-

Asian markets rally again as rate cut hopes bring Christmas cheer

Asian markets rally again as rate cut hopes bring Christmas cheer

-

Australian state poised to approve sweeping new gun laws, protest ban

-

Trapped under Israeli bombardment, Gazans fear the 'new border'

Trapped under Israeli bombardment, Gazans fear the 'new border'

-

Families want answers a year after South Korea's deadliest plane crash

-

Myanmar's long march of military rule

Myanmar's long march of military rule

-

Disputed Myanmar election wins China's vote of confidence

-

Myanmar junta stages election after five years of civil war

Myanmar junta stages election after five years of civil war

-

Ozempic Meals? Restaurants shrink portions to match bite-sized hunger

-

'Help me, I'm dying': inside Ecuador's TB-ridden gang-plagued prisons

'Help me, I'm dying': inside Ecuador's TB-ridden gang-plagued prisons

-

Australia's Cummins, Lyon out of fourth Ashes Test

-

US singer Barry Manilow reveals lung cancer diagnosis

US singer Barry Manilow reveals lung cancer diagnosis

-

'Call of Duty' co-creator Vince Zampella killed in car crash

-

Trump says would be 'smart' for Venezuela's Maduro to step down

Trump says would be 'smart' for Venezuela's Maduro to step down

-

Steelers' Metcalf suspended two games over fan outburst

-

Salah, Foster take Egypt and South Africa to AFCON Group B summit

Salah, Foster take Egypt and South Africa to AFCON Group B summit

-

Napoli beat Bologna to lift Italian Super Cup

-

Salah snatches added-time winner for Egypt after Zimbabwe scare

Salah snatches added-time winner for Egypt after Zimbabwe scare

-

Penalty king Jimenez strikes for Fulham to sink Forest

-

Kansas City Chiefs confirm stadium move

Kansas City Chiefs confirm stadium move

-

Liverpool rocked by Isak blow after surgery on broken leg

-

Liverpool rocked by Isak blow after surgery on ankle injury

Liverpool rocked by Isak blow after surgery on ankle injury

-

US stocks push higher while gold, silver notch fresh records

-

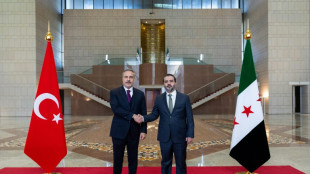

Deadly clashes in Aleppo as Turkey urges Kurds not to be obstacle to Syria's stability

Deadly clashes in Aleppo as Turkey urges Kurds not to be obstacle to Syria's stability

-

Is the United States after Venezuela's oil?

-

Trump admin halts US offshore wind projects citing 'national security'

Trump admin halts US offshore wind projects citing 'national security'

-

Right wing urges boycott of iconic Brazilian flip-flops

-

From misfits to MAGA: Nicki Minaj's political whiplash

From misfits to MAGA: Nicki Minaj's political whiplash

-

Foster grabs South Africa winner against Angola in AFCON

-

Russia pledges 'full support' for Venezuela against US 'hostilities'

Russia pledges 'full support' for Venezuela against US 'hostilities'

-

Spotify says piracy activists hacked its music catalogue

-

Winter Olympics organisers resolve snow problem at ski site

Winter Olympics organisers resolve snow problem at ski site

-

Fuming Denmark summons US ambassador over Greenland envoy

-

UK's street artist Banksy unveils latest mural in London

UK's street artist Banksy unveils latest mural in London

-

Rugby players lose order challenge in brain injury claim

-

UK singer Chris Rea dies at 74, days before Christmas

UK singer Chris Rea dies at 74, days before Christmas

-

Last of kidnapped Nigerian pupils handed over, government says

-

Zambia strike late to hold Mali in AFCON opener

Zambia strike late to hold Mali in AFCON opener

-

Outcry follows CBS pulling program on prison key to Trump deportations

-

Sri Lanka cyclone caused $4.1 bn damage: World Bank

Sri Lanka cyclone caused $4.1 bn damage: World Bank

-

Billionaire Ellison offers personal guarantee for son's bid for Warner Bros

-

Tech stocks lead Wall Street higher, gold hits fresh record

Tech stocks lead Wall Street higher, gold hits fresh record

-

Telefonica to shed around 5,500 jobs in Spain

-

Cambodia says Thailand launches air strikes after ASEAN meet on border clashes

Cambodia says Thailand launches air strikes after ASEAN meet on border clashes

-

McCullum wants to stay as England coach despite Ashes drubbing

-

EU slams China dairy duties as 'unjustified'

