-

Salah snatches added-time winner for Egypt after Zimbabwe scare

Salah snatches added-time winner for Egypt after Zimbabwe scare

-

Penalty king Jimenez strikes for Fulham to sink Forest

-

Kansas City Chiefs confirm stadium move

Kansas City Chiefs confirm stadium move

-

Liverpool rocked by Isak blow after surgery on broken leg

-

Liverpool rocked by Isak blow after surgery on ankle injury

Liverpool rocked by Isak blow after surgery on ankle injury

-

US stocks push higher while gold, silver notch fresh records

-

Deadly clashes in Aleppo as Turkey urges Kurds not to be obstacle to Syria's stability

Deadly clashes in Aleppo as Turkey urges Kurds not to be obstacle to Syria's stability

-

Is the United States after Venezuela's oil?

-

Trump admin halts US offshore wind projects citing 'national security'

Trump admin halts US offshore wind projects citing 'national security'

-

Right wing urges boycott of iconic Brazilian flip-flops

-

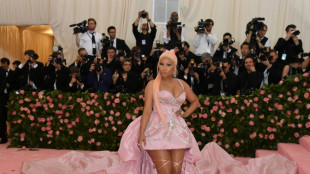

From misfits to MAGA: Nicki Minaj's political whiplash

From misfits to MAGA: Nicki Minaj's political whiplash

-

Foster grabs South Africa winner against Angola in AFCON

-

Russia pledges 'full support' for Venezuela against US 'hostilities'

Russia pledges 'full support' for Venezuela against US 'hostilities'

-

Spotify says piracy activists hacked its music catalogue

-

Winter Olympics organisers resolve snow problem at ski site

Winter Olympics organisers resolve snow problem at ski site

-

Fuming Denmark summons US ambassador over Greenland envoy

-

UK's street artist Banksy unveils latest mural in London

UK's street artist Banksy unveils latest mural in London

-

Rugby players lose order challenge in brain injury claim

-

UK singer Chris Rea dies at 74, days before Christmas

UK singer Chris Rea dies at 74, days before Christmas

-

Last of kidnapped Nigerian pupils handed over, government says

-

Zambia strike late to hold Mali in AFCON opener

Zambia strike late to hold Mali in AFCON opener

-

Outcry follows CBS pulling program on prison key to Trump deportations

-

Sri Lanka cyclone caused $4.1 bn damage: World Bank

Sri Lanka cyclone caused $4.1 bn damage: World Bank

-

Billionaire Ellison offers personal guarantee for son's bid for Warner Bros

-

Tech stocks lead Wall Street higher, gold hits fresh record

Tech stocks lead Wall Street higher, gold hits fresh record

-

Telefonica to shed around 5,500 jobs in Spain

-

Cambodia says Thailand launches air strikes after ASEAN meet on border clashes

Cambodia says Thailand launches air strikes after ASEAN meet on border clashes

-

McCullum wants to stay as England coach despite Ashes drubbing

-

EU slams China dairy duties as 'unjustified'

EU slams China dairy duties as 'unjustified'

-

Italy fines Apple nearly 100 mn euros over app privacy feature

-

America's Cup switches to two-year cycle

America's Cup switches to two-year cycle

-

Jesus could start for Arsenal in League Cup, says Arteta

-

EU to probe Czech aid for two nuclear units

EU to probe Czech aid for two nuclear units

-

Strauss says sacking Stokes and McCullum will not solve England's Ashes woes

-

Clashing Cambodia, Thailand agree to border talks after ASEAN meet

Clashing Cambodia, Thailand agree to border talks after ASEAN meet

-

Noel takes narrow lead after Alta Badia slalom first run

-

Stocks diverge as rate hopes rise, AI fears ease

Stocks diverge as rate hopes rise, AI fears ease

-

Man City players face Christmas weigh-in as Guardiola issues 'fatty' warning

-

German Christmas markets hit by flood of fake news

German Christmas markets hit by flood of fake news

-

Liverpool fear Isak has broken leg: reports

-

West Indies captain says he 'let the team down' in New Zealand Tests

West Indies captain says he 'let the team down' in New Zealand Tests

-

Thailand says Cambodia agrees to border talks after ASEAN meet

-

Alleged Bondi shooters conducted 'tactical' training in countryside, Australian police say

Alleged Bondi shooters conducted 'tactical' training in countryside, Australian police say

-

Swiss court to hear landmark climate case against cement giant

-

Steelers beat Lions in 'chaos' as three NFL teams book playoffs

Steelers beat Lions in 'chaos' as three NFL teams book playoffs

-

Knicks' Brunson scores 47, Bulls edge Hawks epic

-

Global nuclear arms control under pressure in 2026

Global nuclear arms control under pressure in 2026

-

Five-wicket Duffy prompts West Indies collapse as NZ win series 2-0

-

Asian markets rally with Wall St as rate hopes rise, AI fears ease

Asian markets rally with Wall St as rate hopes rise, AI fears ease

-

Jailed Malaysian ex-PM Najib loses bid for house arrest

Bank of Japan sticks to easing, raises inflation forecast

The Bank of Japan dug its heels in on its easy-money policies Thursday while raising its inflation forecast, even as other countries hike interest rates to tackle soaring prices.

Policymakers have refused to move away measures put in place a decade ago as the BoJ battles to achieve sustained price rises in the world's third-largest economy.

But the decision leaves it increasingly alone as its peers raise rates, sending the yen tumbling to a 24-year low against the dollar.

Highlighting the different approaches, the European Central Bank is later Thursday expected to announce its first rate increase since 2011.

Prices are rising in Japan, and the BoJ raised its inflation forecast for fiscal 2022-23 to 2.3 percent, up from 1.9 percent in April, "due to rises in prices of such items as energy, food, and durable goods".

"Thereafter, the rate of increase is expected to decelerate" as energy prices stabilise, it said.

The BoJ added that it would hold rates at minus 0.1 percent and continue buying unlimited government bonds to maintain a low cap on long-term yields.

These monetary easing policies are intended to achieve sustained two-percent inflation, a target the bank considers key for stable growth.

The central bank views current price increases, driven by pandemic supply snarls and higher commodity prices linked to the war in Ukraine, as temporary.

So while its counterparts elsewhere are moving to tame inflation, it sees no need to change tack.

"There is no sign of meaningful accelerations in the rate of increase in wages, which is necessary for a sustainable rise of prices," said Ryutaro Kono, chief economist at BNP Paribas.

And some feel rate hikes would not address current inflationary pressure in Japan.

"Higher rates would do little to meaningfully change the situation", Stefan Angrick, senior economist at Moody's Analytics, told AFP.

"Inflation in Japan is driven predominantly by higher prices for imported food and energy, which are beyond the BoJ's reach."

Rate hikes are also not guaranteed to boost the yen, he added, noting that "many other currencies have depreciated against the dollar despite their respective central banks hiking rates."

Following Friday's announcement, the dollar jumped as high as 138.55 yen before easing slightly, though that still compares with 115 yen at the start of the year.

The BoJ cut its economic growth forecast for the current fiscal year to 2.4 percent, down from 2.9 percent in its previous forecast, warning that "extremely high uncertainties" remain, from Covid-19 to the situation in Ukraine.

A.O.Scott--AT