-

Ozempic Meals? Restaurants shrink portions to match bite-sized hunger

Ozempic Meals? Restaurants shrink portions to match bite-sized hunger

-

'Help me, I'm dying': inside Ecuador's TB-ridden gang-plagued prisons

-

Australia's Cummins, Lyon out of fourth Ashes Test

Australia's Cummins, Lyon out of fourth Ashes Test

-

US singer Barry Manilow reveals lung cancer diagnosis

-

'Call of Duty' co-creator Vince Zampella killed in car crash

'Call of Duty' co-creator Vince Zampella killed in car crash

-

Trump says would be 'smart' for Venezuela's Maduro to step down

-

Steelers' Metcalf suspended two games over fan outburst

Steelers' Metcalf suspended two games over fan outburst

-

Salah, Foster take Egypt and South Africa to AFCON Group B summit

-

Napoli beat Bologna to lift Italian Super Cup

Napoli beat Bologna to lift Italian Super Cup

-

Salah snatches added-time winner for Egypt after Zimbabwe scare

-

Penalty king Jimenez strikes for Fulham to sink Forest

Penalty king Jimenez strikes for Fulham to sink Forest

-

Kansas City Chiefs confirm stadium move

-

Liverpool rocked by Isak blow after surgery on broken leg

Liverpool rocked by Isak blow after surgery on broken leg

-

Liverpool rocked by Isak blow after surgery on ankle injury

-

US stocks push higher while gold, silver notch fresh records

US stocks push higher while gold, silver notch fresh records

-

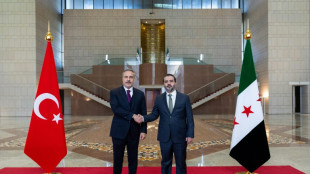

Deadly clashes in Aleppo as Turkey urges Kurds not to be obstacle to Syria's stability

-

Is the United States after Venezuela's oil?

Is the United States after Venezuela's oil?

-

Trump admin halts US offshore wind projects citing 'national security'

-

Right wing urges boycott of iconic Brazilian flip-flops

Right wing urges boycott of iconic Brazilian flip-flops

-

From misfits to MAGA: Nicki Minaj's political whiplash

-

Foster grabs South Africa winner against Angola in AFCON

Foster grabs South Africa winner against Angola in AFCON

-

Russia pledges 'full support' for Venezuela against US 'hostilities'

-

Spotify says piracy activists hacked its music catalogue

Spotify says piracy activists hacked its music catalogue

-

Winter Olympics organisers resolve snow problem at ski site

-

Fuming Denmark summons US ambassador over Greenland envoy

Fuming Denmark summons US ambassador over Greenland envoy

-

UK's street artist Banksy unveils latest mural in London

-

Rugby players lose order challenge in brain injury claim

Rugby players lose order challenge in brain injury claim

-

UK singer Chris Rea dies at 74, days before Christmas

-

Last of kidnapped Nigerian pupils handed over, government says

Last of kidnapped Nigerian pupils handed over, government says

-

Zambia strike late to hold Mali in AFCON opener

-

Outcry follows CBS pulling program on prison key to Trump deportations

Outcry follows CBS pulling program on prison key to Trump deportations

-

Sri Lanka cyclone caused $4.1 bn damage: World Bank

-

Billionaire Ellison offers personal guarantee for son's bid for Warner Bros

Billionaire Ellison offers personal guarantee for son's bid for Warner Bros

-

Tech stocks lead Wall Street higher, gold hits fresh record

-

Telefonica to shed around 5,500 jobs in Spain

Telefonica to shed around 5,500 jobs in Spain

-

Cambodia says Thailand launches air strikes after ASEAN meet on border clashes

-

McCullum wants to stay as England coach despite Ashes drubbing

McCullum wants to stay as England coach despite Ashes drubbing

-

EU slams China dairy duties as 'unjustified'

