-

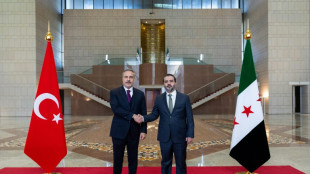

Deadly clashes in Aleppo as Turkey urges Kurds not to be obstacle to Syria's stability

Deadly clashes in Aleppo as Turkey urges Kurds not to be obstacle to Syria's stability

-

Is the United States after Venezuela's oil?

-

Trump admin halts US offshore wind projects citing 'national security'

Trump admin halts US offshore wind projects citing 'national security'

-

Right wing urges boycott of iconic Brazilian flip-flops

-

From misfits to MAGA: Nicki Minaj's political whiplash

From misfits to MAGA: Nicki Minaj's political whiplash

-

Foster grabs South Africa winner against Angola in AFCON

-

Russia pledges 'full support' for Venezuela against US 'hostilities'

Russia pledges 'full support' for Venezuela against US 'hostilities'

-

Spotify says piracy activists hacked its music catalogue

-

Winter Olympics organisers resolve snow problem at ski site

Winter Olympics organisers resolve snow problem at ski site

-

Fuming Denmark summons US ambassador over Greenland envoy

-

UK's street artist Banksy unveils latest mural in London

UK's street artist Banksy unveils latest mural in London

-

Rugby players lose order challenge in brain injury claim

-

UK singer Chris Rea dies at 74, days before Christmas

UK singer Chris Rea dies at 74, days before Christmas

-

Last of kidnapped Nigerian pupils handed over, government says

-

Zambia strike late to hold Mali in AFCON opener

Zambia strike late to hold Mali in AFCON opener

-

Outcry follows CBS pulling program on prison key to Trump deportations

-

Sri Lanka cyclone caused $4.1 bn damage: World Bank

Sri Lanka cyclone caused $4.1 bn damage: World Bank

-

Billionaire Ellison offers personal guarantee for son's bid for Warner Bros

-

Tech stocks lead Wall Street higher, gold hits fresh record

Tech stocks lead Wall Street higher, gold hits fresh record

-

Telefonica to shed around 5,500 jobs in Spain

-

Cambodia says Thailand launches air strikes after ASEAN meet on border clashes

Cambodia says Thailand launches air strikes after ASEAN meet on border clashes

-

McCullum wants to stay as England coach despite Ashes drubbing

-

EU slams China dairy duties as 'unjustified'

EU slams China dairy duties as 'unjustified'

-

Italy fines Apple nearly 100 mn euros over app privacy feature

-

America's Cup switches to two-year cycle

America's Cup switches to two-year cycle

-

Jesus could start for Arsenal in League Cup, says Arteta

-

EU to probe Czech aid for two nuclear units

EU to probe Czech aid for two nuclear units

-

Strauss says sacking Stokes and McCullum will not solve England's Ashes woes

-

Clashing Cambodia, Thailand agree to border talks after ASEAN meet

Clashing Cambodia, Thailand agree to border talks after ASEAN meet

-

Noel takes narrow lead after Alta Badia slalom first run

-

Stocks diverge as rate hopes rise, AI fears ease

Stocks diverge as rate hopes rise, AI fears ease

-

Man City players face Christmas weigh-in as Guardiola issues 'fatty' warning

-

German Christmas markets hit by flood of fake news

German Christmas markets hit by flood of fake news

-

Liverpool fear Isak has broken leg: reports

-

West Indies captain says he 'let the team down' in New Zealand Tests

West Indies captain says he 'let the team down' in New Zealand Tests

-

Thailand says Cambodia agrees to border talks after ASEAN meet

-

Alleged Bondi shooters conducted 'tactical' training in countryside, Australian police say

Alleged Bondi shooters conducted 'tactical' training in countryside, Australian police say

