-

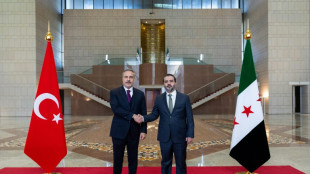

Deadly clashes in Aleppo as Turkey urges Kurds not to be obstacle to Syria's stability

Deadly clashes in Aleppo as Turkey urges Kurds not to be obstacle to Syria's stability

-

Is the United States after Venezuela's oil?

-

Trump admin halts US offshore wind projects citing 'national security'

Trump admin halts US offshore wind projects citing 'national security'

-

Right wing urges boycott of iconic Brazilian flip-flops

-

From misfits to MAGA: Nicki Minaj's political whiplash

From misfits to MAGA: Nicki Minaj's political whiplash

-

Foster grabs South Africa winner against Angola in AFCON

-

Russia pledges 'full support' for Venezuela against US 'hostilities'

Russia pledges 'full support' for Venezuela against US 'hostilities'

-

Spotify says piracy activists hacked its music catalogue

-

Winter Olympics organisers resolve snow problem at ski site

Winter Olympics organisers resolve snow problem at ski site

-

Fuming Denmark summons US ambassador over Greenland envoy

-

UK's street artist Banksy unveils latest mural in London

UK's street artist Banksy unveils latest mural in London

-

Rugby players lose order challenge in brain injury claim

-

UK singer Chris Rea dies at 74, days before Christmas

UK singer Chris Rea dies at 74, days before Christmas

-

Last of kidnapped Nigerian pupils handed over, government says

-

Zambia strike late to hold Mali in AFCON opener

Zambia strike late to hold Mali in AFCON opener

-

Outcry follows CBS pulling program on prison key to Trump deportations

-

Sri Lanka cyclone caused $4.1 bn damage: World Bank

Sri Lanka cyclone caused $4.1 bn damage: World Bank

-

Billionaire Ellison offers personal guarantee for son's bid for Warner Bros

-

Tech stocks lead Wall Street higher, gold hits fresh record

Tech stocks lead Wall Street higher, gold hits fresh record

-

Telefonica to shed around 5,500 jobs in Spain

-

Cambodia says Thailand launches air strikes after ASEAN meet on border clashes

Cambodia says Thailand launches air strikes after ASEAN meet on border clashes

-

McCullum wants to stay as England coach despite Ashes drubbing

-

EU slams China dairy duties as 'unjustified'

EU slams China dairy duties as 'unjustified'

-

Italy fines Apple nearly 100 mn euros over app privacy feature

-

America's Cup switches to two-year cycle

America's Cup switches to two-year cycle

-

Jesus could start for Arsenal in League Cup, says Arteta

-

EU to probe Czech aid for two nuclear units

EU to probe Czech aid for two nuclear units

-

Strauss says sacking Stokes and McCullum will not solve England's Ashes woes

-

Clashing Cambodia, Thailand agree to border talks after ASEAN meet

Clashing Cambodia, Thailand agree to border talks after ASEAN meet

-

Noel takes narrow lead after Alta Badia slalom first run

-

Stocks diverge as rate hopes rise, AI fears ease

Stocks diverge as rate hopes rise, AI fears ease

-

Man City players face Christmas weigh-in as Guardiola issues 'fatty' warning

-

German Christmas markets hit by flood of fake news

German Christmas markets hit by flood of fake news

-

Liverpool fear Isak has broken leg: reports

-

West Indies captain says he 'let the team down' in New Zealand Tests

West Indies captain says he 'let the team down' in New Zealand Tests

-

Thailand says Cambodia agrees to border talks after ASEAN meet

-

Alleged Bondi shooters conducted 'tactical' training in countryside, Australian police say

Alleged Bondi shooters conducted 'tactical' training in countryside, Australian police say

