-

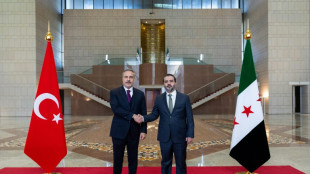

Deadly clashes in Aleppo as Turkey urges Kurds not to be obstacle to Syria's stability

Deadly clashes in Aleppo as Turkey urges Kurds not to be obstacle to Syria's stability

-

Is the United States after Venezuela's oil?

-

Trump admin halts US offshore wind projects citing 'national security'

Trump admin halts US offshore wind projects citing 'national security'

-

Right wing urges boycott of iconic Brazilian flip-flops

-

From misfits to MAGA: Nicki Minaj's political whiplash

From misfits to MAGA: Nicki Minaj's political whiplash

-

Foster grabs South Africa winner against Angola in AFCON

-

Russia pledges 'full support' for Venezuela against US 'hostilities'

Russia pledges 'full support' for Venezuela against US 'hostilities'

-

Spotify says piracy activists hacked its music catalogue

-

Winter Olympics organisers resolve snow problem at ski site

Winter Olympics organisers resolve snow problem at ski site

-

Fuming Denmark summons US ambassador over Greenland envoy

-

UK's street artist Banksy unveils latest mural in London

UK's street artist Banksy unveils latest mural in London

-

Rugby players lose order challenge in brain injury claim

-

UK singer Chris Rea dies at 74, days before Christmas

UK singer Chris Rea dies at 74, days before Christmas

-

Last of kidnapped Nigerian pupils handed over, government says

-

Zambia strike late to hold Mali in AFCON opener

Zambia strike late to hold Mali in AFCON opener

-

Outcry follows CBS pulling program on prison key to Trump deportations

-

Sri Lanka cyclone caused $4.1 bn damage: World Bank

Sri Lanka cyclone caused $4.1 bn damage: World Bank

-

Billionaire Ellison offers personal guarantee for son's bid for Warner Bros

-

Tech stocks lead Wall Street higher, gold hits fresh record

Tech stocks lead Wall Street higher, gold hits fresh record

-

Telefonica to shed around 5,500 jobs in Spain

-

Cambodia says Thailand launches air strikes after ASEAN meet on border clashes

Cambodia says Thailand launches air strikes after ASEAN meet on border clashes

-

McCullum wants to stay as England coach despite Ashes drubbing

-

EU slams China dairy duties as 'unjustified'

EU slams China dairy duties as 'unjustified'

-

Italy fines Apple nearly 100 mn euros over app privacy feature

-

America's Cup switches to two-year cycle

America's Cup switches to two-year cycle

-

Jesus could start for Arsenal in League Cup, says Arteta

-

EU to probe Czech aid for two nuclear units

EU to probe Czech aid for two nuclear units

-

Strauss says sacking Stokes and McCullum will not solve England's Ashes woes

-

Clashing Cambodia, Thailand agree to border talks after ASEAN meet

Clashing Cambodia, Thailand agree to border talks after ASEAN meet

-

Noel takes narrow lead after Alta Badia slalom first run

-

Stocks diverge as rate hopes rise, AI fears ease

Stocks diverge as rate hopes rise, AI fears ease

-

Man City players face Christmas weigh-in as Guardiola issues 'fatty' warning

-

German Christmas markets hit by flood of fake news

German Christmas markets hit by flood of fake news

-

Liverpool fear Isak has broken leg: reports

-

West Indies captain says he 'let the team down' in New Zealand Tests

West Indies captain says he 'let the team down' in New Zealand Tests

-

Thailand says Cambodia agrees to border talks after ASEAN meet

-

Alleged Bondi shooters conducted 'tactical' training in countryside, Australian police say

Alleged Bondi shooters conducted 'tactical' training in countryside, Australian police say

-

Swiss court to hear landmark climate case against cement giant

-

Steelers beat Lions in 'chaos' as three NFL teams book playoffs

Steelers beat Lions in 'chaos' as three NFL teams book playoffs

-

Knicks' Brunson scores 47, Bulls edge Hawks epic

-

Global nuclear arms control under pressure in 2026

Global nuclear arms control under pressure in 2026

-

Five-wicket Duffy prompts West Indies collapse as NZ win series 2-0

-

Asian markets rally with Wall St as rate hopes rise, AI fears ease

Asian markets rally with Wall St as rate hopes rise, AI fears ease

-

Jailed Malaysian ex-PM Najib loses bid for house arrest

-

Banned film exposes Hong Kong's censorship trend, director says

Banned film exposes Hong Kong's censorship trend, director says

-

Duffy, Patel force West Indies collapse as NZ close in on Test series win

-

Australian state pushes tough gun laws, 'terror symbols' ban after shooting

Australian state pushes tough gun laws, 'terror symbols' ban after shooting

-

A night out on the town during Nigeria's 'Detty December'

