-

Ozempic Meals? Restaurants shrink portions to match bite-sized hunger

Ozempic Meals? Restaurants shrink portions to match bite-sized hunger

-

'Help me, I'm dying': inside Ecuador's TB-ridden gang-plagued prisons

-

Australia's Cummins, Lyon out of fourth Ashes Test

Australia's Cummins, Lyon out of fourth Ashes Test

-

US singer Barry Manilow reveals lung cancer diagnosis

-

'Call of Duty' co-creator Vince Zampella killed in car crash

'Call of Duty' co-creator Vince Zampella killed in car crash

-

Trump says would be 'smart' for Venezuela's Maduro to step down

-

Steelers' Metcalf suspended two games over fan outburst

Steelers' Metcalf suspended two games over fan outburst

-

Salah, Foster take Egypt and South Africa to AFCON Group B summit

-

Napoli beat Bologna to lift Italian Super Cup

Napoli beat Bologna to lift Italian Super Cup

-

Salah snatches added-time winner for Egypt after Zimbabwe scare

-

Penalty king Jimenez strikes for Fulham to sink Forest

Penalty king Jimenez strikes for Fulham to sink Forest

-

Kansas City Chiefs confirm stadium move

-

Liverpool rocked by Isak blow after surgery on broken leg

Liverpool rocked by Isak blow after surgery on broken leg

-

Liverpool rocked by Isak blow after surgery on ankle injury

-

US stocks push higher while gold, silver notch fresh records

US stocks push higher while gold, silver notch fresh records

-

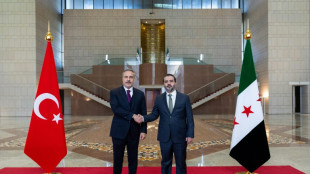

Deadly clashes in Aleppo as Turkey urges Kurds not to be obstacle to Syria's stability

-

Is the United States after Venezuela's oil?

Is the United States after Venezuela's oil?

-

Trump admin halts US offshore wind projects citing 'national security'

-

Right wing urges boycott of iconic Brazilian flip-flops

Right wing urges boycott of iconic Brazilian flip-flops

-

From misfits to MAGA: Nicki Minaj's political whiplash

-

Foster grabs South Africa winner against Angola in AFCON

Foster grabs South Africa winner against Angola in AFCON

-

Russia pledges 'full support' for Venezuela against US 'hostilities'

-

Spotify says piracy activists hacked its music catalogue

Spotify says piracy activists hacked its music catalogue

-

Winter Olympics organisers resolve snow problem at ski site

-

Fuming Denmark summons US ambassador over Greenland envoy

Fuming Denmark summons US ambassador over Greenland envoy

-

UK's street artist Banksy unveils latest mural in London

-

Rugby players lose order challenge in brain injury claim

Rugby players lose order challenge in brain injury claim

-

UK singer Chris Rea dies at 74, days before Christmas

-

Last of kidnapped Nigerian pupils handed over, government says

Last of kidnapped Nigerian pupils handed over, government says

-

Zambia strike late to hold Mali in AFCON opener

-

Outcry follows CBS pulling program on prison key to Trump deportations

Outcry follows CBS pulling program on prison key to Trump deportations

-

Sri Lanka cyclone caused $4.1 bn damage: World Bank

-

Billionaire Ellison offers personal guarantee for son's bid for Warner Bros

Billionaire Ellison offers personal guarantee for son's bid for Warner Bros

-

Tech stocks lead Wall Street higher, gold hits fresh record

-

Telefonica to shed around 5,500 jobs in Spain

Telefonica to shed around 5,500 jobs in Spain

-

Cambodia says Thailand launches air strikes after ASEAN meet on border clashes

-

McCullum wants to stay as England coach despite Ashes drubbing

McCullum wants to stay as England coach despite Ashes drubbing

-

EU slams China dairy duties as 'unjustified'