-

Swiss court to hear landmark climate case against cement giant

-

Steelers beat Lions in 'chaos' as three NFL teams book playoffs

Steelers beat Lions in 'chaos' as three NFL teams book playoffs

-

Knicks' Brunson scores 47, Bulls edge Hawks epic

-

Global nuclear arms control under pressure in 2026

Global nuclear arms control under pressure in 2026

-

Five-wicket Duffy prompts West Indies collapse as NZ win series 2-0

-

Asian markets rally with Wall St as rate hopes rise, AI fears ease

Asian markets rally with Wall St as rate hopes rise, AI fears ease

-

Jailed Malaysian ex-PM Najib loses bid for house arrest

-

Banned film exposes Hong Kong's censorship trend, director says

Banned film exposes Hong Kong's censorship trend, director says

-

Duffy, Patel force West Indies collapse as NZ close in on Test series win

-

Australian state pushes tough gun laws, 'terror symbols' ban after shooting

Australian state pushes tough gun laws, 'terror symbols' ban after shooting

-

A night out on the town during Nigeria's 'Detty December'

-

US in 'pursuit' of third oil tanker in Caribbean: official

US in 'pursuit' of third oil tanker in Caribbean: official

-

CO2 soon to be buried under North Sea oil platform

Stock markets drift lower as traders prepare for big week

Equity markets in Asia and Europe slipped Monday at the start of a key week for equities as the Federal Reserve prepares to lift interest rates again and some of the world's biggest companies report earnings.

While the US central bank is widely expected to hike borrowing costs by 75 basis points, traders will be poring over policymakers' views on the outlook for the world's biggest economy as they try to rein in inflation while nurturing growth.

The decision comes a day before second-quarter gross domestic product data is released, with some observers warning it could show a second successive contraction, which is considered a technical recession.

All three main indexes on Wall Street ended last week with a loss, ending a three-day rally, following a big data miss on the crucial services sector.

Asia and Europe fared little better, with Tokyo, Hong Kong, Shanghai, Sydney, Taipei, Mumbai, Manila, Jakarta and Wellington all in the red, while London, Paris and Frankfurt dropped in early trade.

There were small gains in Singapore, Bangkok and Seoul.

Investors are also awaiting the release of earnings from business titans Apple, Amazon and Google parent Alphabet.

The figures will provide a clearer idea about the impact of surging inflation and rising interest rates on consumer spending and companies' bottom lines.

But analysts remain cautious about the outlook, while attention on trading floors turns from rising prices to economic growth, with some saying a slowdown could allow banks to ease up on their monetary tightening.

Fed chiefs have already said their main priority was bringing inflation down from four-decade highs, even at the expense of growth.

"We still see further downside for risky assets as recession fears accumulate and central banks remain committed to fighting inflation at the expense of growth," said Standard Chartered strategist Eric Robertsen.

And Stephen Innes at SPI Asset Management added: "While rising jobless claims, softer home sales, and a buildup in gasoline inventory show the Fed front-loading rate hikes are causing a slowdown and bringing inflation under control, the issue is at what cost."

Others warned that while inflation could begin to ease, the Fed could still push borrowing costs to around five percent and were unlikely to lower rates as soon as many traders hope.

The economic slowdown -- and the expected hit to demand -- continues to put pressure on oil prices, with both main contracts well down Monday.

Crude has given up most of the gains seen since Russia's invasion of Ukraine, and Vandana Hari, of Vanda Insights, said she saw further losses.

"While prices have been volatile, I expect renewed downward pressure on crude," she said, adding that the Fed decision "will likely serve as a fresh reminder of the economic headwinds ahead".

- Key figures at around 0810 GMT -

Tokyo - Nikkei 225: DOWN 0.8 percent at 27,699.25 (close)

Hong Kong - Hang Seng Index: DOWN 0.2 percent at 20,562.94 (close)

Shanghai - Composite: DOWN 0.6 percent at 3,250.39 (close)

London - FTSE 100: DOWN 0.3 percent at 7,258.20

Euro/dollar: DOWN at $1.0206 from $1.0220 on Friday

Pound/dollar: UP at $1.2008 from $1.1998

Euro/pound: DOWN at 85.00 pence from 85.07 pence

Dollar/yen: UP at 136.40 yen from 136.05 yen

West Texas Intermediate: DOWN 1.6 percent at $93.22 per barrel

Brent North Sea crude: DOWN 1.3 percent at $101.88 per barrel

New York - Dow: DOWN 0.4 percent at 31,899.29 (close)

-- Bloomberg News contributed to this story --

H.Romero--AT