-

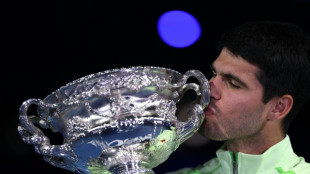

Alcaraz sweeps past Djokovic to win 'dream' Australian Open

Alcaraz sweeps past Djokovic to win 'dream' Australian Open

-

Death toll from Swiss New Year bar fire rises to 41

-

Alcaraz says Nadal inspired him to 'special' Australian Open title

Alcaraz says Nadal inspired him to 'special' Australian Open title

-

Pakistan seeks out perpetrators after deadly separatist attacks

-

Ukraine war talks delayed to Wednesday, Zelensky says

Ukraine war talks delayed to Wednesday, Zelensky says

-

Djokovic says 'been a great ride' after Melbourne final loss

-

Von Allmen storms to downhill win in final Olympic tune-up

Von Allmen storms to downhill win in final Olympic tune-up

-

Carlos Alcaraz: tennis history-maker with shades of Federer

-

Alcaraz sweeps past Djokovic to win maiden Australian Open title

Alcaraz sweeps past Djokovic to win maiden Australian Open title

-

Israel says partially reopening Gaza's Rafah crossing

-

French IT giant Capgemini to sell US subsidiary after row over ICE links

French IT giant Capgemini to sell US subsidiary after row over ICE links

-

Iran's Khamenei likens protests to 'coup', warns of regional war

-

New Epstein accuser claims sexual encounter with ex-prince Andrew: report

New Epstein accuser claims sexual encounter with ex-prince Andrew: report

-

Italy's extrovert Olympic icon Alberto Tomba insists he is 'shy guy'

-

Chloe Kim goes for unprecedented snowboard halfpipe Olympic treble

Chloe Kim goes for unprecedented snowboard halfpipe Olympic treble

-

Pakistan combing for perpetrators after deadly separatist attacks

-

Israel partially reopens Gaza's Rafah crossing

Israel partially reopens Gaza's Rafah crossing

-

Iran declares European armies 'terrorist groups' after IRGC designation

-

Snowstorm disrupts travel in southern US as blast of icy weather widens

Snowstorm disrupts travel in southern US as blast of icy weather widens

-

Denmark's Andresen swoops to win Cadel Evans Road Race

-

Volkanovski beats Lopes in rematch to defend UFC featherweight title

Volkanovski beats Lopes in rematch to defend UFC featherweight title

-

Sea of colour as Malaysia's Hindus mark Thaipusam with piercings and prayer

-

Exiled Tibetans choose leaders for lost homeland

Exiled Tibetans choose leaders for lost homeland

-

Afghan returnees in Bamiyan struggle despite new homes

-

Mired in economic trouble, Bangladesh pins hopes on election boost

Mired in economic trouble, Bangladesh pins hopes on election boost

-

Chinese cash in jewellery at automated gold recyclers as prices soar

-

Israel to partially reopen Gaza's Rafah crossing

Israel to partially reopen Gaza's Rafah crossing

-

'Quiet assassin' Rybakina targets world number one after Melbourne win

-

Deportation raids drive Minneapolis immigrant family into hiding

Deportation raids drive Minneapolis immigrant family into hiding

-

Nvidia boss insists 'huge' investment in OpenAI on track

-

'Immortal' Indian comics keep up with changing times

'Immortal' Indian comics keep up with changing times

-

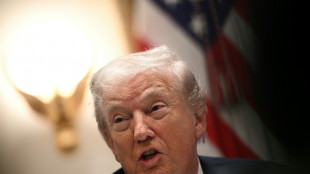

With Trump mum, last US-Russia nuclear pact set to end

-

In Sudan's old port of Suakin, dreams of a tourism revival

In Sudan's old port of Suakin, dreams of a tourism revival

-

Narco violence dominates as Costa Rica votes for president

-

Snowstorm barrels into southern US as blast of icy weather widens

Snowstorm barrels into southern US as blast of icy weather widens

-

LA Olympic chief 'deeply regrets' flirty Maxwell emails in Epstein files

-

Rose powers to commanding six-shot lead at Torrey Pines

Rose powers to commanding six-shot lead at Torrey Pines

-

BusinessHotels Launches AI Hotel Price Finder for Real-Time Rate Verification

-

Sidekick Tools Announces Upcoming Depop OTL and WhatNot Follow Features Alongside AI Updates

Sidekick Tools Announces Upcoming Depop OTL and WhatNot Follow Features Alongside AI Updates

-

Remotify CEO Maria Sucgang Recognized as Tatler Gen.T Leader of Tomorrow

-

The Blessing of Good Fortune Is Here: Own Equity in a Lithium Mining Company - Elektros Inc. - at a Bottom-Basement Discount, Right Here, Right Now