-

Italy fines Apple nearly 100 mn euros over app privacy feature

Italy fines Apple nearly 100 mn euros over app privacy feature

-

America's Cup switches to two-year cycle

-

Jesus could start for Arsenal in League Cup, says Arteta

Jesus could start for Arsenal in League Cup, says Arteta

-

EU to probe Czech aid for two nuclear units

-

Strauss says sacking Stokes and McCullum will not solve England's Ashes woes

Strauss says sacking Stokes and McCullum will not solve England's Ashes woes

-

Clashing Cambodia, Thailand agree to border talks after ASEAN meet

-

Noel takes narrow lead after Alta Badia slalom first run

Noel takes narrow lead after Alta Badia slalom first run

-

Stocks diverge as rate hopes rise, AI fears ease

-

Man City players face Christmas weigh-in as Guardiola issues 'fatty' warning

Man City players face Christmas weigh-in as Guardiola issues 'fatty' warning

-

German Christmas markets hit by flood of fake news

-

Liverpool fear Isak has broken leg: reports

Liverpool fear Isak has broken leg: reports

-

West Indies captain says he 'let the team down' in New Zealand Tests

What's next for the euro after slump against dollar?

The euro's plunge against the dollar, triggered by the Ukraine war and mounting risks to the EU economy, has driven the two currencies to parity for the first time in two decades.

The European single currency sank to $0.9952 on Thursday -- a level not seen since the end of 2002, the year it was officially introduced.

But traders believe the euro could recover, provided it clears several hurdles in the coming months.

The first to get over is to avoid the risk of a halt in Russian gas supplies to Europe, which would cause electricity prices to soar and force eurozone countries to limit some industrial activity.

"If gas flows from Russia normalise, or at least stop falling, following the end of the Nord Stream 1 maintenance shut-down next week, this should somewhat decrease market fears of an imminent gas crisis in Europe," Esther Reichelt, an analyst at Commerzbank, told AFP.

With Russian gas giant Gazprom having warned it cannot guarantee that the pipeline will function properly, European countries fear that Moscow will use a technical reason to permanently halt deliveries and put pressure on them.

French President Emmanuel Macron even said on Thursday that Russia was using energy "as a weapon of war".

If Nord Stream 1 "doesn't turn back on, the euro falls as the economic shock waves will be felt worldwide as the European energy crisis could very well trigger a recession," warned Stephen Innes, an analyst at SPI Asset Management.

- ECB wake-up call -

"Recession would inevitably mean that the market becomes even more concerned about fragmentation risks in the eurozone," added Jane Foley, a foreign exchange specialist at Rabobank.

Like other central banks, the European Central Bank (ECB) is seeking to avoid stifling the economy by raising rates too sharply.

But it also has to worry about a possible fragmentation of the debt market, with large differences in borrowing rates across the eurozone.

The ECB has so far maintained an ultra-loose monetary policy to support the economy, while the US Federal Reserve has instead raised rates and promises to continue to do so to counter inflation.

It will announce its monetary policy decision on Thursday, and has indicated that it will raise rates for the first time in 11 years.

"If the ECB is aiming to give the euro a boost, it will have to deliver a 50-bp hike in July and/or signal that 75-bp moves are on the cards for September," S&P analysts said in a note.

"Speedier policy adjustments now would help anchor inflation expectations, reducing the risk of needing a restrictive policy stance further down the line," they added.

- Fed slowdown -

For economists at Berenberg, the euro's fall is more attributable to the strength of the dollar, which has "appreciated strongly against a broad basket of currencies since mid-2021".

The dollar has benefited from the Fed's tightening of monetary policy as it tries to limit inflation, which hit record highs again in June.

"Markets are speculating that the Fed may raise rates by 100bp instead of 75bp at its next meeting on 27 July," noted Berenberg.

"If so, this could strengthen the dollar further."

UniCredit added: "Towards year-end, prospects of declining inflation and more-balanced messaging from central banks as the cyclical peak of official rates nears should support a return of risk appetite and ease USD demand."

Should that happen, the euro could move away from parity in the last few months of 2022, they say.

H.Thompson--AT