-

US in 'pursuit' of third oil tanker in Caribbean: official

US in 'pursuit' of third oil tanker in Caribbean: official

-

CO2 soon to be buried under North Sea oil platform

Fed set for another big rate hike with economy on knife's edge

US central bankers face an increasingly difficult balancing act as they struggle to douse scorching inflation while still keeping the economy growing, though they have made it clear they are willing to risk a recession.

But with war still raging in Ukraine, and Covid-19 causing ongoing issues in Asia, avoiding an economic downturn will require luck and depend on many factors outside the Federal Reserve's control.

As families struggle to make ends meet amid surging prices for gas, food and housing, and a rising number of Americans take on second jobs to pay the bills, Fed officials have made it clear that fighting inflation is their top priority even if that means inflicting pain.

The Fed holds its two-day policy meeting next week, where it is expected to hike the benchmark borrowing rate on Wednesday by another three-quarters of a percentage point in its aggressive campaign to cool demand and ease price pressures.

Despite a healthy job market with near-record low unemployment, workers are seeing their wage gains overwhelmed by sky-high consumer prices that rose by a new 40-year high of 9.1 percent in June.

Slowing the economy is likely to cause more job losses, but policymakers want to avoid at all costs the greater pain of a price spiral that becomes entrenched or spins out of control.

Treasury Secretary Janet Yellen, herself a former Fed chief, warned last week that achieving a "soft landing... will require skill and good luck."

- Aggressive rate hikes -

Former Fed vice chair Donald Kohn agreed.

"It's a very complicated, multi-dimensional issue," Kohn told AFP, especially due to the ongoing supply chain uncertainty.

After flooding the world's largest economy with support during the pandemic -- zero interest rates and a steady stream of liquidity into the financial system -- Fed policymakers were congratulating themselves on how quickly the economy recovered, regaining millions of jobs in a matter of months.

But they were caught flat-footed by the rapid run-up in prices, as Americans flush with cash due to massive government aid went on a spending spree, buying up cars, houses and other goods at a time when the global supply chain was still bogged down by pandemic lockdowns that continue in China.

The Fed finally began liftoff -- taking the policy interest rate off zero -- in March, starting with a 25-basis-point increase, followed by 50 in May and 75 in June.

Higher lending costs make it more expensive to borrow funds to buy cars and homes or expand businesses, which should cool demand, while also making it more attractive to save rather than spend.

Other major central banks have followed suit, including the European Central Bank that made its first move last week.

Fed Chair Jerome Powell last month said the policy-setting Federal Open Market Committee would consider either a 50 or 75 bps hike at the July meeting, and most economists expect a repeat of the June three-quarter-point increase.

Fed Governor Christopher Waller recently floated the idea of a mammoth 100-bps hike, which would be the first since the US central bank started using the federal funds rate for policy in the early 1990s.

The equivalent amount of tightening in a single move hasn't been seen since the early 1980s, when then-Fed chief Paul Volcker was on a crusade to crush a wage-price inflationary spiral.

- Mixed data -

But even Waller noted that it is important not to move too fast, and a full point hike would only be called for if data continue to show accelerating price increases.

"I think they will probably discuss 100 basis points just because the inflation picture is still very bad," said Julie Smith, a Lafayette College economics professor.

But some recent data "indicate that previous rate increases have very likely started to work," she said in an interview.

Housing prices have skyrocketed, hitting new records repeatedly, even as interest rates have risen, and consumer spending continues to increase, leading some economists to warn of a contraction in the second quarter.

But there are signs of cracks, including falling home sales, a dramatic drop in mortgage applications and an increasing share of spending going to necessities.

Officials have said the US economy is strong enough to withstand higher rates without a serious downturn, but others, including former Treasury secretary Lawrence Summers, say they are overly optimistic and job losses will have to rise sharply in order to tame inflation.

Kohn said it will be important for Powell to communicate clearly about what data the Fed is looking for to slow or pause the rate hike cycle.

"I think a fairly shallow recession," with higher unemployment than the 3.7 percent the Fed projected last month, "will be necessary to break this inflation spiral," he said.

"But, boy, the amount of uncertainty around it is just huge."

P.A.Mendoza--AT