EU slams China dairy duties as 'unjustified'

-

Italy fines Apple nearly 100 mn euros over app privacy feature

-

America's Cup switches to two-year cycle

America's Cup switches to two-year cycle

-

Jesus could start for Arsenal in League Cup, says Arteta

-

EU to probe Czech aid for two nuclear units

EU to probe Czech aid for two nuclear units

-

Strauss says sacking Stokes and McCullum will not solve England's Ashes woes

Stocks rise as US consumers keep spending

Stocks rose Friday after the latest data showed that US consumers continue to spend more in the latest signal of the strength of the economy despite high inflation and rising interest rates.

Better-than-expected results from Citigroup also helped allay somewhat concerns about what waits in store for investors as companies begin to report their next quarterly results.

The euro held above $1.00, having sunk below parity this week on fears Russia would cut off Europe's gas supplies in retaliation for Ukraine war sanctions, pushing the region into recession.

Oil prices rebounded having slumped Thursday on renewed fears of a global recession that would dent demand for energy.

Wall Street opened higher on a better-than-expected 1.0 percent rise in retail sales in June.

While not adjusted for inflation, sales were still up 0.7 percent even when gasoline was removed from the calculation, according to the Commerce Department data.

"The key takeaway from the report is that it was strong enough to keep concerns about weakening consumer spending at bay for the time being," said analysts at Briefing.com.

Markets took a major knock this week from news that US inflation zoomed to a 40-year high of 9.1 percent in June on energy costs.

After rate hikes by several countries this week, investors now expect the Federal Reserve to lift rates later this month by 75 basis points as officials battle decades-high inflation, though some observers suggest a one-percentage-point move could even be on the cards.

While experts warn that raising US rates risks hammering the economy, the Fed has made it clear the number-one priority is bringing down prices.

The retail sales figures join other data showing that the US economy is holding up relatively well so far despite high inflation and rising interest rates.

Meanwhile, Citigroup's net profits fell by 25 percent to $4.5 billion, yet earnings per share easily beat expectations. The banking group took in more revenue and benefited from rising interest rates.

Citigroup shares jumped 6.0 percent as trading got underway in New York.

Wall Street stumbled Thursday with sentiment weighed down by disappointing reports from JPMorgan Chase & Co. and Morgan Stanley.

Those compounded worries that company profits would be hit by the fallout from a number of issues including rocketing consumer prices, monetary policy tightening and the war in Ukraine.

European stocks were higher in afternoon trading.

In Asia, Hong Kong and mainland Chinese equity markets led losses after data showed China's economy grew just 0.4 percent in the second quarter, battered by Covid lockdowns in major cities including Shanghai and Beijing.

The reading was well off the 1.6-percent growth predicted by analysts in an AFP survey.

Elsewhere, traders are keeping tabs on US President Joe Biden's visit to the Middle East as he tries to persuade Saudi Arabia to bring down high oil prices by pumping more crude.

- Key figures at around 1330 GMT -

London - FTSE 100: UP 1.4 percent at 7,138.46 points

Frankfurt - DAX: UP 2.2 percent at 12,793.69

Paris - CAC 40: UP 1.2 percent at 5,986.08

EURO STOXX 50: UP 1.7 percent at 3,455.59

New York - Dow: UP 1.5 percent at 31,081.84

Tokyo - Nikkei 225: UP 0.5 percent at 26,788.47 (close)

Hong Kong - Hang Seng Index: DOWN 2.2 percent at 20,297.72 (close)

Shanghai - Composite: DOWN 1.6 percent at 3,228.06 (close)

Euro/dollar: UP at $1.0062 from $1.0022 Thursday

Pound/dollar: UP at $1.1836 from $1.1826

Euro/pound: UP at 85.04 pence from 84.72 pence

Dollar/yen: DOWN at 138.74 yen from 138.93 yen

West Texas Intermediate: UP 2.6 percent at $98.26 per barrel

Brent North Sea crude: UP 2.9 percent at $102.00 per barrel

burs-rl/bp

R.Chavez--AT