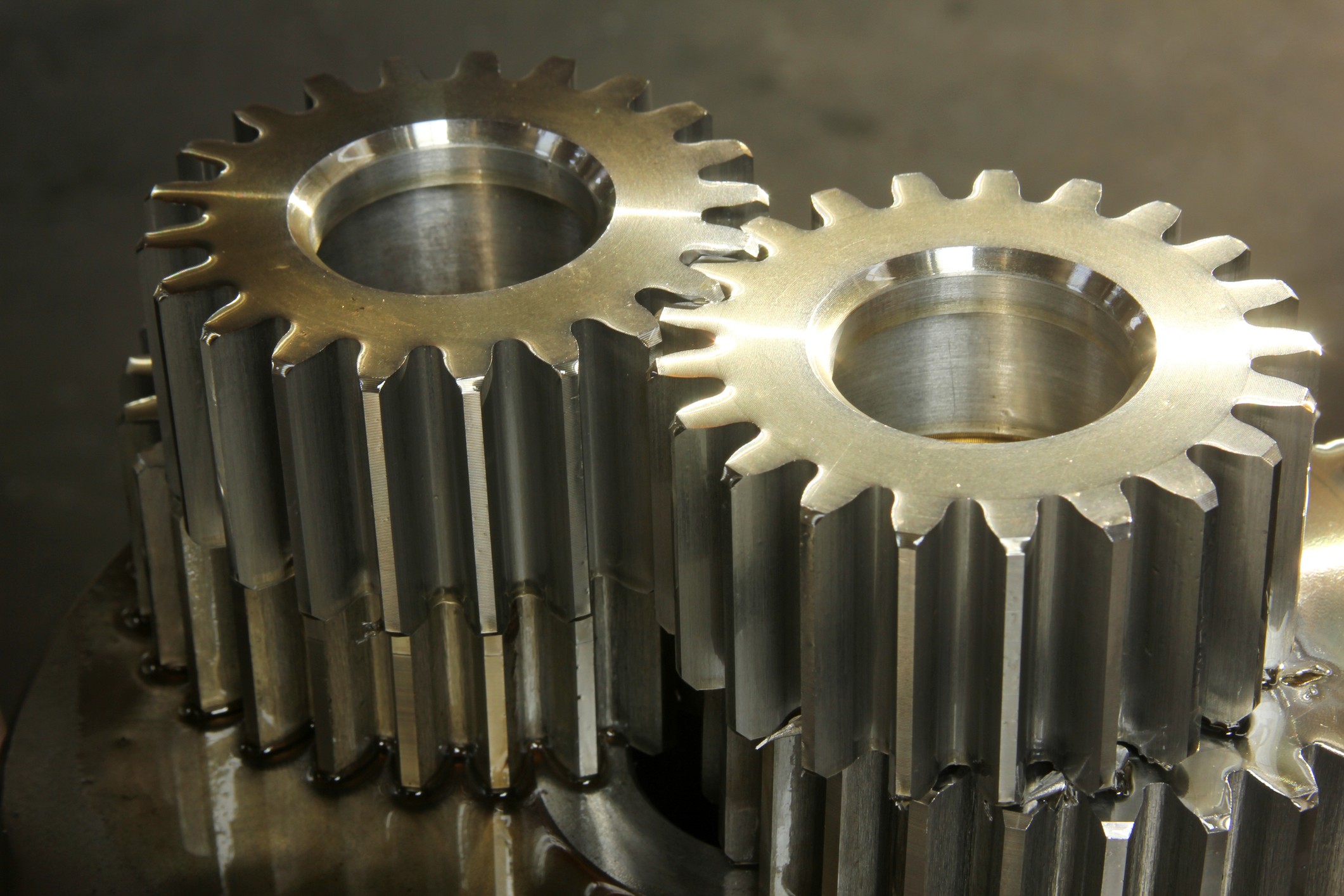

Over recent months, SMX has moved its molecular identity technology out of controlled environments and into active commercial systems. These were not showcase pilots designed for investor presentations. They were live deployments across plastics, textiles, and metals-materials that travel through harsh processing, recycling, blending, and reuse cycles. In those environments, performance is unforgiving. Either the markers endure, or the system fails.

SMX's technology endured.

That reality materially alters how risk should be assessed. Early-stage industrial companies often trade at a discount because feasibility risk dominates valuation. Investors price the possibility that the core technology will break under real-world conditions. Once that uncertainty is removed, the company exits a binary risk phase and enters an execution phase-where timelines, adoption, and economics matter more than scientific viability. SMX has now crossed that line.

From Validation to Infrastructure

Taken individually, SMX's recent initiatives demonstrate functionality. Viewed together, they signal something more consequential: repeatability. Across multiple material classes with different chemistries and supply-chain dynamics, the technology performed consistently. That consistency is what turns a solution into infrastructure.

Infrastructure behaves differently from single-use technology. It can be extended across industries without proportional increases in cost. Each successful deployment lowers marginal risk for the next. As markers survive recycling streams, refining processes, and downstream manufacturing, the platform stops being experimental and starts behaving like a foundational layer-one that can support multiple markets simultaneously.

Markets often struggle to price this moment correctly. Revenue expansion does not always immediately reflect collapsing technical risk, even though probability-weighted outcomes improve dramatically. Once feasibility is no longer in question, adoption becomes a question of integration, regulation, and economics-not whether the technology works. Historically, this gap between proof and visible scale is where valuation inefficiencies persist.

Why Multi-Material Proof Changes the Equation

One of the more underappreciated signals in SMX's recent execution is cross-material validation. Plastics, cotton, and metals do not share processing methods or lifecycle behaviors. Proving durability across all three suggests the company is not building a narrow compliance tool, but a generalized verification layer embedded directly into physical matter.

From a valuation standpoint, that creates optionality. Platforms that scale horizontally-rather than vertically within a single niche-command different multiples because their future expansion does not require reinventing the core system. The value lies not only in individual deployments, but in the cumulative effect of embedding identity into materials themselves.

The conclusion is straightforward. SMX is no longer asking investors to believe. It is asking them to account for what has already been demonstrated. Technical uncertainty has been largely removed. Commercial scale is still forming. That combination-high certainty, incomplete recognition-is where markets most often misprice opportunity.

About SMX

As global businesses face increasing pressure to meet carbon neutrality goals and comply with evolving regulatory standards, SMX provides marking, tracking, measuring, and digital platform technologies that enable material-level verification across supply chains, supporting a more transparent and low-carbon economy.

Contact:

Jeremy Murphy

[email protected]

SOURCE: SMX (Security Matters) Public Limited

View the original press release on ACCESS Newswire

E.Hall--AT