-

Italy fines Apple nearly 100 mn euros over app privacy feature

Italy fines Apple nearly 100 mn euros over app privacy feature

-

America's Cup switches to two-year cycle

-

Jesus could start for Arsenal in League Cup, says Arteta

Jesus could start for Arsenal in League Cup, says Arteta

-

EU to probe Czech aid for two nuclear units

-

Strauss says sacking Stokes and McCullum will not solve England's Ashes woes

Strauss says sacking Stokes and McCullum will not solve England's Ashes woes

-

Clashing Cambodia, Thailand agree to border talks after ASEAN meet

-

Noel takes narrow lead after Alta Badia slalom first run

Noel takes narrow lead after Alta Badia slalom first run

-

Stocks diverge as rate hopes rise, AI fears ease

-

Man City players face Christmas weigh-in as Guardiola issues 'fatty' warning

Man City players face Christmas weigh-in as Guardiola issues 'fatty' warning

-

German Christmas markets hit by flood of fake news

-

Liverpool fear Isak has broken leg: reports

Liverpool fear Isak has broken leg: reports

-

West Indies captain says he 'let the team down' in New Zealand Tests

US bank results highlight risk and resiliency

Despite mounting worries over inflation, just-released bank earnings painted a resilient picture of the US economy and consumer, generating talk that any recession might be milder than earlier downturns.

Reports from six US banking giants showed a significant drop in profits from the heady year-ago period, with most of the group establishing fresh provisions in case of defaults.

Executives expressed caution about what's to come in light of the growing hit from higher gasoline and food prices, along with the burden of increased lending costs following several Federal Reserve interest rate hikes and persistent supply chain problems.

But banks still haven't seen a significant rise in charge-offs from bad loans. They say many households still have a buffer of savings after conserving funds during the height of the pandemic when the federal government had generous relief programs.

Citigroup Chief Financial Officer Jane Fraser noted "sharply lower" consumer confidence compared with earlier in the year.

"That said, while sentiment has shifted, little of the data I see tells me the US is on the cusp of a recession," Fraser said Friday, adding that households savings provided "a cushion for future stress" amid a tight job market.

Fraser contrasted the backdrop in the United States with Europe, where vulnerability to Russian energy could make for a "difficult winter."

Executives acknowledged that the rising price of fuel and other essential goods poses burden to low-income households who are cutting back.

But most of the bank's clients are not in this situation now.

"US consumers remain quite resilient," Bank of America Chief Executive Brian Moynihan said Monday. "Consumers continue to spend at a healthy pace even as some time has passed since the receipt of any stimulus."

JPMorgan Chase Chief Executive described the consumer as "in great shape," which means that even if there is a recession, they're entering it in "far better shape" compared with 2008 or 2009.

- Muted tone -

On Monday Bank of America reported $6.2 billion in second-quarter profits, a 34 percent drop compared with the year-ago period when results were lifted by a large reserve release amid a strengthening macroeconomic backdrop.

In spite of weakness in some parts of the business, results were boosted by higher net interest income following Fed rate hikes.

Bank of America also enjoyed growth in overall loans and pointed to "improvement" in overall asset quality.

At Goldman Sachs -- the final of the US banking giants to report -- profits fell 48 percent to $2.8 billion, again due in part to its decision to set aside $667 million in provisions for credit losses.

Operations were mixed, with a big jump in revenues tied to trading amid volatile markets offsetting the hit from a drop in revenues connected to mergers and acquisition advising and loan underwriting.

The reports came on the heels of similar releases last week from JPMorgan Chase, Citigroup, Morgan Stanley and Wells Fargo.

Stuart Plesser, a senior director at S&P Global Ratings described the industry's overall tone as muted.

"They're not saying anything's disastrous, they're not optimistic, either," Plesser said.

"If you read the news, you got this possibility with inflation, the higher rate increases and all the other issues, but you can't point to anything in the results," he added.

H.Romero--AT