-

Trump says would be 'smart' for Venezuela's Maduro to step down

Trump says would be 'smart' for Venezuela's Maduro to step down

-

Steelers' Metcalf suspended two games over fan outburst

-

Salah, Foster take Egypt and South Africa to AFCON Group B summit

Salah, Foster take Egypt and South Africa to AFCON Group B summit

-

Napoli beat Bologna to lift Italian Super Cup

-

Salah snatches added-time winner for Egypt after Zimbabwe scare

Salah snatches added-time winner for Egypt after Zimbabwe scare

-

Penalty king Jimenez strikes for Fulham to sink Forest

-

Kansas City Chiefs confirm stadium move

Kansas City Chiefs confirm stadium move

-

Liverpool rocked by Isak blow after surgery on broken leg

-

Liverpool rocked by Isak blow after surgery on ankle injury

Liverpool rocked by Isak blow after surgery on ankle injury

-

US stocks push higher while gold, silver notch fresh records

-

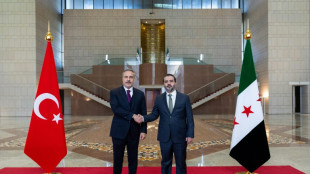

Deadly clashes in Aleppo as Turkey urges Kurds not to be obstacle to Syria's stability

Deadly clashes in Aleppo as Turkey urges Kurds not to be obstacle to Syria's stability

-

Is the United States after Venezuela's oil?

-

Trump admin halts US offshore wind projects citing 'national security'

Trump admin halts US offshore wind projects citing 'national security'

-

Right wing urges boycott of iconic Brazilian flip-flops

-

From misfits to MAGA: Nicki Minaj's political whiplash

From misfits to MAGA: Nicki Minaj's political whiplash

-

Foster grabs South Africa winner against Angola in AFCON

-

Russia pledges 'full support' for Venezuela against US 'hostilities'

Russia pledges 'full support' for Venezuela against US 'hostilities'

-

Spotify says piracy activists hacked its music catalogue

-

Winter Olympics organisers resolve snow problem at ski site

Winter Olympics organisers resolve snow problem at ski site

-

Fuming Denmark summons US ambassador over Greenland envoy

-

UK's street artist Banksy unveils latest mural in London

UK's street artist Banksy unveils latest mural in London

-

Rugby players lose order challenge in brain injury claim

-

UK singer Chris Rea dies at 74, days before Christmas

UK singer Chris Rea dies at 74, days before Christmas

-

Last of kidnapped Nigerian pupils handed over, government says

-

Zambia strike late to hold Mali in AFCON opener

Zambia strike late to hold Mali in AFCON opener

-

Outcry follows CBS pulling program on prison key to Trump deportations

-

Sri Lanka cyclone caused $4.1 bn damage: World Bank

Sri Lanka cyclone caused $4.1 bn damage: World Bank

-

Billionaire Ellison offers personal guarantee for son's bid for Warner Bros

-

Tech stocks lead Wall Street higher, gold hits fresh record

Tech stocks lead Wall Street higher, gold hits fresh record

-

Telefonica to shed around 5,500 jobs in Spain

-

Cambodia says Thailand launches air strikes after ASEAN meet on border clashes

Cambodia says Thailand launches air strikes after ASEAN meet on border clashes

-

McCullum wants to stay as England coach despite Ashes drubbing

-

EU slams China dairy duties as 'unjustified'

EU slams China dairy duties as 'unjustified'

-

Italy fines Apple nearly 100 mn euros over app privacy feature

-

America's Cup switches to two-year cycle

America's Cup switches to two-year cycle

-

Jesus could start for Arsenal in League Cup, says Arteta

-

EU to probe Czech aid for two nuclear units

EU to probe Czech aid for two nuclear units

-

Strauss says sacking Stokes and McCullum will not solve England's Ashes woes

-

Clashing Cambodia, Thailand agree to border talks after ASEAN meet

Clashing Cambodia, Thailand agree to border talks after ASEAN meet

-

Noel takes narrow lead after Alta Badia slalom first run

-

Stocks diverge as rate hopes rise, AI fears ease

Stocks diverge as rate hopes rise, AI fears ease

-

Man City players face Christmas weigh-in as Guardiola issues 'fatty' warning

-

German Christmas markets hit by flood of fake news

German Christmas markets hit by flood of fake news

-

Liverpool fear Isak has broken leg: reports

-

West Indies captain says he 'let the team down' in New Zealand Tests

West Indies captain says he 'let the team down' in New Zealand Tests

-

Thailand says Cambodia agrees to border talks after ASEAN meet

-

Alleged Bondi shooters conducted 'tactical' training in countryside, Australian police say