-

Swiss court to hear landmark climate case against cement giant

-

Steelers beat Lions in 'chaos' as three NFL teams book playoffs

Steelers beat Lions in 'chaos' as three NFL teams book playoffs

-

Knicks' Brunson scores 47, Bulls edge Hawks epic

-

Global nuclear arms control under pressure in 2026

Global nuclear arms control under pressure in 2026

-

Five-wicket Duffy prompts West Indies collapse as NZ win series 2-0

-

Asian markets rally with Wall St as rate hopes rise, AI fears ease

Asian markets rally with Wall St as rate hopes rise, AI fears ease

-

Jailed Malaysian ex-PM Najib loses bid for house arrest

-

Banned film exposes Hong Kong's censorship trend, director says

Banned film exposes Hong Kong's censorship trend, director says

-

Duffy, Patel force West Indies collapse as NZ close in on Test series win

-

Australian state pushes tough gun laws, 'terror symbols' ban after shooting

Australian state pushes tough gun laws, 'terror symbols' ban after shooting

-

A night out on the town during Nigeria's 'Detty December'

-

US in 'pursuit' of third oil tanker in Caribbean: official

US in 'pursuit' of third oil tanker in Caribbean: official

-

CO2 soon to be buried under North Sea oil platform

Why is the world worried about China's property crisis?

China's troubled property sector suffered another blow this month when frustrated homebuyers stopped making mortgage payments on units in unfinished projects.

The boycott came with many developers struggling to manage mountains of debt, and fears swirling that the crisis could spread to the rest of the Chinese -- and global -- economy.

How big is China's property sector?

Colossal. Property and related industries are estimated to contribute as much as a quarter of China's Gross Domestic Product (GDP).

The sector took off after market reforms in 1998. There was a breathtaking construction boom on the back of demand from a growing middle class that saw property as a key family asset and status symbol.

The bonanza was fuelled by easy access to loans, with banks willing to lend as much as possible to both developers and buyers.

Mortgages make up almost 20 percent of all outstanding loans in China's entire banking system, according to a report by ANZ Research this month.

Many developments rely on "pre-sales", with buyers paying mortgages on units in projects yet to be built.

Unfinished homes in China amount to 225 million square metres (2.4 billion square feet) of space, Bloomberg News reported.

Why did it plunge into crisis?

As property developers flourished, housing prices also soared.

That worried the government, which was already concerned about the risk posed by debt-laden developers.

It launched a crackdown last year, with the central bank capping the proportion of outstanding property loans to total lending by banks to try to limit the threat to the entire financial system.

This squeezed sources of financing for developers already struggling to handle their debts.

A wave of defaults ensued, most notably by China's biggest developer, Evergrande, which is drowning in liabilities of more than $300 billion.

On top of the regulatory clampdown, Chinese property firms were also hit by the Covid crisis -- the economic uncertainty forced many would-be homebuyers to rethink their purchase plans.

How have homebuyers reacted?

Evergrande's decline had sparked protests from homebuyers and contractors at its Shenzhen headquarters in September last year.

In June this year, a new form of protest emerged: the mortgage boycott.

People who had bought units in still-unfinished projects announced they would stop making payments until construction resumed.

Within a month, the boycott spread to homebuyers in more than 300 projects in 50 cities across China.

Many of the unfinished projects were concentrated in Henan province, where mass protests in response to rural bank fraud broke out and were suppressed.

Chinese lenders said last week that the affected mortgages account for less than 0.01 percent of outstanding residential mortgages, but analysts say the fear is how far the boycotts will spread.

Why is there global concern?

China is the world's second-largest economy, with deep global trade and finance links.

If the property crisis spreads to China's financial system, the shock would be felt far beyond its borders, analysts say.

"Should defaults escalate, there could be broad and serious economic and social implications," Fitch Ratings wrote in a note on Monday.

This echoed a warning by the US Federal Reserve, which said in May that while China has managed to contain the fallout so far, a worsening property crisis could impact the country's financial system too.

The crisis could spread and impact global trade and risk sentiment, the Fed said in its May 2022 Financial Stability Report.

What can China do to fix it?

A bailout or rescue fund for the entire property sector is unlikely, even as mortgage boycotts mount, analysts say, as those would mean the government is admitting to the scale of the crisis.

A major bailout may also encourage developers and home buyers to continue with risky decisions as they would see the government and banks taking on responsibility.

But pressure has been building on Chinese banks to help ease the situation. China's banking regulator said Thursday that it would help ensure that projects are completed and units handed over to buyers.

Some intervention has happened at the local level in Henan province, where a bailout fund was set up in collaboration with a state-backed developer to help stressed projects.

Chen Shujin at Jefferies Hong Kong said local governments, developers and homeowners might also be able to negotiate interest waivers and suspension of mortgage payments for a certain period on a case-by-case basis.

P.A.Mendoza--AT