The Blessing of Good Fortune Is Here: Own Equity in a Lithium Mining Company - Elektros Inc. - at a Bottom-Basement Discount, Right Here, Right Now

-

Barca wasteful but beat Elche to extend Liga lead

-

Konate cut short compassionate leave to ease Liverpool injury crisis

Konate cut short compassionate leave to ease Liverpool injury crisis

-

Separatist attacks in Pakistan kill 33, dozens of militants dead

-

Dodgers manager Roberts says Ohtani won't pitch in Classic

Dodgers manager Roberts says Ohtani won't pitch in Classic

-

Arsenal stretch Premier League lead as Chelsea, Liverpool stage comebacks

-

Korda defies cold and wind to lead LPGA opener

Korda defies cold and wind to lead LPGA opener

-

New head of US mission in Venezuela arrives as ties warm

-

Barca triumph at Elche to extend Liga lead

Barca triumph at Elche to extend Liga lead

-

Ekitike, Wirtz give Liverpool sight of bright future in Newcastle win

Kensington's KHPI ETF Surpasses $250 Million in Assets

Milestone Highlights Advisor Demand for Risk-Aware Income Strategies

AUSTIN, TEXAS / ACCESS Newswire / January 6, 2026 / Kensington Asset Management, LLC ("Kensington") announced that the Kensington Hedged Premium Income ETF (Ticker:KHPI) has surpassed $250 million in Assets Under Management (AUM) as of 12/18/2025. The milestone represents a meaningful level of scale for the actively managed ETF following its launch in September 2024 and reflects continued advisor adoption across platforms.

KHPI was designed to address demand for income-oriented strategies with an explicit focus on risk management. The fund seeks to generate income through a disciplined option overlay while maintaining an approach intended to help manage downside risk during periods of market volatility. Since launch, KHPI has expanded across national Broker-Dealer platforms, model portfolios, and Turnkey Asset Management Platforms ("TAMPs").

"KHPI's growth reflects strong alignment between the fund's design and the needs we hear from advisors," said Brian Weisenberger, Chief Market Strategist of Kensington Asset Management. "Advisors are incorporating the strategy into portfolios where income consistency and risk awareness are important considerations."

"Reaching $250 million in assets represents a meaningful level of scale in the ETF market, where many strategies face challenges building sustainable adoption," said Mano Fanopoulos, Managing Partner of Kensington Asset Management. "KHPI's role as a differentiated income solution with embedded hedging has become increasingly relevant as markets remain unpredictable."

The milestone underscores Kensington's continued focus on developing risk-aware, outcome-oriented investment strategies and supporting financial professionals with tools designed for evolving market conditions.

About Kensington Asset Management: Kensington Asset Management, advisor to the Kensington Hedged Premium Income ETF (KHPI) specializes in active systematic strategies, built to navigate market volatility by providing innovative pathways to upside participation with a downside hedge.

About Liquid Strategies: Liquid Strategies, sub-advisor to the Kensington Hedged Premium Income ETF (KHPI) focuses on managing dynamic investment strategies designed to help investors achieve their investment goals with innovative investment solutions. In addition to KHPI, the Sub-Advisor manages a series of Strategies and Exchange Traded Funds ("ETFs") under the name Overlay Shares.

For more information about KHPI, please visit Kensington Hedged Premium Income ETF.

Investors should consider the investment objectives, risks, charges and expenses of the Kensington Hedged Premium Income ETF (KHPI) before investing. The Fund's prospectus and summary prospectus contain this and other information about the Fund may be obtained by calling 1(866) 303-8623 / visiting www.kensingtonassetmanagement.com, which should be read carefully. There is no guarantee the Fund will achieve its investment objectives. Please read carefully. There is no guarantee any investment strategy will generate a profit or prevent a loss.

The Kensington Hedged Premium Income ETF ("KHPI"), prospectus available here. Investing in the Funds involves risk, including loss of principal. Risks specific to the KHPI are detailed in the prospectus.

Future distributions are not guaranteed, and distributions may include option income, dividends, and possibly some return of capital.

Past performance does not guarantee future results. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost.

Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recent month-end please call (866) 303-8623 or visit our website, available here.

Options Risk: An option gives the holder the right, but not the obligation, to buy (call) or sell (put) an asset at a specified price. Options are speculative. The Fund may lose the premium paid if the underlying asset's price doesn't move favorably. Writing put options risks declines in the asset's value, while writing call options may require delivering the asset below market price. Uncovered call options carry the risk of unlimited loss.

Advisory services offered through Kensington Asset Management, LLC.

Quasar Distributors, LLC, Distributor, Member FINRA/SIPC not affiliated with Kensington Asset Management, LLC or Liquid Strategies, LLC.

KAML-854541-2025-12-16

SOURCE: Kensington Asset Management, LLC

View the original press release on ACCESS Newswire

B.Torres--AT