Alleged Bondi shooters conducted 'tactical' training in countryside, Australian police say

-

Swiss court to hear landmark climate case against cement giant

-

Steelers beat Lions in 'chaos' as three NFL teams book playoffs

Steelers beat Lions in 'chaos' as three NFL teams book playoffs

-

Knicks' Brunson scores 47, Bulls edge Hawks epic

Stocks advance despite Apple report concerns

Stock markets mostly advanced on Tuesday despite fresh recession worries on a report tech titan Apple may scale back hiring and investment.

Meanwhile, the euro rallied against the dollar as traders looked ahead to a key European Central Bank meeting later this week, while oil gave up some of its strong gains on Monday.

European stocks were higher in afternoon trading, with London up 0.5 percent and both Frankfurt and Paris climbing 0.7 percent.

Wall Street opened higher, with the blue-chip Dow adding 0.7 percent, and the broader S&P 500 and tech-heavy Nasdaq Composite rising more than one percent.

Asian equity indices closed mixed after an overnight sell-off on Wall Street fuelled by fresh recession worries on the Bloomberg report on Apple's plans.

"Apple put the cat among the pigeons following a media report that it plans to pull back hiring and growth spending next year in anticipation of the possible economic downturn," noted Richard Hunter, head of markets at Interactive Investor.

Apple's shares were 0.4 percent up shortly after trading began.

The euro meanwhile jumped around one percent against the dollar, as traders mulled whether the European Central Bank could hike interest rates more than expected to fight runaway inflation.

The ECB has signalled it would raise eurozone interest rates on Thursday for the first time in more than a decade but is under pressure to do more to tackle spiralling prices.

It intends to raise borrowing costs by a quarter point, the first such move since 2011.

"In all likelihood, the ECB will raise interest rates by 25 basis points this week and follow this up with a 50-basis-point move in September," noted Matthew Ryan, head of market strategy at financial firm Ebury.

"That said, we do not rule out a 50-basis-point rate hike at this week's meeting.

"We have already seen most major central banks deliver bumper rate increases in recent weeks in an attempt to control rampant price growth," Ryan added.

The Federal Reserve's aggressive rate tightening this year has sent the dollar soaring against most other currencies in recent weeks.

Last week, the euro fell below parity with the dollar for the first time in nearly 20 years, also on growing fears of a eurozone recession as high inflation hampers growth.

On Tuesday, the dollar briefly hit a record high above 80 rupees, with the Indian unit hammered by massive outflows of capital as the economy struggles.

While some are predicting inflation may have reached its peak, oil prices -- the key driver of soaring costs -- remain elevated.

Both main contracts fell Tuesday after rocketing more than five percent Monday on expectations that Saudi Arabia would not open up the taps further, with a plea by US President Joe Biden seeming to have fallen on deaf ears.

Traders were keeping a nervous eye on Europe, where a 10-day maintenance shutdown of the Nord Stream 1 pipeline from Russia is due to end this week.

Many fear Vladimir Putin will keep it shut in retaliation for sanctions imposed on Moscow for invading Ukraine.

That would deal another blow to the already creaking eurozone economy and could send crude prices soaring.

Supply fears are trumping worries about a demand hit in China from another possible lockdown in Shanghai as officials struggle to contain another Covid-19 outbreak.

- Key figures at around 1330 GMT -

London - FTSE 100: UP 0.5 percent at 7,258.68 points

Frankfurt - DAX: UP 0.7 percent at 13,050.89

Paris - CAC 40: UP 0.7 percent at 6,131.94

EURO STOXX 50: UP 0.7 percent at 3,537.00

New York - Dow: UP 0.7 percent at 31,293.30

Tokyo - Nikkei 225: UP 0.7 percent at 26,961.68 (close)

Hong Kong - Hang Seng Index: DOWN 0.9 percent at 20,661.06 (close)

Shanghai - Composite: FLAT percent at 3,279.43 (close)

Euro/dollar: UP at $1.0246 from $1.0146 on Monday

Pound/dollar: UP at $1.2019 from $1.1950

Euro/pound: UP at 85.21 pence from 84.88 pence

Dollar/yen: DOWN at 137.49 yen from 138.13 yen

West Texas Intermediate: DOWN 1. percent at $101. per barrel

Brent North Sea crude: DOWN 1. percent at $105. per barrel

burs-rl/bp

B.Torres--AT